We discuss price, adoption, tokenomics and risks, among other factors investors should know before buying SOL.

In this guide we answer one of the most common questions we get; Is Solana a good investment in 2025? To answer, we look at recent data, forecasts, and trade-offs to help you decide with clarity.

In the past month Solana has risen roughly 27.7% while moving from its cycle low of ~$96.09 toward its cycle high near $225.49. SOL remains around 24% below its all-time high of $294.85 reached in January 2025.

These figures show strong momentum, but also place Solana’s upside and risks in sharp relief.

RELATED: Is It Worth Buying Solana In 2025?

So, should you invest in SOL? Let’s look at some key investment factors.

1. Price Performance And Market Snapshot

Today, Solana trades around 99.37, with a market cap of $120.6 billion and a circulating supply of about 542.32 million, per CoinMarketCap. Its 24-hour volume is roughly $8.8 billion, which shows available liquidity for larger orders.

SOL jumped 24% over the past month, majorly due to ETF filings and large corporate treasury purchases.

Over the past 12 months SOL has gained about 65%, showing strong ecosystem activity and rotation into app chains. Price action remains volatile, with several weeks showing 20% or larger moves and a seven-month high around $225.

Because Solana’s market cap remains much smaller than Bitcoin or Ethereum, relatively small inflows can move price materially and increase short-term risk. Use these numbers to size positions, set stop levels, and decide what allocation, if any, fits your risk profile.

RECOMMENDED: Solana Price Forecast: September Could Send SOL To New Highs

2. Solana Network Adoption And Real Usage

On-chain activity shows real usage, not just price moves. DeFiLlama reports Solana handles about 65 million transactions and roughly 2.6 million active addresses daily, with chain fees around $1.85m per day, indicating heavy throughput.

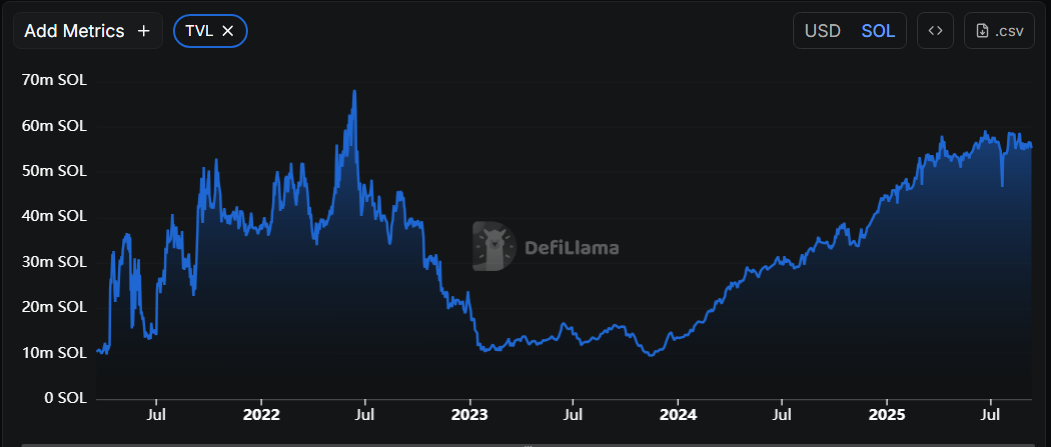

Total value locked on Solana reached $12.2 billion, an all-time high, which reflects capital committed to on-chain apps. Electric Capital’s developer report found Solana captured the largest share of new developers in 2024, suggesting sustained builds and a product pipeline.

Higher transaction counts and rising TVL support growth, but cohort analyses show many addresses are short lived, so user retention remains an open question. Therefore, monitor developer commits weekly, and compare TVL growth against active users to assess sustainability prospects.

3. Solana Institutional Adoption And Liquidity

Regulated derivatives and ETF filings increase institutional access and liquidity. CME launched cash-settled Solana futures on March 17, 2025, offering micro and standard contracts, which allows traders to hedge large positions on a regulated exchange.

Several asset managers filed for spot Solana ETFs, including Franklin Templeton and filings on Cboe, which signals demand for custodial-grade products. Canadian Solana ETPs hold roughly $444m in assets, showing early institutional interest outside the U.S.

On-chain liquidity also improved, with daily volumes often in the billions, which reduces slippage for larger trades. Generally, higher institutional flows can tighten spreads, reduce slippage, and increase baseline valuation over time gradually.

RECOMMENDED: Which Crypto Is More Likely to Be a Millionaire Maker? XRP vs. Solana

4. Roadmap And Scaling For SOL

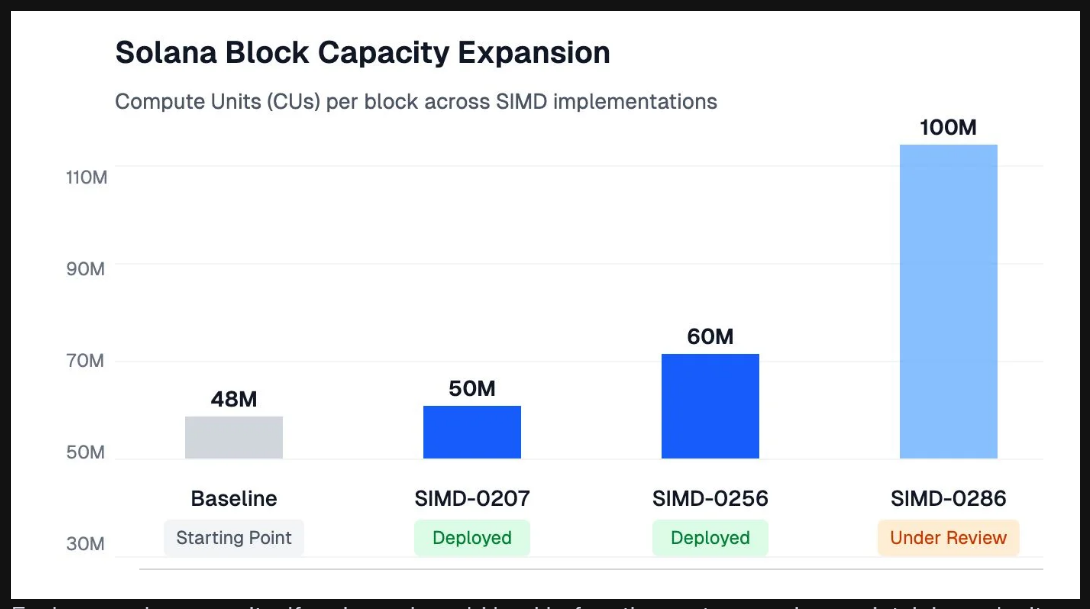

Solana has advanced technical upgrades that increase capacity and reduce fees. The network raised its per block compute unit limit from 48,000,000 to 60,000,000 CUs, a 25% increase, which already adds hundreds of additional token transfers per block, according to the Solana Foundation blog.

Developers proposed a further jump to 100,000,000 CUs, which would raise per block capacity by about 66% over the current limit and allow more complex DeFi, gaming, and payments workloads.

Firedancer, the independent validator client from Jump Crypto, improves throughput and client diversity and entered mainnet testing and early deployments in 2025. These changes reduce congestion and can lower fees if adoption follows, and validator economics improvements.

RECOMMENDED: Can The Price Of Solana (SOL) Ever Hit $1,000?

5. Tokenomics And Staking

About 66% of SOL is staked, which means 353 million to 418 million SOL sit in validators and stake pools, depending on the data source.

Staking yields vary, typically between 4.5% and 7% annual, with platform fees and validator commissions affecting net returns.

Liquid staking tokens account for about 13.6% of staked SOL, roughly 57 million tokens, which improves liquidity but adds protocol and counterparty risk.

The SEC Division of Corporation Finance issued a staff statement on Aug 5, 2025, clarifying that certain liquid staking activities do not necessarily involve securities, which reduces one regulatory uncertainty for staking products.

RELATED: Is Solana A Good Investment Right Now?

6. Risks: Outages, Centralization, Regulation And Competition

Solana’s technical risk centers on intermittent network outages. For instance, on Feb 6, 2024, Solana experienced a five-hour outage after which engineers released a patch. These interruptions have recurred across multiple years and have disrupted trading and on-chain services, triggering price declines when block production halted.

Validator concentration and rising validator hardware requirements raise decentralization concerns. Firedancer documentation recommends 32-core CPUs and 512GB RAM for high-performance clients, which increases operating cost and tends to favor large operators.

On-chain analyses also show a substantial share of stake sits with a limited validator set, which can influence governance and availability.

Finally, regulatory action and competing Layer 1 and rollup ecosystems add adoption risk, because policy changes or superior alternatives can reduce liquidity and slow Solana’s adoption pace. Plan for these risks, and size positions with care, prudently.

RECOMMENDED: Will Solana (SOL) Hit All-Time Highs in 2025?

7. Solana Price Forecasts

Analysts and public forecasters share varied 2025 price predictions for Solana (SOL). InvestingHaven lists forecasts from seven experts ranging from $200 to $1,000, with an average around $425, assuming bullish conditions like ETF approvals and continued adoption.

Cryptopolitan estimates a 2025 average near $352.97, with a possible high near $391 under favorable technical and market factors.

Other experts cited by IH include Pantera Capital quoting a $1,000 target, CryptoZachLA with $450, Tyler Hill forecasting $220–$400, and Ben Armstrong projecting around $500. These forecasts assume strong adoption, regulatory clarity, and no major disruptions.

FAQ

Will Solana Go Up In 2025?

Possible, if institutional flows and ETF activity continue.

Can Solana Reach $1000?

Mathematically yes. With roughly 542.32 million circulating SOL, $1,000 implies a $542.32 billion market cap, a very large outcome that needs sustained, large inflows.

Is Solana Better Than Bitcoin For Investment?

They do different jobs. Bitcoin targets store-of-value. Solana targets fast apps and DeFi. Match allocation to your horizon and risk tolerance.

Is Solana A Safe Investment Long Term?

No. Solana has recorded multi-hour outages that disrupted services and price, and regulation still evolves. Watch outage history and the SEC’s staking guidance when sizing exposure.

How High Can Solana Realistically Go Before 2030?

Models vary widely. Bull scenarios in public forecasts place SOL in the low hundreds to several hundred dollars by 2025–2026; beyond that, outcomes depend on TVL, users, and institutional demand.

Should I Buy Solana Right Now?

Only after you set an allocation that reflects high risk, plan stops, and confirm you accept potential outages and regulatory shifts.

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here

How To Know When To Buy SOL?

To receive alerts on possible key entry and exit points for SOL along with many other crypto assets, you should consider joining the original blockchain-investing research service — live since 2017.

InvestingHaven alerts come from a proprietary 15‑indicator methodology built over 15+ years of market experience.

Get insights from the service that identified major turning points through crypto winters and bull runs alike

Act now and see why thousands trust us to deliver signals before markets move.

This is how we are guiding our premium members (log in required):

- Is A Trendless Crypto Market Good or Bad? The Current and Emerging Winners Look Awesome. (Sept 7th)

- BTC Testing Long Term Trendline. Here Is Short and Long Term Guidance. (Aug 26th)

- Crypto – To Break Out Or Not To Break Out? (Aug 23rd)

- What Happened This Week? Leading Indicator Analysis and 7 Token Charts. (Aug 16th)

- Crypto Shows More Resilience Than Expected. A Bullish Impulse May Be Underway. (Aug 9th)

- Prepare To Buy The Dip In Crypto (Aug 2nd)

- Alt Season 2025 – Progress Update (July 26th)