Solana has been a standout performer, drawing the attention and excitement of investors. However, while many crypto enthusiast have been focused on the upside potential, we believe the flipside should be considered as well. We may be very bullish very long term on Solana, even our 2024 SOL outlook is bullish, but we are also cognizant of the medium term cycles.

Fundamentals matter don’t matter

What does the statement ‘fundamentals matter don’t matter’ really mean?

It is inspired by the Oracle of Delphi, obviously.

We believe that fundamentals matter most of the time, but not always.

Here is one really interesting development for Solana’s ecosystem. It should make every crypto enthusiast excited.

On Solana, we see Anatoly’s vision of a single atomic state machine as a powerful use case of decentralized blockchains, lowering information asymmetry. And we are impressed by all the activity seen on Solana in Q4 2023

-DePIN

-DeFi

-Meme coins

-NFT innovation

-Firedancer— Franklin Templeton (@FTI_US) January 17, 2024

However, fundamentals are not necessarily driving price, not always. SOL fundamentals mattered when it was trading at $20, hugely undervalued. While fundamentals still matter, long term, we should not forget the context: a 6-fold rise requires a cooling off period, no matter how strong fundamentals may be.

Don’t mix up fundamental readings with chart readings.

Solana chart requires a cooling off period

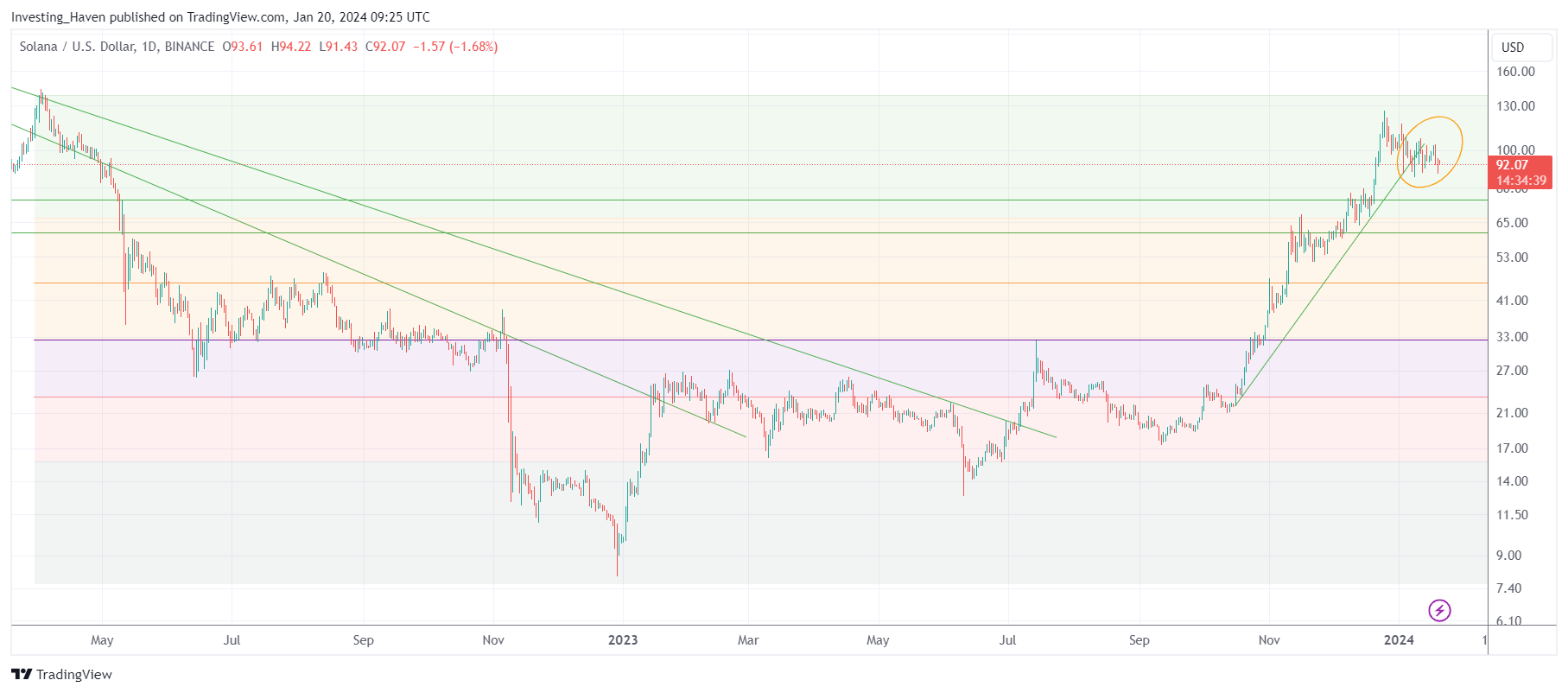

From a humble $21 to a staggering $120 between October and December, Solana’s ascent has been nothing short of impressive. This surge is not just a testament to its market performance but also a response to the SEC’s scrutiny, affirming the value created by the Solana project amid regulatory challenges.

Now, let’s shift our focus to the charts, the heartbeat of crypto analysis. The breaking news here is SOL‘s breakdown of the falling trendline, an event that’s on the verge of confirmation. A breakdown isn’t merely a technicality; it unleashes a force of downward pressure, potentially altering the trajectory of Solana’s price.

As we look at chart specifics, the SOL chart reveals crucial support levels at $80, $72, and $64. These levels act as safety nets, providing some stability amidst the tumultuous world of cryptocurrency. However, our analysis suggests a cooling-off period for Solana, projecting a consolidation phase in the $72-$120 range. This breathing space is essential for any asset that experiences rapid growth, allowing it to recalibrate and find its new equilibrium.

But, and this is a big but, forecasts come with conditions. Our prediction of Solana’s consolidation is contingent on it staying below $110 in February. If Solana defies our expectations and consistently hovers above this mark, it could signal a different narrative. It could potentially challenging the projected cooling-off phase.

Long term bullish Solana, short term neutral with a slight bearish bias

In conclusion, Solana’s journey, while remarkable, is not immune to the market’s ebb and flow. The breakdown of the falling trendline adds a layer of complexity. The support levels serve as key indicators for potential shifts.

Investors should keep a keen eye on the charts, recognizing excitement and caution. As Solana navigates these waters, its future path will likely be shaped by how well it balances the heat of its rapid rise with the necessity of a cool-down period.

CRYPTO PREMIUM SERVICE TIP – This Cryptocurrency Can Rise Up to 8x, Provided ‘Narrative Effect’ Kicks In.