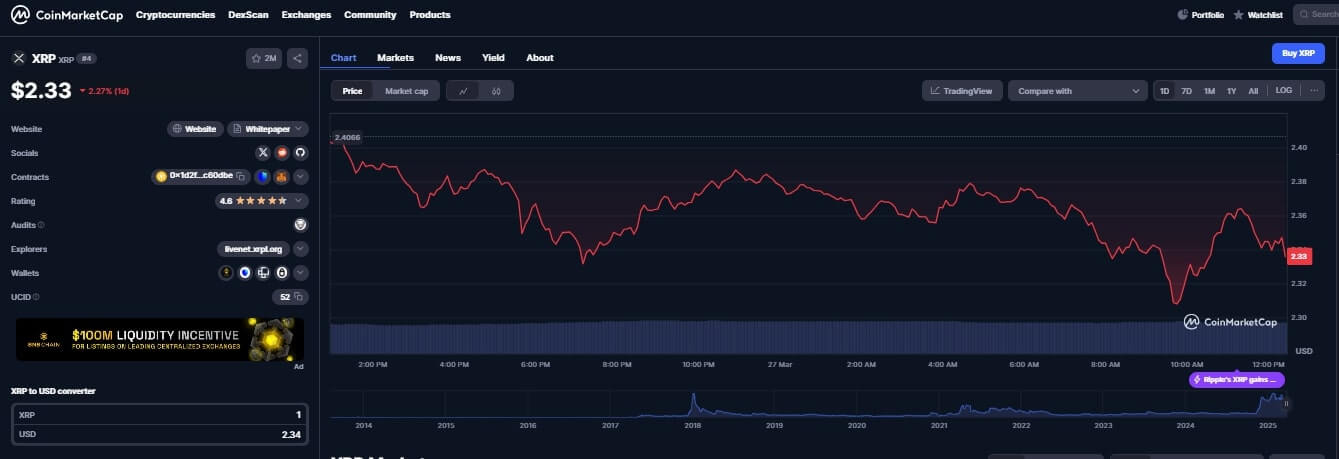

In the latest XRP news, the top altcoin turned slightly bullish today after slipping 4% to settle around $2.41.

The drop comes hours ahead of the SEC vote to end the legal battle against the top altcoin.

On Thursday, March. 27, XRP prices slipped and fell by 4% pushing the popular altcoin to the lows of $2.41, a few points below the current resistance level of $2.51.

The slip defied the slightly bullish momentum that saw the larger crypto industry market cap jump by 1% to top $2.85 Trillion.

The slump comes hours before the much anticipated SEC vote, with commissioners expected to decide whether to go on with the XRP appeal or not.

A vote to the affirmative would bring to an end one of the longest-running and most contentious crypto-related court battles.

At the time of writing, all indicators point to the fact that SEC is deeply inclined to drop the case. In fact, there are rumors that SEC and Ripple have already agreed on an out-of-court settlement.

This will see the regulatory agency keep $50 Million from the $125 Million paid earlier as a fine and refund Ripple the rest. Reports also indicate that Ripple has agreed to counter-sue the agency or seek damages.

So … Why is XRP Falling Today?

One factor for XRP falling, could be due to President Trump’s recent remarks on the upcoming reciprocal tariffs which have put the crypto industry on edge.

Given the significance of today’s event and its evidently predetermined outcome, one would have expected XRP to storm into the day rallying.

President Trumps remarks have spooked investors and sucked any bullish momentum associated with positive Ripple news from XRP’s price.

This price action has also caused a bearish tilt for the altcoin as evidenced by multiple technical indicators.

The Next Big Day for XRP?

After today, the next big day for XRP will be Liberation Day on April. 2 when President Trump makes his “Big Announcement” on reciprocal tariffs.

He has already said he doesn’t want many exceptions to the tariffs, which only means a wider tariff base and a more volatile and chaotic crypto market.

Investors should note, however, that tariffs are also brewing concerns of a recession in the back half of 2025, which could push investors toward cryptocurrencies, including XRP, as alternative assets or hedge against traditional market volatility.

Crypto investments are risky and may not suit retail investors; you could lose your entire investment.Understand the risks here

Get Instant Access to Our Latest High-Potential Crypto Alerts

This is how we are guiding our premium members (log in required):

- A Promising And Welcome Evolution On Crypto’s Leading Indicator Chart (March 24th)

- The Dates & Data Points To Watch In The Next 3 Weeks (March 17th)

- The Time Window as of March 14 Should Bring Relief (March 11th)

- Buy The Dip Is Here (March 1st)