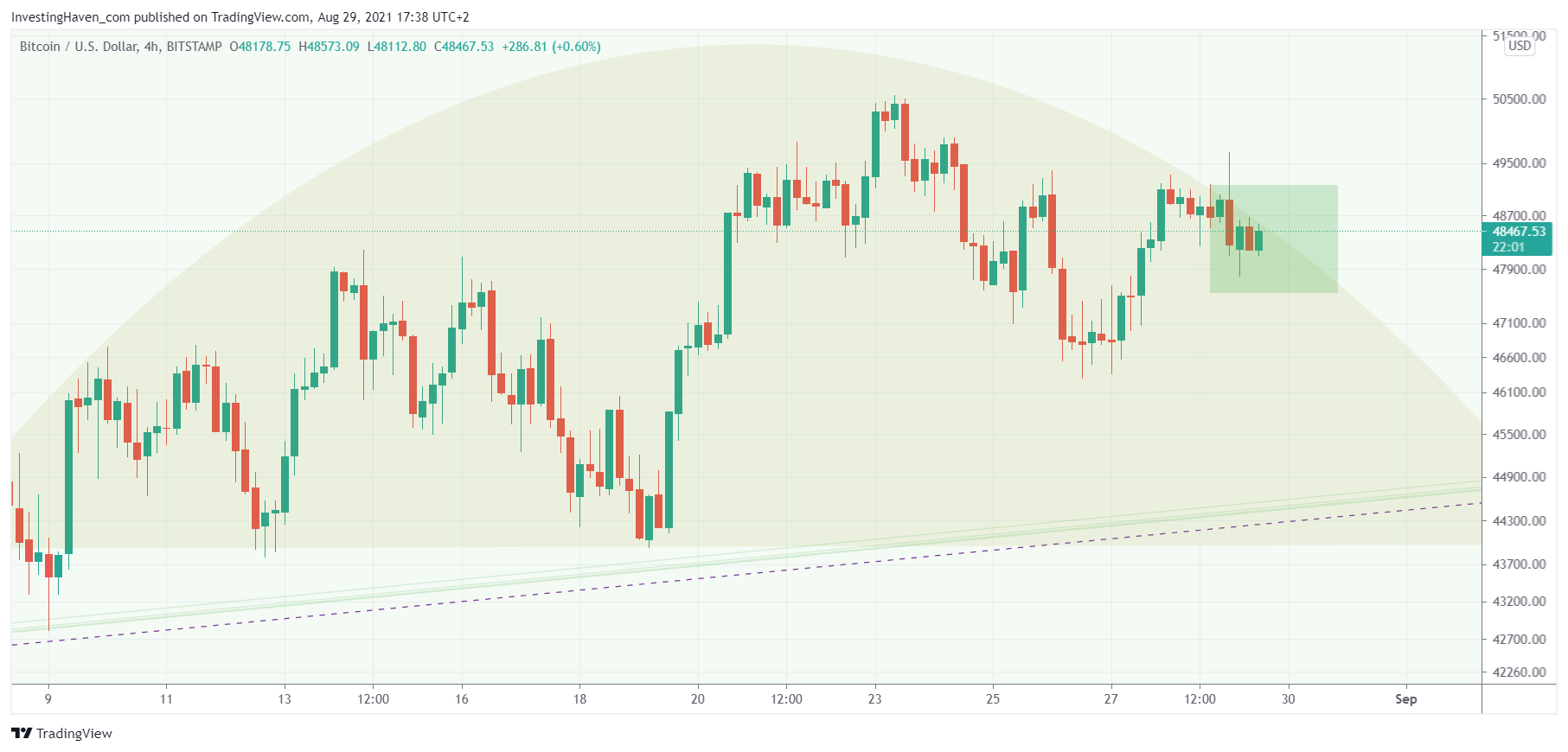

We have a fantastic setup in the crypto market’s leading indicator Bitcoin. The 4 week consolidation period is reaching a decision point, and the decision window is indicated with the green ‘box’ on below 4h chart. As explained in our latest crypto investing research alert The next few hours, ultimately tomorrow, will be decisive. What exactly does this mean, and what not?

The chart has a clear message: it is decision time in BTC, and because BTC provides direction to the entire crypto market (directionally) we believe the outcome of this decision should be taken seriously.

The 4 week pattern on the BTC chart shown below has this decision window in green. One of the three scenario’s will unfold today and tomorrow, and it will have impact on the crypto market direction in September (the 3d and last month of this 3 month cycle):

- BTC moves higher (48.6k is the line in the sand), and confirms a ‘break up’ out of this pattern. This will be bullish, but we need at least 3x 4h candles to confirm this (ideally even 72h).

- BTC cannot move above 48.6k, and is going to fall to its first next support level(s). The 46.6k level will be tested, and the outcome at that level will be a crucial one. We can expect a slightly bearish market in the short term, but the jury will be out on the medium term trend.

- BTC gives up, and moves down fast where a real make-or-break level is waiting: 44k. The result of a potential 44k level test will have longer term effects on the direction of the crypto market.

Note one thing on the 4h chart we embedded below: the dotted line (around 44k). This is a trendline on a 10 year trend pattern. It is a decisive level, it won’t be fun if BTC cannot hold 44k.

In our last crypto alert we featured the NFT space which is on fire today. We featured the one NFT token that is ready to ‘explode’, and it’s a matter of hours presumably. One of our short term trade tips went up +40% and hit our exit target. We mostly don’t offer short term trade tips, but when we do they are very profitable.