The first week of October 2024 has been extremely eventful for both Ripple and XRP. In this article, we look at 7 key developments in October. We check them against XRP price chart trends, and our expected XRP price impact.

RELATED – XRP price prediction 2025

All developments in this article occurred in the first 7 days of October 2024.

1. Ripple’s stablecoin RLUSD about to launch

RLUSD which is Ripple’s stablecoin is about to launch very soon, probably still in October 2024.

Ripple CEO announces that RLUSD will expand the #XRP Ledger ecosystem, adding massive liquidity — and we’re only weeks away, not months!

RLUSD is likely going to drive a lot of value, primarily by making Ripple’s payment software applications more accessible than ever before. One of the problems with XRP is its volatility, often perceived as an issue by financial institutions, presumably a hurdle to enable cross-border payments at scale.

With RLUSD, a few game-changing functions will be enabled:

- Instant settlement.

- Multi-chain.

- Enablement of many new finance use cases.

Watch this short video with Ripple’s CEO:

#Ripple CEO announces that RLUSD will expand the #XRP Ledger ecosystem, adding massive liquidity—and we’re only weeks away, not months!

— Collin Brown (@CollinBrownXRP) October 5, 2024

InvestingHaven’s assessment – We expect that RLUSD will have a positive effect on the price of XRP, over time, not immediately. The way RLUSD will affect XRP is through utility (adoption); that’s a slow process that we can reasonably expect to start slowly but accelerate at a certain point in time.

2. Ripple and Mercado Bitcoin partner to enable cross-border payments in Brazil

Ripple has launched Ripple Payments in Brazil.

Mercado Bitcoin, Latin America’s largest cryptocurrency exchange, will be the first to use this managed payments solution.

It allows businesses to utilize blockchain for faster, cheaper, and more efficient cross-border payments securely.

Customers can transfer funds globally 24/7, settling payments in just minutes, significantly improving the efficiency of moving value.

Ripple’s end-to-end payments solution is now live in Brazil! Learn how our new partnership with @MercadoBitcoin will streamline treasury operations between Brazil & Portugal, boosting cross-border payment efficiency via Ripple’s managed payments solution.

Source – Ripple post on X

InvestingHaven’s assessment – While this development can become a game changer for Ripple, as it can become a solid business case with proven value, it is not likely going to impact XRP directly in the short term. However, longer term, as Ripple finds a way to integrate RLUSD in their payment services, there might eventually be a positive impact on the price of XRP.

3. Dubai Financial Services Authority approves Ripple’s financial services license

The approval is a game-changer as Ripple is now able to introduce Ripple Payments Direct, a service that allows businesses to leverage Ripple’s blockchain technology for instant, cheap payments.

This matters because over 20% of Ripple’s global customer base is located in the UAE.

RELATED – As SEC Appeal Countdown Nears, Ripple & XRP Global Adoption Far Outweigh Legal Drama

We’re delighted to have secured in-principle approval of a financial services license from Dubai Financial Services Authority, unlocking our end-to-end managed payments services in the UAE. 🌍🇦🇪 https://t.co/4zq8YPlgaG

— Ripple (@Ripple) October 1, 2024

InvestingHaven’s assessment – Similar to the previous points, this game changing evolution is primarily going to affect Ripple. However, when it comes to potential impact on XRP, there is a very important confidence and trust element at play here. We believe there is an instant effect on the price of XRP by establishing a layer of confidence; this might result in a layer of support in the price of XRP.

4. Bitwise files a request for an XRP ETP

Bitwise is about to establish an XRP ETP (variant of an ETF). The ETP will hold XRP directly.

The most important quote from their press release:

XRP is the digital asset that powers the XRP Ledger (“XRPL”) public blockchain. XRPL is best known for its role in facilitating cross-border payments and remittances, as well as newer capabilities that enable institutional participation in Decentralized Finance, real-world asset tokenization, and EVM interoperability. XRPL typically processes transactions in seconds with fees under $0.01.

InvestingHaven’s assessment – This may directly and indirectly affect the price of XRP. On the one hand, Bitwise is setting a precedent, more fund managers may follow, increasing demand for XRP. On the other hand, it signals a vote of confidence for XRP. Both effects, combined, will create solid support on the XRP price chart, and also fuel the price of XRP whenever bullish momentum re-enters crypto markets.

5. SEC files appeal targeting Ripple, not XRP

The SEC filing appeal is old news in the meantime.

From attorney Jeremy Hogan:

- Big mistake by the SEC. It will appeal the programmatic sales ruling and IF it wins, it will get more money from Ripple and have protected no one. Ripple will raise its “Blue Sky” law issue and, if it wins, the SEC’s ability to regulate the entire Crypto space is essentially destroyed. Not a good calculation of risk by the SEC.

- This is an appeal by right (not like when the SEC tried to appeal before), the trial Judge can’t reject the appeal.

- The SEC is very very likely to lose, both statistically and based on the fact-heavy way the Judge wrote her opinion.

- Even IF the SEC were to “win” on appeal, it’s very very likely just a matter of money – nothing would change as to XRP and its use by Ripple.

- In a couple weeks we’ll know what issue(s) the SEC is appealing and then it must file its first brief by mid-December. It will NOT (and cannot) be appealing that “XRP is not a Security.” Importantly, watch for whether the SEC is appealing the injunction.

Especially points 3, 4, 5 matter a lot, in our view.

InvestingHaven’s assessment – While the price of XRP sold off initially on the news of appeal, it did hold up pretty well, in the grand scheme of things. Support was respected, the price drop ended up being ‘just’ 15%. Compared to the major price drop in December 2020, it is meaningless. More importantly, the SEC’s appeal is likely only targeting Ripple and the monetary penalty; it’s unlikely that the SEC is questioning whether XRP is a security. This bodes well for the price of XRP.

6. The SEC has to specify what exactly is in scope of the appeal

The SEC filed appeal. It did not specify any detail about its disagreement with Judge Torres.

The SEC has a short time window to do this. Ripple has a 14-day window to file a cross-appeal.

NEW: The @SECGov has not filed its Form C with the Second Circuit yet which will detail what exactly they’re appealing. They need to do that pronto so that @Ripple knows how to proceed. Ripple also has 14 days from today to file a cross-appeal if they choose to.

Form C: pic.twitter.com/IomvRZXw9N

— Eleanor Terrett (@EleanorTerrett) October 3, 2024

InvestingHaven’s assessment – While the initial XRP price reaction on the news of appeal was violent, it remains unclear what the SEC exactly is appealing. Frankly, this XRP price reaction given the unknowns makes us think the impact may be limited.

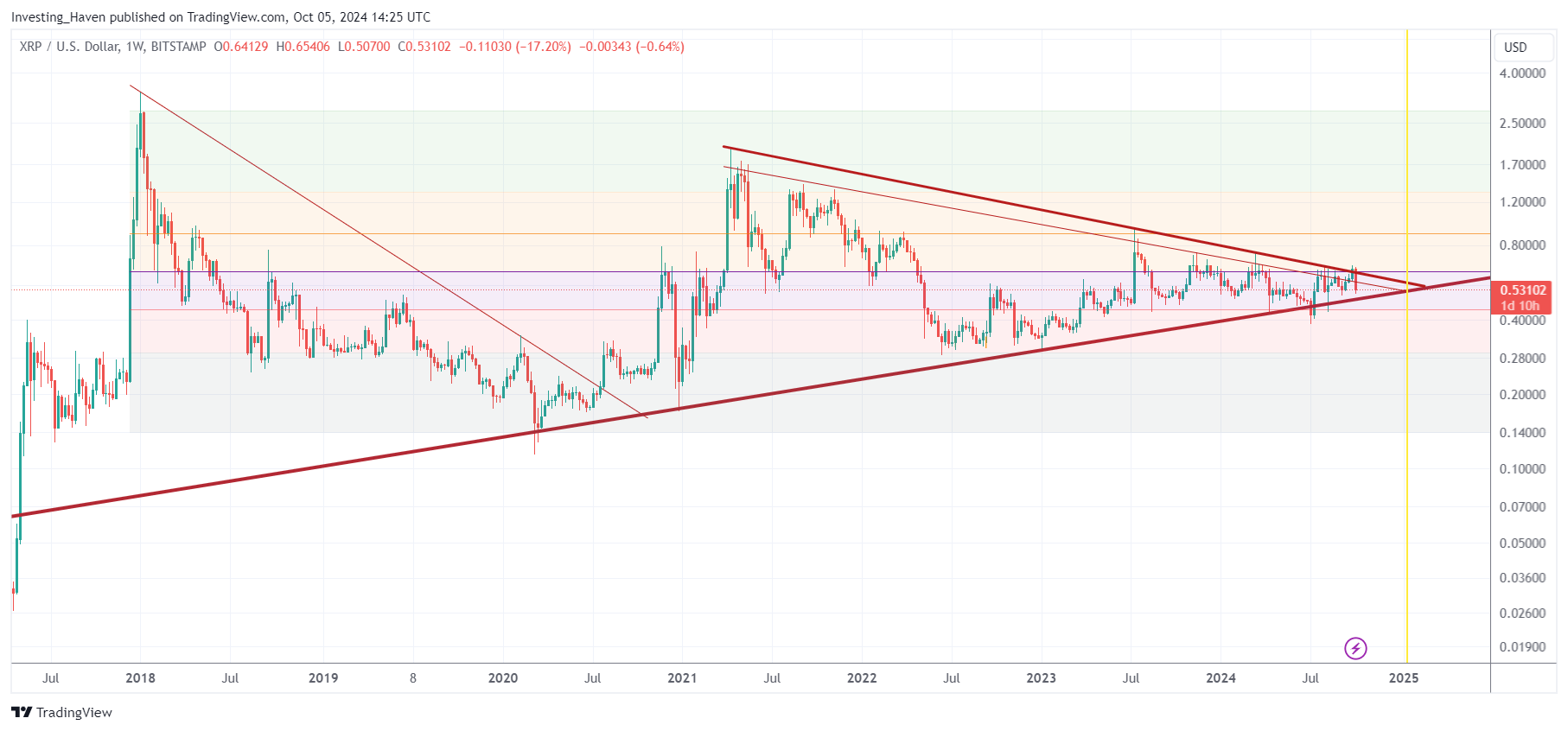

7. Long term XRP chart continues to look awesome

In the meantime, we believe our XRP price assessments on each of the 6 points mentioned above is reflected on the XRP chart.

In order to clearly see our point, we need to zoom out – below is the secular XRP chart on 7 years.

- Is there a positive or negative impact on the price of XRP? It’s not visibly negative, is the conclusion.

- Is there support on the XRP chart? Yes, tons of support, in line with our assessments (above).

- Is XRP bullish or bearish? It continues to be long term bullish.

What’s more – decision time is coming, see yellow line on the chart. Moreover, XRP has time till Feb/March to stage an epic breakout which is when the rising trendline will cross its 50% Fibonacci level (purple line).

We continue to see good outcome for XRP, it might take a few more months. Developments are supportive, is our conclusion, and we believe the chart is reflecting this.

Conclusion – The 6 key developments nicely align with the XRP chart development.