Solana rallied by more than 12% in the last 24 hours to climb above $135 for the first time in ten days.

The price jump was inspired by the launch of Solana Futures set to launch on Thursday as well as Calming comments from FED’s Jerome Powell.

Solana stormed into Thursday, March. 20 eager to prove its resilience after rallying 12% in the last 24 hours.

The price jump helped it scale the $135 mark for the first time in 10 days.

Its daily trading volumes also shot up by more than 73% to reach $3.61 Billion.

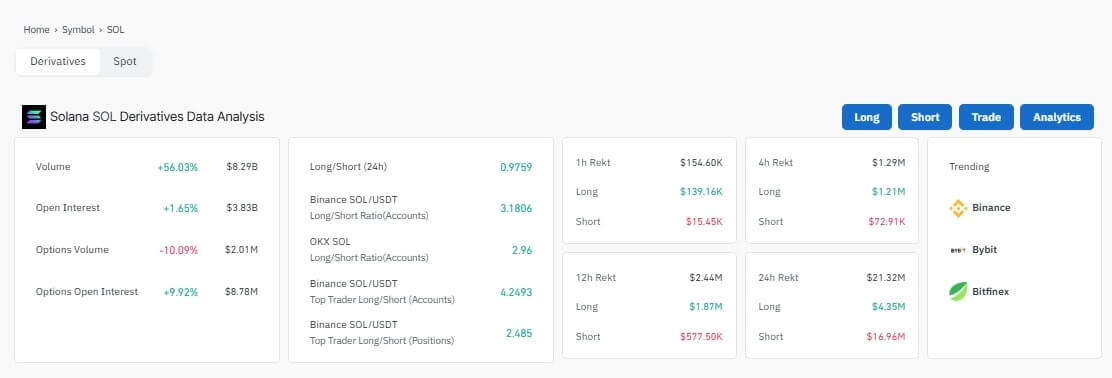

Solana’s derivative markets have also reported an increase in trader activity, with daily trader volumes increasing by 56%, hitting $8.29 Billion in the last 24 hours.

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

GET STARTED

Crypto investments are risky and may not suit retail investors; you could lose your entire investment.Understand the risks here

Coinglass derivative market data

Among the two key factors credited with this shot at recovery was the launch of the Solana Futures ETF.

Today, Volatility Shares LLC, a US-based hedge fund that develops and manages innovative leveraged ETFs, will launch two Solana-based future ETFs.

According to a filing with the SEC, the investment firm will be launching Volatility Shares Solana ETF (SOLZ) and Volatility Shares 2X Solana ETF (SOLT).

SOLZ tracks Solana futures while SOLT offers twice the leverage exposure of SOLZ and will carry an expense ratio of 0.95% and 1.85%, respectively.

Futures ETFs Historically Precede Spot ETF Approvals

The announcement sparked excitement among SOL investors who believe the futures ETF will impact SEC’s decision on approval of Solana Spot ETF.

They base their argument on a regulatory precedent set by Bitcoin and Ethereum.

In both cases, the SEC approved the Futures ETFs first, followed by their spot counterparts.

At the time of writing, bettors on Polymarkets have raised their predictions that a SOL ETF will be approved in the year to 88%.

Fed Chair Calms the Markets

During a press conference after the FOMC meeting yesterday, FED chair Jerome Powell calmed the markets by keeping benchmark lending rates unchanged.

He also downplayed the impact that trump tariffs will have on the markets following growing concerns they may sink the country into a recession.

Following the press conference, the crypto market rallied by 4% with top coins like Bitcoin hitting the highs of $87k. That’s primarily because the Fed continues to see two rate cuts in 2025.

Lower interest rates often make bonds and saving accounts less attractive, making investors more interested in risk-on assets for better returns – and those include cryptocurrencies.

Our latest crypto alerts – instantly accessible

This is how we are guiding our premium members (log in required):

- The Dates & Data Points To Watch In The Next 3 Weeks (March 17th)

- The Time Window as of March 14 Should Bring Relief (March 11th)

- Buy The Dip Is Here (March 1st)

- BTC Very Close To Its 200 dma – Chart Looks Constructive (Feb 26th)