XRP is trading around $2.85 and faces $3 resistance, with $2.66 support. Volume and legal headlines will set the near-term path.

XRP trades at $2.85 with 24-hour volume close to $4.9B, posing a simple question, can buyers push it above $3, or will sellers force a break below the $2.66 XRP support? Two factors matter most, the SEC case finality and short-term volume trends, and macro rate moves too.

Lets look at some XRP price prediction to understand whether the coin will retreat or breakout this week.

RELATED: XRP Price Prediction: Is Today’s Fall a Buying Chance?

Where XRP Stands Now

XRP sits at $2.85, up 0.9% over 24 hours, with 24-hour volume about $4.9B and a market cap above $170B, ranking it fourth by market cap, according to CoinMarketCap.

Circulating supply stands at 59.48B XRP. This week the token traded between $2.50 low and $3.01 high, showing elevated volatility and higher network activity, with new wallet growth reported last month.

TradingView technical summary reads neutral to buy on short timeframes, which matches mixed momentum in price and volume. Order book resistance clusters around $2.82 to $3.00, with immediate support at $2.66 for now.

RECOMMENDED: 3 Big Reasons XRP Might Be The Best Crypto To Buy Today

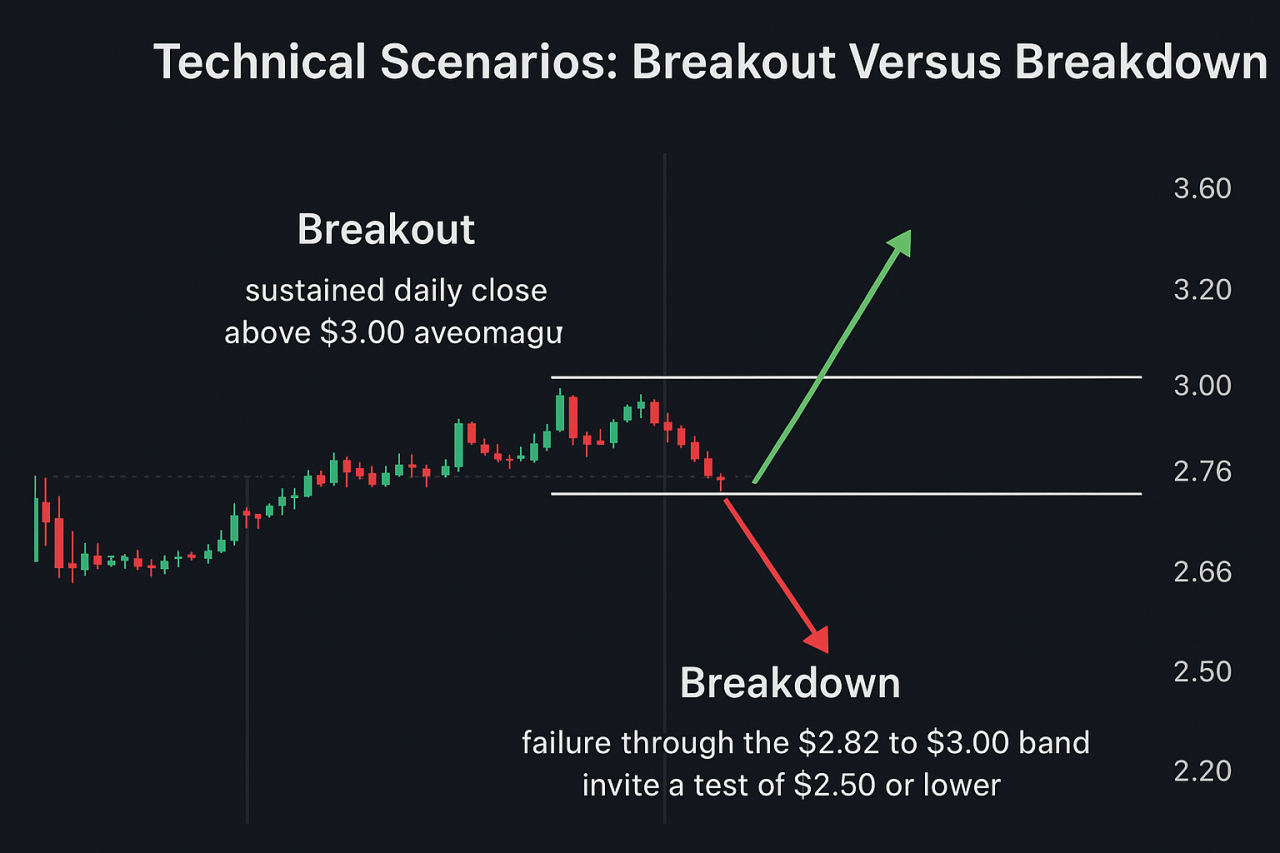

Technical Scenarios: Breakout Versus Breakdown

Two clear technical scenarios define near-term outcomes. In the bull case, a sustained daily close above $3.00, accompanied by rising volume above the recent 30-day average, opens a path toward $3.60 and the next resistance zone.

Traders will treat a breakout with conviction only if exchanges register net outflows and open interest rises.

In the bear case, failure through the $2.82 to $3.00 band and a breach below $2.66 would likely invite a test of $2.50 or lower on increased selling. Indicators remain mixed, so probability stays balanced until a clear directional trigger appears soon.

RECOMMENDED: 3 Reasons To Buy Ripple (XRP) Like There’s No Tomorrow

Catalysts And Risks To Watch

Near-term catalysts include the SEC vs. Ripple case closure and evolving ETF rules. Legal finality reduces a major roadblock, while SEC orders allowing in-kind creations for crypto ETPs raise the odds of faster listings.

For now, monitor exchange inflows, wallet growth, and macro headlines, because sudden news or rate moves can flip momentum within hours. If you are trading, size positions and use stop losses accordingly.

RECOMMENDED: Is It Worth Buying XRP in 2025?

Conclusion

Watch $3 resistance and $2.66 support, use volume and exchange flows to confirm moves. A daily close above $3 favors a retest of $3.60, a break below $2.66 raises risk.

Don’t Miss the Next Big Move – Access Alerts Instantly

Join the original blockchain-investing research service — live since 2017. Our alerts come from a proprietary 15‑indicator methodology built over 15+ years of market experience. You’re following the service that identified major turning points through crypto winters and bull runs alike

Act now and see why thousands trust us to deliver signals before markets move.

This is how we are guiding our premium members (log in required):

- BTC Testing Long Term Trendline. Here Is Short and Long Term Guidance. (Aug 26th)

- Crypto – To Break Out Or Not To Break Out? (Aug 23rd)

- What Happened This Week? Leading Indicator Analysis and 7 Token Charts. (Aug 16th)

- Crypto Shows More Resilience Than Expected. A Bullish Impulse May Be Underway. (Aug 9th)

- Prepare To Buy The Dip In Crypto (Aug 2nd)

- Alt Season 2025 – Progress Update (July 26th)