With growing interest from whales, significant price surges, and ongoing legal battles with the SEC, the price of XRP (XRP) is increasingly attracting the attention of traders, investors, and analysts.

This article outlines what to expect with XRP price as we move into October based on historical performance and seasonal trends, the recent developments surrounding XRP including whale activity, current technical analysis, and our recent XRP price prediction.

Whale activity driving XRP’s momentum

In recent weeks, whale activity has been pivotal in XRP’s market performance. Large XRP holders, known as whales, have moved significant amounts of XRP.

A notable transaction involved the transfer of 100 million XRP on September 19, worth approximately $57.9 million. This followed another 18 million XRP transfer that happened on September 18 and was followed by another 19.7 million XRP transfer later on September 19.

Such massive transfers often signal key strategic moves or institutional interest, hinting at potential market shifts. Ripple’s price, partly fueled by these whale movements, rose by 10.40% in the past two weeks.

Over the past ten days, whales have accumulated over 380 million XRP tokens, valued at roughly $228 million. This accumulation of XRP by whales is seen as a strong indicator of confidence in the asset, despite Ripple’s ongoing legal challenges with the SEC.

#Ripple whales bought over 380 million $XRP in the past 10 days, worth around $228 million! pic.twitter.com/Fs9ayiHITA

— Ali (@ali_charts) September 19, 2024

These acquisitions suggest long-term bullish sentiment as whales accumulate XRP tokens and reduce exchange reserves, signaling reduced selling pressure.

Rising trading volume amid a dropping XRP exchange reserve

In the wake of the increased whale interest, the XRP trading volume has surged significantly, reflecting heightened market participation.

Currently, the XRP’s 24-hour trading volume sits at above $1.3 billion, signaling increased interest in the asset.

Source: Coinglass XRP Volume

This rise in volume often precedes major price movements, as investors gear up for potential breakouts.

XRP derivatives markets also show a bullish trend with the trading volume for XRP derivatives increased climbing above $1.4 billion.

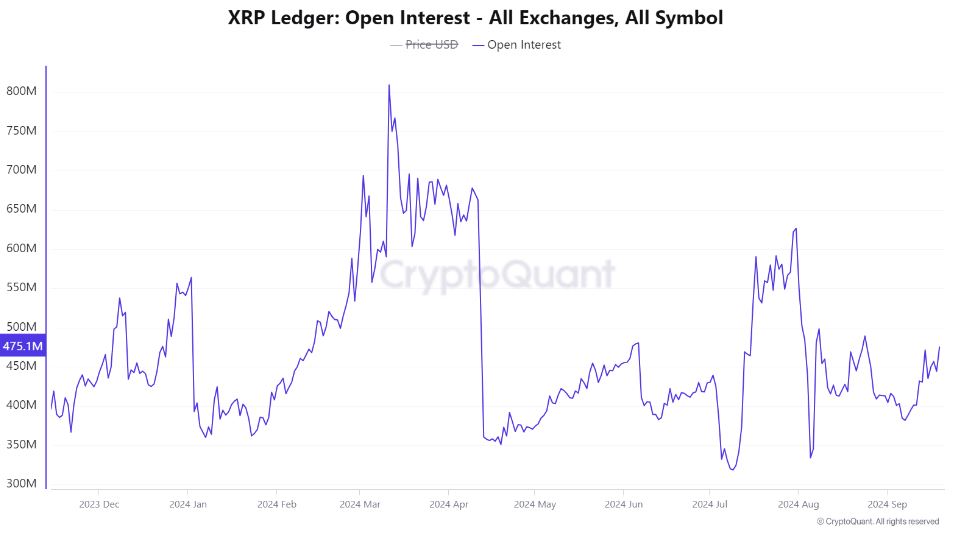

Open interest has grown significantly since the beginning of August, with long positions dominating on exchanges such as Binance and OKX.

Source: CryptoQuant

This is further evidenced by the liquidation of short positions, reinforcing the market’s bullish outlook.

As long positions outpace shorts, the pressure on short sellers intensifies, contributing to XRP’s upward momentum.

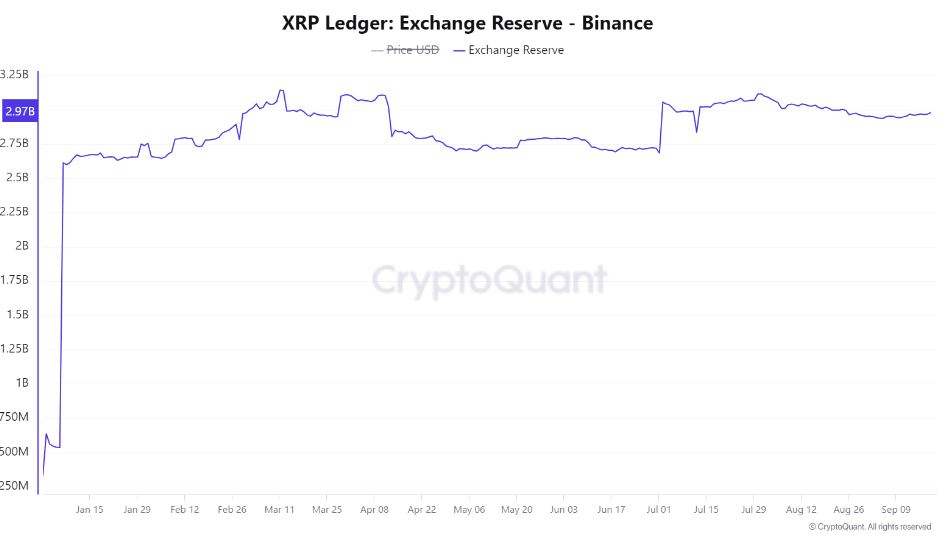

The exchange reserves for XRP have also dropped by 0.17% to 2.977 billion, indicating a movement of tokens off exchanges and into private wallets; a common sign of holders preparing for long-term gains.

Source: CryptoQuant XRP Exchange Reserve Data

With increasing volume, whale activity, and rising transaction counts, XRP’s market participation is strengthening.

What key technical indicators say about Ripple (XRP) price

From a technical perspective, XRP appears to be positioned for a breakout. The cryptocurrency has been testing critical resistance levels, with the first major resistance at $0.6374. If XRP manages to close above this level, it could move toward the next resistance at $0.6884.

Conversely, XRP’s support level sits at $0.5842, below which the price may see a decline.

The Relative Strength Index (RSI) on XRP’s daily chart currently hovers at 75.58, indicating overbought conditions. While this could signal a near-term price drop, the overall market sentiment remains bullish.

Source: TradingView

On the weekly chart, the RSI stands at 56.56, suggesting that XRP is in a natural range and may continue its upward trend.

In terms of exponential moving averages (EMAs), XRP is showing positive signals. It is currently trading above all its 10, 20, 50, 100, and 200-day EMAs, signaling strong buying interest and bullish sentiment among investors.

Source: TradingView

What’s next for XRP? – Here’s what to expect as we head into October

Ripple’s (XRP) journey in the cryptocurrency market continues to be shaped by whale activity, market sentiment, and the outcome of its legal battle with the SEC.

Whale transactions and rising trading volumes suggest that institutional players are positioning themselves for a possible breakout.

Key technical indicators point to a bullish outlook, with XRP trading above key moving averages and testing major resistance levels.

As XRP approaches the critical $0.59 resistance, its next moves will likely be influenced by ongoing market sentiment, whale behavior, and broader developments in the crypto industry.

Looking beyond short-term fluctuations, XRP’s long-term price outlook is optimistic. According to technical analysis and historical trends, XRP could hit $0.6501 in the next 10 days, as it approaches critical resistance levels.

However, whether XRP will reach its ambitious target of $1 before end of 2024 depends on a combination of market conditions, legal outcomes, and continued adoption. However, for now, the signs point to a bright future for Ripple’s native token.