Is XRP a good investment in 2025? This remains one of the most pressing questions in crypto. After years of legal uncertainty, the SEC case against Ripple concluded in 2024, giving XRP regulatory clarity and reopening institutional access. That turning point has renewed interest in its long-term role within global payments.

To assess XRP’s investment potential, investors should consider seven key factors:

Regulation and legal clarity

Real-world adoption and partnerships

Utility in cross-border payments

Supply dynamics and token distribution

Institutional trends

Competition from other blockchains

Market risks and volatility

This guide breaks down these elements to help you evaluate XRP’s 2025 outlook with data-driven insights.

🔑 Key Takeaways: XRP Investment 2025

- Regulatory clarity: SEC case ended in 2024 with a $125M fine; XRP continues without existential legal risk, improving institutional access.

- Real-world utility: XRP powers Ripple’s On-Demand Liquidity (ODL), enabling fast, low-cost cross-border payments with growing adoption in Asia and the UAE.

- Institutional adoption: Post-clarity, asset managers are pursuing XRP ETFs/ETPs, adding predictable capital inflows and deeper liquidity.

- Tokenomics: Fixed 100B supply; ~59.5B circulating. Ripple still controls ~35–37B in escrow, creating supply-overhang risk.

- Partnerships & XRPL ecosystem: RippleNet banks + stablecoin integrations (e.g., USDC on XRPL in 2025) strengthen network effects.

- Performance & volatility: XRP up >400% YoY but remains highly volatile. Best approached with small, risk-managed allocations.

- Risks: Centralized supply, regulatory constraints, and competition from CBDCs/stablecoins continue to weigh on XRP’s long-term risk profile.

Bottom line: XRP may suit investors seeking payment utility exposure, but should be treated as a small, higher-risk allocation within a diversified crypto portfolio.

RELATED: Is It Worth Buying XRP in 2025?

Is XRP A Good Investment: Quick Verdict

XRP is a good investment for investors who accept higher risk for utility exposure. XRP shows payments utility and rising institutional interest, yet supply concentration, past regulatory uncertainty, and high volatility create elevated risk.

Treat XRP as a specialist allocation inside a broader crypto portfolio, using careful position sizing and custody practices. We recommend focusing on a long-term strategy.

Now, let’s look at the factors you should know before investing in XRP.

1. Regulatory Clarity & Why It Matters

Legal outcomes shape XRP’s investability because rules determine who can hold, trade, and offer exposure to the token. The SEC ended its case against Ripple with a $125 million fine. This result removed a years-long cloud that restricted listings and institutional participation.

Why is this important? A clear legal endpoint affects four practical areas:

- Exchanges can relist or maintain XRP with less overhead

- Regulated custodians can add XRP to institutional custody products

- Futures and ETP sponsors can pursue listings

- Asset managers can consider allocation without an unresolved securities claim.

Each of these lowers the institutional risk premium that previously priced XRP well below peers.

That said, there are still legal constraints. The court found that certain historical institutional sales violated securities law, and a permanent injunction tied to those findings still governs direct institutional offers.

Firms must design sales and custody around that injunction, which keeps some counterparty and compliance work on the table.

Clear and durable legal rules reduce uncertainty, shorten compliance lead times, and make large capital flows more feasible. For investors, that translates into narrower bid-ask spreads and potentially steadier liquidity for Ripple XRP over time.

ALSO READ: 3 Big Reasons XRP Might Be The Best Crypto To Buy Today

2. Real-World Utility – Payments, ODL And The XRPL

XRP’s standing rests heavily on utility in payments, not just speculation. On-Demand Liquidity, or ODL, uses XRP as a bridge currency to source liquidity on demand for cross-border transfers, removing the need for pre-funded nostro accounts.

That reduces working capital requirements for counterparties and shortens settlement flows.

The XRP Ledger offers settlement finality in about 3–5 seconds and typical on-ledger fees under 0.001 XRP, making transactions both fast and cheap. These performance metrics give XRP practical advantages for micro-value rails and wholesale liquidity corridors where speed and cost matter.

Real transaction demand can emerge from remittances, payout networks, and corridor liquidity services that prefer on-chain settlement.

Ripple continues to add payment customers and payout partners in regions such as the UAE and Asia, showing how adoption of ODL and custodial integrations can translate into operational use of XRP.

When firms use XRP as a working liquidity asset, that use-case demand differs from a pure store-of-value narrative and can anchor long-term utility value.

RECOMMENDED: 3 Reasons To Buy Ripple (XRP) Like There’s No Tomorrow

3. Institutional Adoption & Market Access (ETFs, ETPs)

Institutional adoption has moved from discussion to action, and that shift affects XRP investment in 2025. CoinDesk reported a notable uptick in institutional flows and daily trading volumes after legal clarity, a signal that large buyers reentered the market.

Asset managers and sponsors have filed or revised products to give institutions regulated exposure to XRP without direct custody. For example, Amplify filed an XRP option-income ETF, joining a wave of proposals and ETP planning that aim to package XRP for mainstream investors.

Investing Haven’s analysis shows bullish XRP price predictions for 2025, which supports demand assumptions used by some issuers.

Easier institutional access matters because regulated products aggregate large pools of capital, increase assets under management, and add predictable buying pressure.

That increased AUM tends to deepen liquidity, narrow spreads, and reduce short-term volatility, making XRP a more practical option for diversified crypto portfolios. Institutional adoption therefore affects both price formation and risk profiles for investors.

RECOMMENDED: Better Crypto To Buy: XRP Or ETH?

4. Tokenomics, Supply Concentration & Liquidity

XRP’s supply mechanics remain a core, durable factor for investors. The token has a fixed maximum supply of 100 billion, with about 59.48 billion XRP currently circulating according to CoinMarketCap and CoinGecko. These baseline figures matter for market cap and per-token valuation math.

Ripple controls a large portion of the remaining supply through escrow, with recent tallies showing roughly 35–37 billion XRP locked, equal to about 35–42% of the total. Escrow rules allow scheduled releases, historically up to 1 billion XRP per month, though Ripple often re-locks unused amounts.

That concentration creates potential overhang and centralization concerns, and it remains a persistent, non-ephemeral risk to liquidity and price discovery on the XRPL.

RECOMMENDED: Want to Make $1M with XRP? Here’s How in 10 Years or Less

5. Partnerships, Network Effects & XRPL Ecosystem

Partners include banks, payment providers, cloud platforms, exchanges and fintechs. Ripple lists more than 100 RippleNet members, such as Santander, CIBC, Kotak Mahindra, Itaú Unibanco and RAKBANK, which shows institutional interest.

AWS hosts case studies on Ripple’s integration for scalability and global reach.

The XRPL ecosystem now supports tokenization and stablecoins. USDC launched natively on the XRPL in June 2025, giving institutions a regulated stablecoin rail without bridging. The XRPL documentation outlines stablecoin issuer mechanics and tokenization use cases.

These partnerships and on-ledger assets create network effects that can aid XRP adoption. RippleNet adoption does not always imply use of XRP, a nuance noted by Nasdaq, but these integrations support cross-border payments.

RECOMMENDED: An In‑Depth Review of Buying XRP on eToro

6. Price Performance & Volatility

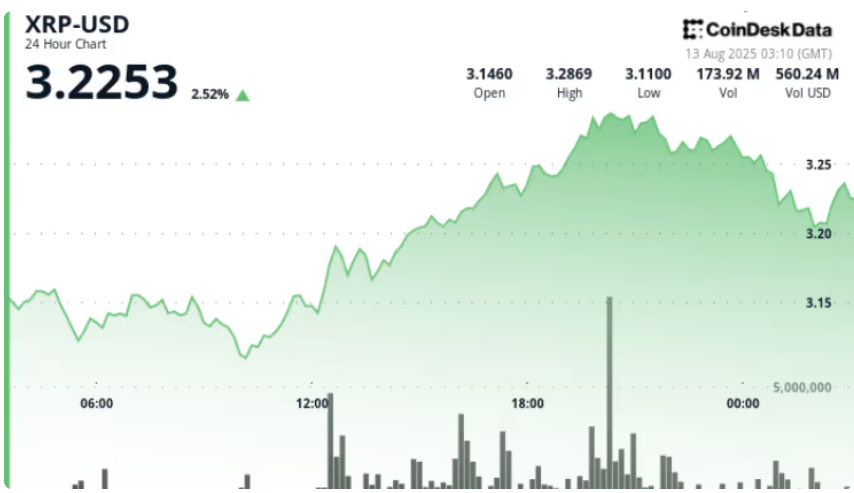

Measured over medium windows, XRP’s move has been large. Using current price data, XRP is up about 402.8% over the past year.

It is up about 745.2% over three years, based on exchange price snapshots for Aug 30. Its market cap ranks among the top three cryptocurrencies, which supports deep liquidity and tradability.

High historical volatility affects how investors should enter positions. Consider dollar-cost averaging to reduce timing risk and limit any single position to a small allocation in a diversified crypto portfolio.

XRP often shows larger intracycle swings than Bitcoin or Ethereum, so size positions and use regulated custody for institutional exposures. Institutional flows and listed ETPs can reduce realized volatility over time by deepening order books and narrowing spreads.

For most retail investors, gradual accumulation and strict risk controls work best.

RECOMMENDED: Best Place to Buy Ripple (XRP) In Dubai

7. Risks: Regulation, Centralization, Competition & Liquidity Traps

XRP investment risks start with regulation and legal uncertainty. The SEC concluded its case and left a $125m fine and an injunction on some institutional sales. This shows the XRP regulation SEC case can change market access.

Supply concentration creates second-order risks for price discovery and liquidity. Ripple holds roughly 35–37 billion XRP in escrow, about 35–42% of the 100 billion supply. Top exchanges and institutions concentrate holdings, with the top 20 owning over 50% of circulating supply.

The third risk is competition from other rails, including central bank digital currencies and widely adopted stablecoins. Central banks and firms explore central bank digital currencies and stablecoins that could reduce demand for XRP in payments corridors.

The Bank of International Settlements reports 91% of central banks explore CBDCs, a fact investors must monitor as policy evolves. Given these risks, the question “Is XRP a safe investment long term” has no simple yes or no answer.

RECOMMENDED: Is Ripple (XRP) A Good Investment And How To Buy It?

How To Approach XRP If You’re An Investor

Start by defining your time horizon and risk tolerance. Decide if XRP fits your crypto portfolio diversification and whether you view crypto as an inflation hedge.

If risk-tolerant, consider a small-to-moderate allocation to XRP, typically 1–5% of total crypto exposure. Also, use disciplined position sizing and stop rules to limit losses and prevent emotional trading.

Choose regulated custody and consider ETPs where available to receive institutional-style exposure. If you prefer passive exposure, low-cost ETPs may suit long-term holders. ETP availability has expanded as spot and futures products launched in 2025, changing how investors access XRP.

You can also use dollar-cost averaging to reduce timing risk during high volatility, and track escrow releases, regulatory developments, and tax implications while using regulated exchanges or custodians that comply with local rules.

Price Forecasts: Range, What Analysts Say, And How To Interpret Them

According to InvestingHaven’s XRP price prediction for 2025, the token is expected to trade between $1.81 and $4.10, with an average price near $2.91. If XRP clears its all-time high at $3.30, momentum could drive a fast move higher, with a long-term bullish target of $9 before 2030. These forecasts highlight the role of adoption, institutional interest, and technical patterns in shaping XRP’s trajectory.

These XRP forecasts rely on adoption of On-Demand Liquidity, approvals for spot ETPs or ETFs, and overall risk appetite in global markets. Treat these price models as conditional scenarios not guarantees, and use them to inform position sizing and portfolio allocation rather than trading certainties.

If you are seeking an inflation hedge, you should weigh XRP’s utility in payments against its centralization and regulatory exposure.

Conclusion

So, is XRP a good investment? It can be for investors who accept elevated regulatory, concentration and volatility risks. The 2025 crypto environment includes clearer rules after the SEC case ended. That outcome eased institutional access but did not eliminate all legal or custody constraints.

Use XRP price predictions as conditional guides rather than certainties. Keep positions small, diversify holdings, and perform due diligence before allocating capital. Remember to rebalance positions and review regularly.

Don’t Miss the Next Big Move – Access Alerts Instantly

Join the original blockchain-investing research service — live since 2017. Our alerts come from a proprietary 15‑indicator methodology built over 15+ years of market experience. You’re following the service that identified major turning points through crypto winters and bull runs alike

Act now and see why thousands trust us to deliver signals before markets move.

This is how we are guiding our premium members (log in required):

- BTC Testing Long Term Trendline. Here Is Short and Long Term Guidance. (Aug 26th)

- Crypto – To Break Out Or Not To Break Out? (Aug 23rd)

- What Happened This Week? Leading Indicator Analysis and 7 Token Charts. (Aug 16th)

- Crypto Shows More Resilience Than Expected. A Bullish Impulse May Be Underway. (Aug 9th)

- Prepare To Buy The Dip In Crypto (Aug 2nd)

- Alt Season 2025 – Progress Update (July 26th)