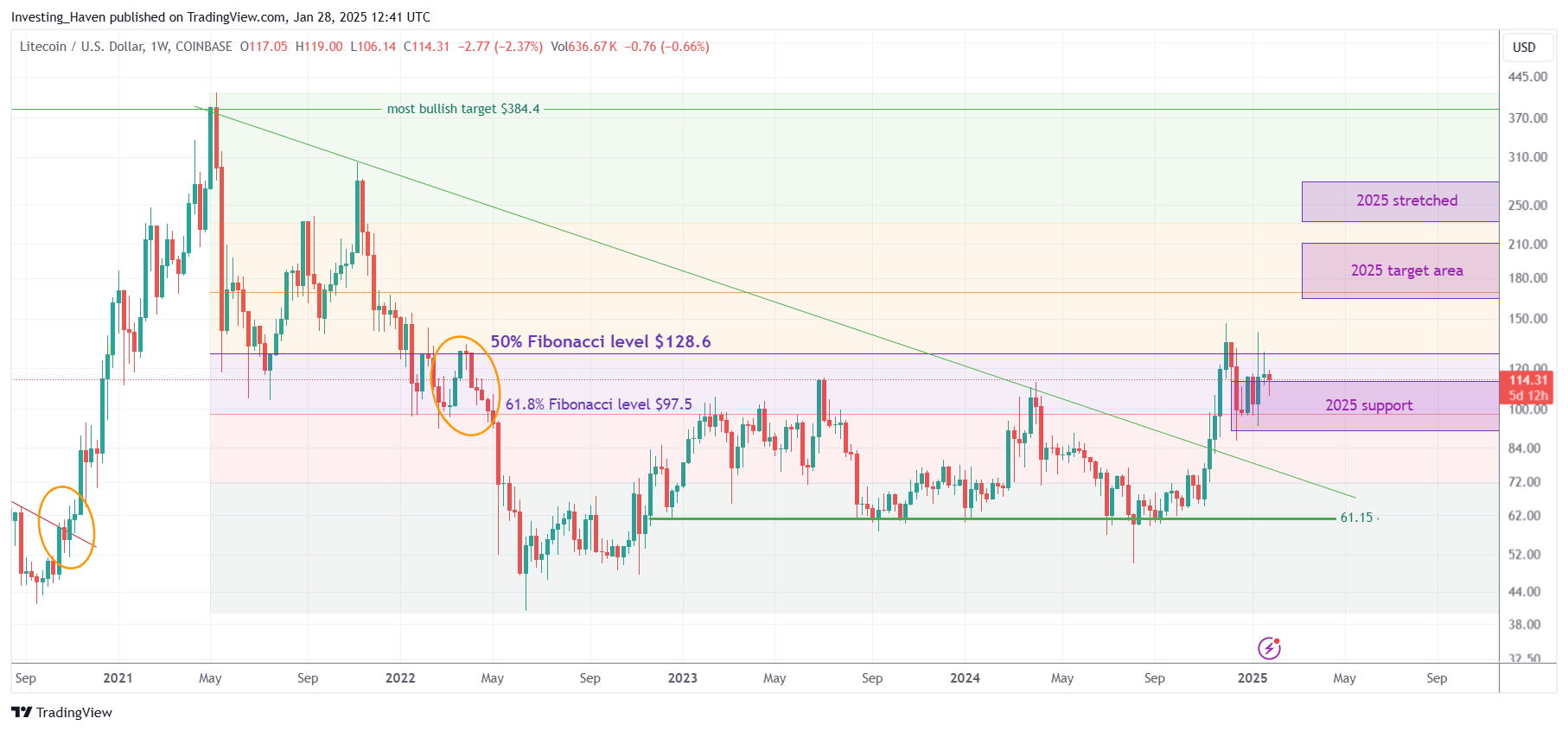

Litecoin’s bullish reversal requires one condition to be respected: its 61.8% Fibonacci retracement level needs to be respected. The Litecoin bullish reversal has 2x upside potential as a conservative LTC forecast.

There is a lot of fuzz about Litecoin ETF approvals.

While excitement around Litecoin ETFs is justified, there is one and only one indicator that truly matters: the 61.8% Fibonacci level on Litecoin’s chart.

We break through the noise by remaining focused on chart details.

Litecoin

Coindesk writes:

Prospective litecoin exchange-traded funds (ETFs) could see inflows of up to $580 million if investors adopt them at the same rate as the bitcoin ETFs.

Those numbers are mind boggling, for sure, and create a positive outlook for LTC.

What’s even more interesting is that in the midst of excitement and super bullish sentiment, a few weeks ago, we suggested to stay focused on the chart. In particular, in our Litecoin Price Analysis for January 2025, we said that excitement does not matter until and unless LTC clears $132. That’s the key level on Litecoin’s bullish reversal:

LTC will break out once it convincingly clears $132. That’s when the acceleration (higher) will occur. Between now and then, it will need to create solid support, which is what it is expected to do in January 2025. This will pave the way for a breakout in Feb/March provided a few conditions are in place.

As always, we recommend to stick to chart readings and complement them with fundamental or other data points, not the other way around.

Litecoin bullish reversal

Loyal readers know that we stick to our recommendation to remain focused on the chart. While positive news may spark some positive feelings, it also creates bias.

That said, in the midst of volatility, we need to consider the most important point of support on Litecoin’s chart. While we mentioned the 50% Fib level as the breakout level (previous paragraph), the more important thing to watch is the 61.8% Fib level.

Fibonacci support must be respected for the Litecoin bullish reversal to materialize.

The LTC chart says it all.

However, the ‘trick’ is that we need the weekly timeframe. That’s where the beauty (read: power) of the Litecoin bullish reversal becomes visible.

Note – the 61.8% Fib level at $97.5 has been a pivotal price point, going back almost 3 years in time (‘the longer, the stronger’).

Litecoin: which Fibonacci level matters

While we love the Litecoin bullish reversal on its weekly timeframe, we need to ensure to correctly interpret it. Fibonacci levels can help us tremendously:

- The 50% Fib level is the breakout level. Once LTC clears $128.6 for 3 consecutive weeks, without touching $128.6 in that 3-week time period, it will mark a secular breakout. That’s when LTC will accelerate its move higher.

- The 61.8% Fib level is THE most important support level. As long as LTC doesn’t drop below $97.5, it is working on a long term bullish reversal.

In our latest premium crypto alerts, we covered Litecoin extensively. You too might be interested in understanding how Litecoin qualifies against other crypto opportunities in 2025.

READ – Our latest premium crypto alerts.