Crypto investment funds hit a record $167B AUM in May, signaling a growing shift toward digital assets as macro hedges.

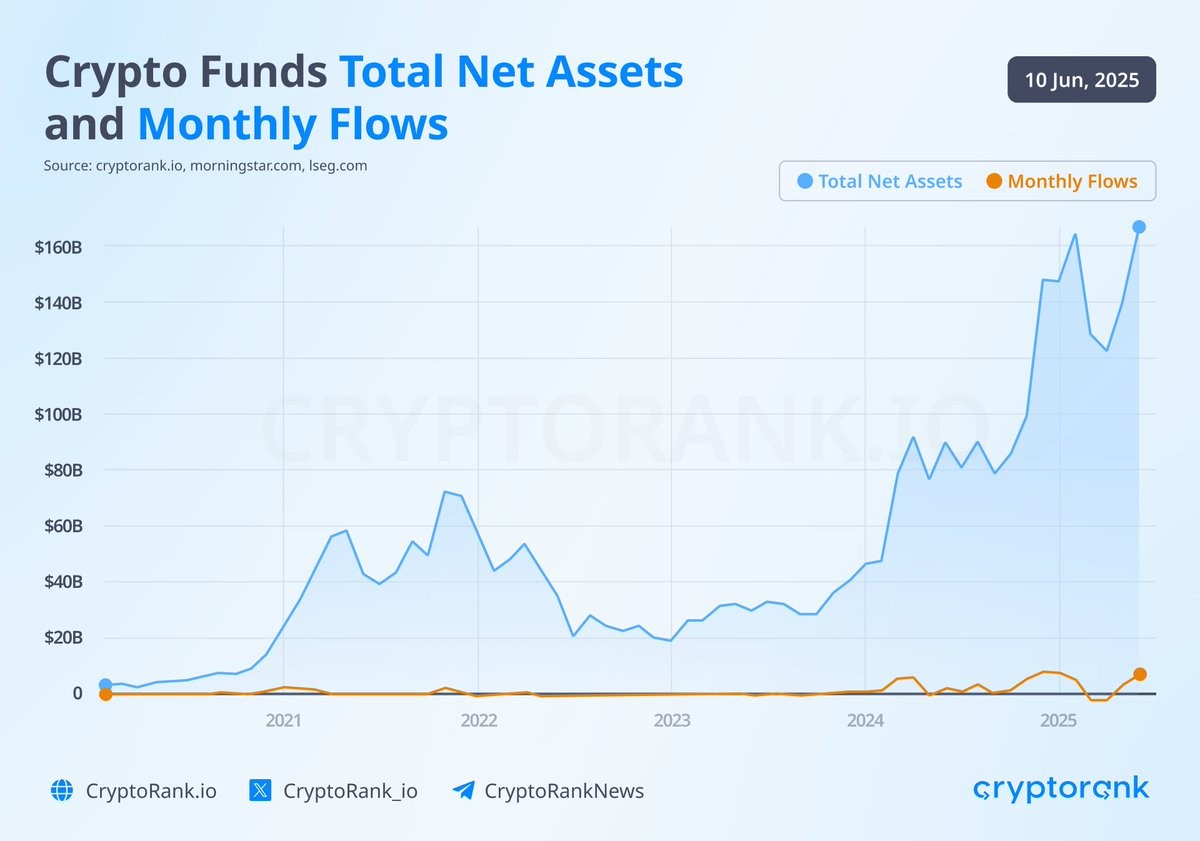

In May 2025, crypto investment funds achieved a landmark high of $167 billion in AUM, fueled by $7.05 billion in net inflows—the largest monthly intake since December 2023.

This surge highlights a strategic realignment as investors shift away from equities and gold toward crypto, seeking fresh macro hedges.

Market Momentum & Flow Overview

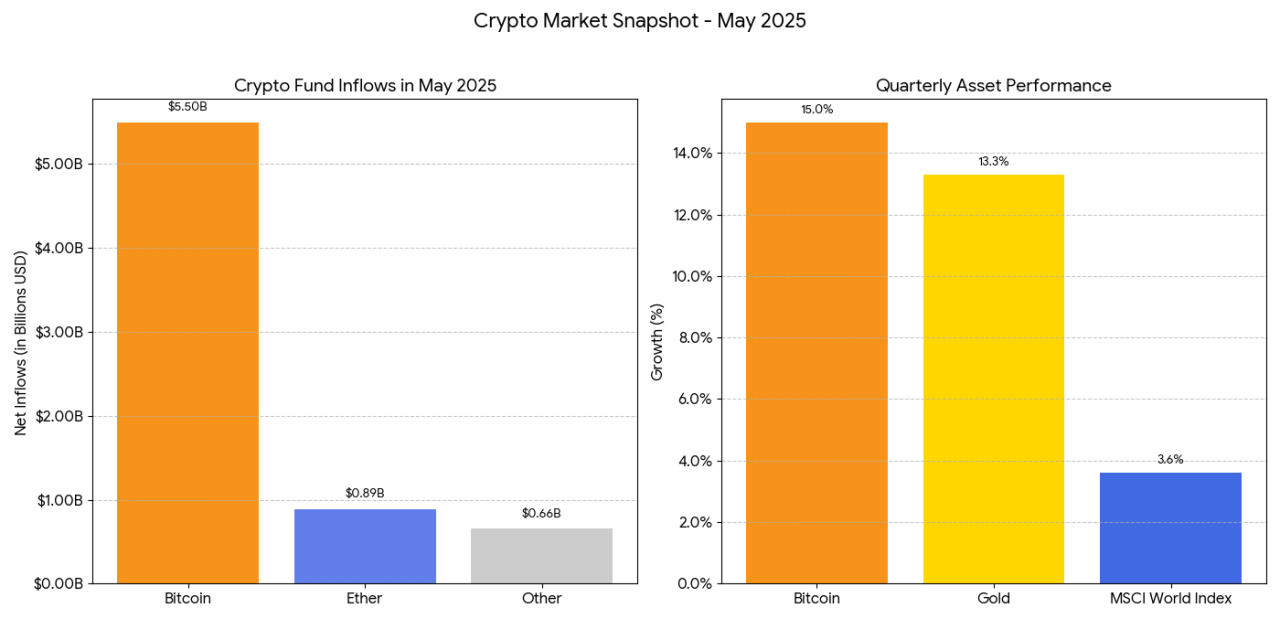

Bitcoin-led funds captured the lion’s share, drawing $5.5 billion in new capital, while Ether-focused products added $890 million, according to the report published by Reuters.

Over the past quarter, BTC has climbed more than 15%, surpassing gold’s 13.3% and the MSCI World Index’s 3.6%. With spot Bitcoin and Ether ETFs now live in the U.S., the market has seen improved liquidity and streamlined capital flows.

Exchange outflows on-chain point to stronger long-term conviction, further stabilizing the rally.

Why Investors Are Turning to Crypto

According to analysts like Nic Puckrin, the trigger lies in macro tension: a weakening U.S. dollar, climbing bond yields, and tepid equity sentiment.

In May, global equity funds recorded $5.9 billion in outflows, while gold funds suffered their first withdrawal in 15 months—$678 million—signalling diminished confidence in traditional hedges.

Institutional momentum, buoyed by spot ETF approvals and thought leadership from figures like Aether Holdings’ CEO Nicolas Lin, is solidifying crypto’s role in diversified portfolios.

Outlook & Key Risk Factors

If macroeconomic pressures—such as renewed inflation, geopolitical friction, or continued dollar weakening—persist, crypto AUM could feasibly breach $200 billion by year-end, especially as more ETFs launch.

However, risks remain: potential regulatory setbacks, quicker-than-expected stabilization in traditional markets, or a sudden reversal in bond yields could divert capital back to safer assets.

Conclusion

The $167 billion milestone marks a critical shift: crypto is no longer only speculative—it’s a recognized macro hedge. With institutional inflows and regulatory clarity supporting the trend, monitoring capital flow, on-chain health, and macro headwinds will be crucial to assessing whether this is a lasting paradigm shift or a tactical blip.

Our latest crypto alerts – instantly accessible

This is how we are guiding our premium members (log in required):

- Another Test of 106.1k, Is This THE Big One? (June 8th)

- How Much Longer Do We Have To Wait For Alt Season 2025? (June 1st)

- The Bitcoin vs. Altcoin Divergence (May 24th)

- Is A Massive Breakout Coming? (May 17th)

- Top Altcoin Picks in the Strongest Emerging Narrative (May 9th)

- Bitcoin’s Must-Watch Chart Structure, What It Means For Top Altcoins (May 6th)