Solana crashed a further 11% in the last 24 hours to fall to $124 – a level last seen in September 2024. Analysts are worried that macro headwinds and the watch-and-wait mood may push it towards $100 in the coming weeks.

Solana is the worst-performing asset in the 10 most valuable class after slipping 11% in the last 24 hours, compounding its losses for the month to more than 30%. With the loss came a sharp rise in volatility, with daily trading volumes increasing by 115% to top $4.5 billion.

Looking at Solana’s price action, you will notice that its losses loom larger than most of the top 10 cryptos, especially Bitcoin and Ethereum.

And there is a perfect explanation for this, which is that there are more macro factors dragging Solana prices and investor sentiment down in comparison to the rest of the market.

Scandals and Liquidity Diversion to Memecoins Hurting SOL Prices

In addition to dealing with the bearish market sentiments and the watch-and-wait mood that has gripped the market, SOL prices have to contend with scandals and sucked liquidity.

The altcoin’s troubles started blowing up in the last week of January when Diego Aguilar filed a class action suit in New York against Solana’s meme coin factory – Pump.fun.

Less than two weeks later, the $4.5 Billion meme coin scandal involving Argentinian [president Javier Milei blew.

Analysts then started highlighting the fact that meme coins have been stealing liquidity from Solana.

They claim that while community interest in Solana remains at an all-time high, their investment draw has shifted from SOL to the meme coins operating in the Solana ecosystem.

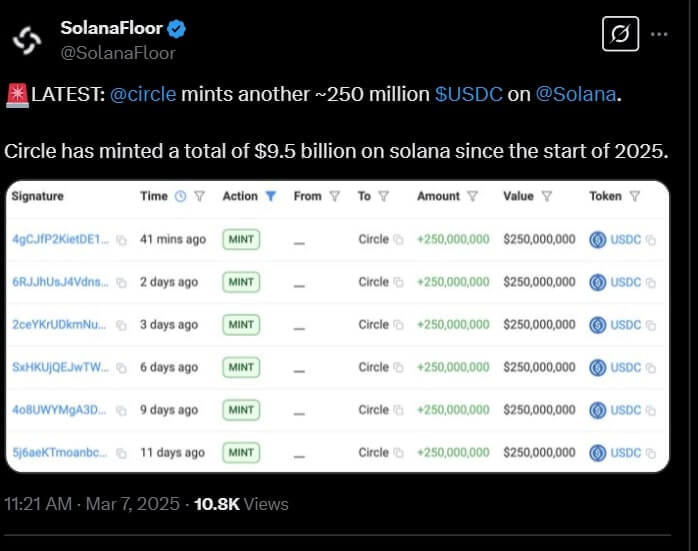

They back these claims with the argument that though close to $10 Billion in liquidity has been injected into Solana in 2025, SOL prices have slipped by 25% over the same period.

This implies that much of this liquidity has been diverted to the Solana meme coin market.

Solana’s Next Price Action

Solana’s price action has been stuck in a descending channel pattern marked by higher lows and lower lows.

This has gone on since January 20 this year, and any attempt at a breakout, as happened on the first weekend of March, has been met with a lot of resistance.

A further examination of the MACD and RSI indicators also reveals there isn’t enough bullish momentum to help SOL defend the current support level of $127.

Traders are, therefore, worried that any more headwinds will drag SOL prices further down with some forecasters expecting to settle around $100 in the coming weeks.

Which Crypto Should You Buy in Your Very Next Trade?

With the crypto market evolving rapidly in 2025, many investors are uncertain about where to put their money next. The question isn’t whether to invest—but which crypto has the highest potential.

At InvestingHaven, our proprietary crypto investing service delivers high-potential opportunities backed by leading indicators and deep market analysis.

🚀 In 2024 alone, our crypto insights identified several altcoins that surged over 150%, with multiple others gaining 30%+—proving our strategy works.

Whether you’re looking for high-growth altcoins, stable large-cap cryptos, or emerging blockchain projects, our expert forecasts guide you to the right investment at the right time.

📊 Stay ahead of the market—get exclusive access to our proven crypto alerts today!