SUI token prices rallied by more than 20% on the day after Trump-affiliated World Liberty Financial added support for the coin.

But the bullish momentum wasn’t enough to help it climb above the important $3 mark.

The crypto market reacted positively to the news that the Trump administration had granted automakers a one-month exemption on his tariffs on imports from Mexico and Canada.

The announcement helped top altcoins, including Bitcoin and SUI, recover some of the losses incurred after Monday’s flash crash when the tariffs were announced.

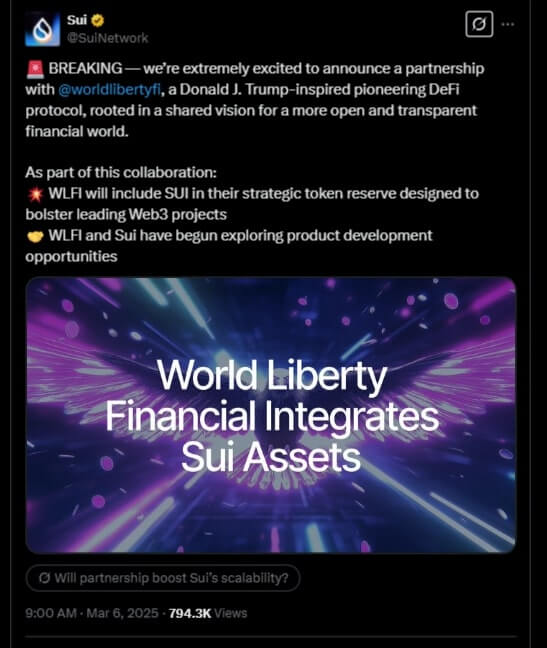

However, SUI’s price received a major boost when the Trump-affiliated World Liberty Finance (WLF) announced that it had entered into a deal that would see the layer-1 blockchain network added to their crypto holdings.

In addition to adding it to their strategic reserve, WLF also announced that the two brands will also “explore product development opportunities.”

SUI Faces Strong Resistance Below $3

SUI jumped 20% on the news, rising from yesterday’s low of $2.58 to an intraday high of $2.98.

It, however, faced strong resistance around this price level that prevented it from breaking above the $3 mark and possibly smashing the critical resistance level of $3.2.

Not even the equally positive news of Lombard Finance launching its liquid Staking Bitcoin Token (LBTC) on SUI could help it marshal the bullish momentum needed to help it scale above $3.

The bearish sentiment that has taken over the crypto industry has made it impossible for top coins to record significant rallies or breakouts.

SUI, for example, has been trapped in a descending channel, also known as a falling channel pattern, which is marked by consistently making lower highs and lower lows.

And though today’s attempt at a breakout bounced from the lower boundary of the channel, technical indicators show that there isn’t meaningful bullish momentum to support a trend reversal.

On the daily SUI/USD chart, the altcoin has an RSI of 43, having jumped from the lows of 36 two days ago.

This implies that it is operating in the neutral-to-oversold region, which suggests slight buy pressure is returning. Additionally, the MACD line is still below the signal line implying that the bearish trend isn’t fully over.

On a positive note, though, the lines are hinting at convergence, which, combined with a rising RSI would confirm a bullish momentum and a trend reversal.

🚀 Don’t Miss the Next Big Crypto Move!

Our premium members received real-time alerts on major crypto plays before they happened. Will you be ready for the next one?

🔴 Latest Insider Alerts:

- 📢Buy The Dip Is Here (Feb 28th)

- 📢How To Know Whether BTC Will Set A Bottom This Week? (Feb 25th)

- 📢This Token Is Set To Emerge As An Outperformer as USD Breaks Down. (Feb 16th)

- 📢When Will This Market Finally Start Moving? (Feb 9th)

- 📢Will February 5th Come To The Rescue? (Feb 4th)

⏳ Limited Spots Available – Secure Yours Now!