Should I invest in crypto? People have been increasingly asking this question over the past year, as cryptocurrency prices set new record highs and as financial institutions become more heavily involved in the crypto market.

Data from Google Trends reveals that, worldwide, searches for “crypto” have neared their record high in recent weeks, while US-based searches for “should I invest in crypto” hit three-year peaks in December. This highlights the noticeable surge in interest that cryptocurrencies have attracted, with the decidedly pro-crypto stance of the new Trump administration one of the key causes of this surge.

But is investing in crypto actually a good idea? We answer this question in this article, examining what cryptocurrency is, the pros and cons of investing in crypto, and also how to buy cryptocurrencies safely. This should leave you better equipped to decide whether investment in digital assets is right for you.

What is Cryptocurrency?

- Cryptocurrency is electronic money that’s cryptographically verified.

- Cryptos are decentralized, in contrast to normal money which is issued by central banks.

- Some cryptos have fixed supplies.

Cryptocurrency is a form of electronic money in which transactions are processed on an online network. Unlike with traditional payment systems, this network is not centralized.

Each participant in the network keeps a record of all transactions, with groups of transactions recorded together in ‘blocks,’ which is where the term ‘blockchain’ comes from. Any given block is verified by network participants solving a cryptographic puzzle that produces the correct hash for that block, which once verified cannot be modified.

Launched in 2009, Bitcoin was first the cryptocurrency to function in this way. Thousands of other cryptocurrencies, often referred to as altcoins, have followed in the succeeding years, including Ethereum, Ripple (XRP), Solana and Dogecoin. Each of these has different features and different ways of working, but they all involve decentralized online networks.

Aside from being decentralized, the key difference between cryptocurrencies and traditional forms of money (i.e. fiat currencies) is that cryptocurrencies are not issued and/or backed by a central bank. Some of them, such as Bitcoin, also have fixed total supplies, meaning that they will theoretically experience deflation, becoming more valuable over time.

Why People Invest in Crypto

- Potential for above-average returns.

- Hedge against inflation.

- Decentralized, pro-privacy technology.

Since July 2013, when it was priced at $67, Bitcoin has risen in price by 169,900%. Other cryptocurrencies have recorded even bigger returns, with Ethereum rising by 1,000,000% since October 2015, for example. These massive percentages highlight why people invest in crypto, with the earliest movers in the space making considerable profits (e.g. the Winklevoss twins).

Even over short-term periods, cryptocurrency prices can rise dramatically, enabling investors to make quick profits. For example, Dogecoin climbed from $0.063 to $0.7316 – a 1,000% increase – in a few weeks between April and May 2021, after entrepreneur Elon Musk repeatedly tweeted in support of the meme token.

More recently, people and organisations have begun investing in crypto as a means of diversifying their portfolios.

This is particularly the case with financial institutions, who have been increasingly investing in Bitcoin and Ethereum exchange-traded funds, which currently account for just over $220 billion in assets under management. Something similar also applies to a growing number of publicly listed companies, with BitcoinTreasuries.NET now counting 190 public firms worldwide which hold Bitcoin as a reserve asset.

The growth in such firms and institutions stems from two primary factors. The first is that many institutions, companies and investors believe that, as a hard-capped (and deflationary) cryptocurrency, Bitcoin and similar cryptos are a hedge against inflation.

Secondly, there’s also a belief that cryptocurrencies and blockchains represent advanced and innovative technology, which may end up having applications in numerous industrial and financial areas. This is reflected in the expansion of DeFi and NFTs in recent years, as well as in the growth of stablecoins, which could increasingly replace fiat currencies for cross-border transfers.

Risks of Investing in Crypto

- Volatility – prices can plunge as well as surge.

- Hacks and scams.

- Market manipulation by big traders.

One of the main attractions of crypto – its volatility – is also one of its biggest risks, since cryptocurrency prices can fall just as sharply as they can rise. This has been evident in downturns of recent years, such as those witnessed after the 2017 and 2021 bull markets. For example, Bitcoin reached a then-record high of $19,783 in December 2017, only to fall to $6,800 by early February 2018.

Volatility can be even more pronounced with altcoins and meme tokens, which are cryptocurrencies styled after internet memes. As noted above, Dogecoin reached an all-time high of $0.7316 in May 2021, but then proceeded to decline all the way down to $0.060 just over a year later, making for a decline of 91.7%.

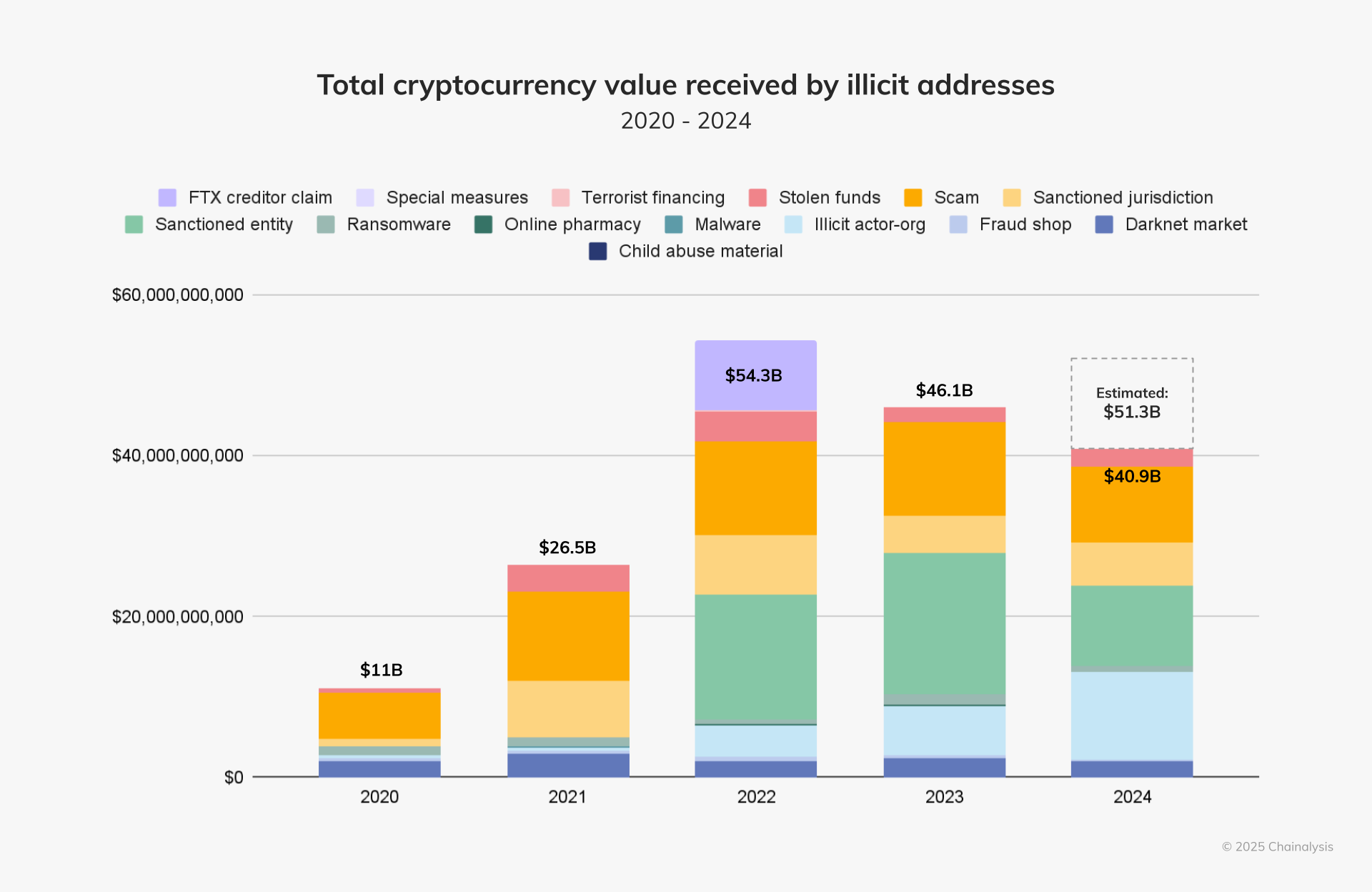

There’s therefore a real chance that you could lose most or pretty much all of your investment in crypto, particularly if you operate over shorter timeframes and/or pick the wrong token. In fact, losing all your money is also something that could happen if you have the bad luck of falling victim to a scam or hack. This is a real risk in crypto, with data from Chainalysis indicating that as much as $51 billion in crypto was received by illicit addresses in 2024.

Given that cryptocurrency gains and rallies can often be dramatic and spectacular, some investors may have a hard time telling when something is too good to be true.

Things are made even more difficult by the fact that so much information in crypto is spread online and (in particular) on social media, where fake and spam accounts can bamboozle newcomers with promises of big profits.

Crypto also has a problem with market manipulation. Again, this relates to volatility, which can often be worse with altcoins with smaller markets and lower volumes. In such cases, so-called whales (i.e. larger traders) can send prices up or down with a single big trade, making it very hard for normal investors to predict when to time their own transactions.

More broadly, the cryptocurrency market can also be susceptible to regulation. While things have changed for the positive in the United States in 2025, this hasn’t always been the case. Previous years have seen prices fall after a regulator has taken some kind of action detrimental to crypto, such as when the SEC sued Ripple and two of its executives in December 2020.

Crypto vs Other Investments

- Bitcoin has shown more correlation with gold in recent years.

- BTC is also correlated with stocks, particularly tech stocks.

When considering the pros and cons of cryptocurrency investing, it’s also worth comparing crypto against other investments. That’s because crypto behaves quite differently from more traditional assets, despite the fact that people generally use the same language to describe both.

Probably the most popular comparison is between Bitcoin and gold, given that Bitcoin is often referred to as ‘digital gold,’ due its status as a store of value. However, the correlation between BTC and gold has fluctuated quite strongly through time, veering from positive to negative every few weeks. There’s also the fact that Bitcoin is capable of more dramatic rises or falls, whereas gold moves more steadily.

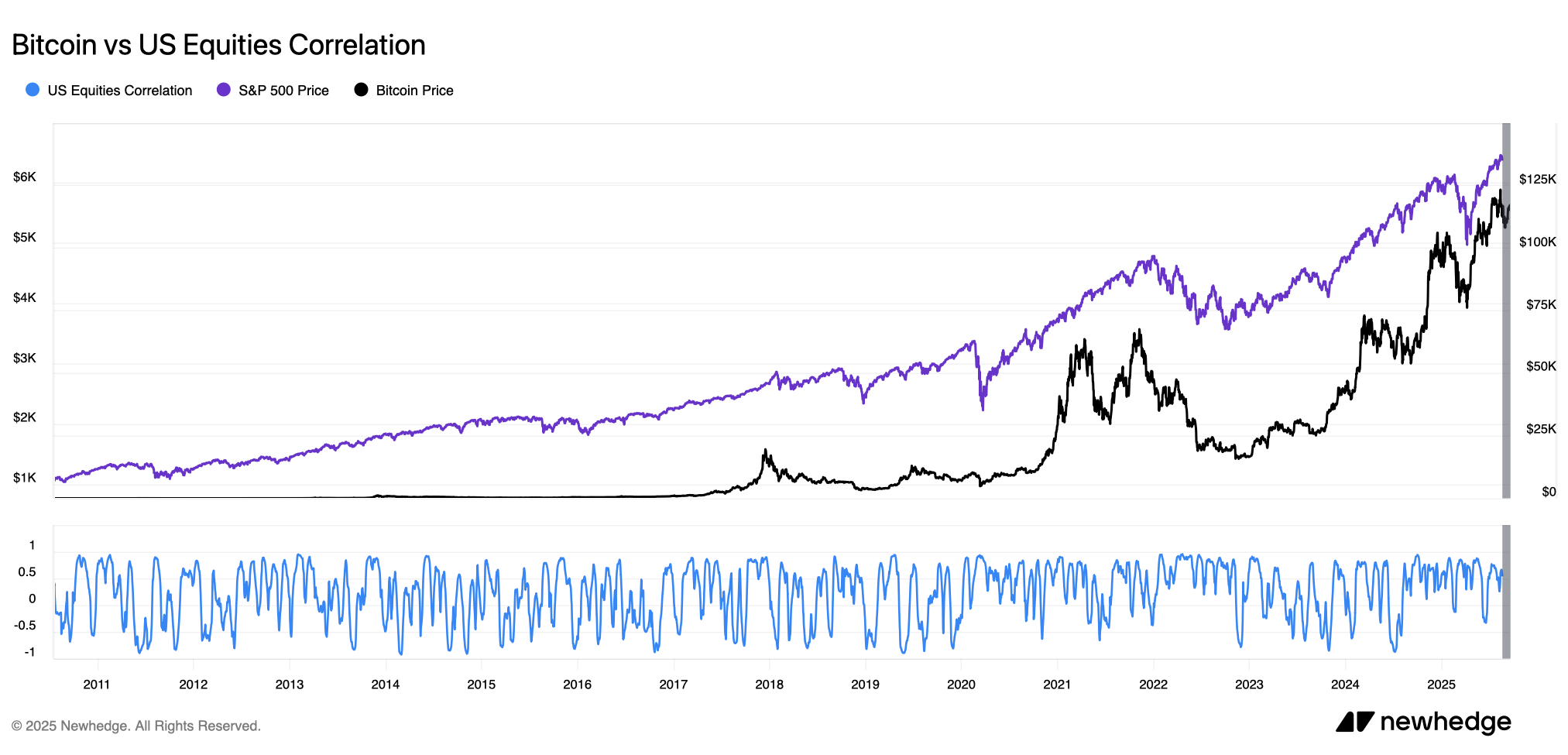

On the other hand, Bitcoin and other cryptos are also compared with stocks, especially tech stocks. And if we check the correlation between BTC and the Nasdaq (an index of the biggest tech stocks in the US), we see that it’s more frequently positive than negative. The same holds for the correlation between BTC and the S&P 500, which again is more frequently positive.

That said, investors should remember that both gold and stocks are less volatile than crypto, while other traditional assets – such as real estate and government bonds – are even less volatile. However, investors should bear in mind that the flipside of this is that crypto can bring bigger returns, making them a high-risk, high-reward asset.

How to Invest in Crypto Safely

There are several rules of thumb investors should observe in order to invest in crypto safely, or at least with the minimum possible risk.

- Invest only what you can afford to lose: this is probably the most important rule for crypto investors. Basically, it means acknowledging the likelihood that the price of any given crypto could fall dramatically. And as such, it means setting and sticking to strict budgetary limits, perhaps using a dollar-cost averaging strategy (i.e. buying a fixed amount each month).

- Use only regulated, reputable exchanges: given the number of hacks and exchange bankruptcies over the years (e.g. FTX), it’s vitally important to trade only with the most reputable cryptocurrency exchanges. Search for reviews of an exchange you’re considering, and check whether they’re licensed to provide crypto services in your country.

- Use hardware wallets: if you have significant sums of crypto, keeping them on an exchange or any other trading platform is not a good idea. Instead, buy a hardware wallet from manufacturers such as Trezor or Ledger if you’re holding crypto for the longer term. These are offline devices that minimize the risk of your tokens being hacked.

- Diversify your holdings: one way of reducing the risk of investing in crypto is to own a diversified basket of cryptos. That way, if one particular token falls heavily in price, you could offset your losses with your other holdings. This strategy also works in the opposite direction, in that diversification increases your chances of owning a token that will surge in price.

- Ignore FOMO and hype: one of crypto’s biggest negatives is that it’s driven significantly by social media-based noise. Influencers can create a buzz about a token, and retail investors often follow blindly, usually losing money in the process. This is why it’s important to do your own research, and to devise a long-term gameplan and stick to it.

FAQs

Is it too late to invest in Bitcoin in 2025?

Despite its recent gains, there are signs that Bitcoin will continue to rise in price for the foreseeable future. This mostly relates to the growth in institutions investing in Bitcoin exchange-traded funds, as well as in public companies building their own Bitcoin treasuries. Such expanding demand is likely to continue pushing the Bitcoin price up for a while.

How much should a beginner invest in crypto?

The answer to this question usually relates to how much you can afford to lose. However, for beginners it’s best to start off with smaller investments, in order to have a taste of how crypto trading works and what it feels like to make profits or losses. That way, you can develop a keener sense of the pros and cons of cryptocurrency investing.

Centralised or decentralised exchanges?

Decentralised exchanges are cryptocurrency trading platforms that transact entirely on a blockchain (e.g. the Ethereum or Solana blockchain). There’s no centralised operator or market maker, so investors trade on a peer-to-peer basis. Their advantages included greater transparency and privacy, yet they come with added complexity for the new crypto investor. They may also be more susceptible to hacks.

Should I be worried about crypto scams?

Yes and no. On the one hand, the cryptocurrency space is full of scammers and fraudsters, particularly on social networks such as X, Telegram and Discord. However, if you ignore anyone who approaches you on social media, and if you stick to regulated exchanges (e.g. Coinbase, Kraken, Bitstamp), then you’re unlikely to fall victim to a scam. Always do your own research, and steer clear of very new coins with small or nonexistent footprints.

Conclusion: Should I Invest in Crypto?

Deciding whether to invest in crypto depends on your tolerance for risk. Cryptocurrencies are a high-risk, high-reward asset, meaning that they can rise and fall suddenly. Their prices can rise quickly and outperform more traditional assets over shorter timeframes, but they can also drop heavily during downturns.

This means that most normal investors should be prepared to take a long-term view of investment. They should probably consider adopting a dollar-cost averaging strategy, buying smaller amounts at intervals in order to average out peaks and troughs. And they should try to disregard the noise that can flood the crypto market, particularly on social media.

In order to do this, they should do their own research into the cryptocurrencies in which they might potentially invest. By arriving at a well-informed view of particular cryptos, they’ll be better able to choose the coins that are best for them, and then to stick to their own investment plan. One way of becoming well-informed is to find a reputable source of info and analysis, such as InvestingHaven’s crypto forecasts.

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here

Which Crypto Should You Invest In Right Now?

For alerts on the key crypto assets that are primed for investment right now you should consider Join the original blockchain-investing research service — live since 2017.

InvestingHaven alerts come from a proprietary 15‑indicator methodology built over 15+ years of market experience.

You’ll be following the service that identified major turning points through crypto winters and bull runs alike

Act now and see why thousands trust us to deliver signals before markets move.

This is how we are guiding our premium members (log in required):

- Is A Trendless Crypto Market Good or Bad? The Current and Emerging Winners Look Awesome. (Sept 7th)

- BTC Testing Long Term Trendline. Here Is Short and Long Term Guidance. (Aug 26th)

- Crypto – To Break Out Or Not To Break Out? (Aug 23rd)

- What Happened This Week? Leading Indicator Analysis and 7 Token Charts. (Aug 16th)

- Crypto Shows More Resilience Than Expected. A Bullish Impulse May Be Underway. (Aug 9th)

- Prepare To Buy The Dip In Crypto (Aug 2nd)

- Alt Season 2025 – Progress Update (July 26th)