in the latest Crypto News, Bitcoin and Ethereum face key support levels as Fed signals and whale activity shape a volatile week ahead for crypto markets.

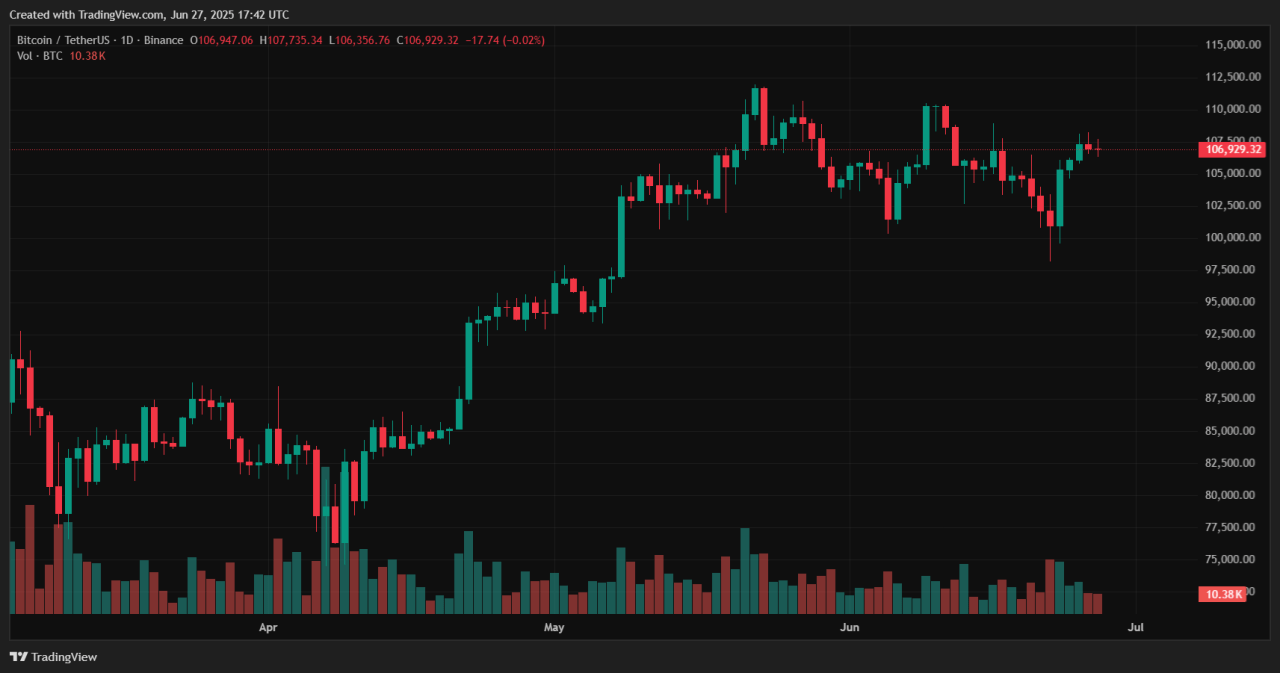

Bitcoin is consolidating around $107,400, dipping from $107,418 amid a massive $40 billion options expiry, which could trigger short-term volatility.

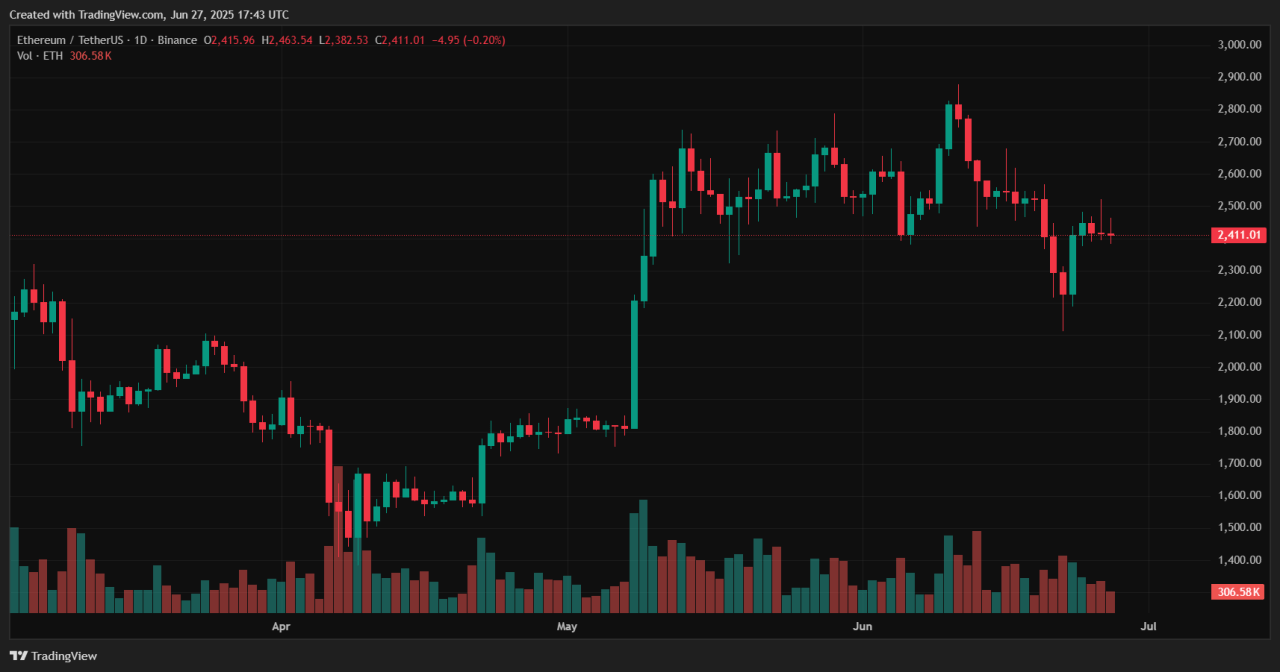

Ethereum, hovering near $2,560–$2,580, is under the watch of accumulating whales; its trading range—$2,415 to $2,512—suggests hesitation ahead of key catalysts. With these levels in play, next week’s Fed signals are poised to spark decisive moves across crypto.

Fed Signals & Dollar Sentiment

The CME FedWatch tool assigns a 99.9% probability to a rate hold at June’s FOMC meeting, with markets expecting only one cut in 2025—significantly more conservative than March’s forecast.

However, recent remarks from Vice-Chair Bowman supporting a July cut have raised expectations, although markets still forecast a first cut in September. This tug-of-war is weighing on the USD, currently near multi-year lows—juicing risk assets like crypto.

Key Price Zones & On‑Chain Crypto Alerts

Bitcoin just tested its 50-day SMA (~$107K). A failure to hold could signal a slide toward $100K, while reclaiming $110–112K may reignite bullish momentum.

Ethereum has remained just above $2,400, supported by robust whale accumulation—over 871K ETH added in a single day recently, the highest since 2017.

Watch for rising exchange inflows and whale movement; historical patterns suggest that significant inflows often precede price corrections.

Altcoin Momentum & Market Tone

Altcoins like Solana, Cardano, and XRP are primed to mirror the moves of BTC and ETH. In a dovish Fed scenario, expect funds to rotate into mid-cap assets. Notably, ETH plunged ~15% during weekend macro headlines—prompting traders to intensify hedging strategies .

Conclusion

With the Fed’s tone and upcoming PCE/CPI data looming, crypto’s path depends on whether Bitcoin holds above the 50-day SMA or breaks sub-$100K. Ethereum must maintain its anchor around $2,400 to keep the rally intact.

Expect this week to test key zones, with on-chain signals and Fed cues steering momentum. A dovish pivot could spark a rebound into $112K+, while hawkish noise might drag BTC into the low $100K range—altcoins poised to follow whichever narrative prevails.

Our latest crypto alerts – instantly accessible

This is how we are guiding our premium members (log in required):

- Alt Season 2025: The Animals Are Back, This May Be A Very Bullish Signal (June 29)

- BTC And Altcoins About To Hit Big Support Areas (June 22)

- The Alt Season Charts (June 15th)

- Another Test of 106.1k, Is This THE Big One? (June 8th)

- How Much Longer Do We Have To Wait For Alt Season 2025? (June 1st)

- The Bitcoin vs. Altcoin Divergence (May 24th)