The cobalt price is the fastest rising green battery metal right before 2022 kicks off. This bodes well for cobalt stocks in 2022, hence our wildly bullish cobalt stocks forecast for 2022. In fact, we believe that 2022 will be the year of cobalt stocks as well as graphite stocks. We explained the reason why we believe so first in our masterpiece Which Is The Biggest Investing Opportunity Of This Decade and then followed up on this in our green battery metals forecast 2022 (our graphite 2022 forecast provides a sector specific outlook). Not to say that lithium won’t be bullish, it will as said in our lithium 2022 forecast. But graphite and cobalt are the laggards while their prices are on the rise lately. Moreover, cobalt stocks have not reacted to the recent cobalt price rise yet. So it is a matter of time until cobalt stocks will do something really interesting for those who hold quality cobalt shares. This is one more forecast in our long list of 2022 predictions.

The summary of our 2022 cobalt stocks forecast:

- Cobalt prices are on the rise right before 2022 kicks in.

- Cobalt stocks have not broken out yet, as a group. The continue to consolidate going into 2022.

- Markets may start getting volatile right before 2022 kicks in. But once they start calming down cobalt stocks will do the same as what lithium stocks did starting summer of 2021: double and tripe in a few months time (yes, all our top lithium stock tips shared with Momentum Investing members went up triple digits since we tipped them).

Cobalt, similar to graphite and lithium, will face a supply deficit in the coming 3 years. Lithium stocks have reacted to this, we believe cobalt and graphite stocks are going to react to this with some delay. That’s why our cobalt stocks forecast for 2022 is so bullish.

Last year’s cobalt forecast was spot-on

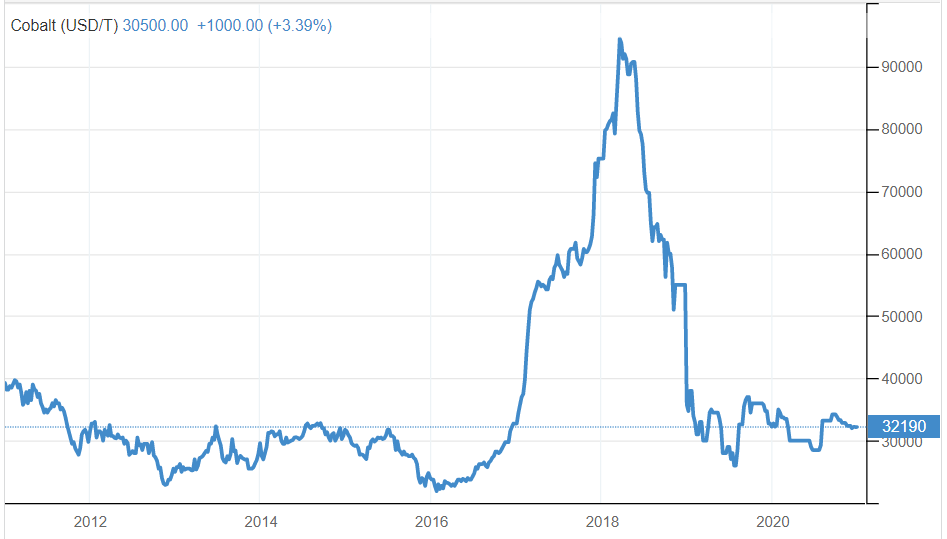

This is the cobalt price chart (source) which we shared a year ago. These are the comments we made back then (copy/paste):

What’s much more interesting and relevant is what’s going on right now, and what to make out of this price chart going forward in 2021. Also how does this chart inform us on our cobalt stocks forecast for 2021.

We see 2 higher lows in the last 24 months on this cobalt price chart.

Looking at this chart in the last 5 years we see 3 higher lows.

That’s not interesting, that’s extremely interesting particularly because this truly is a forgotten sector! After all those revivals in almost every sector post-Corona crash we don’t see a lot of ‘forgotten sectors’. Cobalt stocks are one of them, the cobalt price is one of them.

This is the cobalt price chart from our cobalt market forecast one year ago:

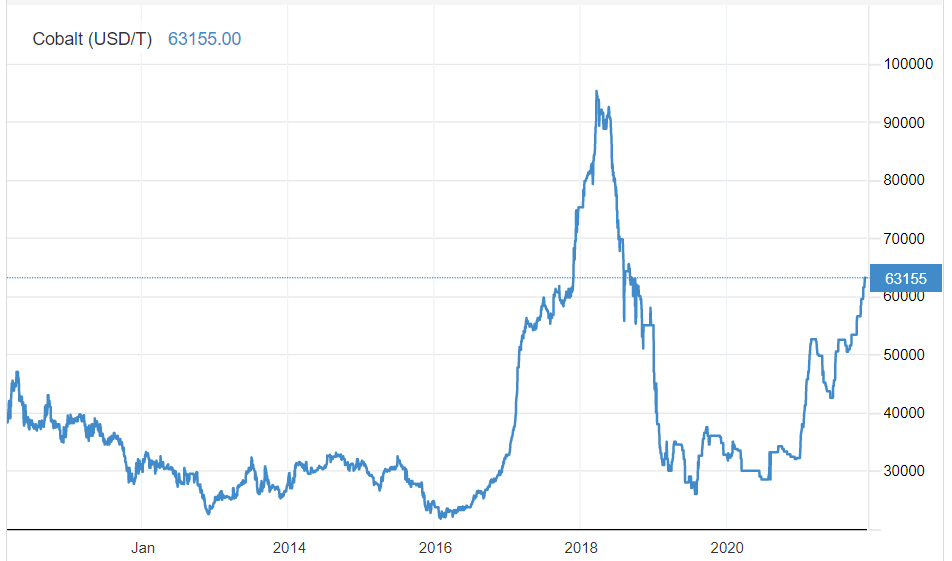

This is the same cobalt price chart, exactly one year later:

Our expectation worked out, exactly as described.

Cobalt market not done rising, only now warming up

The setup we see on the current cobalt price chart suggests that higher cobalt prices are underway.

We are looking at 2 possible scenarios:

- Either a giant W pattern. This would push the cobalt price chart to the 60k-70k area after which it would come down to 40k.

- Or a push to set new highs, similar to what lithium did in 2021.

Fundamentals for this commodity underpin higher cobalt prices. Fundamentals cannot predict a chart pattern though, they can only suggest if prices are set to rise.

As per Reuters (source):

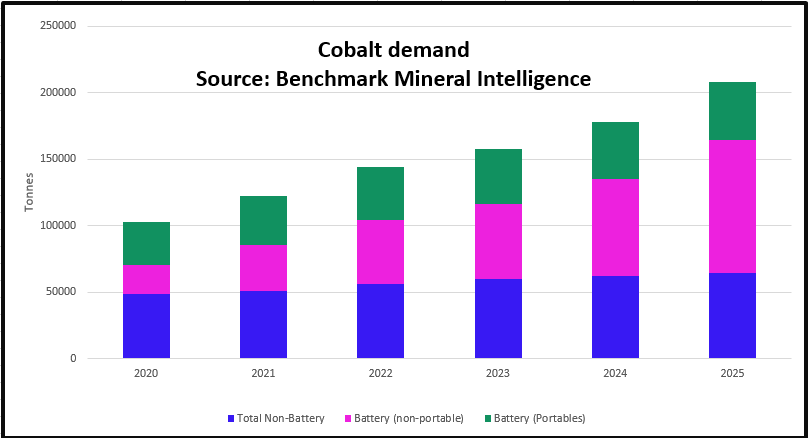

The 127,000-tonne cobalt market will likely flip into a deficit of about 1,000 tonnes this year from a surplus of 1,100 tonnes last year, Benchmark data show.

The above chart clearly shows that 2023 is going to be the tipping point. This suggests that prices should react to this in 2022, or even a bit sooner. And that’s what current price behavior currently confirms.

The article continues:

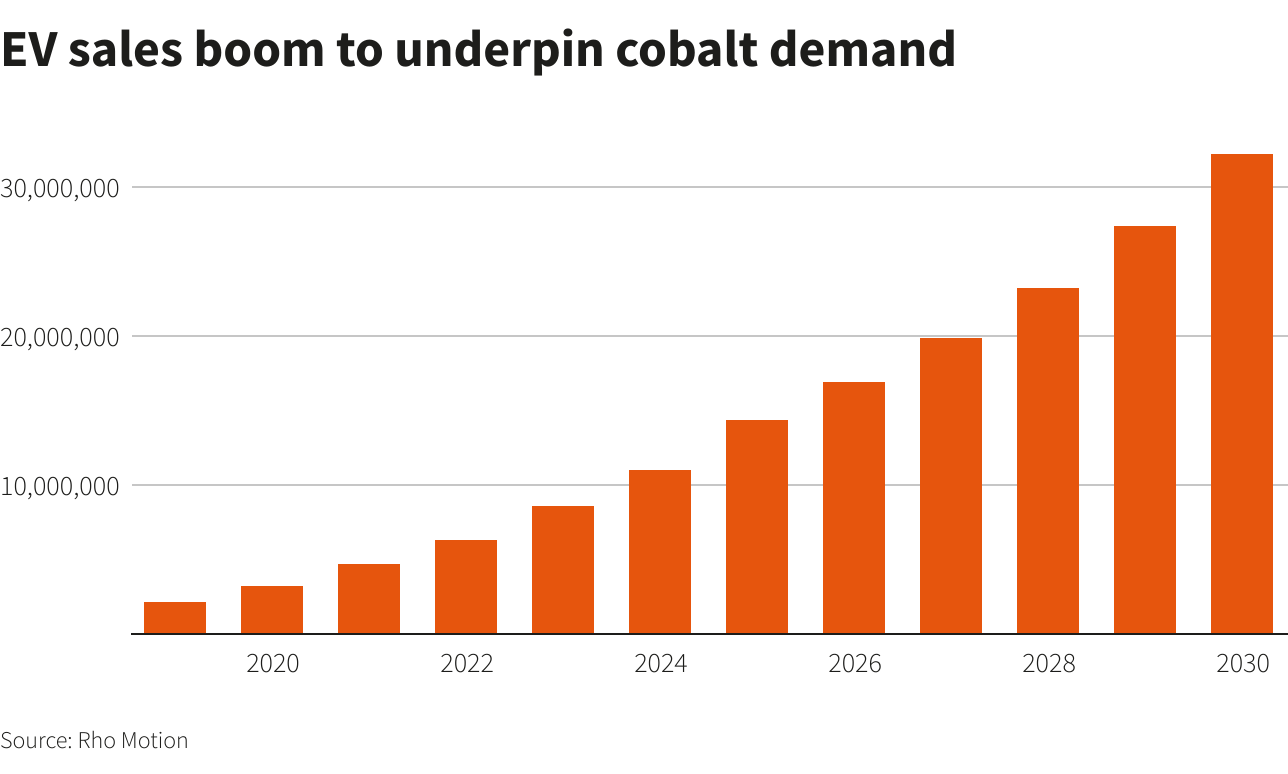

Global EV sales are expected to rocket 50% in 2021 to 4.7 million vehicles and soar to 14.3 million by 2025, consultancy Rho Motion project estimated.

Demand from the battery space is going to drive cobalt demand (into a deficit), and the tipping point as per the above chart is 2022.

Top cobalt stocks and their chart patterns

When it comes to cobalt stocks we have to say it’s not a simple topic, for a few reasons:

- There is no such thing as a cobalt sector ETF.

- Most cobalt miners are no pure-play miners, they focus on much more than only cobalt.

- Most cobalt stocks are small cap, micro cap or nano cap stocks.

- With the sell off since 2018 most cobalt stocks have lost lots of their market cap, making it even more difficult to identify them and invest in them.

- Several cobalt miners trade in Australia (ASX), which is an offline market, making it harder to invest in them.

That said, we have found all cobalt stocks and track them constantly.

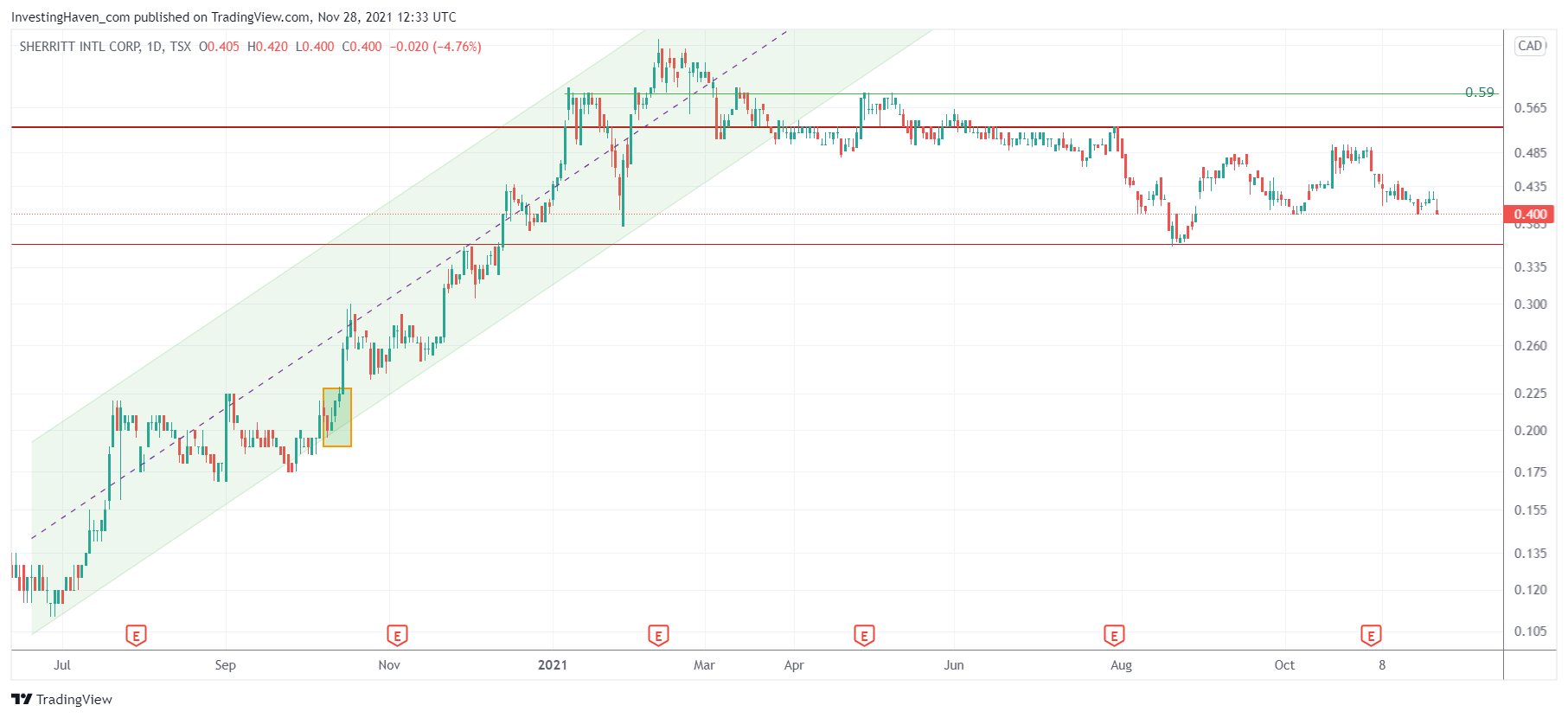

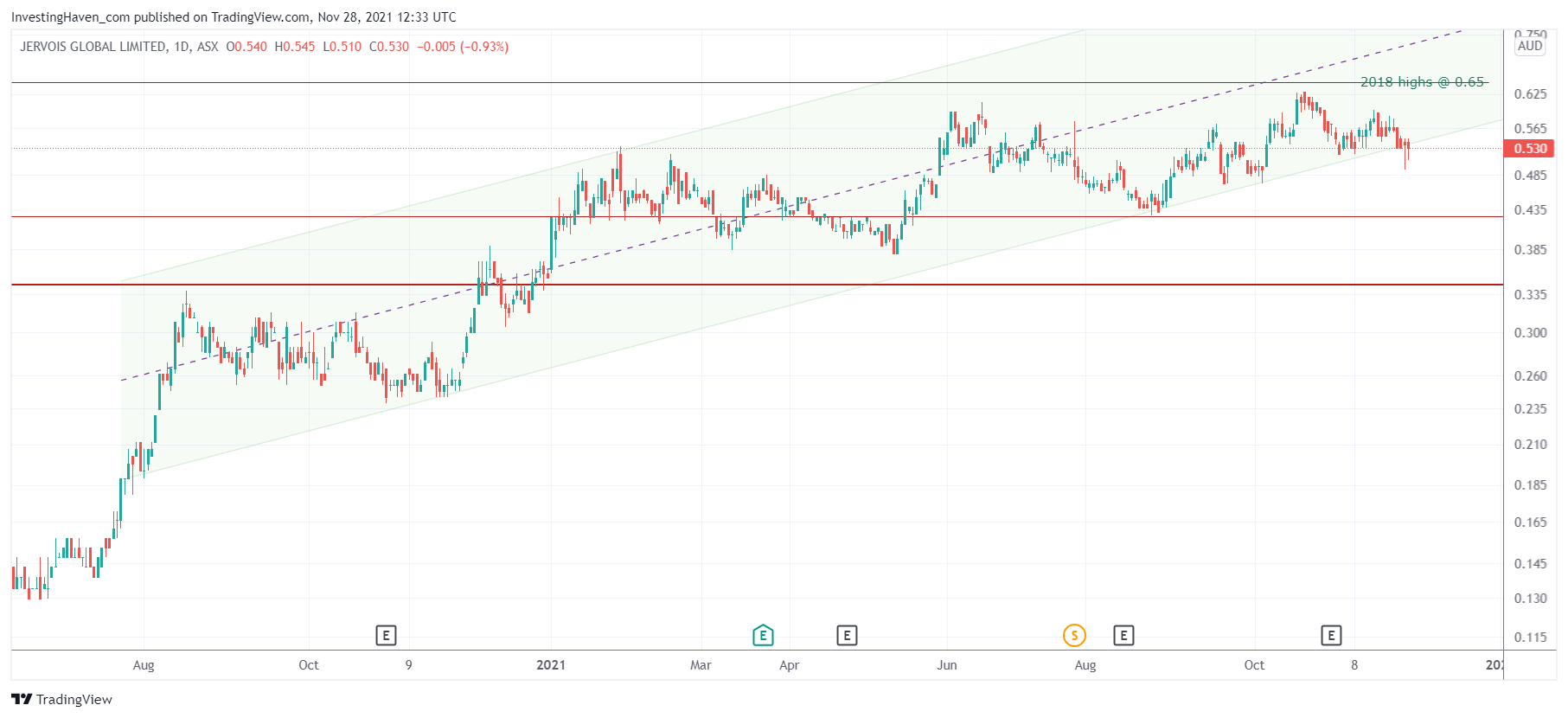

The cobalt stocks chart setups going into 2022 look like this:

Or this:

Long consolidations.

And we all know what happens if a sector is consolidating for a long time while its leading indicator is rising.

That’s indeed why we expect cobalt stocks to be wildly bullish in 2022.

Our cobalt forecast has similarities with the mega gold bull run 20 yrs ago

We have noticed really similarities between the mega bull markets over the last few decades:

- In the 90ies: tech stocks.

- Between 2002 and 2010: precious metals stocks.

- Between 2012 and 2019: specific tech sectors but also cryptocurrencies.

- This decade: lithium, graphite, cobalt.

These mega bull markets have a few characteristics:

- They go on for longer than most of us think.

- The accelerate only once or twice per year.

- The rise (once or twice per year) largely makes up for the waiting and pullback in all other months of the year.

- Buy and hold is delivering phenomenal compound effects on individual positions.

Emphasis on the last point:

Buy and hold is delivering phenomenal compound effects on individual positions.

It is crucial for outrageous success to find a way to create compound effect. It may be on portfolio level or individual positions. Any of the mega bull markets mentioned above created enormous compound effects by buying & holding individual positions for a long period of time.

We believe the investing insights outlined above will also apply to cobalt stocks in 2022 and beyond.

How to play our bullish cobalt stocks forecast in 2022 and beyond

We’ll script it for our readers, and we want to ensure readers understand that this is the exact same script as outlined in our lithium stocks forecast:

- Select the cobalt stocks with the very best setup. Be extremely demanding when it comes to quality. Only high quality (read: really beautiful setups) should be allowed in your portfolio.

- Buy the dip in quality cobalt stocks.

- After a strong rise you may want to take some profits and keep the cash to buy the next dip.

- With the proceeds you may want to re-enter the same growing companies and/or you can pick the next promising cobalt stock (e.g., new discovery or a promising small cap).

When we talk ‘buy the dip’ we really mean a serious dip. Buy the dip is the period in the year in which those stocks come down 30 to 40 pct (if not more).

Enjoying our work? Our Momentum Investing service comes with a selection of 10 top green battery metals, carefully selected out of some 500 green battery metals stocks. All our lithium picks were up triple digits in 2021! We expect graphite and cobalt picks to go up triple digits in 2022.

Our Must-Read 2022 Predictions

We strongly recommend you read the following predictions as they are highly informative and very well researched.