Several key tokens have dropped in price today with Solana (SOL) down 13%, Bitcoin (BTC) down 3%, XRP down 3% and Avalanche (AVAX) down 9%.

Of course, by the time you’re reading this — one or all of them may have gradually recovered.

But let’s dive in to why crypto is down today and why it might be a ‘healthy’ pullback.

Why is SOL down?

Well first things first, let’s not get too greedy here.

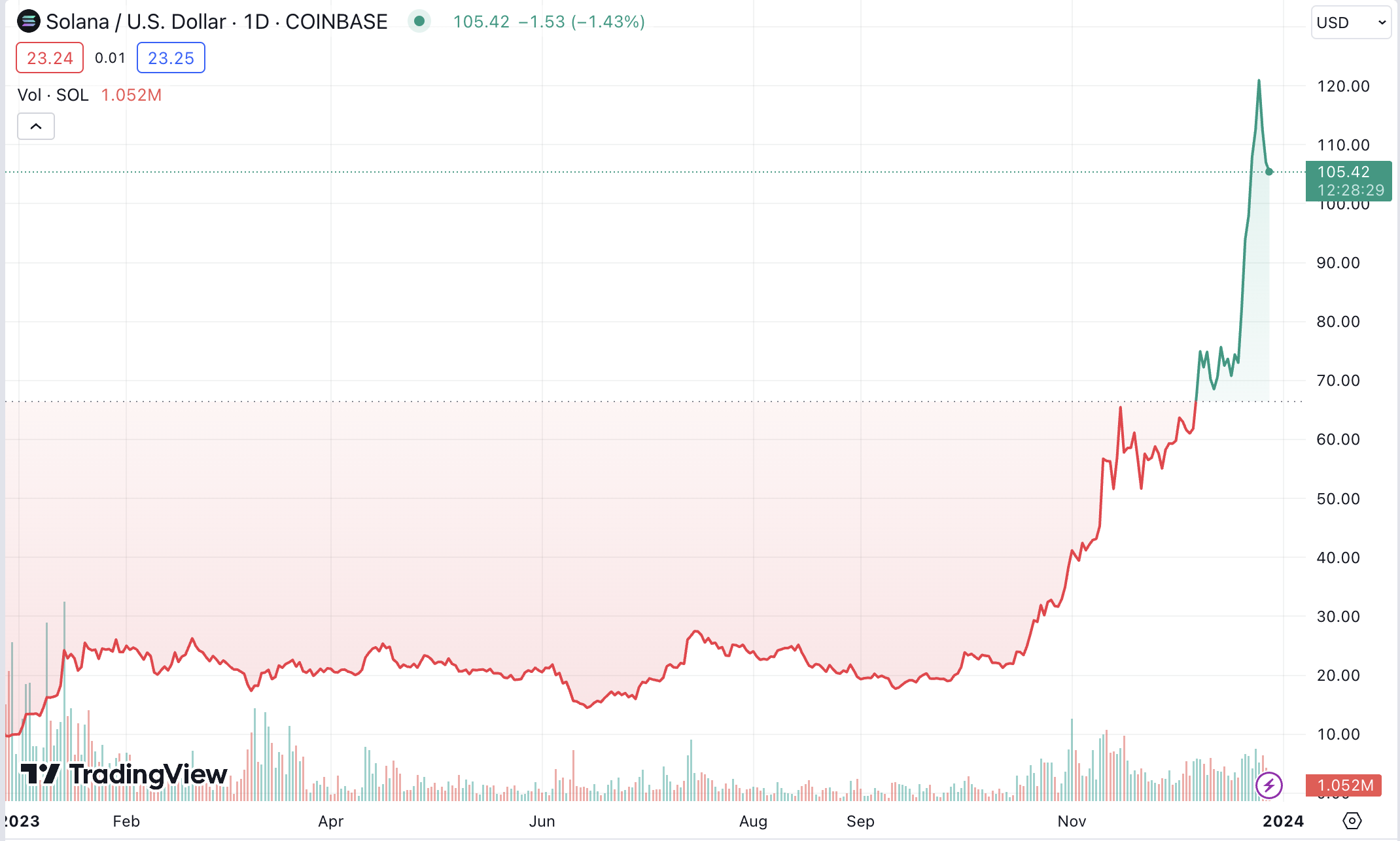

Solana has enjoyed massive gains of close to 1,000% over the past year.

In fact, the daily decline is merely a blip on the radar.

Nonetheless what explains the pullback? First, let’s explain the catalysts behind SOL’s recent surge.

The increased gas fees, more airdrops and a successful smartphone launch, pulled in investors across the board.

$SOL up close

I added on that dip pic.twitter.com/ll1Ho3Nyh5

— Shardi B Trading #teamshardi (@ShardiB2) December 26, 2023

Still, SOL had to run out of ‘gas’ eventually – no pun intended.

Despite the decline in price, SOL volume is still up on the day close to 7% ($6,237,928,922).

This indicates to us that sentiment is still bullish for Solana and investors are looking at the decline as a ‘buying opportunity’.

nice little 12% dip there on $SOL in a monster uptrend with a few more legs to go imo on the btc pair and usd pair

dont fight the trend pic.twitter.com/50VzYV6VKw

— Bluntz (@Bluntz_Capital) December 26, 2023

Why is BTC down?

Let’s be honest: a 2% drop for Bitcoin is mild compared to the declines we saw in crypto winter.

BTC has also enjoyed a nice monthly gain of roughly 13%, capping off a strong year up 150%.

Much of BTC’s price action in the coming weeks could be related to the expected approval of the BTC spot ETF.

At InvestingHaven, we are forecasting some sideways trading and choppiness for BTC leading up to that.

If the BTC spot ETF gets approved — which it sounds is likely — we’re forecasting a quick gain followed by a correction once hype dies down.

Our BTC 2024 forecast should give some reassurance to any ‘paper hands’.

🅱️ (100% Bullish) I Was Wrong About Bitcoin 🎁🎄Merry Christmas by AlanSantana on TradingView.com

When in doubt, we always like to cross references our forecasts with other traders on TradingView.

In this case, it too looks like the slight pullback on BTC is to be expected, prior to a higher breakout.

AVAX Down Big, Time for Concern?

We’ll be releasing our Avalanche forecast in the coming days.

In the meantime, the 10% drop for AVAX today has us slightly concerned.

There was some speculation that people would take recent SOL gains and rotate into AVAX.

If the past 7 days #Solana pump rotated to #Avalanche

Which I think it will

That’d be U$ 65 #AVAX within a week

Of course not all #SOL gains will migrate, also other factors could pump $AVAX in the meantime.

But *some* $SOL profit rotation is pretty much an obvious call IMO pic.twitter.com/OEYyUvrC4C

— REKTBuildr 🔺🔺🔺 (@rektbuildr) December 26, 2023

This doesn’t appear to be happening, at least yet anyway.

With Solana’s volume still being high, it looks like AVAX still has some ground to make up prior to any significant pops.

#AVAX, is it time to shine soon? $75 is not really crazy considering what SOL did the last few days.

Closed my SEI long and rotate to this red coin. pic.twitter.com/30ou62mRZ7

— Degen Ape Trader (@oesnetwork) December 26, 2023

Without giving away our AVAX forecast for 2024, we share similar sentiments of other traders, that the overall sentiment remains bullish.

We hope today is just an outlier and that AVAX can maintain a nice base around the $40 level – prior to climbing higher.

Summary

With a pullback across most tokens today, crypto traders/investors that stick to their convictions, can be assure that they are all likely healthy pullbacks.

While crypto is known for its volatility, we cannot truly enjoy the fruits of our labor without some dips here and there.

Hang on to your hats and your coins, ladies and gentlemen. It looks like we’re in for a good year ahead.

For more detailed research and top crypto picks, we recommend to follow our premium crypto charting alerts in which we share much more details across 35 tokens (including SOL and ETH), with timely insights combined with buy alerts.