Cryptocurrencies sold off this week amid a global stock market crash. In total Bitcoin lost 10 pct top-to-bottom. Altcoins did worse obviously. Ripple which we consider the new Bitcoin went 30 pct lower before recovering in this morning’s session. So why are cryptocurrencies falling with stock markets? Are cryptocurrencies not supposed to be an asset class trading independently?

The answer to this question is very simple: cryptocurrencies are highly correlated to technology stocks, first and foremost the Nasdaq index.

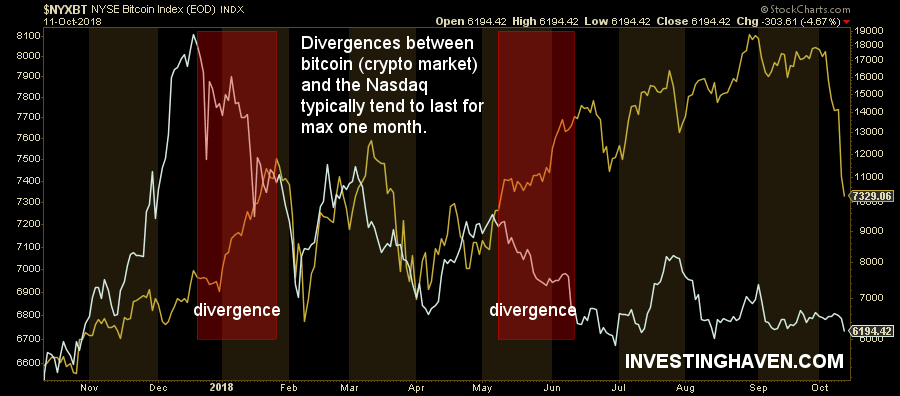

As explained in great detail in our crypto and blockchain investing research the Nasdaq index and Bitcoin’s price (the leading indicator for the cryptocurrency market) move in tandem. Only twice in the last 12 months have we seen a divergence which typically tended to last for maximum one month.

The chart below makes our point.

That said, the Nasdaq fell sharply this week, and, in doing so, broke the summer of 2016 uptrend. This is not a catastrophic event, but there is some damage done and it needs time to recover.

In other words it’s not the global market sell-off that pushed crypto prices lower, but primarily the Nasdaq tech stock weakness.

What is the impact of the recent sell-off on Bitcoin’s (BTC) chart?

So far, no real damage for Bitcoin. As the long term chart from our Bitcoin price forecast 2019 shows Bitcoin continues to trade in its ‘transition band’, and starting to move to its ‘support band’. There is plenty of support before it gets serious which to us suggests Bitcoin is alive and kicking even if its price is going nowhere.

We recommend watching the $6300 level closely as that’s the line in the sand between the two lower bands on Bitcoin’s long term chart seen below.