Tokenized gold offers a modern way to invest in gold by leveraging blockchain technology. It combines the stability of gold with the flexibility of digital assets, providing investors with secure, transparent, and easily tradable exposure to gold.

RELATED – Gold prediction 2025 & Bitcoin prediction 2025.

Gold has long been regarded as a safe haven asset, valued for its stability and his quality of preserving wealth. As fintech capabilities mature, #tokenization — transforming physical assets into digital tokens on a blockchain—is gaining traction. This article explores how tokenized gold could reshape investment strategies and attract traditional investors.

Tokenized Gold and Its Benefits

What is tokenized gold?

Tokenized gold refers to the digital representation of physical gold on a blockchain. This process allows investors to trade and manage gold assets more easily. Here are key features:

- Digital tokens: Each token represents ownership of physical gold.

- Blockchain benefits: Enhanced security and transparency through immutable records.

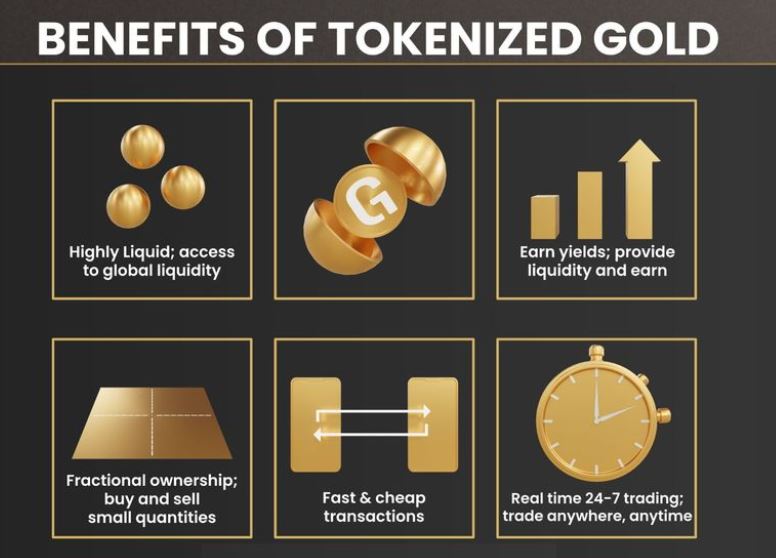

Advantages of tokenized gold

1. Liquidity

Tokenized gold can be traded 24/7 on various platforms, offering enhanced liquidity compared to traditional gold investments. This constant availability allows investors to react quickly to market changes, providing a level of flexibility that physical gold does not offer.

2. Transparency

Blockchain technology provides verifiable ownership and transaction records, fostering trust among investors. Each token’s provenance is easily traceable, allowing for clear verification of ownership. This transparency is essential in an industry where the authenticity of physical assets can sometimes be questioned.

“With tokenized gold, investors can easily confirm the provenance of their assets.”

3. Cost Efficiency

By reducing intermediaries and streamlining processes, tokenized gold can lower transaction and storage costs. Traditional gold investments often involve significant fees for storage and security, while tokenized assets can minimize these costs, making gold investment more affordable.

4. Accessibility

Tokenization allows for fractional ownership, making gold investments more accessible to a wider range of investors. This feature enables individuals to invest in gold without needing large sums of money, democratizing access to this valuable asset.

Courtesy: aurus.io

The Role of Blockchain in Tokenization

Blockchain technology is crucial for the implementation of tokenized gold. Its ability to provide secure and transparent records makes it an ideal solution for managing asset ownership.

The decentralized nature of blockchain ensures that no single entity controls the records, enhancing security and reducing the risk of fraud.

Moreover, blockchain technology facilitates faster transactions. Unlike traditional gold trading, which can involve lengthy processes and significant paperwork, tokenized gold transactions can be completed in real-time, providing a more efficient trading experience.

Market Trends

The current gold market is experiencing rising demand driven by factors such as:

- Inflation concerns: As inflation rates increase, investors often turn to gold as a hedge against currency devaluation.

- Increased central bank purchases: Many central banks are accumulating gold to diversify their reserves, further boosting demand.

These factors create a favorable environment for tokenized gold, reflecting a shift in investor preferences toward more innovative and flexible investment options.

Challenges

While tokenized gold presents many advantages, there are challenges to consider:

- Regulatory landscape: The regulatory environment surrounding tokenized assets is still developing, and unclear regulations may pose risks for investors. Clear guidelines are needed to ensure market stability and protect investors.

- Market adoption: Successful market adoption of tokenized gold requires robust infrastructure and investor education. Many traditional investors may be hesitant to embrace digital assets without a clear understanding of their benefits and risks.

One thing is clear – if even Blackrock is committed to tokenization, you know it’s a new and sustainable trend:

Real-World Examples of Tokenized Gold

Several successful platforms are paving the way for tokenized gold in the market, such as:

- PAX Gold (PAXG): This platform allows investors to hold gold-backed tokens that represent real gold stored in secure vaults. PAXG enhances trust and provides investors with the ability to redeem their tokens for physical gold if desired.

- Perth Mint Gold Token: Similar to PAXG, PMGT offers a model where each token is backed by physical gold held by the Perth Mint, ensuring transparency and security for investors.

While these examples did not go mainstream, not yet, they illustrate the evolution of tokenized gold and increasing adoption (slowly but surely at this point in time).

The Future of Tokenized Gold

Looking ahead, the future of tokenized gold appears promising. As technological advancements continue and the financial landscape shifts, tokenized gold could become increasingly relevant.

- Integration with traditional finance: The potential for integrating tokenized gold with traditional financial products could further enhance its appeal. As more financial institutions adopt blockchain technology, tokenized gold may become a standard offering.

- Increased investor interest: The ongoing interest in digital assets and the rise of fintech solutions are likely to drive demand for tokenized gold, positioning it as a viable option for modern investors.

Bitcoin Dominance and the Emerging Crypto Narrative

An important trend to monitor is Bitcoin’s rising dominance. Recently, Bitcoin dominance has been increasing, suggesting that market focus is shifting toward blue-chip tokens.

This rise in dominance often means that altcoins may experience slower momentum, with attention centered on established cryptocurrencies like Bitcoin.

Interestingly, tokenization tokens are showing relative strength compared to their peers. It is THE key topic in our premium crypto research, and many recent alerts are dedicated to this trend.

This indicates that, while the broader crypto market may consolidate, tokenized assets—including gold—could emerge as crypto narratives in the near future.

Take-aways

The integration of blockchain technology into gold investments represents a noteworthy evolution in the financial sector, worth keeping a close eye on as it may qualify as the next big narrative.

Tokenized gold offers a secure and accessible method for engaging with precious metals, attractive to traditional investors who prefer safety in an increasingly digitized world.

As these innovations evolve, they could play a pivotal role in investing.

Understanding these new technologies can help investors remain informed.

The ongoing developments in tokenization suggest that investing in gold might experience a transformation in the not too distant future.

As the next wave of innovation accelerates, tokenized assets might take center stage. We will follow up on this trend in our premium crypto research service.