XRP’s surge in Google Trends reflects growing market interest fueled by legal developments, whale accumulation, and new institutional products like CME futures, though regulatory uncertainty continues to create volatility.

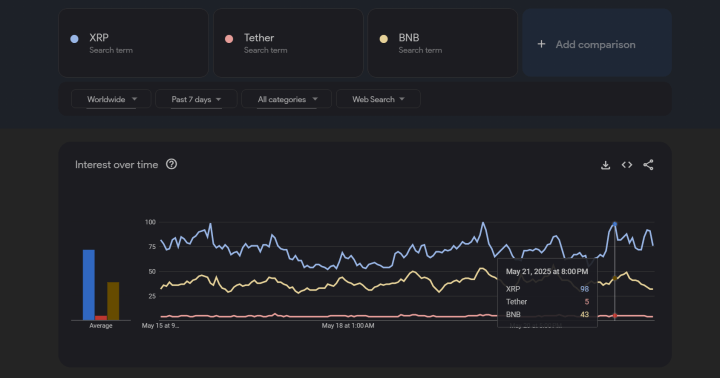

XRP has recently surged in Google Trends, significantly outpacing competitors like BNB and Tether. Search trends often act as a barometer for market sentiment, signaling growing curiosity, speculation, or concern.

But what’s behind this sudden spike in interest?

What the Spike in XRP Search Trends Indicates

Google Trends data, which measures relative search interest on a scale of 0–100 , where 100 represents peak interest, shows XRP peaking at 98 on May 21—far ahead of Tether (5) and BNB (43).

Such spikes typically coincide with major price movements, news events, or heightened speculation. While search volume doesn’t guarantee price action, it does reflect shifting trader attention, often preceding volatility.

Possible Reasons Behind the Surge

The sudden spike in XRP-related searches appears closely tied to recent market-moving developments. On May 16, U.S. District Judge Analisa Torres delivered a blow to Ripple by rejecting its proposed 50 million settlement with the SEC, sending XRP′s price tumbling.

This legal setback triggered a wave of cautious trading, with derivatives markets seeing $160 million in open interest evaporate within 24 hours as investors reassessed their positions amid renewed regulatory uncertainty.

Meanwhile, conflicting signals are emerging from institutional circles. While the SEC’s delay in approving an XRP spot ETF has extended the regulatory limbo, on-chain data reveals whales are accumulating the token at an accelerating pace.

Wallets holding between 1 million and 10 million XRP now control over 6 billion tokens, suggesting big players are positioning for long-term gains.

This accumulation coincides with the May 18 launch of XRP futures on CME Group, which attracted $6 million in trading volume on day one, pushing open interest to $4.69 billion – clear signs of growing institutional participation that could foreshadow broader market acceptance.

XRP’s Current Market Standing

At press time, XRP trades at $2.4—up 2.4% in 24 hours but down 2.35% over the past week. Its market cap stands at $140.63 billion, with daily trading volume jumping 32% to $3.96 billion. .

Technically, XRP is consolidating near $2.30, with key moving averages tightening—a potential precursor to a breakout.

Is It Time to Buy?

While whale activity and futures demand suggest bullish momentum, regulatory risks remain. As an investor, you should consider XRP’s volatility, legal hurdles, and long-term utility rather than chasing short-term hype.

Conclusion

XRP’s search trend explosion reflects a mix of legal drama, institutional interest, and speculative trading. Whether this attention translates to sustained gains depends on regulatory clarity and market sentiment.

Since this could mean a potential price spike, XRP may be an exciting investment for those with high risk-appetite at writing. However, conservative investors should consider the risks involved before making any significant investment decision.

Gain Instant Access to the World’s First Blockchain Investing Research Service — Actionable Crypto Alerts, Built on 15+ Years of Market Experience

Discover market-moving insights and exclusive crypto forecasts powered by InvestingHaven’s proprietary 15-indicator methodology. Join smart investors using our premium alerts to stay ahead of the curve—before the big moves happen.

This is how we are guiding our premium members (log in required):

- Is A Massive Breakout Coming? (May 18th)

- Top Altcoin Picks in the Strongest Emerging Narrative (May 9th)

- Bitcoin’s Must-Watch Chart Structure, What It Means For Top Altcoins (May 6th)

- Charts – XRP, Theta, Uniswap, and two RWA Token Tips (April 29th)

- Juicy Opportunities Are Starting To Show Up On The Charts (April 24th)