KEY TAKEAWAYS

- XRP has dropped 16% YTD, falling from January highs above $2.30.

- Forced liquidations accelerated losses during the February selloff.

- Weak technical levels and soft demand still threaten further declines.

- Should you invest $1,000 in XRP now?

XRP is down 16% YTD and trades near $1.61 in early February 2026. Heavy selling and liquidations erased January gains.

At the time of writing, XRP trades around $1.61 after falling 16% since the start of 2026.

Its market value stands close to $100B, while daily trading volume often reaches $4–6B during volatile sessions.

The token peaked near $2.30 in early January before sliding to an intra-day low of $1.52 on Feb 2.

This sharp reversal shows rising risk pressure across crypto and a rapid exit from leveraged positions.

RECOMMENDED: Is XRP Dead? Here’s Why Crypto Forums Are Going Crazy

XRP Price Today And Year-To-Date Performance

XRP entered 2026 with strong momentum, trading close to $1.90 in early January.

Buyers pushed the price above $2.30, raising hopes for a sustained rally.

That strength did not last. By early February, XRP had slipped back to about $1.61, wiping out most of its early gains.

The token now carries a market capitalization near $100B, supported by about 60.8 billion XRP in circulation. Trading volume remains high, especially on days when prices swing sharply.

The fall to $1.52 on Feb 2 marked the weakest level in several months and confirmed a shift in short-term market direction.

RECOMMENDED: Forget BTC & ETH – Here’s Why Experts Are Calling XRP The Hottest Crypto Of 2026

What Caused XRP’s Recent Price Drop?

Several factors combined to pressure XRP lower. First, global markets turned cautious as interest rate expectations shifted and investors reduced exposure to risky assets.

This trend spread quickly to cryptocurrencies.

Second, many traders had built large leveraged positions after January’s rally.

When prices started falling, exchanges closed these positions automatically.

This wave of liquidations flooded the market with sell orders and deepened losses.

Finally, XRP broke below key support levels around $1.80. Once this happened, technical traders and automated systems increased selling.

Headlines linked to geopolitical risks and falling liquidity added to market stress, making price moves sharper and faster.

RECOMMENDED: This Hidden Senate Clause Could Change Everything For XRP

Network Activity And Trader Positioning

On-chain data shows that active wallet addresses and retail inflows declined in late January. This suggests that smaller investors became more cautious.

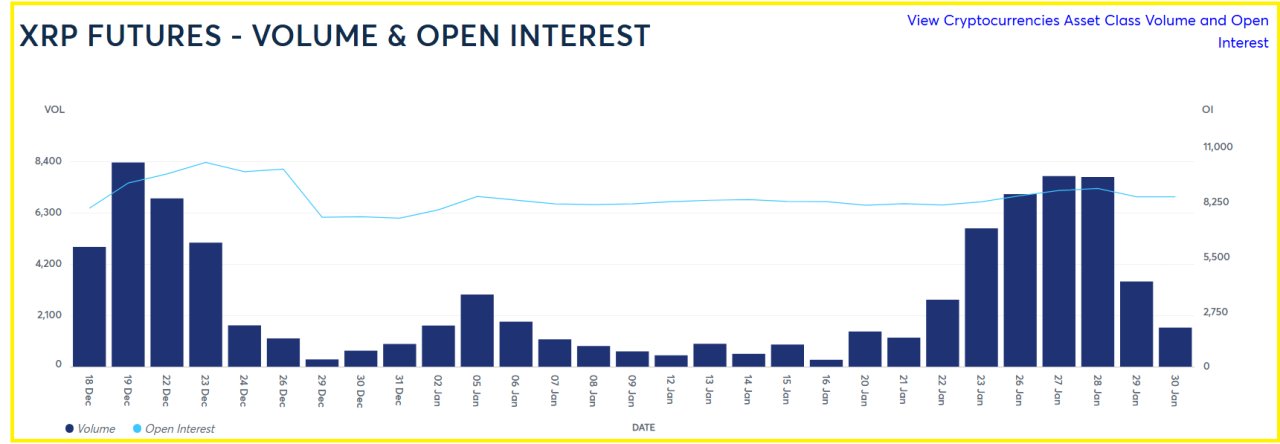

At the same time, futures open interest dropped after the selloff, showing that traders reduced risk.

Some large holders increased positions at lower prices, while many retail traders exited. This split behavior points to uncertainty about XRP’s near-term direction.

Conclusion

XRP may recover if market sentiment improves and prices hold above $1.50, but weak demand and fragile technical levels still leave the downside risk high.

Should You Invest $1,000 In XRP Now?

Before you invest in XRP, you’re going to want to read our next premium crypto alert which will be published in the coming days. We will reveal key crypto assets to consider in 2026 with explosive potential.

Since 2017, InvestingHaven’s blockchain research service has been guiding investors through both bull runs and crypto winters.