October could set XRP’s short-term trend. ETF rulings and first-week fund flows will drive significant price action.

October presents a clear catalyst for XRP. The SEC approved generic listing standards on Sept 18, shortening ETF approval windows, and several spot-XRP filings face decisions in October.

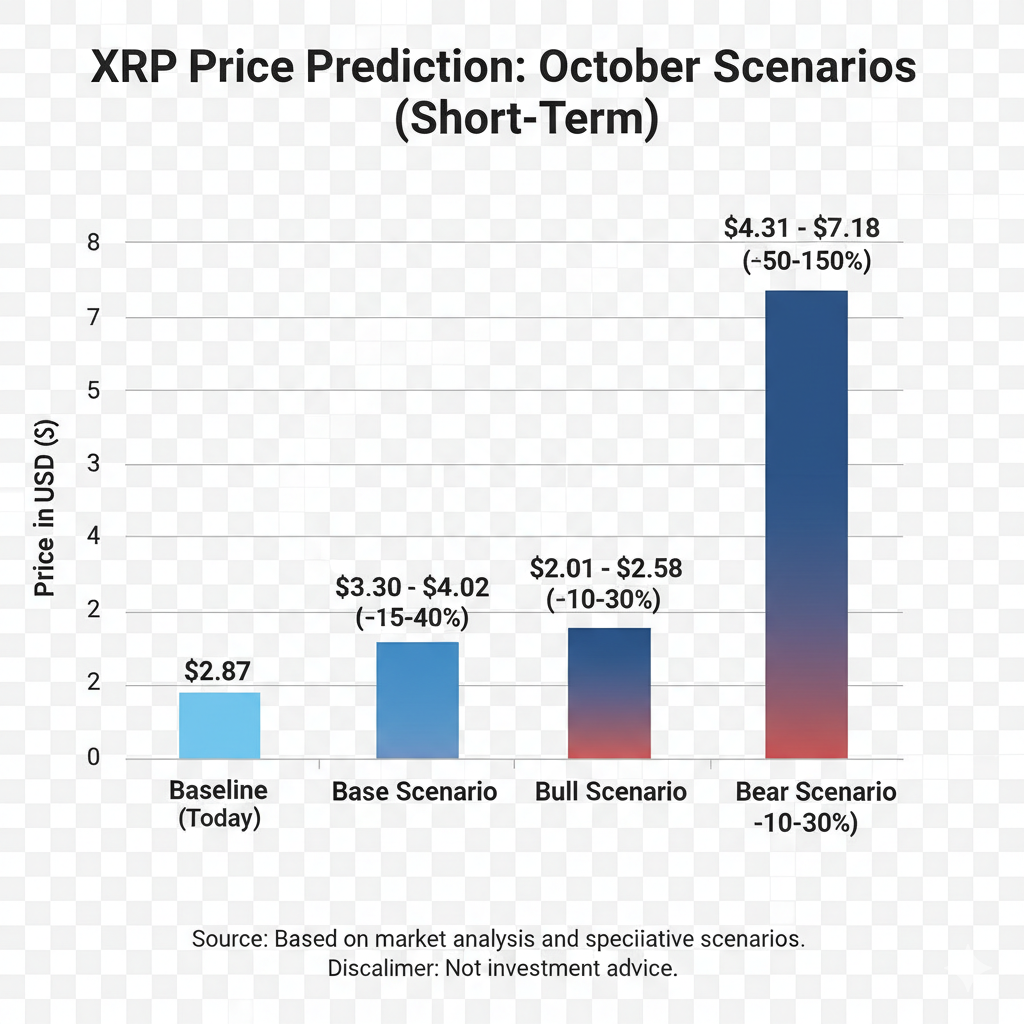

The asset is currently trading at about $2.87, and the REX-Osprey XRPR ETF logged $37.7M in day-one volume.

RELATED: XRP Price Prediction: Record-Launching Spot XRP ETF And Fed Rate Cut Spark New Momentum

Let’s look at what changed, how it will affect price and some XRP price predictions for October.

What Changed?

The SEC vote on Sept 18 lets national exchanges adopt generic listing standards for commodity-based trust shares, including digital assets. This shortens the route to list spot ETFs.

Reuters reports the change can cut approval time from as much as 240 days to roughly 75 days. Multiple issuers have spot-XRP filings waiting review, with decisions expected in October or November.

The REX-Osprey XRPR ETF launched on Sept 18 and recorded $37.7M in day-one trading, which shows investor interest in listed XRP products.

ALSO READ: Will XRP Hit $20? Timeline And Likelihood

Why October Could Move XRP Price

Approvals translate into direct buying pressure, as ETFs must accumulate underlying XRP to match inflows. A successful approval calendar in October could push immediate demand into the spot market, tightening liquidity and raising XPR October price over days or weeks.

The XRPR ETF’s $37.7M debut suggests healthy appetite for listed XRP exposure. Technically, traders will watch whether XRP clears the $3.00 resistance, which could trigger short covering and amplify moves. Conversely, delays or weak first-week flows can cause a sharp pullback.

RECOMMENDED: XRP Up 400%: How $1,000 Turned Into $4,000 in Just One Year

XRP Price Prediction: How October Might Look

XRP sits at about $2.87. The base scenario, with one or two ETF approvals and modest inflows, could lift XRP +15–40% to roughly $3.30–$4.02 in October.

In a bull scenario, multiple approvals and strong inflows, could push XRP +50–150% to roughly $4.31–$7.18.

However, if things turn bearish and there are delays or a market-wide selloff, it could cut XRP -10–30% to about $2.58–$2.01.

RECOMMENDED: 1 Reason Why XRP Could Sky Rocket

Conclusion

October will likely define XRP’s short-term path. To understand whether price gains can sustain, keep an eye on SEC ETF rulings, first-week ETF flows, and order-book liquidity.

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here

Which Crypto Should You Invest In Right Now?

For alerts on the key crypto assets that are primed for investment right now you should consider Join the original blockchain-investing research service — live since 2017.

InvestingHaven alerts come from a proprietary 15‑indicator methodology built over 15+ years of market experience.

You’ll be following the service that identified major turning points through crypto winters and bull runs alike

Act now and see why thousands trust us to deliver signals before markets move.

This is how we are guiding our premium members (log in required):

- Is A Trendless Crypto Market Good or Bad? The Current and Emerging Winners Look Awesome. (Sept 7th)

- BTC Testing Long Term Trendline. Here Is Short and Long Term Guidance. (Aug 26th)

- Crypto – To Break Out Or Not To Break Out? (Aug 23rd)

- What Happened This Week? Leading Indicator Analysis and 7 Token Charts. (Aug 16th)

- Crypto Shows More Resilience Than Expected. A Bullish Impulse May Be Underway. (Aug 9th)

- Prepare To Buy The Dip In Crypto (Aug 2nd)