XRP starts September 2025 at $2.82, caught between pressure and opportunity.

Beneath the surface, strong positive netflows and ETF interest are shifting XRP’s story from “just another altcoin” to a real player in global finance.

Almost $2 million has recently flowed back to exchanges after days of outflows, while Binance alone added 61 million XRP to reserves, signs that large investors are stepping in.

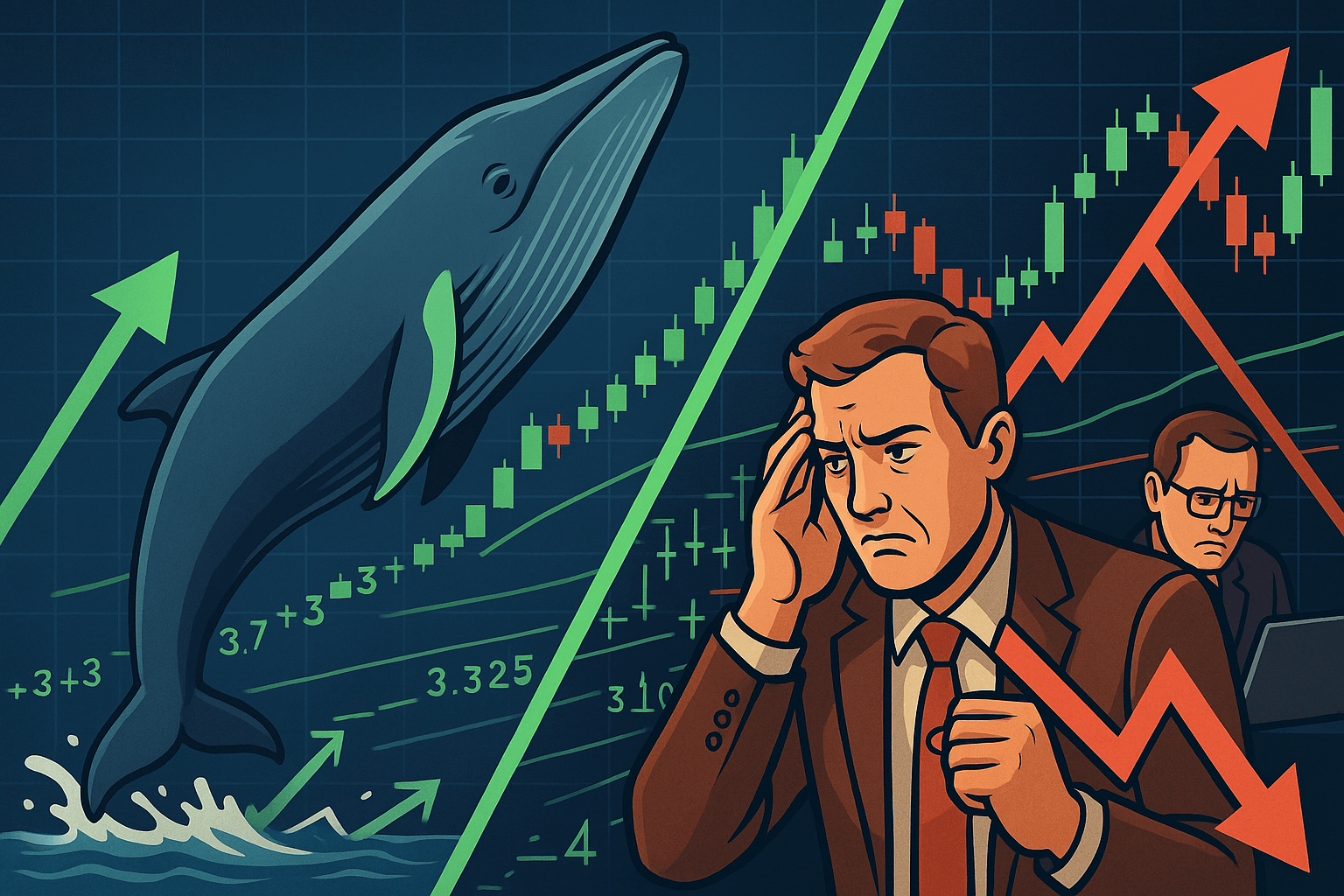

XRP Whales vs. XRP Short Sellers

Short-term traders keep testing support at $2.70–$2.80, with $1.9B in summer liquidations weighing on sentiment.

Yet whales quietly bought 340 million XRP in just two weeks. If price pushes past $2.825, short sellers may be forced to cover, potentially driving XRP toward $3.10, $3.70, or even $4.

ETF Buzz and Corporate Demand

This September stands out for another reason: 15 ETF applications with the SEC and new treasury allocations by big Asian tech companies.

If even one spot ETF is approved, XRP could flip bearish seasonality into bullish momentum.

Any news here could instantly move prices.

Volatility Creates Openings

XRP is down 6% this week, with technical indicators still showing short-term weakness.

However, prediction markets still see an 91% chance of XRP holding near $2.90 in September.

History also leans bullish—since 2021, XRP has averaged 87% gains in September.

With whales buying, ETFs pending, and key support holding, XRP could be setting up for another cycle.

The big question: can XRP’s growing demand,

ETF catalysts, and post-SEC clarity finally push it above the $3.20 barrier and keep it there?

Read our full XRP Price prediction here