XRP’s real-world utility, legal clarity, and growing institutional interest create a strong foundation for long-term value growth and adoption.

With XRP trading around $2 amid daily volumes of ~$4.0 billion, as a long‑term investor you may be wondering if the crypto offers foundational value that can endure for years.

The answer lies in the convergence of real-world utility, regulatory clarity, institutional frameworks, and technical momentum.

Let’s explore some reasons why we think XRP is great for long term investors. If you want further insight you can read our XRP price prediction here

1. Real-World Utility

The XRP Ledger settles payments in 3–5 seconds, using far less energy than proof-of-work chains. More importantly, Ripple is embedding XRP into CBDC pilots and cross-border remittances, creating sustainable, transactional demand.

This consistent usage supports long-term value because adoption-driven activity is more durable than short-term speculation.

2. Regulatory Certainty Removes a Major Long-Term Risk

In 2023, a U.S. court ruled that XRP itself isn’t a security; the SEC has since paused appeals. This legal clarity is a turning point—it addresses the biggest risk hanging over XRP, positioning it for broader adoption without fear of regulatory crackdowns.

3. Institutional Access Could Fuel Multi-Year Growth

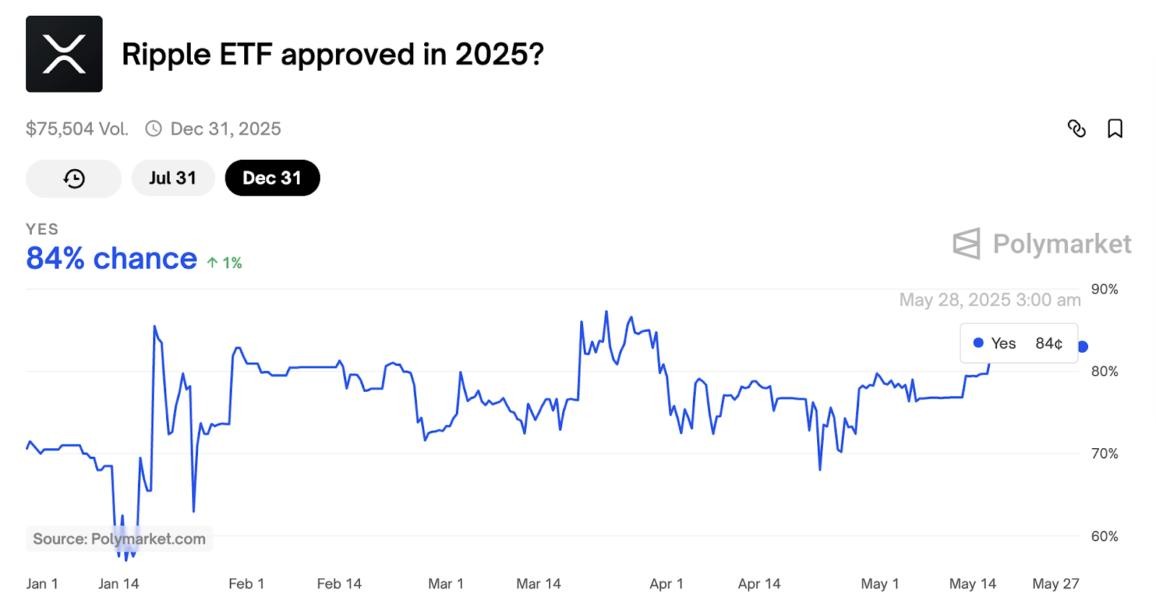

There’s growing momentum behind XRP spot ETFs—with 70–88% implied odds of approval by year-end 2025. If approved, conservative models suggest $4–5 by end‑2025, and some predict even $8+ upside . ETF access invites large-scale, long-term capital allocation—fundamentally different from retail-driven rallies.

4. Technical Momentum and Ecosystem Evolution Provide Built‑In Upside

XRP now trades above key weekly 50- and 200-day moving averages, with neutral RSI—a setup ripe for extended upward trends.

Simultaneously, the launch of XRPL’s built-in Automated Market Maker (AMM) enhances liquidity and strengthens its position in DeFi. This deepens the ecosystem, helping XRP evolve from a payment token to a broader financial asset.

Conclusion

XRP’s fast, cost-efficient network, anchored in real-use payments, now benefits from regulatory resolution and institutional market access via ETFs. These are underpinned by favorable technical trends and ecosystem expansion through DeFi.

For investors with a multi‑year horizon, XRP now presents a layered, aligned, and increasingly robust risk‑reward profile—with the potential for conservative gains ($4–5) to ambitious upside ($8+) driven by adoption, not hype.

Our latest crypto alerts – instantly accessible

This is how we are guiding our premium members (log in required):

- BTC And Altcoins About To Hit Big Support Areas (June 22)

- The Alt Season Charts (June 15th)

- Another Test of 106.1k, Is This THE Big One? (June 8th)

- How Much Longer Do We Have To Wait For Alt Season 2025? (June 1st)

- The Bitcoin vs. Altcoin Divergence (May 24th)