In the latest ETF news, Grayscale has officially filed for an Ethereum Spot ETF with the SEC. The news hasn’t sparked meaningful momentum for the altcoin poised to post its worst February in years.

Ethereum is down by close to 2% in the day to trade below $2400 and is yet to recover from yesterday’s flash market crash that wiped more than $400 Billion off the market and caused the liquidation of $300+ million ETH trades.

The crash not only sent to 3-month lows but has also dimmed any chances of possible recovery for the top altcoin which is set to record its worst February in years.

Ethereum’s Record of Stellar Performances in February

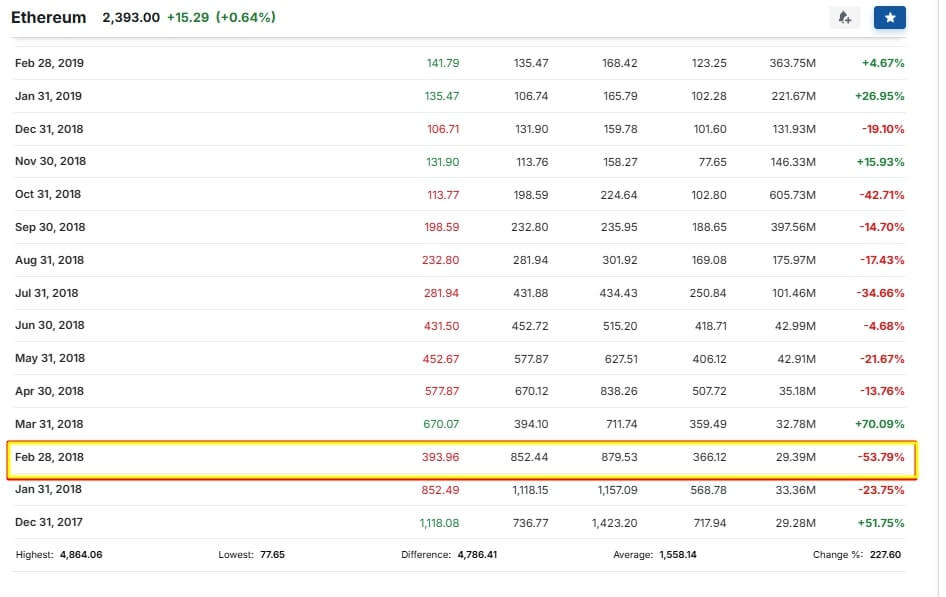

Historically, Ethereum has performed extraordinarily well in February. In fact, it has always ended the month in the green, with the only exception of February 2018 when its value slipped by 59%.

At the time of writing, Ethereum is down by nearly 30% in the month, making this its second-worst February performance in history.

To maintain the impressive February, Ethereum bulls must push their price above the $2600 mark in 48 hours.

Reasons for Ethereum’s Disappointing Performance

Two key factors may be attributed to Ether’s depressing price action over the last 30 days. First was the trade war triggered by Trump tariffs that had a huge impact on risk assets.

It resulted in a crypto meltdown that resulted in the overnight liquidation of nearly $10 Billion worth of leveraged crypto trades.

The second is the ongoing loss of investor confidence in Ethereum. This is evidenced by the growing bearish momentum as revealed by key technical indicators.

On the ETH/USD daily chart, for example, the altcoin has an RSI of 33m down from the highs of 50 at the end of January. The MACD has also been in the negative territory for the entire month of February, signifying a growing bear momentum.

Can Ethereum Recover?

Yes. We believe Ethereum will eventually rebound, with long-term forecasters expecting it to breach the $7000 mark before the end of the year.

Over the short term, however, it is expected to continue trading sideways in reaction to the ever-dynamic investor and trader sentiments as well as macro factors like Ethereum ETF approval and changes in crypto policy.

🚀 Don’t Miss the Next Big Crypto Move!

Our premium members received real-time alerts on major crypto plays before they happened. Will you be ready for the next one?

🔴 Latest Insider Alerts:

- 📢How To Know Whether BTC Will Set A Bottom This Week? (Feb 25th)

- 📢This Token Is Set To Emerge As An Outperformer as USD Breaks Down. (Feb 16th)

- 📢When Will This Market Finally Start Moving? (Feb 9th)

- 📢Will February 5th Come To The Rescue? (Feb 4th)

⏳ Limited Spots Available – Secure Yours Now!