With every tiny drop in the price of BTC we see doomsday message appear everywhere. ‘Everyone’ wants to make you believe that Bitcoin’s bull market has ended. We are here, telling you, Bitcoin’s bull market is alive and kicking.

Note – we update this article on March 24th, 2024. The message ‘Bitcoin’s bull market is alive and kicking’ is applicable at the time of writing, for sure for several more weeks (if not months).

Did you notice that the crowd that is selling the end of Bitcoin’s bull market message is only doing so based on a story, a narrative, data points that are not the real price drivers? None of the ‘Bitcoin’s bull market is dead’ crowd is able to present decent chart analysis to back up their theory.

Watch out when a storyteller is playing with emotional triggers.

Opinions are noise

While we appreciate opinions in real life, we hate them when talking financial markets.

Opinions are noise.

They are disturbing.

You stay away from opinions.

That’s why we keep on saying: ‘start with the chart.’

Opinions that are based on data and facts are acceptable. There is some room for interpretation when analyzing data and charts.

But opinions without charts or other data points are the biggest distractors you can imagine.

The message ‘Bitcoin’s bull market ended’ or the Bitcoin bull market is dead, without verifiable data or charts, suggests one and only one thing: attention.

Stated differently, a desperate cry for Twitter (X) likes and more subscribers.

Bitcoin’s Bull Market Dead Based On Intraday Charts

What’s even worse that making statements like ‘Bitcoin’s bull market is dead’ without using a chart… is using an intraday chart to send out whatever message.

BREAKING 🚨: Bitcoin$BTC falls below $40,000 for the first time since early December pic.twitter.com/AtdovvVnKl

— Barchart (@Barchart) January 22, 2024

Or what about this more recent social media message:

Bitcoin is likely to sell off down to 38-40k in the coming 4-6 weeks.

The bearish structure shows a huge throw-over; these rarely end well. pic.twitter.com/7fAauaG53s

— HZ March 23, 2024

Let’s face it – an intraday chart tells absolutely nothing. Nothing at all.

It’s noise.

We don’t like noise.

Bitcoin’s Bull Market Is Alive And Kicking

We have been shouting it from the roof: the crypto bull market 2024 is a hidden bull market.

Let’s look at what everyone is looking at – Bitcoin charts.

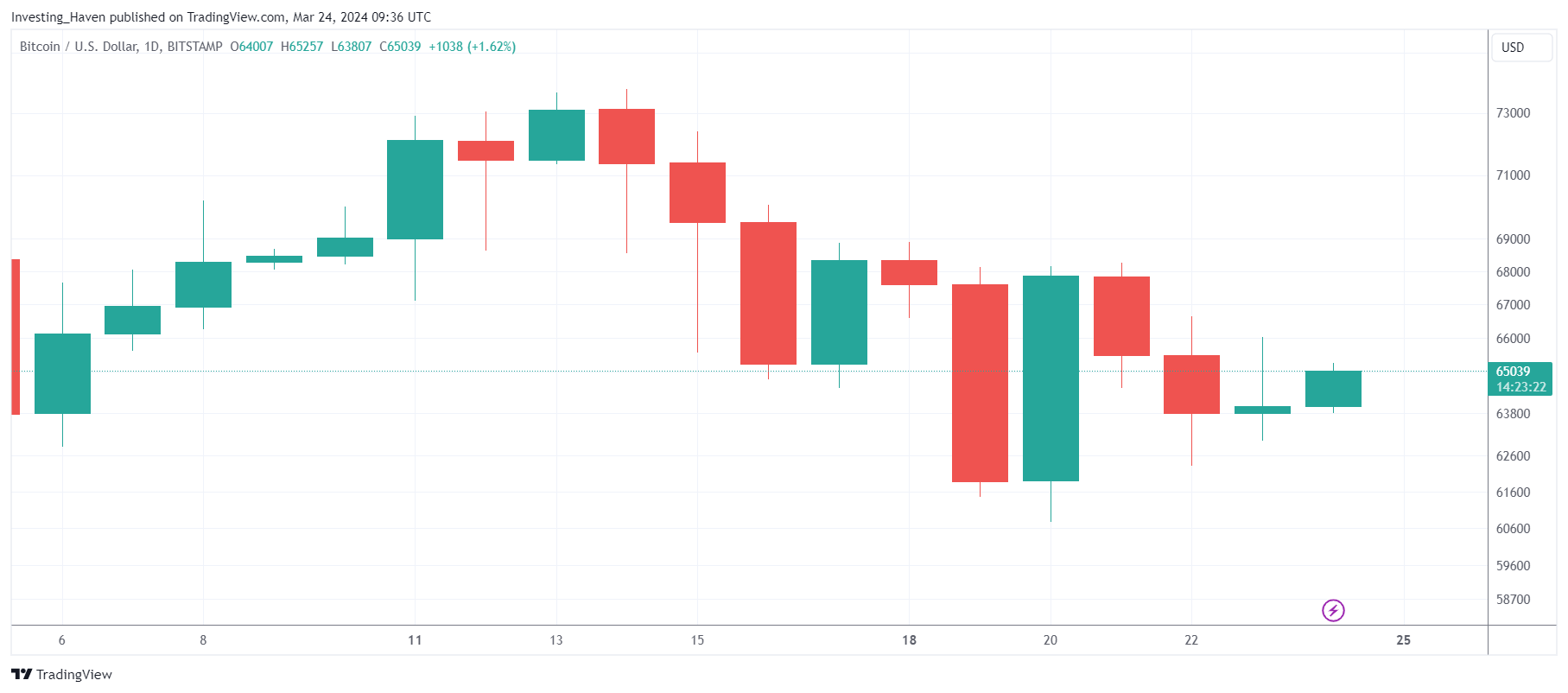

First – these are the daily BTC candles in the last 20 days.

What stands out? The two largest candles, first a red one followed by a larger green one. This is a rejection to move lower – consequently, Bitcoin is most likely in the process of resolving higher.

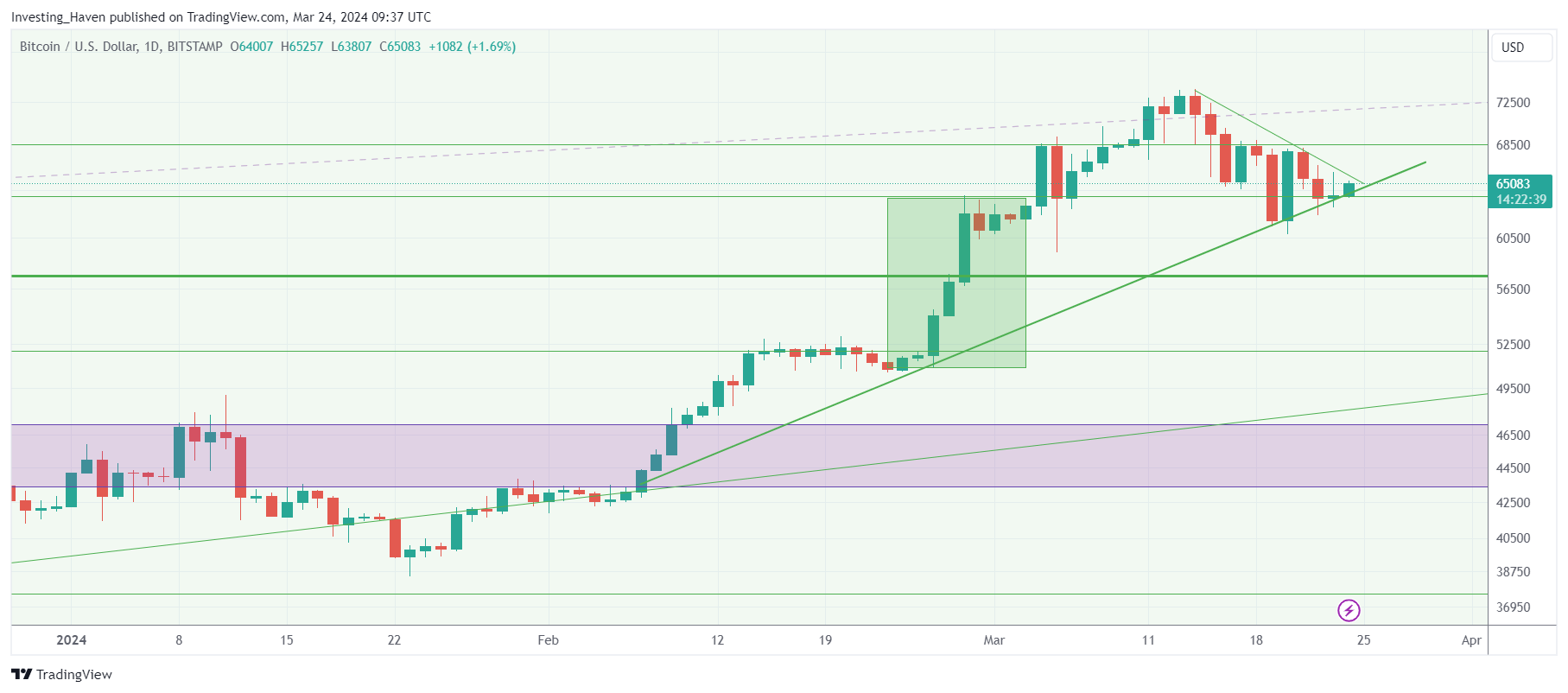

If we zoom out, we can put this daily candle setup in perspective. What stands out is that last week’s rejection occurred right at a rising trendline. This is promising, but the lows of March 20th (around 61k) must hold going forward.

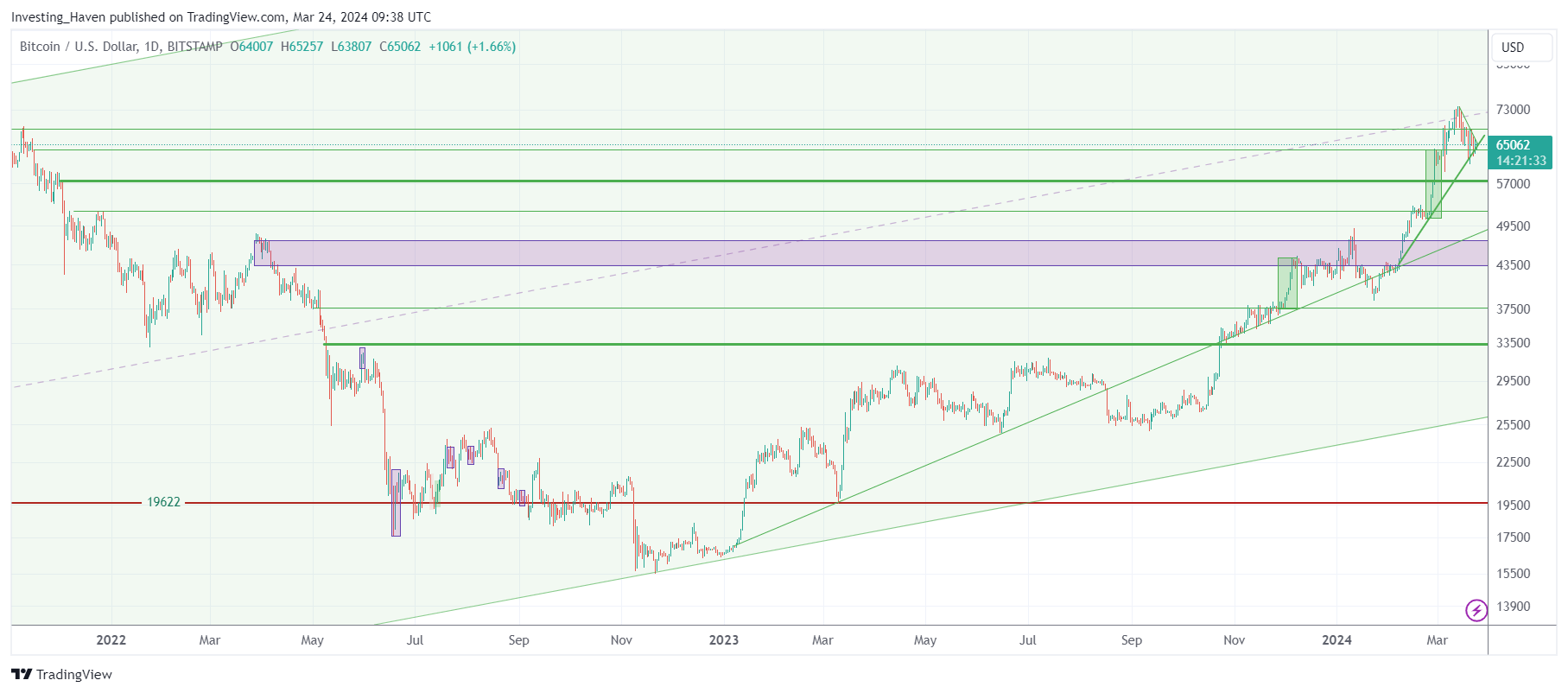

The daily chart since October of 2021 visualizes the long term reversal. Ongoing price action is a secular breakout attempt, is what we observe.

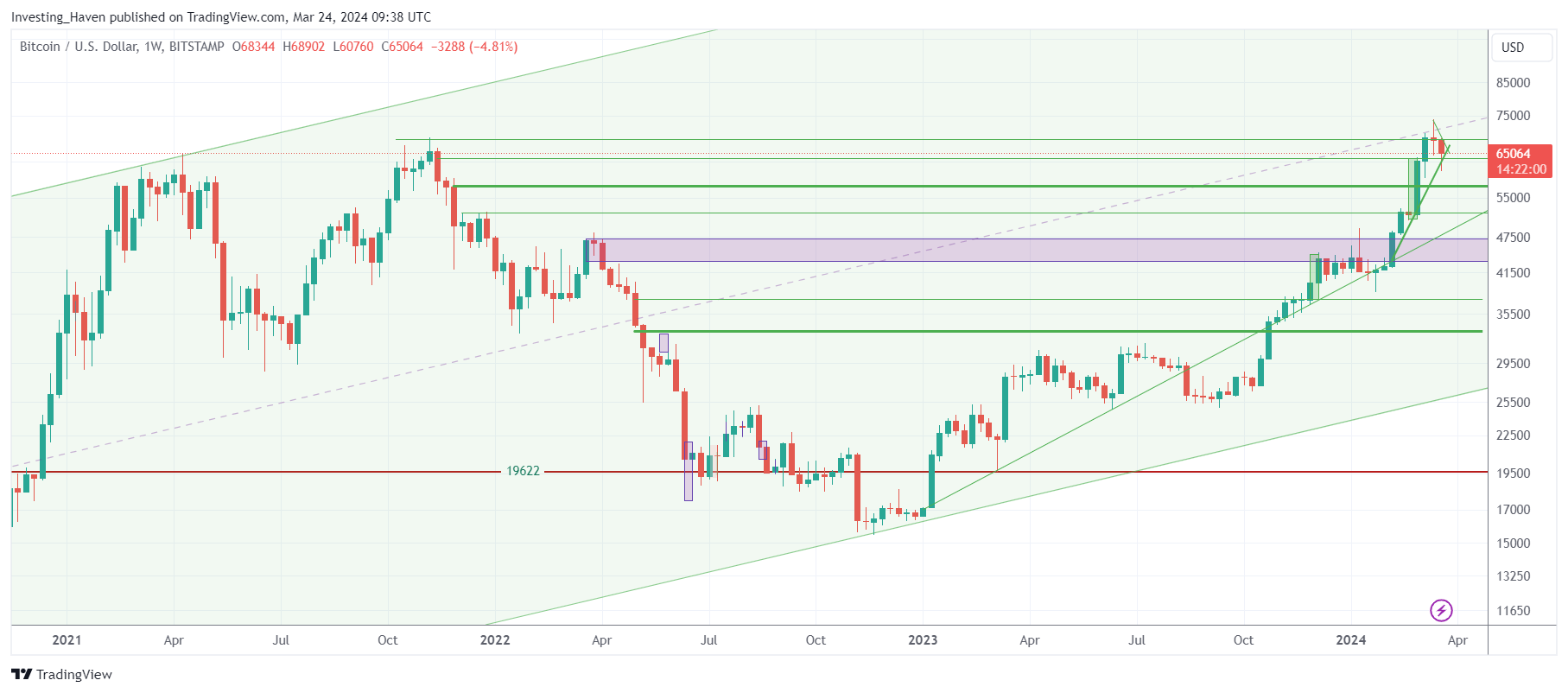

Some selling in the last 2 weeks was healthy, very healthy. The weekly price chart had too many consecutive green candles, that’s not sustainable. The red weekly candles of mid-March are welcome, they will help keep Bitcoin’s bull market alive!

What matters is this – the hidden bull market will create a new trend, it’s a big one, we will dedicate an alert to what we believe will be the biggest crypto trend (narrative) of April 2024. Sign up here to receive our premium crypto alerts >>