To understand why it’s improbable for Bitcoin to hit $1,000,000 before 2030, we explore ‘BTC to $1 million’ conditions beyond market cap and charts.

This analysis takes a rational approach. We simulate Bitcoin to $1m, and analyze valuation comparisons, assess technology requirements and regulation for this scenario, required market dynamics and financial system impact.

The conclusion is that Bitcoin at $1,000,000 before 2030 will have stretched valuations that seem unrealistic. Even with our bullish Bitcoin forecast for 2025 to 2030 it seems that BTC to $1m is stretched. While we believe that BTC will move much higher from here, we doubt it will 10x before 2030.

Some Bitcoin optimists, including Michael Saylor and Coinbase CEO Brian Armstrong, believe that Bitcoin could reach $1 million by 2030. Hitting that target would imply a market cap above $20 trillion, rivaling gold’s value if institutional investors allocate even a small share of their reserves to Bitcoin.

Bitcoin’s core value

Bitcoin is often referred to as digital gold due to its limited supply of 21 million coins and its use case as a store of value.

Unlike traditional currencies, Bitcoin is decentralized, meaning it operates without a central authority, making it resistant to censorship and government interference.

Bitcoin’s value is derived from its scarcity, security, and the growing adoption of blockchain technology.

As more investors and institutions recognize these attributes, Bitcoin’s position as a professional investment vehicle strengthens. Case in point: Blackrock recommends up to 2% coverage per portfolio.

October 2025 – Institutions have now decisively entered the Bitcoin and blockchain space. This is the ultimate confirmation that our bullish Bitcoin forecast is justified..

Bitcoin to $1,000,000 market cap implications

If Bitcoin were to reach a valuation of $1 million per unit, its market capitalization would soar to approximately $21 trillion, given the maximum supply of 21 million coins.

This would position Bitcoin’s market cap:

- Greater than the GDP of most countries: A market cap of $21 trillion would surpass the Gross Domestic Product (GDP) of most countries in the world, including major economies like Germany ($4.2 trillion), the United Kingdom ($3.1 trillion), and Japan ($5.1 trillion). It would position Bitcoin’s market cap just behind the GDP of the United States, which is around $23 trillion.

- Higher than the total market cap of FAANG companies: The combined market capitalization of the major tech giants — Meta, Amazon, Apple, Netflix, and Alphabet — is approximately $7 trillion. Bitcoin’s market cap would be three times larger than the combined value of these tech giants.

- As large as the global real estate market: The estimated value of the entire global real estate market is around $280 trillion. Bitcoin’s $21 trillion market cap would represent about 7.5% of the total value of all real estate worldwide.

Needless to say, for Bitcoin to move to $1,000,000 it would result in real world valuation comparisons that are completely out of synch.

October 2025 Update For Bitcoin to $1 million prediction

Bitcoin’s sharp rebound after its early October correction has revived debate around one of the market’s biggest questions: Can Bitcoin reach $1 million? The cryptocurrency’s recovery from a brief drop, combined with historic ETF inflows, highlights deep institutional demand and growing confidence in Bitcoin’s long-term trajectory.

In early October 2025, Bitcoin reached a new all-time high near $126,200 before a swift correction. Prices stabilized between $115,000 and $121,000, signaling resilience amid volatility. This recovery follows a record $5.95 billion in weekly inflows into Bitcoin ETFs, led by BlackRock’s IBIT, confirming sustained investor appetite.

Global Investment Management firm Vaneck founded in 1955, predicts that Bitcoin could reach $644,000 by 2028 which would put the cryptocurrency in good stead to achieve $1 million by 2030.

Key Positive Drivers For Bitcoin Reaching $1 million

- Institutional accumulation has strengthened through 2025. Major funds and long-term holders increased exposure during the correction, showing conviction that Bitcoin remains underowned relative to traditional assets. This persistent accumulation pattern continues to reduce available supply on exchanges, supporting higher valuations during each wave of renewed buying.

- ETF inflows have reshaped Bitcoin’s liquidity structure. Large, regulated investment products have pulled thousands of BTC out of circulation, increasing scarcity and amplifying sensitivity to demand. This dynamic reinforces Bitcoin’s status as a “hard asset,” appealing to institutions seeking protection from fiat instability and inflationary pressures.

- Macro conditions remain supportive. Inflation, fiscal deficits, and a weakening U.S. dollar are driving renewed interest in alternative stores of value. As macro uncertainty deepens, Bitcoin is increasingly viewed as digital gold—liquid, decentralized, and globally accessible. Institutional participation confirms this evolving perception across asset allocators.

- Technical strength supports the bullish case. Despite volatility, Bitcoin consistently holds above key moving averages, with trading volumes and on-chain activity rising. This momentum suggests accumulation rather than distribution, consistent with early-stage expansion cycles seen before prior parabolic advances.

- Bullish Outlooks Persist

Analysts see $133,000–$178,000 as near-term targets, with longer-term forecasts suggesting potential for Bitcoin to $1 million by 2030. Institutional adoption, ETF expansion, and global liquidity trends could align to make such valuations feasible within the decade, especially as Bitcoin competes with gold as a reserve asset.

Prominent voices including Michael Saylor and Coinbase CEO Brian Armstrong share this view. They argue that if major financial institutions allocate even 10% of reserves to Bitcoin, its market cap could exceed $20 trillion, pushing prices near the million-dollar threshold. Their forecasts reflect growing institutional conviction.

The massive scale of Bitcoin to $1,000,000

A Bitcoin $1 million valuation implies a massive influx of capital into Bitcoin, driven by widespread adoption and acceptance as a global store of value. The implications are vast:

- Economic impact: A $21 trillion market cap would mean that Bitcoin has become a major asset class, potentially influencing global economic policies and financial systems.

- Investment shift: Traditional assets like stocks, bonds, and real estate might see a reallocation of capital towards Bitcoin.

- Global influence: Bitcoin could become a cornerstone in the global financial ecosystem, impacting everything from banking to remittances and international trade.

While Bitcoin may play such a pivotal role, at a certain point in the future, the time is not right for this. Bitcoin has not matured, both as a technology nor asset class adoption in the financial system, to make this a plausible reality in the next 10 years.

Charting Bitcoin to $1 million

Before looking at the Bitcoin to $1,000,000 chart, we look at the BTC predictions by reputable experts. Conclusion: the path for BTC to hit $1 million is well beyond consensus predictions.

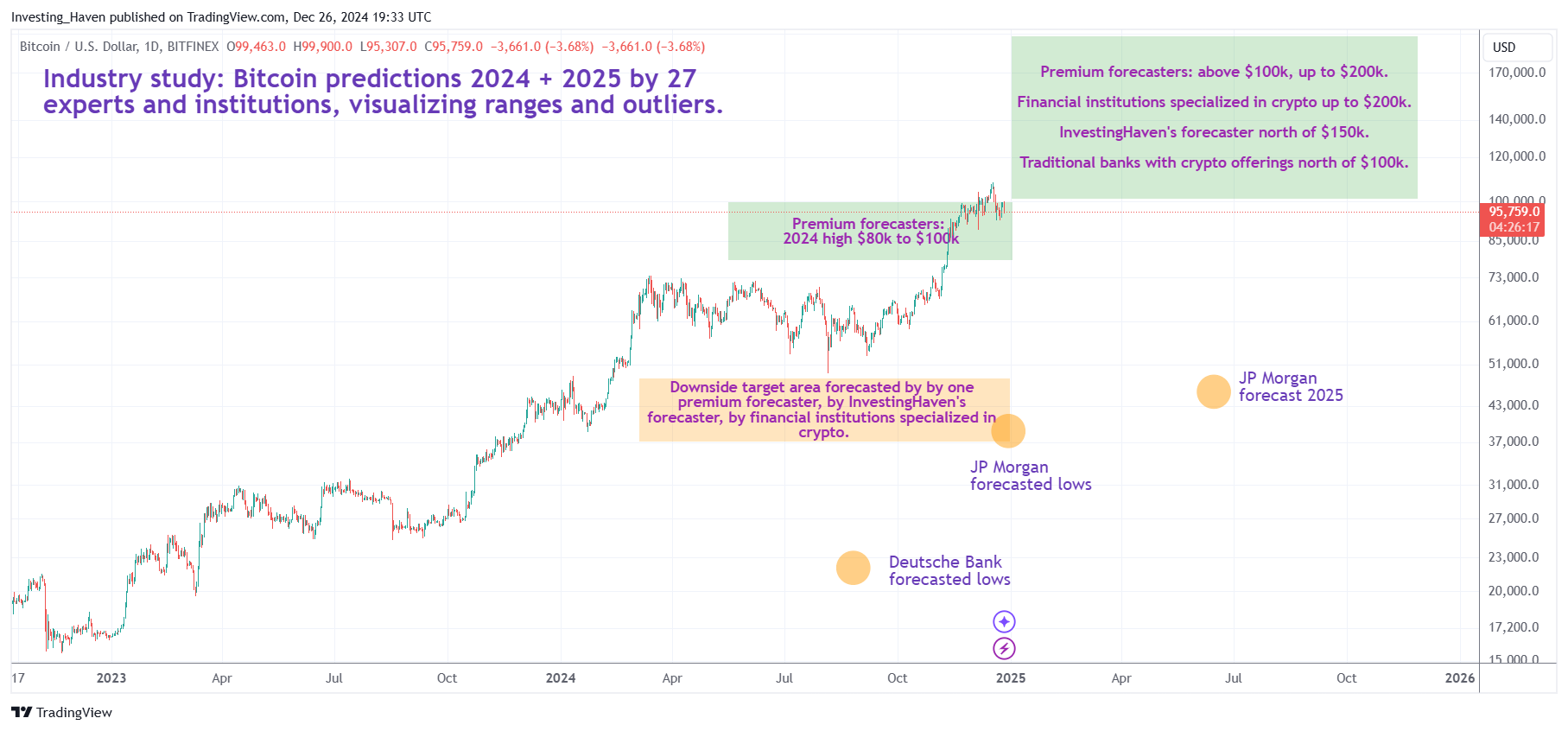

In our predictive Bitcoin research section, we plotted 27 Bitcoin forecasts for 2024 & 2025. Below is the chart from our predictive research.

October 2025 – The chart shows a bullish Bitcoin Price Prediction for 2025, with prices consolidating above $110,000 and a potential maximum target near $150,000. Moving averages confirm strong support and momentum. However, forecasts of Bitcoin hitting $1 million by 2030 remain extremely optimistic, reflecting long-term enthusiasm rather than a realistic projection.

Previous Analysis prior to October 2025 – We created the below chart in December 2024. You can see that some forecasts for Bitcoin were considerably below the reality, which gives hope for Bitcoin optimists hoping for it to hit $1 million by 2030.

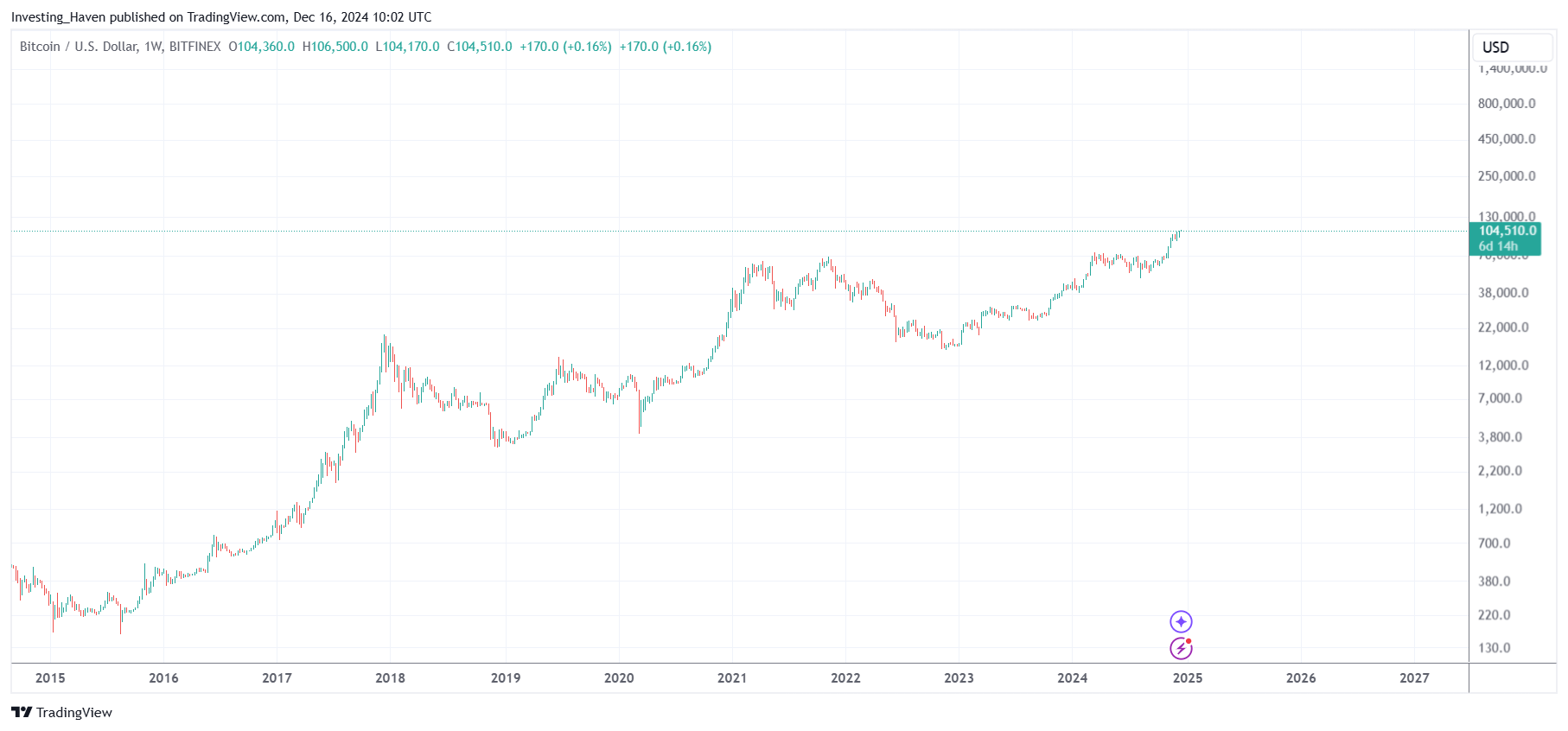

Now FOR Bitcoin to hit $1 million would be completely ‘off the chart’, literally. Below is the weekly BTCUSD chart highlighting where BTC at $1,000,000 comes in.

Historic Charts created prior to October 2025 – This chart from last December visualizes how much BTC has to rise to hit $1 million. While meteoric 15x rises in the BTC price were common, say 10 years ago, it’s not common any longer, as Bitcoin is maturing and slowly entering the financial institutions universe (futures, ETFs, etc).

Make no mistake – if you believe the 2023 bull run was phenomenal, it would require 15x more bullish power to get Bitcoin to $1,000,000 from its current levels.

Another 15x in the price of BTC is not realistic because of the ‘diminishing rising‘ effects of Bitcoin: each bull market, the slope of the uptrend on Bitcoin’s chart has been fading. This implies that Bitcoin is maturing as an asset class; it also implies that 20x is not possible (even though it may have been 8 years).

Still, many pretend they can forecast for BTC to hit $1 million; we could caution against wild dreams and recommend to do background checks of those that are forecasting a BTC move to $1,000,000 (hint: their track record is awful or they don’t have a track record at all).

BTC $1 million requires technological and security advancements

For Bitcoin to reach and sustain a $1 million valuation, continued advancements in blockchain technology and security are essential. Improvements in scalability, transaction speeds, and energy efficiency are crucial to supporting a larger user base and higher transaction volumes.

Let’s face it – Bitcoin is an extremely slow network, processing 7 transactions per second, which is absolutely horrible as a technological performance. The massive re-valuation that comes with BTC hitting $1m requires a much, much more powerful blockchain, with a sophisticated and developed ecosystem, including Layer-2 services.

(source)

Security remains paramount. As Bitcoin’s value increases, it becomes a more attractive target for hackers. Ensuring robust security measures and ongoing improvements to the blockchain’s security protocols are vital to maintaining investor confidence and protecting against malicious activities.

Massive adoption for BTC at $1 million

Bitcoin’s adoption by both institutional and retail investors is a key driver of its value. Institutional adoption, in particular, can provide significant upward pressure on Bitcoin’s price.

- Companies like MicroStrategy, Tesla, and Square have already added Bitcoin to their balance sheets, signaling a growing acceptance of Bitcoin as a legitimate asset class.

- Still, for BTC to move to $1,000,000, a truly massive adoption will be required, exponentially more than current adoption.

The network effect plays a critical role in Bitcoin’s adoption.

- As more people use and invest in Bitcoin, its utility and value increase.

- This self-reinforcing cycle can drive further adoption, creating a virtuous loop that propels Bitcoin’s price higher.

Still, for Bitcoin to move to $1,000,000, the adoption that is required to justify such a price and associated valuation is going to require Bitcoin to be widespread and omnipresent, sort of like a utility (think AI currently and the internet 20 years ago).

Regulatory barriers must be removed

Regulation poses a significant risk to all cryptocurrencies, including Bitcoin. Positive regulatory frameworks could pave the way for institutional investment and wider adoption, while stringent regulations could limit growth or even pose existential threats.

- Supportive regulation: Regulatory clarity and support could foster innovation and provide a secure environment for investors.

- Adverse regulation: Conversely, strict regulations or outright bans in major economies could hinder Bitcoin’s growth and adoption.

The balance between fostering innovation and protecting consumers is delicate, and how regulators manage this balance will significantly impact Bitcoin’s trajectory.

Favorable economic and market dynamics for BTC to hit $1 million

Cryptocurrency markets are notoriously volatile, influenced by factors like investor sentiment, market liquidity, and macroeconomic trends.

Bitcoin reaching $1 million would not only require technological success and widespread adoption but also favorable economic conditions and market dynamics.

- Global economic conditions: Inflation, currency devaluation, and economic instability can drive investors towards Bitcoin as a hedge against traditional financial systems.

- Investor sentiment: The perception of Bitcoin as a safe haven asset can influence its price. Positive sentiment and increasing trust in Bitcoin’s long-term viability are crucial.

Competition from other cryptocurrencies

Bitcoin’s journey to $1 million (if it ever will get there which is questionable) will not occur in a vacuum.

- The rise of alternative cryptocurrencies offering similar or improved functionalities at lower costs and higher speeds represents a significant challenge.

- Ethereum, for example, has positioned itself as a platform for decentralized applications, offering different value propositions compared to Bitcoin.

Bitcoin’s ability to maintain its leading position despite competition will be crucial to its valuation. This will depend on continuous innovation, strong community support, and the ability to address emerging challenges.

Potential pathways for BTC to hit $1 Million

For Bitcoin to reach a $1 million valuation, several factors would likely need to converge:

- Institutional adoption: Increased investment from large financial institutions and corporations could drive demand and legitimacy.

- Global acceptance: Widespread use of Bitcoin as a store of value and medium of exchange.

- Technological innovations: Continued improvements in Bitcoin’s blockchain technology and infrastructure.

- Regulatory support: A favorable regulatory environment that encourages innovation and adoption.

- Economic factors: Global economic conditions that drive investors towards alternative assets.

‘What if’ analysis

What If Bitcoin reaches $1 Million?

- Market cap implications: A $1 million Bitcoin would result in a $21 trillion market cap, positioning it as one of the most valuable assets in the world.

- Economic impact: This level of valuation would reflect Bitcoin’s integration into the global financial system, potentially affecting monetary policies and financial regulations worldwide.

- Institutional adoption: Increased participation from institutional investors could significantly boost Bitcoin’s credibility and drive further adoption.

- Technological advancements: Successful implementation of scalability solutions and ongoing security enhancements would be necessary to support this valuation.

- Regulatory landscape: Favorable regulatory frameworks would be crucial, providing the necessary support and security for investors.

What If Bitcoin does not reach $1 Million?

- Market confidence: Failure to achieve such a milestone could affect market confidence, impacting investor sentiment and potentially leading to market corrections.

- Technological stagnation: Inability to address scalability and security issues could hinder Bitcoin’s growth and adoption.

- Regulatory hurdles: Adverse regulatory actions could limit Bitcoin’s potential, deterring institutional investment and broader acceptance.

Conclusion: can Bitcoin ever hit $1,000,000?

The prospect of Bitcoin reaching $1 million seems too ambitious, certainly in the coming years before 2030.

While the potential exists for BTC to move to $1,000,000, it requires a complex interplay of technological advancements, market adoption, regulatory developments, and economic conditions.

The path to $1 million is loaded with challenges even though the transformative potential of Bitcoin in the global financial ecosystem makes it a very long term possibility.

For now, we conclude that Bitcoin will not be able to hit $1,000,000 in the coming years. We also add that the factors outlined in this article will be the ones to watch if BTC is on a long term path to $1 million (or not).