XRP has managed to stand out in 2023 in the universe of digital assets. The journey of XRP has been marked by volatility and legal challenges, since SEC sued Ripple. However, XRP has shown resilience and potential for growth. In this article, we will explore the single most important trendline for XRP in 2024 and why it holds such significance for crypto enthusiasts and investors.

Overall, we continue to observe that XRP has the most fascinating crypto chart. If the long term bullish reversal holds, which will happen if crypto and BTC remain in a consolidation, which eventually should become a bullish reversal, we believe that XRP will eventually go to 10 USD, in a period of 24 to 36 months from now.

The XRP Chart That Matters

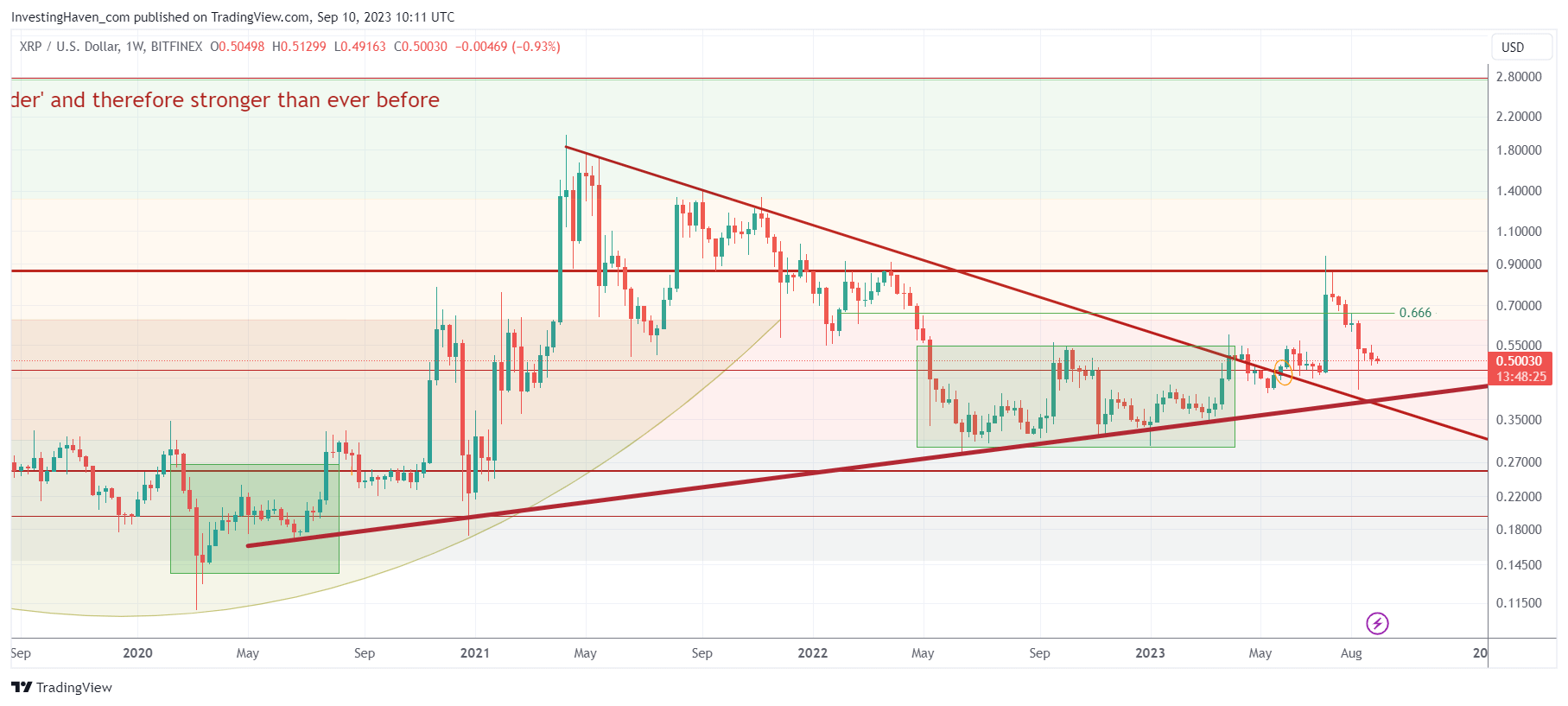

As we examine the chart of XRP, one particular trendline demands our attention. This trendline traces its origins back to the lows experienced during the tumultuous period following the onset of the COVID-19 pandemic. Remarkably, it also intersects with the lows witnessed in 2022. This convergence of critical support levels highlights the profound importance of this trendline.

XRP Buying Opportunity In 2023 or 2024

The strategy surrounding this trendline is straightforward yet powerful. Anytime XRP approaches or touches this trendline, it presents a potential buying opportunity. However, a crucial caveat exists. For this strategy to remain valid, XRP must not remain below the trendline for more than five consecutive days. This stipulation ensures that investors enter the market when XRP is bouncing off a strong support level, minimizing the risk of entering a prolonged bearish trend.

The Case for Consolidation

While XRP’s price action can be exhilarating, investors should be prepared for periods of consolidation. In the crypto world, consolidation phases are as natural as the rapid surges. What makes a consolidation period compelling is when it occurs in tandem with a rising trendline. If, throughout the majority of 2024, XRP consolidates within the range of 0.45 to 0.48 and maintains a rising trendline during this period, it should be viewed as an attractive buying opportunity. Again, the critical condition is that XRP does not breach the trendline for more than five consecutive days.

The Broader Crypto Context

Understanding XRP’s potential also involves examining the broader crypto landscape. Bitcoin, as the leading indicator for the cryptocurrency market, always sets the direction. In this context, it’s essential for Bitcoin to respect its 2022 lows to avoid signaling a bearish trend across the entire crypto market.

Positive Developments and Fundamentals

In 2023, XRP witnessed positive developments, including favorable outcomes in the SEC vs. Ripple legal case. These developments have helped to clear regulatory uncertainties that previously loomed over XRP, enhancing its appeal to investors. Furthermore, XRP’s utility in facilitating cross-border payments and its adoption by financial institutions have positioned it as a significant player in the digital payments ecosystem.

As investors navigate the cryptocurrencies universe, having a clear strategy based on technical analysis and trendlines can be invaluable. The single most important trendline for XRP in 2024, as outlined in this article, offers a roadmap for potential buying opportunities and helps investors make informed decisions. However, as with any investment, it’s essential to conduct thorough research, understand that many cryptocurrencies have no utility (so won’t survive the test of time). Also, crypto needs broad market momentum in order to perform well, so without a bullish trend in broad markets there is no crypto bullish momentum. Timing entries and exits, sometimes forcing an exit, are key elements of a crypto investing strategy.