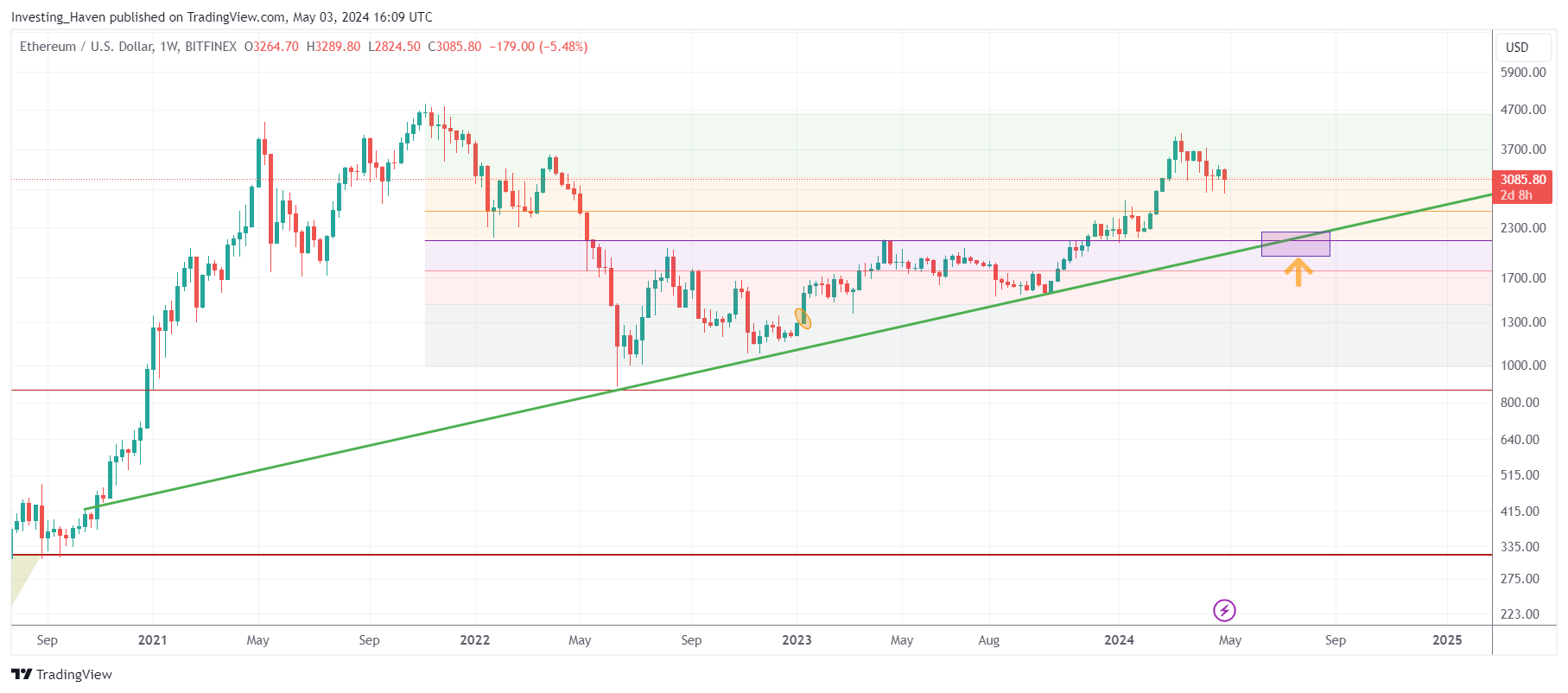

Ethereum’s recent price movements present a paradox that might confuse the average investor. As Ethereum’s price dips, it could, counterintuitively, signal a highly bullish future.

Understanding this dynamic requires a deep dive into the technical patterns that are currently forming on Ethereum’s long-term charts. Chart analysis is one of our forecasting methods with which we try to predict ETH prices in 2024 & 2025.

The Current State of Ethereum

Lately, Ethereum has experienced a downward trend that has left many investors feeling uncertain. This decline is not just a reflection of market sentiment but also a pivotal development in the broader technical narrative of Ethereum’s chart.

The price action, which can seem disheartening at first glance, might actually be setting the stage for a major bullish pattern: the cup and handle.

ETH – Why a Move Lower is Bullish

The concept might seem contradictory at first — how can a decrease in price be a good thing for investors? The answer lies in the pattern itself. A cup and handle formation is recognized in technical analysis as a bullish continuation pattern that often leads to a breakout.

For Ethereum, this pattern begins with a “cup” formation, which the cryptocurrency has been crafting through its recent highs and lows.

The “handle” part of the pattern, which Ethereum is potentially beginning to form now, typically involves a slight downward or sideways movement in price following the cup. This movement is crucial as it consolidates earlier gains and builds a base for the next upward surge. For the pattern to be validated and for the bullish implications to be activated, Ethereum must not fall below a critical support level — in this case, $2,250.

ETH – The Importance of the $2,250 Support Level

This support level is more than just a number. It represents a key psychological and technical threshold that must hold for the cup and handle pattern to complete correctly. If Ethereum’s price respects this support level during its current retrace, it will likely solidify the handle portion of the pattern and set the stage for a significant bullish breakout.

Strategic Considerations for Ethereum Investors

For those looking to capitalize on Ethereum’s potential, here are some conditions and strategies to consider:

- Monitor the $2,250 Support Level: This is the line in the sand for the bullish scenario to remain intact. A sustained movement below this price could invalidate the bullish setup and necessitate a reassessment of your investment approach.

- Understand the Pattern’s Timeframe: The cup and handle formation is a longer-term pattern. Patience is required, as the development and completion of this pattern can span several months.

- Prepare for Volatility: The path to higher prices is rarely smooth. Prepare for potential volatility as Ethereum tests these crucial levels.

- Consider the Broader Market Context: While Ethereum’s individual price movements are crucial, the broader market context, including regulatory news and macroeconomic factors, can also significantly impact price action.

- Set Clear Investment Goals: Whether you’re looking for short-term gains or long-term growth, understanding your own investment goals and risk tolerance is crucial. This clarity will guide your decisions amidst market uncertainty.

Conclusion

Ironically, Ethereum’s recent price retracement might be exactly what is needed to propel its price to new heights. By respecting the critical support level and forming a complete cup and handle pattern, Ethereum is not just performing a technical maneuver but is also setting the stage for a potential major bullish trend in the future. For savvy investors, this period is not just about weathering the storm but recognizing the opportunities that such patterns may present.