Ethereum Price Prediction Insights

Right now, Ethereum price is2278.35 USD but experts predict that ETH could reach and exceed $5,000 in 2026.

Forecast discussions for Ethereum are heating up in 2026, in this article we will look at ETH price predictions for 2026, 2027, 2028 and 2030

After reaching a new all-time high of $4,953.73 in August 2025, the world’s second-largest cryptocurrency is once again at the center of investor attention.

In our next Premium Crypto alert in the coming days we will reveal our top crypto coins for 2026, including our prediction for coins with 10X potential.

[Market Alert – January 2026] Ethereum has had an optimistic start to 2026 but we need to see further conviction for the bull movement to start: is ETH losing momentum, or preparing for a major breakout?

Keep reading for our latest Ethereum forecast, technical insights, and institutional outlook.

How much will your Ethereum be worth?

Based on your prediction that the price of Ethereum will change at a rate of 8% every year, calculate your price prediction return on investment below.

🔑 Key Takeaways – Ethereum Price Prediction 2026

- Forecast range for 2026: $2,500 – $6,000

- Average analyst target: Around $4,200

- Bullish drivers: DeFi expansion, Layer-2 scaling, and Ethereum network upgrades (e.g., ETH 2.0)

- Major support zone: $2,200 – $2,500

- Worst-case scenario: Pullback to $1,500–$1,800, while upside toward $6,000 remains possible

Overall outlook: The Ethereum price prediction for 2026 remains optimistic, supported by ongoing network development, institutional adoption, and increasing on-chain activity.

💡 How to Buy Ethereum (ETH) Safely

The best way to buy Ethereum is through a trusted and regulated crypto exchange.

For a simple, secure, and fast experience, we recommend eToro — it allows you to purchase ETH using a debit or credit card within minutes.

Other reliable platforms include Kraken, Binance, Coinbase, Moonpay, and Bitstamp, but eToro stands out for its ease of use, global access, and transparent fees.

Investing Haven’s Price Prediction For Ethereum (ETH) In 2026

2026 is the year for Ethereum to create a new all time high, we expect ETH to reach at exceed $5,000 if optimism continues.

In this 2026 price prediction forecast for 2026, you will see that we are not the only ones with an optimistic outlook for Ethereum, read on to understand the reasons behind this forecast.

Ethereum Price Prediction 2026

In 2026, Ethereum is expected to trade in a range from $2,500 to $4,500 but has the potential to break above $5,000 under favorable market conditions.

The average projected price prediction for 2026 stands near $4,200.

Ethereum Forecast Timeline

- We expect a bullish breakout in Q1 of 2026 for Ethereum, potentially mid february.

- Followed by a consolidation period and a retracement.

- Our ETH forecast for 2026 is a range between $2,500 to $6,420

🔔 Join thousands of investors acting on premium crypto alerts for real, actionable insights that move before the market —

get access here.

Ethereum (ETH) 2026 Forecast — Expert Summary

Based on multiple expert and institutional analyses, the average Ethereum (ETH) forecast for 2026 ranges between

$4,000 and $6,000, with potential upside if adoption and upgrades continue.

Overall Range (Avg.)

$4,000–$5,500

Conservative Low

$2,900–$3,500

Bullish/High-End

$5,500–$6,000+

Summary of Key Predictions

- Investing Haven: Predicts ETH will respect a minimum of $2,500 and could break above $5,500 with stronger institutional adoption.

- Changelly: Expects ETH between $4,539 and $5,468, with potential ROI up to 95.2% in 2025.

- Coinbase: Suggests an average near $6,596 CAD (~$5,000–$6,000 USD) toward year-end.

- Token Metrics: Indicates ETH could reach $5,000–$10,000 in a bullish cycle, possibly testing $10,000 in strong market conditions.

Average Forecast Breakdown (2025)

Table of contents

- ETH Price Predictions Summary

- ETH Price Predictions by Experts

- ETH Price Prediction 2026

- ETH Price Prediction 2027

- ETH Price Prediction 2028

- ETH Price Prediction 2030

- Forecasting Ethereum’s All-Time Highs

- Ethereum Price Drop Prediction

- ETH Prediction Tomorrow

- ETH Predictions Day-by-day

- Ethereum Historical Prices

- FAQs

Ethereum price predictions overview

| Year | ETH price prediction |

|---|---|

| 2026 | $1,669 to $6,500 |

| 2027 | $3,125 to $7,420 |

| 2028 | $3,650 to $8,000 |

| 2029 | $10,500 |

| 2030 | $11,400 |

| 2031 | $12,000 |

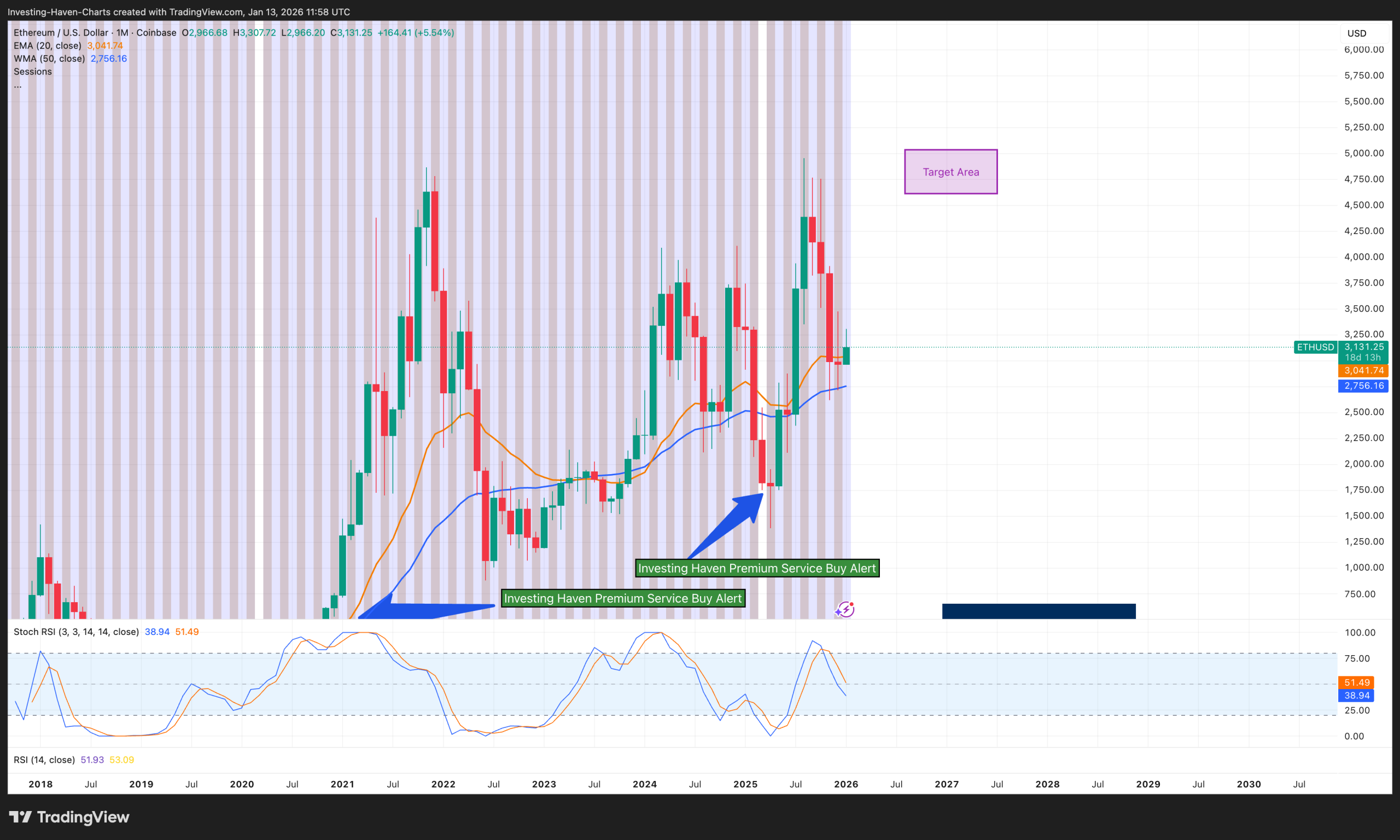

Ethereum Price Prediction Chart Insights January 2026

Ethereum’s current short term price action shows ranging between the $2,700 and $3,500 zone.

A break out above $3,500 could signal a move towards the Ethereum price prediction for late 2026.

The Ethereum price forecast must consider the importance of the $2,800–$3,000 support range, because a sustained hold above these levels could enable a recovery.

While a decisive breakdown below $2,800 for Ethereum would confirm further downside pressure and potentially open a continuation move toward deeper support near $2,400.

ETH Forecast Range for 2026

The original Ethereum price forecast projected a wide trading range between $2,000 and $4,500, with a

bullish extension up to $6,500 under favorable market conditions.

With fundamentals strengthening and institutional demand increasing, the revised 2026 price prediction now stands at

$3,000–$5,000, reflecting a healthy market structure and potential continuation into early 2027.

Summary Snapshot

New All-Time High

$4,953.73 (Aug 24, 2025)

2025 Trading Range

$1,386–$4,953

Confirmed Bullish Targets

$2,888 → $4,155 → $4,953→ $6,000

Ethereum price predictions for 2026:

| Year | Price move | ETH price forecast |

|---|---|---|

| 2026 | Lows to highs | $1,669 to $6,500 |

| 2026 | Stretched | $6,500 |

| 2026 | Buy the dip | $1,990 - $2,906 |

| 2026 | Invalidation | < $1,661 |

GO PREMIUM – Receive crypto market analysis and token tips >>

What are reputable experts predicting?

- Julian Hosp – Foresees Ethereum reaching over $11,000 in the long term. Driven by strong ETF inflows ($12.4B by mid January 2026) and Ethereum’s dominance in smart contracts.

- Michaël van de Poppe – See’s Ethereum as having bottomed and Estimates ETH will reach $10,000 – $17,500 short term. But he does not map this prediction to a specific year.

- Kadan Stadelmann – Predicts Ethereum will range between $2,500 and $3,200. Considers regulatory uncertainties from pending SEC and EU rulings, plus possible stablecoin restrictions.

- Andy LaPointe – Recommends buying Ethereum for the long term without a set price target. Cites Web3 adoption, Layer-2 expansion, and scaling benefits from the Pectra upgrade.

- Fred Schebesta – Projects Ethereum at $6,000–$8,200 in the next bullish phase. Based on increased staking, reduced liquid supply, strong retail sentiment, and whale accumulation.

- Jeremy Britton – Foresees Ethereum reaching $4,200–$6,800 within 12 months. Driven by Ethereum’s deflationary supply, store-of-value appeal, and potential to outperform Bitcoin once BTC nears $80K.

These experts provide a range of perspectives, from highly bullish to more cautious, reflecting the various factors influencing Ethereum’s potential future price.

Expert Forecasts & Institutional Outlook for Ethereum (ETH) — 2025 Update

Finder:

Finder’s expert panel expects Ethereum (ETH) to trade near $5,034 up from $4,300, with a long-term projection of $10,882 by 2030 as adoption and staking participation expand.

Citi – Institutional View:

Citi maintains a target of $4,500 for ETH, supported by rising network adoption and strong staking yield potential. In a bullish scenario, the bank sees upside toward $6,400 if on-chain activity continues to accelerate.

Standard Chartered:

Standard Chartered recently raised its year-end ETH target to $7,500, highlighting increased institutional participation and expanding DeFi and stablecoin usage on the Ethereum network as key growth drivers.

DigitalCoinPrice:

DigitalCoinPrice remains optimistic, forecasting Ethereum could reach $8,100 to $9,800 in 2026 under its advanced model, supported by consistent on-chain growth and favorable macro conditions.

Other Market Insights:

Chatgpt Price Prediction for Ethereum in 2026

Chatgpt predicts that In 2026, Ethereum will likely stay volatile but trend cautiously higher.It’s base case is a broad $2,800–$4,800 range as ETH rebuilds momentum from early-year consolidation. A bullish scenario targets $5,000–$7,500+ if crypto sentiment and inflows accelerate; bear risk remains below $2,700.

Perplexity Price Prediction for Ethereum in 2026

Perplexity AI sees Ethereum trading in the low-to-mid $3,000s through 2026 under base-case scenarios, with trader odds favoring $3,500 year-end. Bull cases reach $9,000 on historical trends and ETF inflows; new ATHs have ~40% probability by December. Aligns with Citi (~$4.3k–$5.4k) and Finder (~$5k extending).

Grok Price Prediction for Ethereum in 2026

Grok predicts that Ethereum will trend upward in 2026, likely ending the year between $4,500–$7,000 (a 45–125% gain from ~$3,100–$3,130 today). This assumes successful upgrades (Glamsterdam/Hegota for scaling), strong ETF inflows, RWA/DeFi growth, and supportive macro conditions. Bearish risks could cap it at $3,500–$4,000 if macro tightens or competition intensifies. Not financial advice—crypto is volatile; DYOR.

AI-driven Ethereum forecast overview

CHECK – Our recent multi-bagger successes from 3x to 30x >>

Ethereum Price Prediction 2027

In 2027, the price of Ethereum (ETH) is expected to feel the effect of broad market adoption combined with institutional adoption. This combination may push ETH to $7,420 as a maximum price. On the lower end, ETH should be able to hold $3,125 as a minimum price.

Ethereum Price Prediction 2028

In 2028, Ethereum is forecasted to move to the highest area of this decade. While it’s tough to predict three years out, it’s fair to assume that institutional adoption may push ETH much higher, towards $8,000. Pre-requisite: ETH clears ATH in 2026 and 2027.

ETH Price Prediction 2030

The highest price point that Ethereum (ETH) can reach on or before 2030 is the area $10,000 to $12,000. An absolute market top might be set when this happens. Arguably, it will happen in the period 2027-2029. ETH may briefly touch a price point in or above this range.

Forecasting Ethereum’s New All-Time Highs

According to predictive research, Ethereum has a high probability of reaching a new all-time high in 2026, with projections around $5,150, followed by $7,500 in 2027.

| Ethereum peak predictions | Probability in time |

|---|---|

| Can ETH hit $10,000 | High, before 2030 |

| Can ETH hit $20,000 | Not before 2030 |

| Can ETH hit $50,000 | Maybe closer to 2040 |

| Can ETH hit $100,000 | Maybe closer to 2050 |

READ – Can Ethereum ever hit $100,000?

Ethereum Price Drop Prediction

Markets don’t move in straight lines. A drop in Ethereum’s price is healthy provided support levels are respected. Ethereum’s recent price drop during September to November 2025 is a not a major concern for long term holders, in fact we may see this drop as a key catalyst for a buying spree in 2026.

| ETH price drop | Fibonacci | Outcome | Prediction |

|---|---|---|---|

| $4,109 | 25% | Bullish | High probability |

| $3,525.69 | 38.2% | Bullish | High probability |

| $2,746.13 | 50% | Bullish | Medium probability |

| $2,430.11 | 61.8% | Bearish | Low probability |

TIP – One of the best kept secrets of whales is that they love to buy low. The general public tends to be afraid when prices drop. Remember, an Ethereum price drop is not a bad thing as long as bullish Fibonacci levels are respected. Maximizing profits over time requires a ‘buy low, sell high‘ practice.

ETH prediction tomorrow

Ethereum price prediction tomorrow (coming soon)

Today, Ethereum trades at 2278.35. Tomorrow, February 5, 2026, ETH is forecasted to move to 0, a change of 0.00%.

ETH Price Predictions Day-by-day

Over the next 30 days, Ethereum is predicted to see the following price range:

We are renewing the predictive model with an AI capability – day by day predictions will be back soon.

Current Ethereum Price

Ethereum price, trading, market cap (source):

| Symbol: ETH |

| Name: Ethereum |

| Price: $2278.34532799 |

| Circulating supply: 120693577.49289000 |

| Total supply: 120693577.49289000 |

| Volume 24h: 46602094194.75700000 |

| Percent change 1h: 0.398% |

| Market cap: 274981648398.75000000 |

Ethereum Historical Prices

2013: The Birth of Ethereum

In 2013, the cryptocurrency landscape was dominated by Bitcoin, which had a focus on payments only. Vitalik Buterin, a young programmer, proposed a new platform that would revolutionize the blockchain world in many ways. Ethereum was born, offering not just a digital currency but a decentralized platform for smart contracts and decentralized applications (dApps).

2014: A Humble Beginning

Ethereum faced a slow start in the market. Its price hovered around $0.30 per ETH at its ICO and for most of 2014, with limited trading volume and investor interest. Despite the skepticism from some quarters, the Ethereum team continued to develop the platform, laying the groundwork for future growth. Initially, one ETH was equivalent to about 2000 BTC. This is now closer to 20.

2015: The Genesis Block

2015 marked a significant turning point for Ethereum. The platform’s developers released the Frontier network, allowing users to mine and trade ETH. Prices remained relatively stable throughout the year, ranging between $0.50 and $3.00 per ETH. The focus was on building a robust ecosystem and attracting developers to create innovative applications on the platform.

2016: The Rise of Ethereum

As Ethereum gained traction, its price began to climb steadily. In early 2016, ETH was trading at around $1.00, but by the end of the year, it had surged to over $8.00 per token. Growing investor confidence in Ethereum’s potential to disrupt traditional industries and enable new forms of digital interaction fueled investor sentiment. 2016 also saw a huge split with the collapse of the DAO, resulting in Ethereum Classic.

2017: The ICO Boom

The year 2017 saw Ethereum catapulted into the spotlight as the platform of choice for ICOs, and it really took off. Hundreds of projects launched their tokens on the Ethereum blockchain, driving up demand for ETH. Prices skyrocketed initially but tumbled soon thereafter, with ETH falling below $100 by the end of the year. It started a “Crypto Winter” and people had to reevaluate their strategies.

2018: Reevaluation of The ICO Model

In 2018, the price of Ethereum experienced significant volatility, mirroring the broader cryptocurrency market. ETH reached an all-time high of over $1,400 in January before undergoing a sharp correction, falling below $400 by April. Regulatory uncertainty, security concerns, and the bursting of the ICO bubble influenced market sentiment. In spite of a harsh reality check for many, development continued and Ethereum moved forward.

2019: Consolidation and Recovery

Developers focused on improving the platform’s scalability and usability, laying the foundation for future growth. Prices remained relatively stable throughout 2019, fluctuating between $100 and $300 per ETH. This period of consolidation allowed the Ethereum community to regroup and prepare for the next phase of development. This was also the start of a wider COVID-19 pandemic which triggered wider economic collapse.

2020: DeFi Explosion

In 2020, Ethereum emerged as the backbone of the decentralized finance (DeFi) movement. A wave of projects leveraging smart contracts and decentralized exchanges proliferated, driving demand for ETH. Prices surged once again, reaching over $600 per token by the end of the year. The explosive growth of DeFi highlighted Ethereum’s potential to disrupt traditional finance and usher in a new era of decentralized applications.

2021: The NFT Craze

The year 2021 witnessed another boom in Ethereum’s price, fueled in part by the rise of non-fungible tokens (NFTs). Artists, creators, and collectors flocked to Ethereum’s blockchain to buy, sell, and trade digital assets, pushing ETH prices to new all-time highs. By May 2021, ETH had surpassed $4,000 per token, propelled by the growing mainstream adoption of NFTs and continued interest in DeFi. Ultimately, the NFT industry would go through a similar boom, bust, and recovery as the ICO model, with multiple scams and overvalued trades taking place.

2022: Market Volatility

In 2022, Ethereum faced increased volatility as regulatory uncertainty and macroeconomic factors weighed on the cryptocurrency market. Prices fluctuated between $1,500 and $3,000 per ETH, reflecting the broader instability in global financial markets. Despite the challenges, Ethereum’s underlying fundamentals remained strong, with ongoing development efforts and growing institutional interest supporting its long-term outlook.

2023: Maturing Market

By 2023, the cryptocurrency market had matured significantly, with Ethereum firmly established as a leading blockchain platform. Prices stabilized around $2,500 to $3,500 per ETH, reflecting a more balanced market sentiment and investor confidence. Continued innovation in DeFi, NFTs, and other blockchain applications further solidified Ethereum’s position as a key player in the digital economy.

2024: Scaling and Evolution

In 2024, Ethereum’s focus shifted to scaling solutions, including Layer 2 integrations and protocol upgrades. Prices ranged from $2,000 to $4,400, reflecting growing adoption and robust network activity. DeFi and NFT use cases expanded, while mainstream acceptance reinforced Ethereum’s status as a critical infrastructure in the digital finance ecosystem.

2025: Breakout and Institutional Momentum

Ethereum’s 2025 performance was volatile: ETH started near $2,255 in February, surged to a new all-time high of $4,953 in August on ETF inflows and staking, but ended weakly below $3,100 after nine straight red months, it’s worst streak since 2018. Net result: up around 110% YTD despite late-year pullback.

ETH Price FAQs

How significant is Ethereum’s price surge?

Ethereum rose from about $2,255 in February 2025 to over $4,953 in August 2025, breaking its all-time high. The increase is driven by record ETF inflows, corporate adoption, and reduced liquid supply from staking. Analysts expect strong institutional momentum to continue and see the potential for new highs in 2026.

Is Ethereum bullish or bearish?

As of Janury 2026, Ethereum is bullish, trading near $3,200. Price strength is supported by record ETF inflows, rising corporate adoption, reduced liquid supply from staking, and sustained DeFi and NFT activity. Analysts expect continued institutional momentum, with potential for new all-time highs in 2026.

What's the future outlook of Ethereum (ETH)?

Ethereum’s future outlook remains highly optimistic. In 2026, it has benefited from record institutional ETF inflows, a game-changing Pectra protocol upgrade, and heightened staking activity, which together are tightening liquid supply and reinforcing its value case. Major banks and analysts now forecast an end-of-year target of $7,500, with long-term scenarios extending toward $10,000 or more if growth continues across DeFi, NFTs, and global adoption.

Will Ethereum go up or down?

According to Investing Haven’s predictive research, Ethereum is expected to gain momentum in early 2026, we may see new all time highs for ETH in 2026, aligning with broader industry growth and upcoming upgrades.

What will Ethereum be worth in 3 years from now?

The value of Ethereum (ETH) is expected to rise over the coming years, although in a typical rollercoaster fashion. Directionally, ETH should be moving higher in the coming years, getting closer to the $10,000 mark in 3 to 4 years from now, provided it continues scaling.

Will Ethereum (ETH) ever hit $50,000?

The possibility of the price of Ethereum to hit $50,000 before 2030 is pretty unlikely. It will require a market cap of more than $6 trillion. Not only is it unlikely to happen this decade, it’s also wishful thinking if any investor portfolio has this price target as an assumption.

What will Ethereum be worth in 5 years from now?

The value of Ethereum (ETH) is expected to be much higher in 5 years from now. ETH should be able to exceed its hard-to-believe level of $10,000 mark in 5 years from now, a major milestone, arguably also the absolute market top.

What will Ethereum be worth in 2030?

Ethereum (ETH) may rise to the $10,000 to $12,000 area by 2030, per Ethereum’s predictive research detailed on this page. This ETH prediction is consistent with leading firms like Van Eck. The main catalyst will be (a) Bitcoin’s continued rise (b) institutional buying (c) continued Ethereum adoption.

Will Ethereum boom in 2026?

Ethereum (ETH) is expected to boom in 2026 after a volatile 2025 it was still up 110% YTD. Classic market dynamics apply: laggards tend to become leaders, bear traps and bull traps are common. Ethereum is preparing an innovative upgrade. Institutional interest will remain the key catalyst.

What is Ethereum worth today?

Today, Ethereum (ETH) is worth $2278.35. This is the average price of ETH in the last 24 hours, today on February 4, 2026. Tomorrow, per predictive research, ETH is forecasted to be worth $0.

Will Ethereum reach a new all-time high soon?

Our Ethereum price prediction suggests a new all-time high is likely once ETH breaks above $3,000–$3,500 and momentum returns. With ETF inflows, institutional demand, and strong on-chain activity, a break above the August 2025 high near $4,953.73 is plausible for ETH in 2026.

Can Ethereum reach $10,000?

Our Ethereum price forecast sees $10,000 as a realistic long-term target rather than a near-term level. Under continued institutional adoption, scaling progress, and a supportive macro backdrop, ETH may approach the $10,000–$12,000 area closer to 2027–2030, potentially marking a major cyclical top.

Will Ethereum go up or down in the next 12 months?

Directionally, our Ethereum price prediction leans higher over the next 12 months, but with the usual crypto volatility. As long as major support zones holds, upside toward $4,500–$6,000 remains on the table, especially if institutional flows, DeFi usage, and network upgrades stay on track.

Is Ethereum a good investment for the next bull run?

From a structural perspective, Ethereum remains a core candidate for the next bull cycle. Our Ethereum price forecast highlights growing institutional interest, DeFi and Layer-2 expansion, and a long-term path toward $10,000–$12,000 as key drivers, while acknowledging interim drawdowns and the need for strict risk management.

Will Ethereum outperform Bitcoin in 2026?

Historically, Ethereum often lags Bitcoin early in a cycle and then outperforms later. Our Ethereum price forecast for 2026 suggests that once BTC sets or retests new highs, ETH could gain relative strength, especially if DeFi, staking yields, and smart-contract activity accelerate versus Bitcoin’s more store-of-value profile.

How does the Pectra upgrade affect the Ethereum price prediction?

The Pectra upgrade strengthens our Ethereum price prediction by improving scalability, efficiency, and user experience, which supports higher on-chain activity and sustained staking demand. While upgrades alone don’t guarantee higher prices, they underpin the bullish case for a $4,000–$6,000 range in 2026 and a path toward $10,000 longer term.

What price will Ethereum reach in the next bull cycle?

Our Ethereum price forecast model 3-5 years points to a next-cycle upside range in the $10,000–$12,000 area, assuming previous cycle patterns repeat and institutional adoption deepens. This zone is viewed as a potential “cycle extreme” rather than a stable level, with sharp corrections likely once that region is tested.

Why is Ethereum going up right now?

When Ethereum rises sharply, it is typically driven by a combination of factors: renewed ETF inflows, improving macro sentiment, rotation from lagging altcoins, and rising on-chain activity in DeFi, NFTs, and Layer-2 networks. Our Ethereum price prediction framework always ties short-term moves back to these underlying structural drivers.

What is the risk of Ethereum dropping below $2,500?

In our Ethereum price forecast, the $2,500 area is a key structural support. A sustained break below this zone would signal a deeper corrective phase, opening downside toward $2,200 or even $1,800. While not our base case, such a drop would likely be triggered by risk-off macro events or failed support levels.

Can Ethereum reach $50,000 in the long term?

Our research views a $50,000 Ethereum price prediction as highly speculative for this decade. It would require a multi-trillion-dollar market cap and unprecedented liquidity. For now, we consider the $10,000–$12,000 area as a more realistic long-term target, while $50,000 looks more like a post-2035 scenario, if ever.

What are the key factors driving Ethereum’s price in 2026?

Our 2026 Ethereum price forecast is driven by five pillars: institutional buying via ETFs, network upgrades such as Pectra, DeFi and Layer-2 expansion, staking and reduced circulating supply, and Bitcoin’s broader cycle. Together, these factors form the backbone of our $2,500–$6,420 forecast range.

How accurate are Ethereum price predictions historically?

Ethereum price predictions tend to be directionally useful over multi-year horizons but highly imperfect on exact timing and levels. Our own forecasts correctly anticipated the 2025 breakout and new all-time high zone, yet we always emphasize ranges, scenarios, and invalidation levels rather than fixed targets, given crypto’s volatility.

What is the Ethereum forecast for 2030 and beyond?

Our long-term Ethereum price forecast projects a potential peak in the $10,000–$12,000 area sometime between 2027 and 2030, assuming continued adoption and favorable macro conditions. Beyond 2030, visibility declines sharply, so we treat any numbers above that range like $20,000 or $50,000 as low-probability, long-horizon scenarios.

Will institutional adoption push Ethereum higher in 2026?

Yes, institutional participation is a central pillar of our 2026 Ethereum price prediction. Spot ETH ETFs, custody solutions, and corporate treasury allocations all support sustained demand. If flows remain steady and macro conditions don’t deteriorate, institutional buying can justify prices gravitating toward the $4,000–$6,000 region.

Will Ethereum reach $5,000 again after the recent retracement?

Our Ethereum price forecast sees a return to the $4,800–$5,000 area as realistic, provided the $2,800–$3,000 support band holds and sentiment stabilizes. The previous high at $4,953.73 acts as both a magnet and resistance; a clean break above it would confirm a renewed bullish cycle in 2026.

🧩 How to Buy Ethereum (ETH) Safely

The most reliable way to buy Ethereum is through a reputable, well-known crypto exchange.

For a fast, secure, and user-friendly experience, we recommend eToro.

It lets you purchase ETH in minutes with common payment methods and a streamlined checkout.

Other established exchanges include Binance, Coinbase, Kraken, and Bitstamp—each offering trusted access to ETH.

That said, eToro stands out for its simple onboarding, broad availability, and transparent flow.

Disclaimer: The information presented in this article is for informational purposes only and does not constitute financial or investment advice. All opinions are those of the author and should not be interpreted as specific trading or investment recommendations. We do not guarantee the completeness, accuracy, or reliability of this content. Cryptocurrency markets are highly volatile and can experience unpredictable fluctuations. Readers are encouraged to conduct their own research, consider multiple perspectives, and understand local regulations before making any investment decisions.