Overall, we expect 2024 to be a year characterized by strong market trends, in different directions. We forecast 4 strong market trends, the ones that really stand out. We believe investors will need to be disciplined in exit decisions in 2024, consider re-entering later and lower in some of the markets that we expect to move strongly. This present article marks the official kick-off of our 2024 forecasts.

We feature 4 markets that we believe will register the strongest moves in 2024.

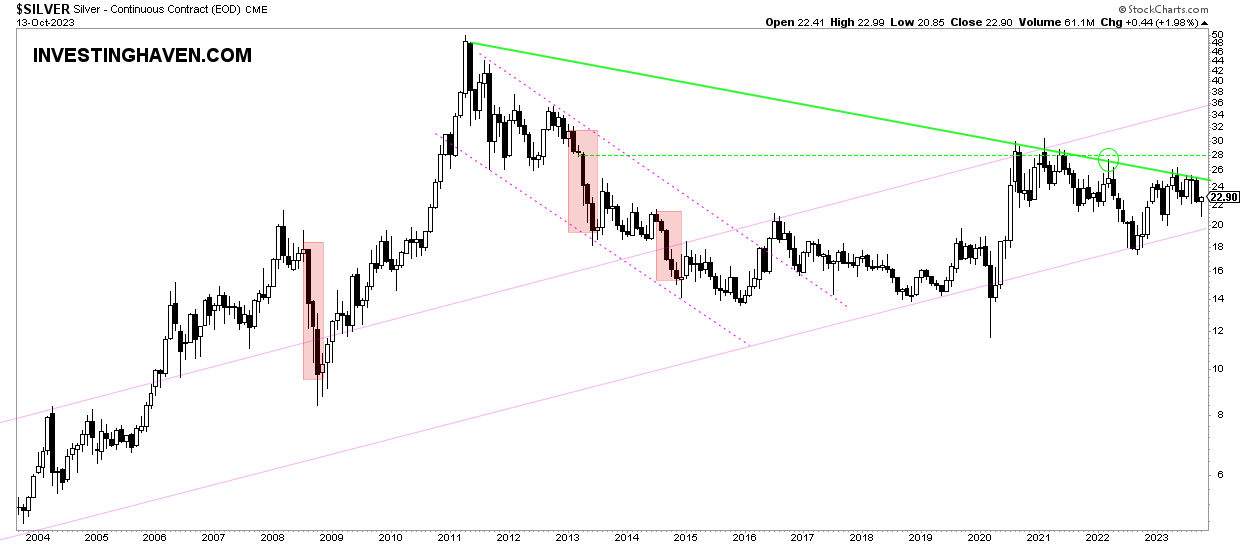

Silver in 2024 – a big bullish move, followed by a pullback

The long term silver chart makes it clear – a bullish triangle is near resolution, the upside potential is tremendous, we see a move to 34.7 USD/oz which might be extended to the 44 USD/oz area. That’s because silver is such a volatile asset, whenever it starts trending it tends to exaggerate its moves.

We believe that silver investors will have an epic opportunity to take profits in the first half of 2024, and reserve their profits to re-enter silver and related investments after a silver pullback from our bullish targets (either 34.7 USD/oz or 44-ish USD/oz) as it settles around 28 USD/oz later in 2024.

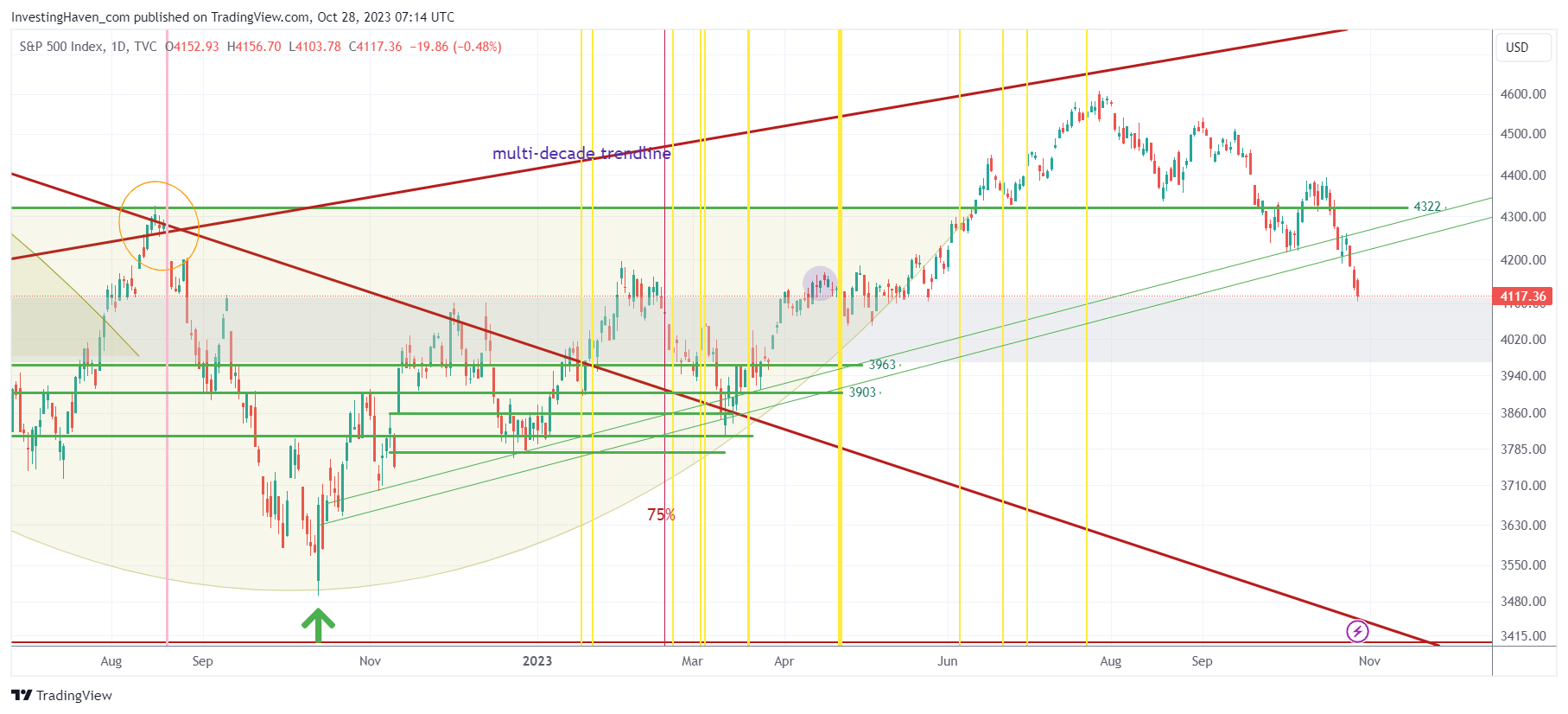

S&P 500 in 2024: test of all-time highs followed by a sharp pullback

We believe that the S&P 500 will test its previous ATH. Interestingly, it will coincide with the multi-decade trendline, seen on below chart. The red rising trendline will should be tested as resistance before April of 2024.

Pre-requisite: our Bullish Stock Market Forecast For November 2023 must be materialized which will happen if the S&P 500 respects the grey shaded area on below chart as strong support.

We expect a sharp pullback after testing ATH.

We expect a local top to be printed in April or May of 2024.

Graphite in 2024: a very bullish trend, pending validation

We covered an epic change in the graphite market in this premium service update Graphite Now More Critical Than Ever Before:

In the graphite market, arguably a niche market, we witnessed another disruptive development. We quote the site Aheadoftheherd.com.

On Friday, October 20th, Beijing said it will require export permits for some graphite products “to protect national security”. China is the largest graphite producer and exporter, and refines almost all the world’s graphite into the material that is used in virtually all EV battery anodes. Under the new graphite restrictions, which take effect Dec 1, exporters must apply for permits to ship two types of graphite: synthetic graphite, and natural flake graphite and its products.

Deficits are expected to kick in by 2025 as new graphite mines fail to keep up with surging demand from automakers.

This is why the Department Of Energy, in its assessment, ranked graphite near the top of its list of minerals critical to America’s energy future. The US federal government’s critical minerals list also has graphite as one of five key battery minerals that are at risk of supply disruptions.

Graphite stocks sold off in 2023, they fell to unexpected and unforeseen levels. It also did make any sense, as the demand for graphite keeps on growing, driven by explosive demand from the automotive sector (EV batteries in particular).

China has been suppressing graphite prices, it is now clear in hindsight. What happens when the suppressor is out of the way? Prices normalize again.

We believe graphite stocks will perform very well this decade which is why this sector qualifies as one of the 4 mega trend sectors of the decade.

In our premium update, we reviewed the stock charts from our graphite selection. While there is one clear winner among current setups, there are several candidates with huge upside potential provided the graphite market heats up in 2024, a forecast that is not confirmed at the time of writing.

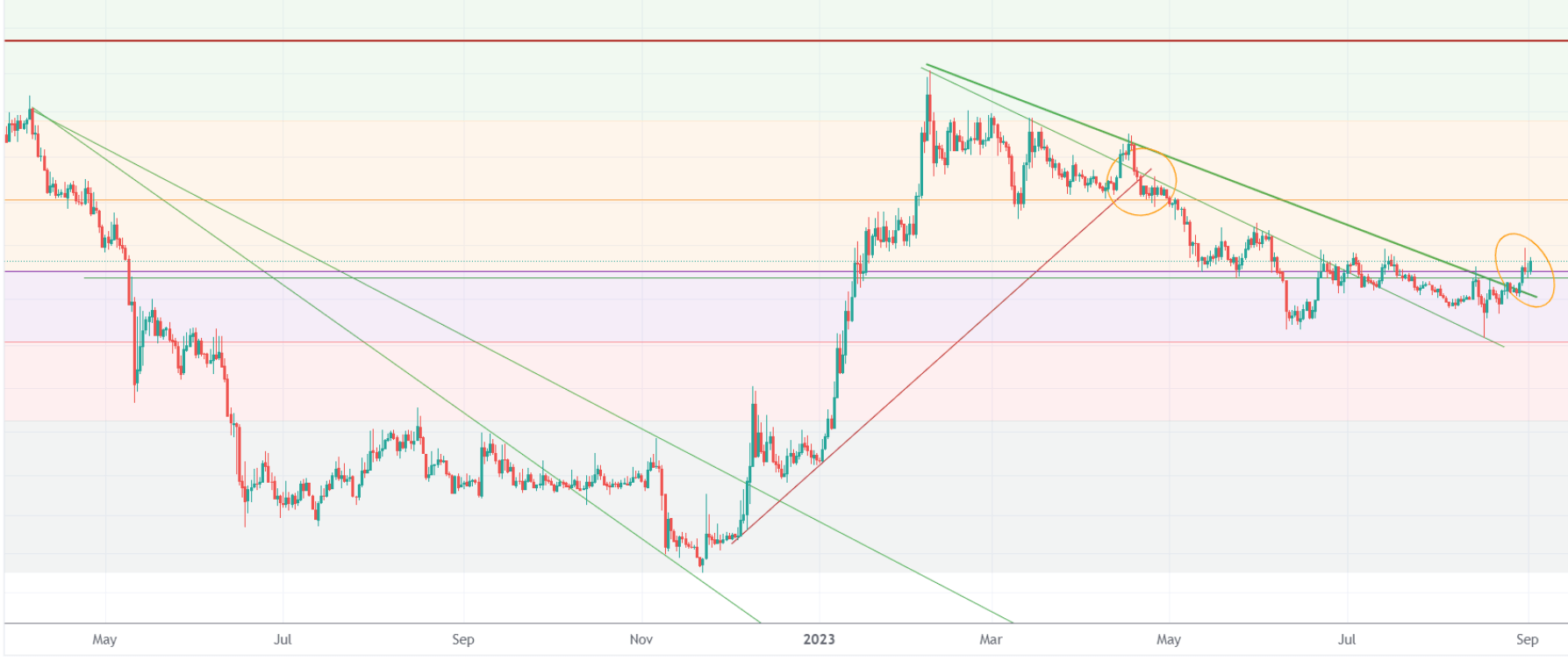

Crypto in 2024: a few multi-baggers, not a lot of them

We expect some altcoins to do unusually well in 2024. However, remember that the crypto market is bi-furcated.

Case in point – in September, we wrote this article in the public post, leaving out the symbol of this token Is This AI Token Ready To Rally?

The chart below is from that article.

This is what happened in the meantime with the token – it nearly doubled since we tipped it (80% up).

While sentiment is very bearish in markets, our top altcoin tip nearly doubled in October.

Talking about accurate readings and token selection. That’s what we have to offer to our premium crypto members.

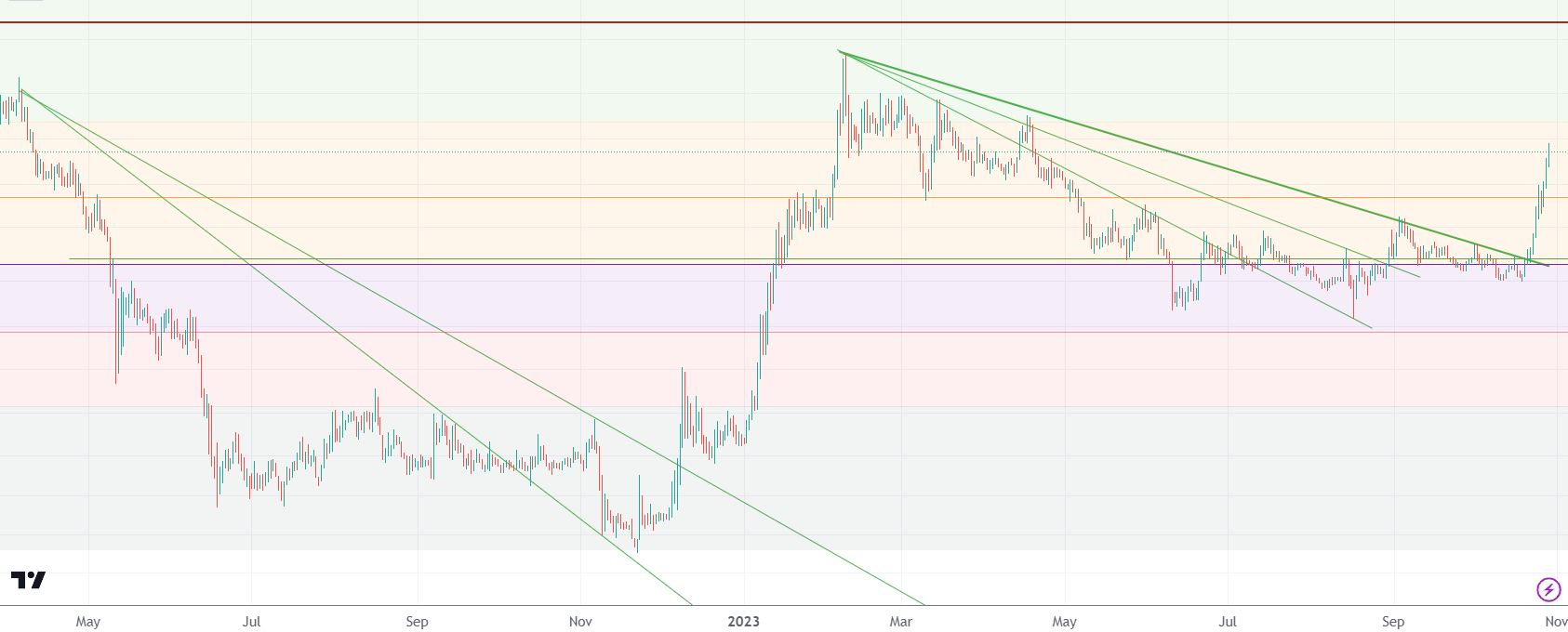

By the way, among our top token tips, featured in our premium crypto research service, is this token. While it may not look as an exciting setup, we are on record calling this a 10-bagger, in the coming 18 months.

We are covering all these markets in our premium services Momentum Investing (stock indexes & sectors) and Crypto Investing, the topics outlined in this article will be the red line throughout 2024.