XRPR logged $37.7M in first-day trading. A 0.25% Fed rate cut helped push XRP toward $3.10.

Two market events moved XRP this week. REX-Osprey’s spot XRP ETF, ticker XRPR, opened with $37.7M in debut volume, the largest day-one ETF showing of 2025. The Federal Reserve lowered its policy rate by 0.25% on Sept 17, lifting risk assets and supporting a short-term uptick in crypto markets.

READ: XRP’s Next Explosive Move Might Already Be Underway

ETF Debut And Early Flows

XRPR’s $37.7M debut places it at the top of 2025 ETF launches, and outlets report heavy early-session activity.

Market commentators note that approved spot ETFs can open pathways for institutional and passive capital, potentially bringing multi-billion dollar flows if demand matches other crypto ETF ramps.

For traders, the key takeaways are real cash entry and faster discovery of XRP’s market price.

Fed Cut And Market Reaction

The Fed’s 0.25% cut on Sept 17 provided a clear macro tailwind for risk assets, helping equities and crypto trade higher the following sessions. XRP traded around $3.08 to $3.12 after the move, showing a modest, immediate response to the combined news flow.

RECOMMENDED: XRP Price Outlook: September 2025 Could Be a Turning Point

Price Levels And What To Watch

Technical levels matter now matter more than ever for XRP. Immediate resistance clusters appear at $3.20, and support lies around $3.00–$3.05, making a decisive close above $3.20 the clearest short-term bullish signal.

Derivatives desks cite roughly $9.16B in open interest and an 86% jump in trading volume on some venues, a condition that raises both breakout potential and liquidation risk.

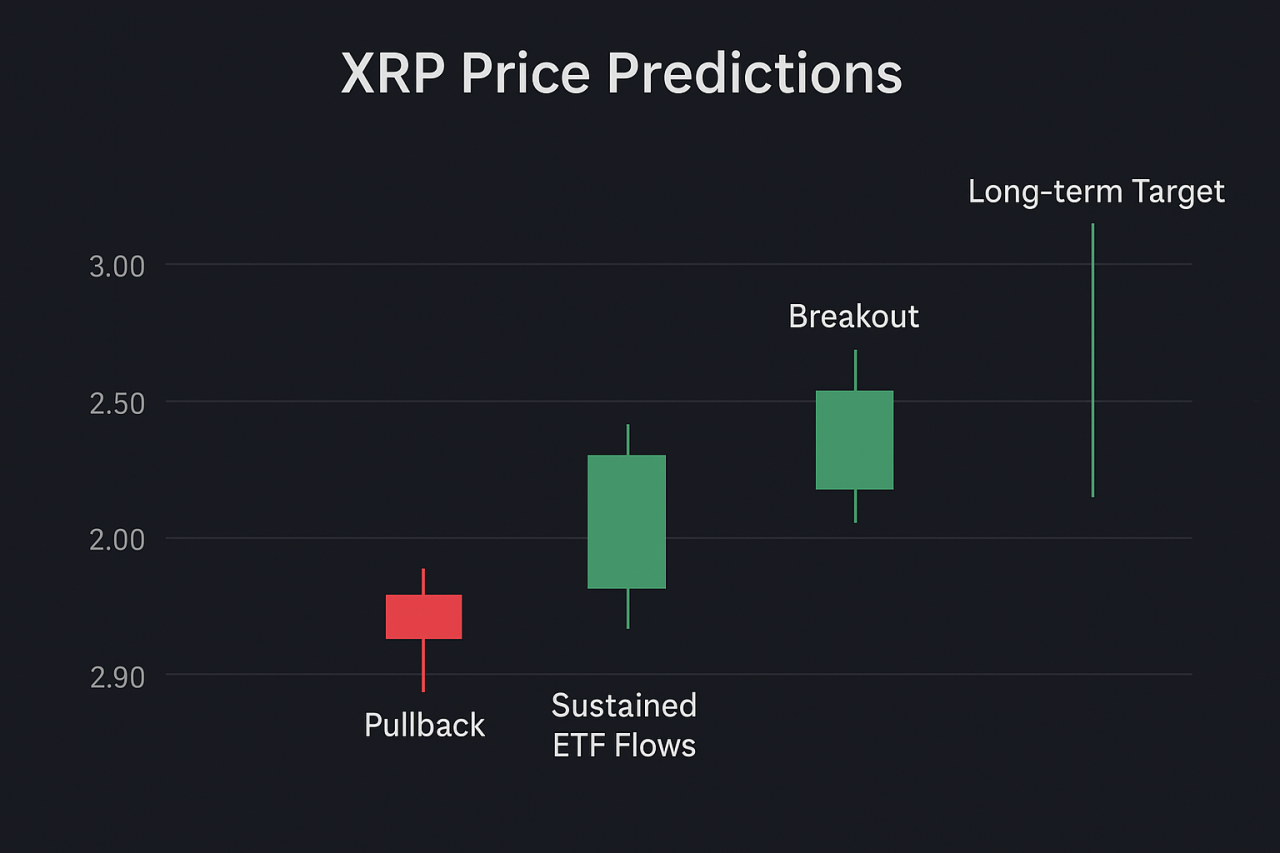

Short-Term XRP Price Predictions:

- If XRP holds support at $3.00 and ETF flows continue, XRP could reach $3.30–$3.50 within the next week.

- A failure to break resistance near $3.20 may lead to a pullback toward $2.90–$2.95.

- A strong close above $3.35 could open targets of $5.00+ in coming weeks if volume remains high.

Monitor 24-hour volume, open interest, XRP price predictions, ETF flow data, and XRPL settlement activity for confirmation.

RECOMMENDED: Is It Worth Buying XRP in 2025?

Conclusion

Short term, the XRP ETF launch plus a 0.25% Fed cut create a credible window for XRP momentum, but traders need confirmation from sustained ETF inflows, rising on-chain throughput, and a clean close above $3.20.

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here

Which Crypto Should You Invest In Right Now?

For alerts on the key crypto assets that are primed for investment right now you should consider Join the original blockchain-investing research service — live since 2017.

InvestingHaven alerts come from a proprietary 15‑indicator methodology built over 15+ years of market experience.

You’ll be following the service that identified major turning points through crypto winters and bull runs alike

Act now and see why thousands trust us to deliver signals before markets move.

This is how we are guiding our premium members (log in required):

- Is A Trendless Crypto Market Good or Bad? The Current and Emerging Winners Look Awesome. (Sept 7th)

- BTC Testing Long Term Trendline. Here Is Short and Long Term Guidance. (Aug 26th)

- Crypto – To Break Out Or Not To Break Out? (Aug 23rd)

- What Happened This Week? Leading Indicator Analysis and 7 Token Charts. (Aug 16th)

- Crypto Shows More Resilience Than Expected. A Bullish Impulse May Be Underway. (Aug 9th)

- Prepare To Buy The Dip In Crypto (Aug 2nd)

- Alt Season 2025 – Progress Update (July 26th)