Ethereum has been struggling below $2k for more than a week and currently wallows below $1900.

This has sparked a debate about ETH ‘going home’ and XRP’s potential to flip the top altcoin in this market cycle.

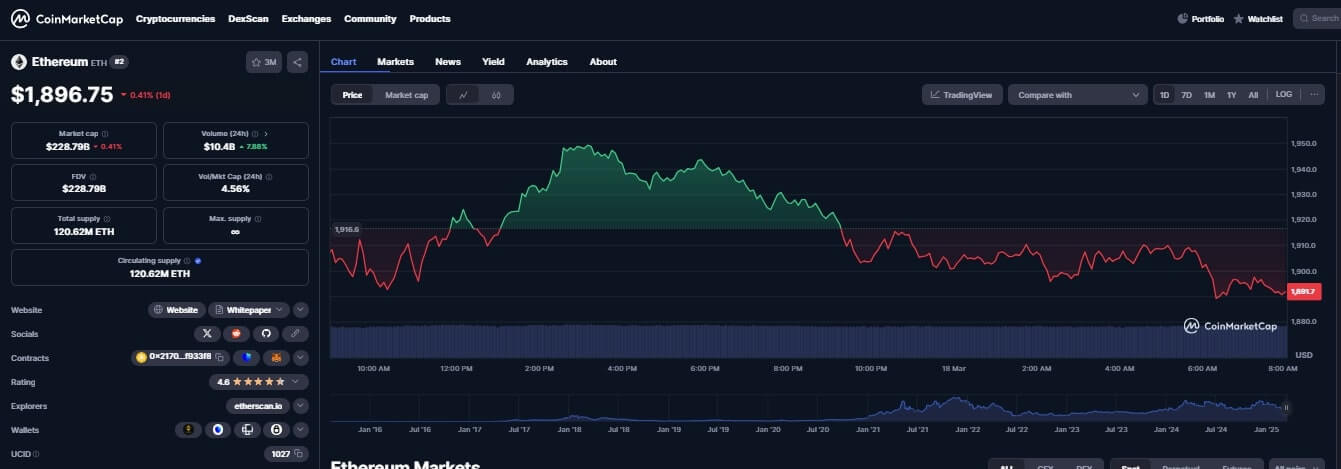

Ethereum’s woes continue on Tuesday, March. 18 as it continues to trade below $2000 for more than a week. At the time of writing, ETH trades below $1900 after slipping by another 1% today, which compounds its losses for the month to 30%.

The sustained losing streak and lack of a potential bullish catalyst in the near future has a growing number of analysts and investors convinced ETH is ‘going home.’ They expect it to crash further, possibly dropping below $1500. This has in turn sparked a debate of XRP possibly flipping ETH as the second most valuable digital asset by market.

Why Is ETH Crashing?

There are two primary factors driving Ethereum prices down. First are the negative macros that have affected the larger crypto market. These include the fears of inflation and trade war triggered by Trump tariffs. They have led to several instant price crashes that spooked investors after they resulted in the forceful liquidation of Billions worth of ETH trades.

Secondly, Ethereum recently failed to roll out the much-anticipated ‘PECTRA’ upgrade. The developer team said they were postponing the upgrade after a hacker infiltrated the last rollout process. This only served to erode the already delicate trust investors had in the altcoin. By dragging ETH prices lower, these events have left more than 50% of current ETH holders staring at unrealized losses.

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

GET STARTED

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here

Can XRP Flip ETH This Cycle?

A number of analysts have argued for the case of Ripple flipping Ethereum as the second most valuable digital asset. They argue that XRP has what it takes to rally by the 76% needed to bridge the $96 Billion gap between their market caps. To master such a bullish momentum, however, Ripple would need to win the SEC case first and have the Ripple ETFs approved.

ETH Price Forecast

Over the short term, ETH will likely continue to feel the weight of the bearish-inclining crypto market. By the end of this year, our analysis indicates that Ethereum will rebound and oscillate in a wide range, between $2445 and $5890.

It should, however, recover after this and rally to the peak price of $12000 by 2030. For context, that translates to a more than six-fold increase in ETH price from current levels.

Our latest crypto alerts – instantly accessible

This is how we are guiding our premium members (log in required):

- The Time Window as of March 14 Should Bring Relief (March 11th)

- Buy The Dip Is Here (March 1st)

- BTC Very Close To Its 200 dma – Chart Looks Constructive (Feb 26th)

- How To Know Whether BTC Will Set A Bottom This Week? (Feb 25th)

- Crypto Markets Showing Strong Signs Of Selling Exhaustion. Buy The Dip?! (Feb 23d)