The short answer: we are not concerned about an Ethereum price crash, for many reasons. However, the panic that is being created for Ethereum’s retracement might make you think otherwise. As always, we prefer to let the data speak, first and foremost the charts.

Bitcoin’s topping pattern was too obvious

We explained that is not the end of Bitcoin’s bull market, contrary to what many make you believe. Consequently, this is not the end of Ethereum’s bull market and there should be no Ethereum price crash.

It was so clear that a breakdown in Bitcoin would occur, it was too obvious.

But a pullback and a price crash are two completely different things.

We predicted, mid-December, in our premium service, and recommended members in our crypto investing research service to take profits. We called for a choppy January, that’s what we got.

From our premium crypto alert sent on Dec 21st, 2023, ‘How To Spend Cash Realized From Free Tokens? Hint: The Mega Opportunities Of 2024!‘ (available for anyone after signing up here):

Short term, it is blatantly clear that we are hitting a big resistance area. Like with any resistance area that has its roots many years back in time, the local top requires time to complete. In the end, if anything, the market would like to keep this bull market hidden. BTC has to come down a bit, it might be 34.5k or a little higher where it will find support. It might be a slow process, choppy, and that’s fine.

It’s not a crash. It is a buy opportunity.

In that same premium research alert, mentioned before, we wrote the following:

Much more important is the following: the big, huge, giant profits will be made in tokens that nobody is talking about. We see tremendous reversals. We cannot believe what we start seeing on the charts: it’s going to be huge, mark our words. But a minority will hit those multi-baggers. Why? Because the market will follow a different script, a very different script. The point is that the market never follows the same path, every cycle is different. The majority of investors will be looking for a replay of 2020/2021, we are telling you ‘it won’t happen like 2 years ago’, it will happen in a very different way.

Indeed, the concept of the HIDDEN BULL MARKET is one we have covered extensively in our research service. Interestingly, we explained it even on our public blog: Crypto’s bull market 2024 is an hidden bull market.

Hidden bull market? What about Ethereum’s price crash?

The one and only way to neutralize these loaded topics, like the end of Bitcoin’s bull market and the so-called Ethereum price crash, is to look at the data. Charts are data. They may be read differently, but it’s data.

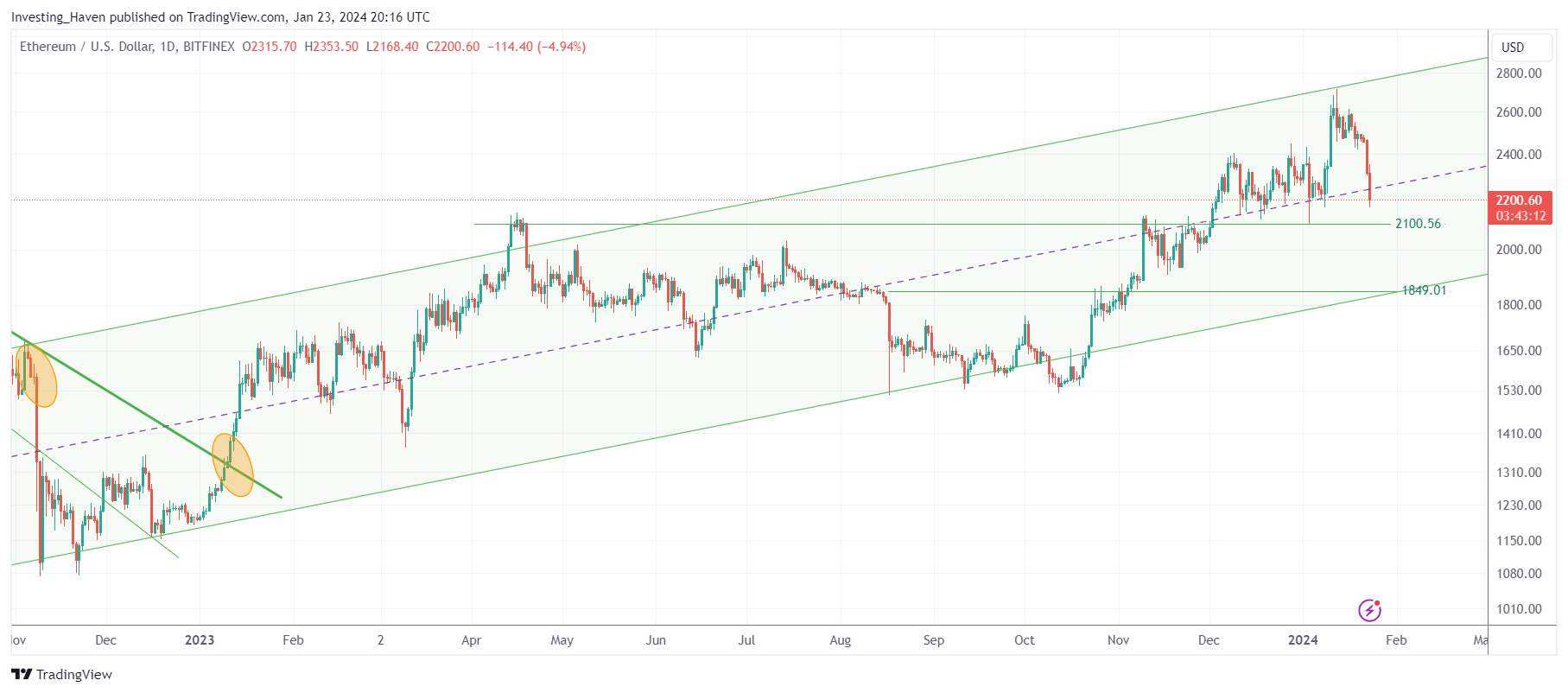

Ethereum’s price chart, shown below, shows a rising channel.

A rising channel is an uptrend.

An Ethereum price crash would occur in a downtrend. The direction of the channel would point down, the color of the channel would be red.

We have the exact opposite in place now.

Downside targets of Ethereum’s retracement? We see $2100.56 and $1849.01 as candidates, in that order. We think in terms of closing prices, so we cannot exclude a scenario in which Ethereum dips, intraday, to $1849 only to close that same day around $2100. This is the world of crypto, volatile are normal.

More evidence: no Ethereum price crash

We have been shouting from the roof: crypto in 2024 will come with a HIDDEN BULL MARKET. We also have been calling for a bi-furcated alt season 2024.

Hardly anyone is talking about this, but finally there is this one social media post that suggests there is another analyst on this planet that shares our expectations:

With the #Bitcoin ETF becoming a classic sell-the-news event, we explore the market’s risk appetite for tokens further out on the risk curve.

There are some indicators alluding to #Ethereum outperformance, as well as interesting divergences in altcoin price action relative to… pic.twitter.com/r2P897hmVd

— glassnode (@glassnode) January 23, 2024

Buying Ethereum? Sentiment is negative, selling makes more sense.

That’s the sentiment when price is dropping, indeed.

You need a lot of courage to be contrarian. When prices are dropping, they can continue to drop. A contrarian call can be disastrous if you don’t have a decent price analysis methodology in place as an analyst.

At InvestingHaven, we are convinced there will be no Ethereum price crash in the coming months, certainly not in the coming 3 months.

How can we know?

Because there is no secular bearish turning point in our cycle analysis.

Analyzing charts, analyzing Ethereum, analyzing any other market or stock requires price analysis combined with time analysis. Both, combined, make a price analysis methodology complete.

While we can always be wrong, we simply have not detected a secular bearish turning point that suggests a crash is underway in the short term, not in Bitcoin nor in Ethereum.

You may want to consider receiving our premium research notes because all the points we made in this article were shared a month ago in our research service. Below this article you will find a banner with a link to our premium service, why don’t you give it a try?