KEY TAKEAWAYS

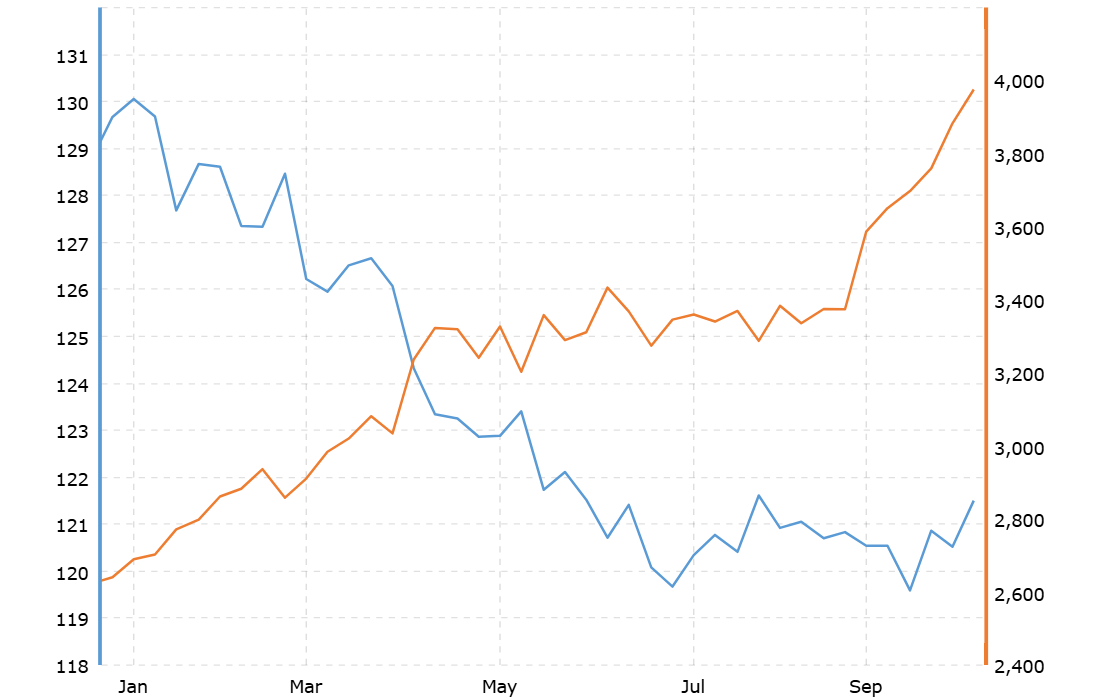

- Gold and the U.S. dollar index (DXY) continue to move in opposite directions, showing strong inverse correlation through 2025.

- Real yields remain a key factor: falling yields make gold more attractive and encourage risk appetite for crypto.

- In October 2025, gold crossed $4,000 and Bitcoin saw higher ETF inflows during periods of dollar weakness.

- Even a small rotation of 3%–5% from gold into Bitcoin could significantly raise crypto market capitalization.

Changes in the U.S. dollar affect how investors move money between gold and crypto. A stronger or weaker dollar influences prices through exchange rates, interest rates, and investment flows.

The U.S. dollar plays a key role in global markets. When it strengthens, dollar-priced assets like gold and cryptocurrencies often come under pressure. When it weakens, these assets tend to rise as investors look for ways to protect their purchasing power.

In 2025, this relationship has become more visible as gold prices, crypto trends, and dollar moves have all shifted together.

RECOMMENDED: De-Dollarization Driving Gold Higher, Is The Next Rally Here?

How Dollar Moves Affect Gold And Crypto

A weaker dollar usually pushes gold prices higher because it becomes cheaper for foreign investors to buy. It also reduces real yields making non-yielding assets like gold more attractive.

Data this year shows gold and the U.S. dollar index (DXY) often move in opposite directions, with gold rising when DXY falls.

For crypto, the link is less direct but still important. When the dollar weakens, it signals easier financial conditions. That often boosts risk appetite and encourages investment in assets like Bitcoin and Ethereum.

Falling real yields and a softer dollar have also coincided with higher inflows into spot Bitcoin ETFs, showing how macro shifts affect digital assets.

What 2025 Data Shows

In October 2025, gold briefly crossed the $4,000 mark, supported by heavy ETF inflows and a weaker dollar. Around the same time, crypto markets saw large trading volumes and short-term rallies.

Analysts estimate that if just 3% to 5% of institutional gold holdings move into Bitcoin, crypto market caps could expand sharply. These rotations show how capital moves between traditional and digital stores of value when the dollar changes direction.

RECOMMENDED: Crypto Meets the Debt Ceiling: Government Debt Stress as a Catalyst for Digital Assets

The Key Signals To Watch

The most useful indicators are the DXY trend, real 10-year Treasury yields, and daily ETF flow data.

A weaker DXY and lower yields usually lift both gold and crypto. A stronger dollar and rising yields tend to pull money out of both.

RECOMMENDED: How Dollar Weakness is Turbocharging Precious‑Metals ETFs

Conclusion

The dollar now acts as a signal for investors deciding between gold and crypto. Watching how the dollar, real yields, and investment flows interact gives a clear picture of where capital may move next.

When you understand this link you can read both markets more confidently in the months ahead.

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here

Wondering which crypto to focus on right now?

Our premium members already know.

Since 2017, InvestingHaven’s blockchain research service has been guiding investors through both bull runs and crypto winters.

What makes it different?

Proprietary 15-indicator methodology developed over 15+ years of market research.

Proven track record of spotting major turning points before markets move.

Focused alerts on only the key crypto assets that matter — no noise, no distractions.

Thousands of readers rely on InvestingHaven to stay ahead of the crowd. Now it’s your turn.

👉 Act today and join the original crypto research service — still live and stronger than ever since 2017.

This is how we are guiding our premium members (log in required):

- The Ongoing Test Of Bitcoin’s 200 dma Will Be Decisive For The Outcome In Crypto Markets (Oct 20th)

- From Failed Breakout to Consolidation: How to Think About Yesterday’s Flash Crash (Oct 12th)

- ATH in BTC = Alt Season 2025 Catalyst? (Oct 5th)

- Crypto Consolidation: When Will Bullish Momentum Return? (Sept 28)

- Is Meme Season Underway? (Sept 19th)

- Alt Season Is Brewing, In Silence. These 3 Charts Tell The Crypto 2025 Story. (Sept 10th)

- Is A Trendless Crypto Market Good or Bad? The Current and Emerging Winners Look Awesome. (Sept 7th)