Ripple (XRP) crashed by more than 10% in the last 24 hours, falling below $2 for the first time in four months. While much of this can be attributed to a spooked market after Trump issued fresh tariffs on Chinese products, a 50% network crash also affects investor sentiments.

For the second time in 30 days, the crypto market has crashed, and billions worth of leveraged trades – mostly long –have been forcefully liquidated because of Trump tariffs.

Yesterday’s crash, for instance, resulted in the liquidation of $25.3 Million worth of XRP trades (88% long positions) when the tariff-inspired crash sent Ripple coin prices tumbling by more than 10%.

Confirming the previously paused Tariffs for Canada and Mexico and introducing new 10% tariffs for China spooked an already tense crypto market.

Ripple has especially been severely affected by the ongoing bearish sentiment as evidenced by its failure to reclaim the $3 mark and a 23% price crash over the last 30 days.

Factors Driving Ripple (XRP) Prices Down

In addition to the crashing market, several other factors may be attributed to Ripple’s disappointing price action. First is the declining activity on the Ripple Network.

A top analyst, for example, recently brought to the limelight the fact that the number of active Ripple addresses had dropped by 50% from the peak levels of 202,250 in early December to the current level of 101,160.

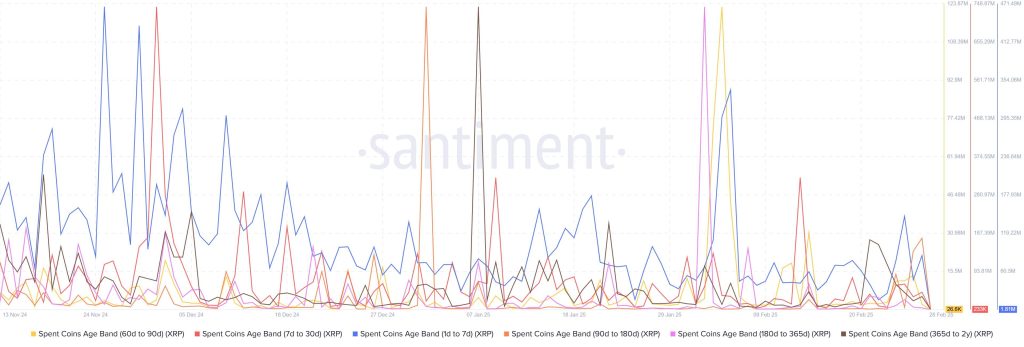

Secondly, Ripple is currently experiencing massive sell pressure from retail investors. According to the Spent Coins Age Band, selling activity has come from two key cohorts; tokens held for 1D to 7D and those held for 90D to 180D.

Upon further analyzing this data alongside the Network Realized Profit/Loss metric, it becomes clear that the 1D to 7D cohort is selling Ripple rapidly to minimize losses, while the 90D to 180D cohort is capitalizing on profits before prices drop below their entry price.

🚀 Don’t Miss the Next Big Crypto Move!

Our premium members received real-time alerts on major crypto plays before they happened. Will you be ready for the next one?

🔴 Latest Insider Alerts:

- 📢Buy The Dip Is Here (Feb 28th)

- 📢How To Know Whether BTC Will Set A Bottom This Week? (Feb 25th)

- 📢This Token Is Set To Emerge As An Outperformer as USD Breaks Down. (Feb 16th)

- 📢When Will This Market Finally Start Moving? (Feb 9th)

- 📢Will February 5th Come To The Rescue? (Feb 4th)

⏳ Limited Spots Available – Secure Yours Now!