KEY TAKEAWAYS

- XRP lost the $1.81 support and now depends on $1.50 to prevent deeper losses.

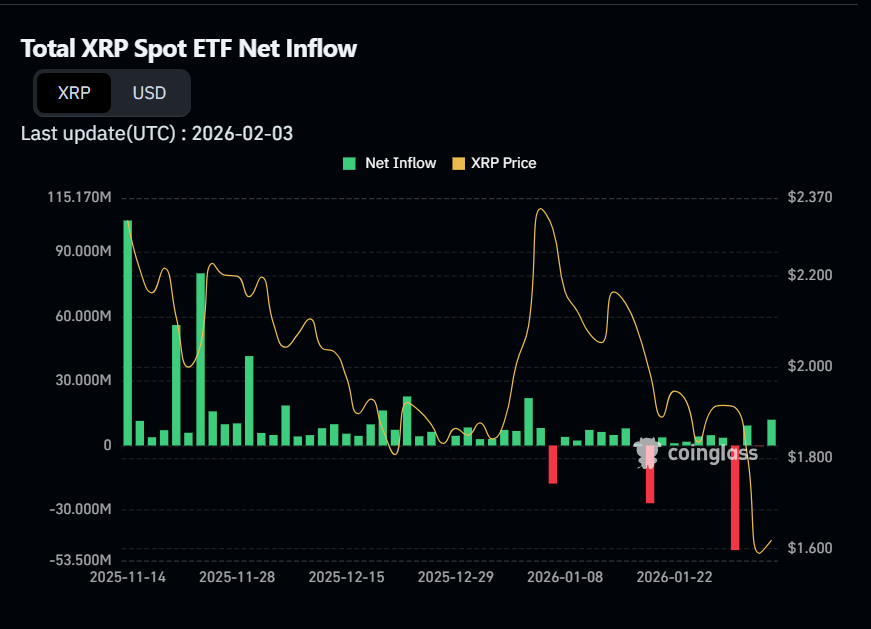

- Spot ETF flows have flipped negative, adding steady pressure to price.

- On-chain activity shows fewer retail transfers and higher concentration in large wallets.

- A daily close below $1.40 with strong volume would open the door to a move toward $1.

- Check out the understudied XRP/BTC Chart

- Should you invest in XRP now?

XRP has slipped into a fragile zone as price breaks, fund outflows, and weak demand line up. A $1 test is no longer unthinkable if pressure continues.

XRP dropped about 6% on February 3 and traded around $1.56 after losing a key support level that held for weeks.

The sell-off came with heavier volume than recent rebounds, a detail that often signals stronger conviction from sellers.

At the same time, short-lived rallies failed to attract follow-through buying.

Together, these signals show a market that feels cautious rather than confident, and one where downside risk has become easier to trigger.

RECOMMENDED: Is XRP Dead? Here’s Why Crypto Forums Are Going Crazy

Current XRP Price Levels And Recent Moves

XRP’s current setup is rather uncomfortable. The token broke below $1.81, a level that acted as support through much of January.

Once that floor gave way, sellers stepped in faster than buyers could respond.

Price then slid to the $1.50 zone, where some demand appeared, though not with much force.

Volume data is important here because sell days now show higher volume than bounce days, which suggests traders are more eager to exit than to add exposure. Short-term resistance sits between $1.70 and $1.80, an area where selling previously emerged. Any rebound into that range faces immediate friction.

Below $1.50, liquidity reduces quickly. This does not guarantee a sharp drop, but it raises the risk. If buyers hesitate and price slips again, the move can accelerate simply because fewer orders sit underneath. So, if you are a regular trader, understand that XRP no longer trades from a position of strength.

RECOMMENDED: XRP Fell 16% YTD – Temporary Pullback or Start of a Downtrend?

Why XRP Is Under Pressure Right Now

Three data points explain most of the current weakness. First, spot XRP ETFs have posted net outflows in recent sessions.

The numbers are not huge, but direction matters more than size. So, even modest institutional selling can weigh on price when demand feels fragile.

Second, the broader crypto market has struggled under macro stress tied to dollar moves and rate expectations. When this happens, altcoins often feel it first and hardest. XRP has followed that familiar pattern.

Third, on-chain activity shows fewer daily transfers compared with earlier in the year. Retail participation looks muted, while a large share of supply remains in top wallets. That concentration can amplify downside moves because selling from a small group carries more weight.

None of these signals alone spells disaster. But together, they explain why XRP has struggled to stabilize and why rebounds have looked thin.

ALSO READ: 10 Best Exchanges To Buy XRP in the USA Today

Can XRP Drop To $1? Key Scenarios Explained

The fate of XRP’s future rests on two scenarios. In the first, XRP holds above $1.50. This outcome requires selling pressure to ease, ETF flows to stabilize, and retail activity to slowly return.

If exchange balances fall and daily flows improve, buyers can rebuild confidence and keep price supported above $1.40.

The second scenario involves a deeper slide. A daily close below $1.40 on strong volume would signal that support has failed. That move could trigger forced selling from leveraged positions and push XRP toward the psychological $1 level. This only requires continued pressure without enough buyers stepping in.

Some forecast models still see $1 as unlikely this month, while others see it as possible. The difference comes down to flows and volume, not opinions. If selling accelerates and liquidity dries up, the math becomes less forgiving.

Understudied XRP Chart

One chart that we reference in our XRP price prediction is the XRP/BTC chart. We have identified one key level that has seen a significant rally every time it was hit.

Keep a close eye on this chart as it may present the buying opportunity you’re looking for with XRP.

Conclusion

XRP now trades in a narrow zone where small shifts can have outsized effects.

The loss of $1.81 changed the structure, ETF outflows added pressure, and low retail activity reduced the market’s ability to absorb selling.

The $1.50 level remains the first line of defense, while $1.40 acts as the warning signal.

If price holds above those areas and demand returns, downside risk fades quickly. If not, a move toward $1 becomes a realistic outcome rather than a dramatic one.

Should You Invest In XRP Now?

Before you invest in XRP, you’re going to want to read our next premium crypto alert which will be published in the coming days. We will reveal key crypto assets to consider in 2026 with explosive potential.

Read our latest alert here: Major Support Being Tested in Crypto – This Is The Point For a Bounce to Develop

Since 2017, InvestingHaven’s blockchain research service has been guiding investors through both bull runs and crypto winters.