Learn the 7 most dangerous errors crypto investors make – from weak research and security lapses to scams and tax trouble – and use smart strategies to protect and grow your investments.

Many people think crypto is about fast riches, but in most cases, it leads to steep losses. In fact, a widely cited claim is that up to 90% of crypto investors lose money. During recent market crashes, stories of six-figure portfolio losses became common.

Crypto markets carry far more risk than stocks or bonds. A lack of maturity, weak regulation, and aggressive speculation make these dangers more profound.

In this guide, we review 7 costly crypto investment mistakes that new and even intermediate investors often make. For each mistake, we offer a smart, practical fix you can use immediately.

If you follow this carefully, you improve your chance to avoid crypto investing errors, protect your capital and grow more steadily.

1. Failing To Do Proper Research

Many investors jump in after hearing a tip, without probing the fundamentals. They skip reading the whitepaper, avoid checking the team behind the token, and ignore tokenomics. That leaves them exposed to weak projects, rug pulls, and exit scams.

Investopedia notes that “lack of research” is among the top costly crypto investing mistakes. Projects without solid fundamentals or verifiable teams often collapse or vanish.

To avoid this mistake, adopt a simple research checklist:

- Read the whitepaper and see if it explains use case, roadmap, and token supply

- Check the team — are their identities verifiable? Do they have credentials or past work?

- Look for code audits by independent firms

- Inspect the community — an active, critical community is healthier than blind hype

- Watch token supply and inflation models — some projects dilute holders aggressively

When you do this work up front, you reduce your chance of investing in a risky project. Even if an asset fails, you will make more informed decisions and limit losses.

2. Chasing Hype, FOMO & Trendy Tokens

Buying a token after a huge run is a trap many investors fall into. Fear of missing out (FOMO) pushes people to chase momentum instead of value.

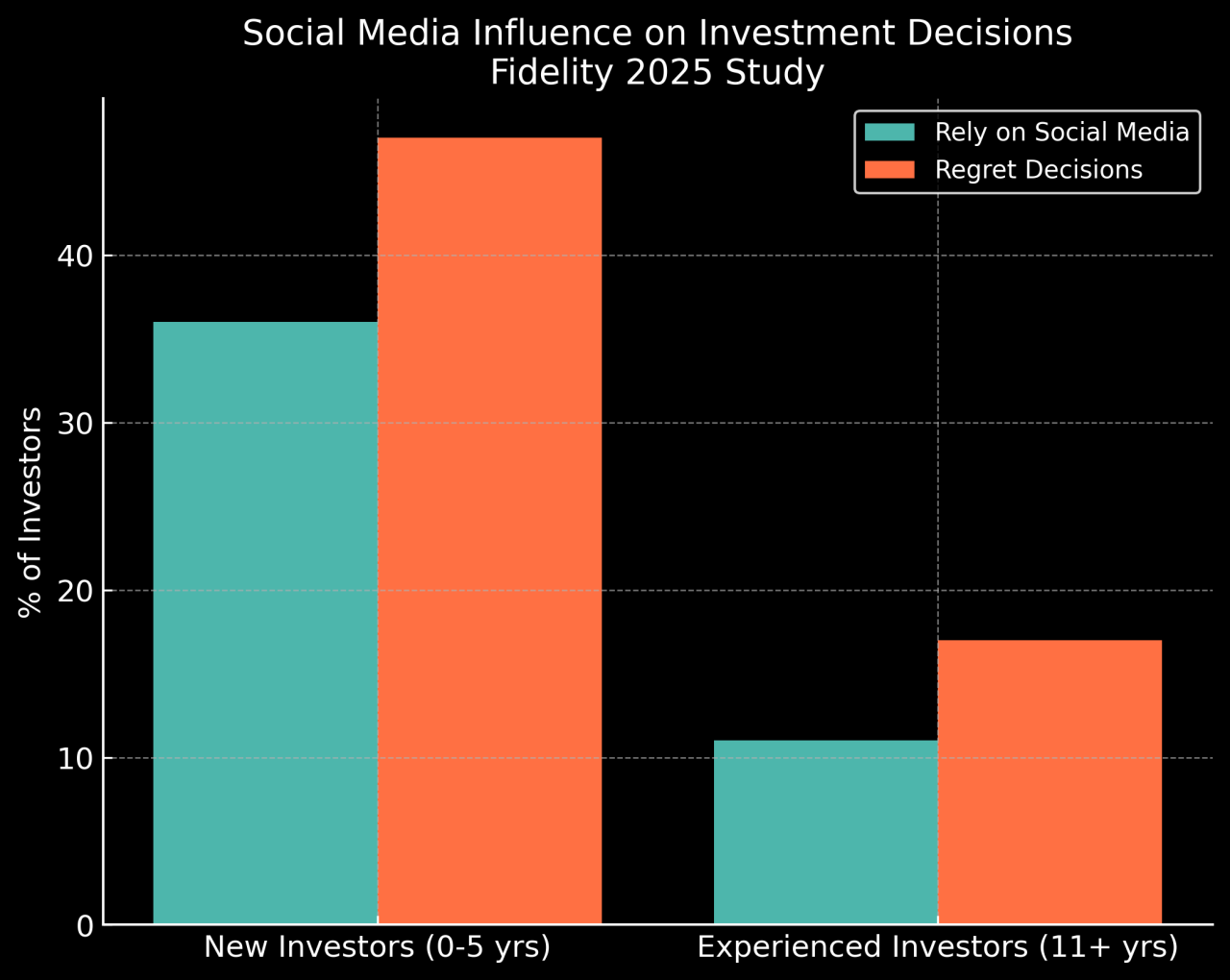

Social media makes this even worse. For instance, a recent Fidelity study found that about one-third of new investors rely heavily on social media for investment ideas.

When everyone is talking about a “hot coin,” the price is often near the peak. After the hype fades, prices often retrace. Emotional buying in that zone causes many to lose money.

To avoid this, set rules before you invest:

- Wait for confirmations (e.g. price holds support after a dip)

- Limit how much you put into hype plays (e.g. no more than 5–10% of your crypto allocation)

- Use risk tools like stop orders to protect if things reverse

- Focus on projects you understand, rather than trends you don’t

By resisting the hype, you give yourself space to act rationally. You reduce the chance of buying at the top and suffering a sharp drop soon after.

RECOMMENDED: 7 Top Tips to Start Investing in Crypto

3. Overconcentration / Putting All Eggs In One Basket

Some investors go “all in” on one altcoin that seems promising. That approach carries huge risk. Even blue-chip cryptos swing widely. At one point, many Bitcoin users lost money when markets dropped sharply.

Effective portfolios don’t bet everything on one name. They distribute risk across multiple assets and sectors.

Here’s how to diversify intelligently:

- Set a cap on allocation to any single coin (e.g. max 10-20% per asset)

- Spread across types: Layer 1 chains, smart contract platforms, utility tokens, stablecoins

- Use token index funds or baskets to gain exposure without overexposure

- Periodically rebalance when one position grows too large

With a diversified portfolio, a fall in one coin won’t devastate your holdings. You spread risk and increase resilience.

4. Ignoring Volatility & Risk Management

Crypto markets are volatile. Stocks may swing 1–3% per day, but crypto often jumps or falls 5–20% or more. Many investors panic and sell during sharp dips, locking in losses.

Some common errors in this instances include:

- Panic selling during a temporary crash

- Overleveraging (borrowing to amplify returns)

- Investing too much on one trade

Smart crypto risk management strategies help you stay in the game:

- Only risk a small fraction of your total capital on any one trade (1–3%)

- Use stop-loss or trailing stops to limit downside

- Avoid or limit leverage, especially in volatile markets

- Rebalance positions when some grow too big

- Understand that drawdowns are part of the investing experience

By treating volatility as part of the investment journey – not a surprise – you stay calmer. You avoid rash moves and preserve capital for good opportunities.

5. Neglecting Security, Custody & Safekeeping

Many investors assume their funds are safe once they buy crypto. That is false. Hacks, phishing, lost keys, insider misconduct, and wallet vulnerabilities cost people millions.

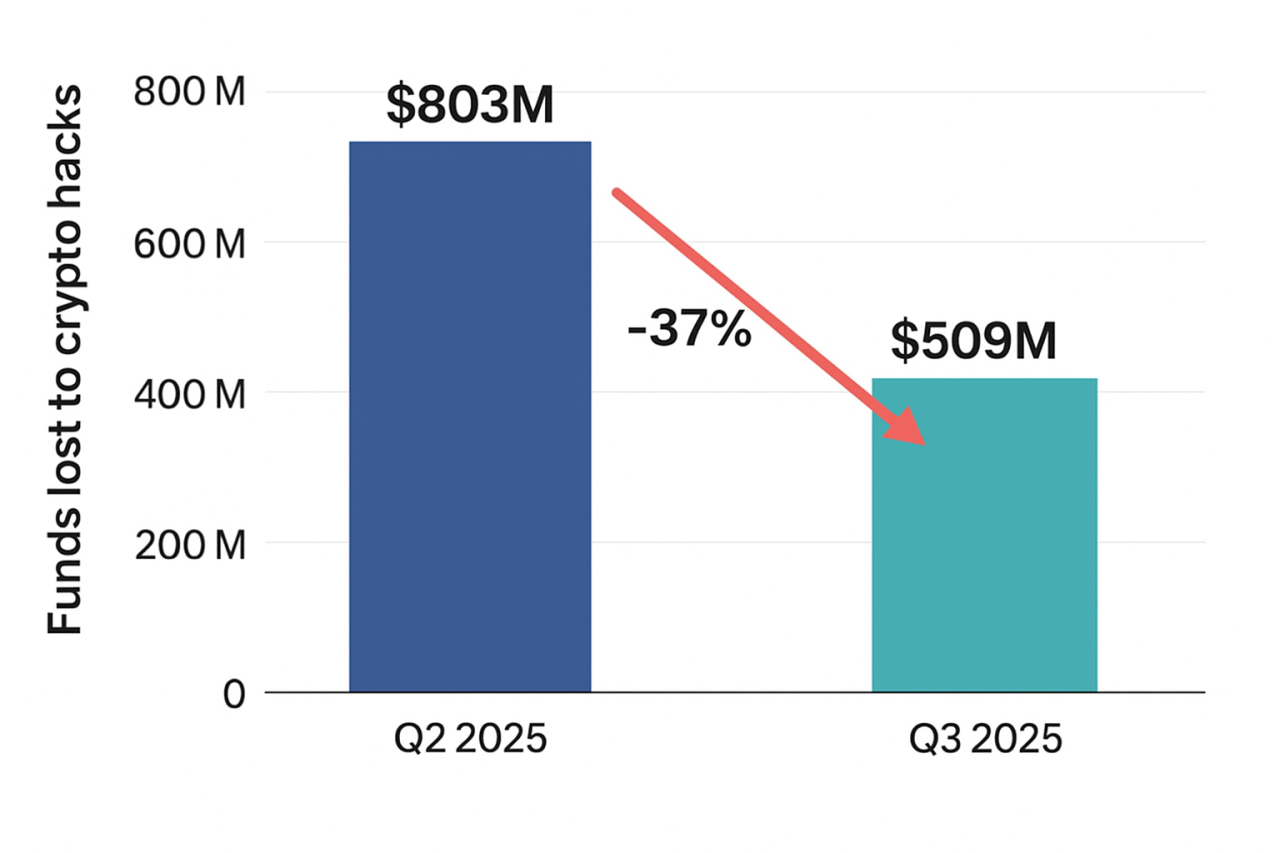

In Q3 2025, total funds lost to crypto hacks dropped to $509 million, a 37% decline from the prior quarter.

Yet September alone saw a record number of million-dollar thefts, showing that risks remain serious. Attackers have now shifted away from smart contract exploits toward wallet and exchange operations.

Some famous hacks include a case where the Indian crypto exchange WazirX lost about $234.9 million in 2024 via a wallet breach. Other high-profile exploits include Poly Network’s $610 million loss (though funds were later returned).

To protect yourself:

- Use hardware wallets or cold storage rather than leaving funds on exchanges

- Enable 2FA (two-factor authentication) and strong passwords

- Use multisig wallets where more than one signature is needed

- Keep private keys offline and in secure physical locations

- Regularly update firmware and wallet software

- Verify transaction addresses carefully (address poisoning is a rising threat)

A single security lapse can wipe out months or years of gains. Prioritize safeguarding first.

RECOMMENDED: 7 Strategic Crypto Investing Tips Based On ‘KISS’

6. Falling For Scams, Fraud & Pump-and-Dump Schemes

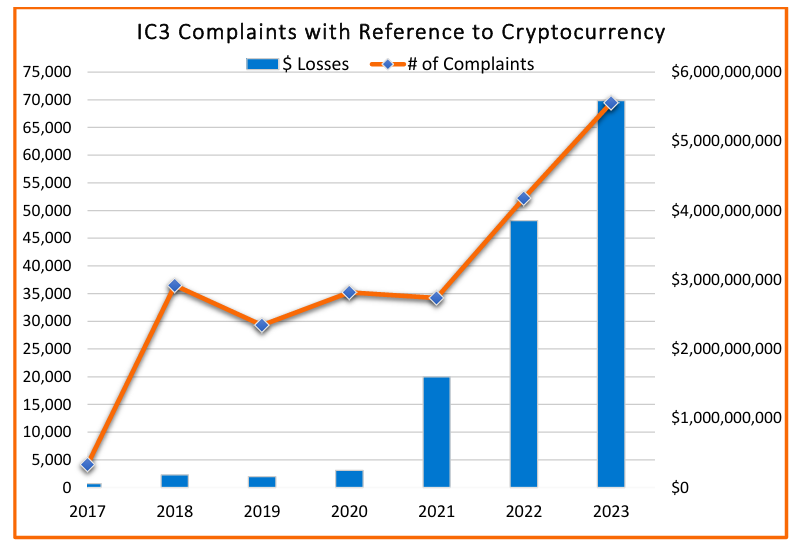

Scams remain among the most common and costly mistakes. According to the FBI’s 2023 report, investment scams accounted for about 71% of all crypto-related losses.

In 2024, crypto thefts jumped to $2.2 billion from hacks alone. In the first half of 2025, losses from crypto scams, hacks and exploits already reached $2.47 billion, exceeding the full 2024 total.

One high scale fraud is the “Bitcoin Queen” (Zhimin Qian) who defrauded over 128,000 people by converting proceeds into 61,000 bitcoins, one of the largest seizures in crypto history.

Scams come in many forms: fake investment schemes, impersonation, paid promotions, pyramid or Ponzi structures, and pump-and-dump token promotions.

To avoid crypto scams:

- Be highly skeptical of guaranteed returns or promises of “too good to be true” yields

- Verify identities of promoters (check social profiles, regulatory status)

- Make small test transfers to new platforms before large ones

- Avoid token launches with heavy hype and no transparent fundamentals

- Use escrow or smart contract mechanisms where possible

- Demand proof of withdrawal or liquidity before investing

- Check community feedback, forums, audit reports

If you consistently follow due diligence, you will not fall prey to the usual traps that cost many novice investors dearly.

RECOMMENDED: Tips To Secure Your Cryptocurrency Wallet

7. Ignoring Regulation, Tax & Compliance Risks

Crypto regulation and tax rules now affect most markets. Ignoring them puts you at risk of fines, penalties, or forced liquidation.

Globally, non-compliance penalties for crypto tax evasion now reach $250,000 in the U.S. or €500,000 in Germany.

In the U.S., starting January 1, 2025, crypto brokers must issue Form 1099-DA to report gross proceeds of digital asset sales.

From 2026 onward, cost basis reporting at the wallet level becomes mandatory. Failure to align your records with those forms can trigger audits.

Also, crypto is treated as property for tax purposes. Every sale, exchange, or disposal counts as a taxable event.

Regulators are increasingly active. In the U.S., the SEC replaced its crypto enforcement unit with a Crypto Task Force to clarify rules. Stablecoin regulation passed with the GENIUS Act in mid-2025.

What to do:

- Keep good records: dates, amounts, transaction fees, types of transactions

- Use crypto tax software or tools

- Understand your jurisdiction’s tax laws

- Consult specialists when needed

- Review regulatory status of platforms you use

Regulation isn’t optional. Your long-term safety depends on compliance.

RECOMMENDED: 10 Tips To Master Investing Without Emotions

Conclusion

Crypto markets are volatile and risky, but many costly mistakes are avoidable.

The most damaging ones include: skipping due research, chasing social media hype, putting too much into one coin, neglecting risk control, weak security practices, falling for scams and ignoring tax or regulatory rules.

Use a methodical checklist and protect capital first. With discipline, careful security, and compliance, you can invest smarter and reduce the chance of severe losses.

To sum it up:

- Research thoroughly before investing

- Avoid chasing hype or FOMO

- Diversify rather than overconcentrate

- Use solid risk management and controls

- Secure your assets with strong custody practices

- Stay alert to scams, fraud, and manipulative schemes

- Follow tax and regulatory requirements carefully

If you adopt these practices and remain disciplined, you greatly improve your odds of preserving capital and capturing gains.

The easiest way to buy Cryptocurrencies is through a trusted crypto exchange like Moonpay, Coinbase, or Uphold. These platforms allow users to purchase and trade crypto instantly from any device, including smartphones, tablets, and computers.

Buy Crypto NowCrypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here.

Wondering which crypto to focus on right now?

Our premium members already know.

Since 2017, InvestingHaven’s blockchain research service has been guiding investors through both bull runs and crypto winters.

What makes it different?

Proprietary 15-indicator methodology developed over 15+ years of market research.

Proven track record of spotting major turning points before markets move.

Focused alerts on only the key crypto assets that matter — no noise, no distractions.

Thousands of readers rely on InvestingHaven to stay ahead of the crowd. Now it’s your turn.

👉 Act today and join the original crypto research service — still live and stronger than ever since 2017.

This is how we are guiding our premium members (log in required):

- ATH in BTC = Alt Season 2025 Catalyst? (Oct 5th)

- Crypto Consolidation: When Will Bullish Momentum Return? (Sept 28)

- Is Meme Season Underway? (Sept 19th)

- Alt Season Is Brewing, In Silence. These 3 Charts Tell The Crypto 2025 Story. (Sept 10th)

- Is A Trendless Crypto Market Good or Bad? The Current and Emerging Winners Look Awesome. (Sept 7th)

- BTC Testing Long Term Trendline. Here Is Short and Long Term Guidance. (Aug 26th)

- Crypto – To Break Out Or Not To Break Out? (Aug 23rd)