XRP shows strong upside potential amid bullish patterns and rising on-chain activity, but legal and technical risks demand cautious entry.

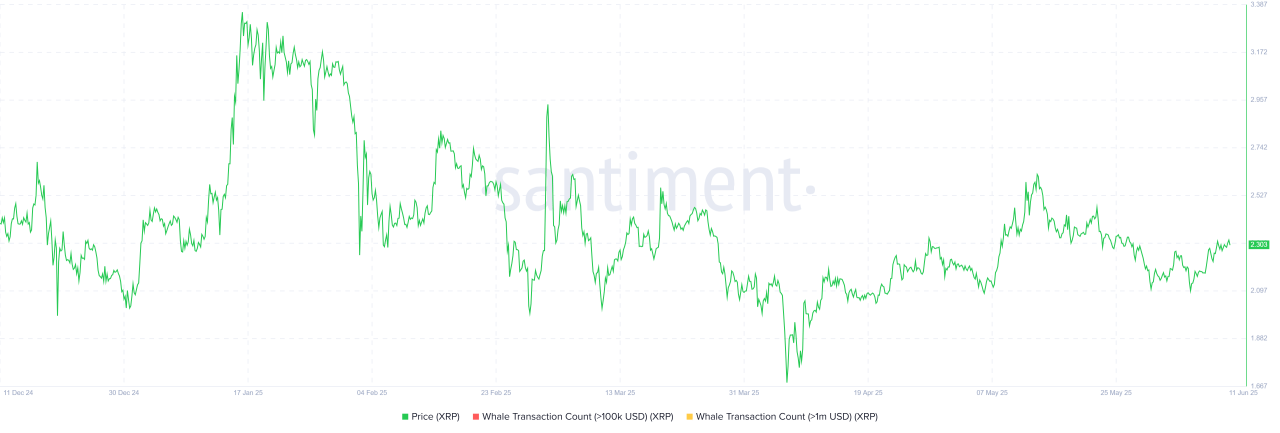

With XRP currently trading between $2.28 and $2.32, the token sits at a critical juncture. Price action has shown buyers defending the $2.27–$2.28 support zone, while sellers push back around $2.31–$2.32.

As the market eyes key developments—including legal outcomes and potential ETF announcements—XRP’s next move could be significant.

That said, here are some factors you should consider before buying.

Technical Landscape

XRP is showing mixed short-term signals. Technically, it’s holding above an ascending trendline, suggesting consolidation may continue until a breakout above $2.32 or breakdown below $2.27.

A broader look reveals a long-term falling wedge pattern, which often precedes bullish reversals. Chart watchers are also eyeing a possible “W” formation—an indicator that could signal upside toward $4.50 or even $7.60 in the medium term.

However, downside risks remain. If the current consolidation fails and breaks the lower support, XRP may slide toward the $2.00–$1.25 range, especially if accompanied by negative news or broader market weakness.

Fundamentals and On-Chain Trends

XRP’s fundamentals have strengthened following a partial court victory in its long-standing case with the SEC in 2023. More recently, speculation around a potential spot XRP ETF—mirroring developments seen with Bitcoin and Ethereum—has boosted investor optimism.

Additionally, XRP’s rumored inclusion in a U.S. government-backed crypto reserve framework could further validate its institutional use case.

On-chain data supports this renewed interest. Daily active addresses are up over 1,600%, and recent whale activity suggests accumulation, with nearly 500 million XRP moved in large transactions. Daily trading volume remains robust, hovering around $2.1 billion.

Price Outlook and Risk Strategy

If bullish catalysts align—such as an ETF approval or final legal resolution—XRP could rally past $3, with targets beyond $4 in play. Yet, you should also prepare for the bear case: any regulatory setbacks could see the token dip toward $1.85 or lower.

Risk management is key. Watch the $2.27 support closely and consider stop-losses or position sizing to limit downside exposure.

Conclusion

Buying XRP now offers strong upside potential, but with considerable volatility. Between bullish technical setups, on-chain growth, and looming legal/regulatory catalysts, timing and discipline are essential. Always invest with a clear plan.

Our latest crypto alerts – instantly accessible

This is how we are guiding our premium members (log in required):

- Another Test of 106.1k, Is This THE Big One? (June 8th)

- How Much Longer Do We Have To Wait For Alt Season 2025? (June 1st)

- The Bitcoin vs. Altcoin Divergence (May 24th)

- Is A Massive Breakout Coming? (May 17th)

- Top Altcoin Picks in the Strongest Emerging Narrative (May 9th)