The lithium market is our top favorite market. As explained in Which Is The Biggest Investing Opportunity Of This Decade we are forecasting a mega trend in the lithium market. Mega trends go through multiple phases in their uptrend, they don’t go up in one straight line. The price of lithium continues to move higher, the supply deficit is now well underway, broad market conditions will start improving. Those are the 3 drivers to confirm our wildly bullish lithium forecast 2023, without any doubt the most bullish of our 2023 forecasts.

Readers can track how our lithium investing section continues to feature bullish lithium market forecasts, despite the market downturn in 2022.

The lithium market went through a dip in May and June of 2022. Mostly big lithium stocks recovered really fast, while other lithium stocks are consolidating.

We strongly recommend signing up to our Momentum Investing service to access our latest lithium stock selection, based on a very thorough analysis of the lithium market. We bring in structure based on the logic that the lithium market is following. Please check our research note “Lithium & Graphite top stock selection” available in the restricted area of Momentum Investing members (published on October 21st)!

Lithium forecast drivers

As explained above we see 3 drivers for the lithium market. We define the ‘lithium market’, in this context, as lithium stocks.

- The price of lithium. Think of it as ‘spot lithium.’ We discuss the lithium price chart in the next paragraph.

- The supply deficit in the lithium market. This one speaks for itself. We dedicate a section to this topic.

- Broad markets. Once broad markets confirm a bottom and start calming down, after a violent 2022, we see momentum return into the lithium market.

We discuss the first two items in the next sections. When it comes to the broad market conversation we recommend to read our articles Dow Jones 100 Years and Dow Jones 20 years.

Lithium price forecast 2023

The lithium price has a phenomenal setup.

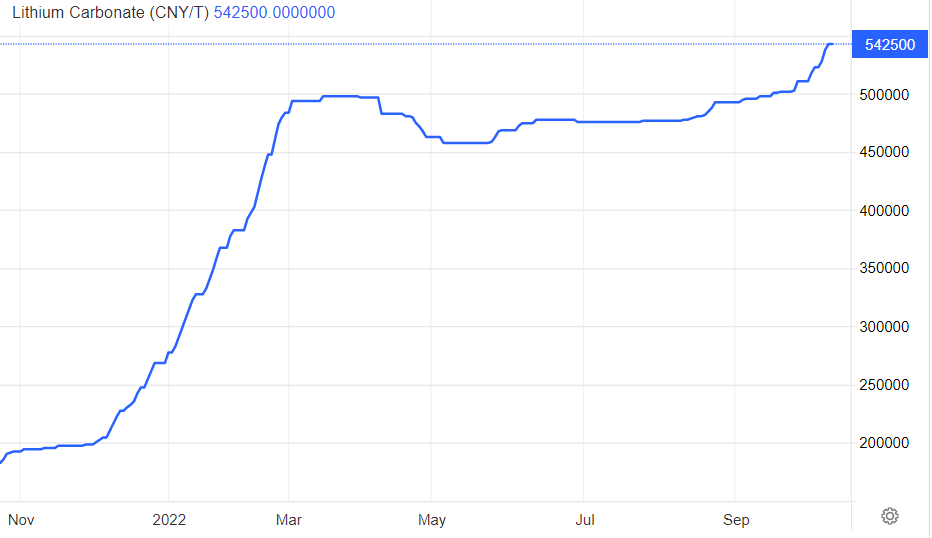

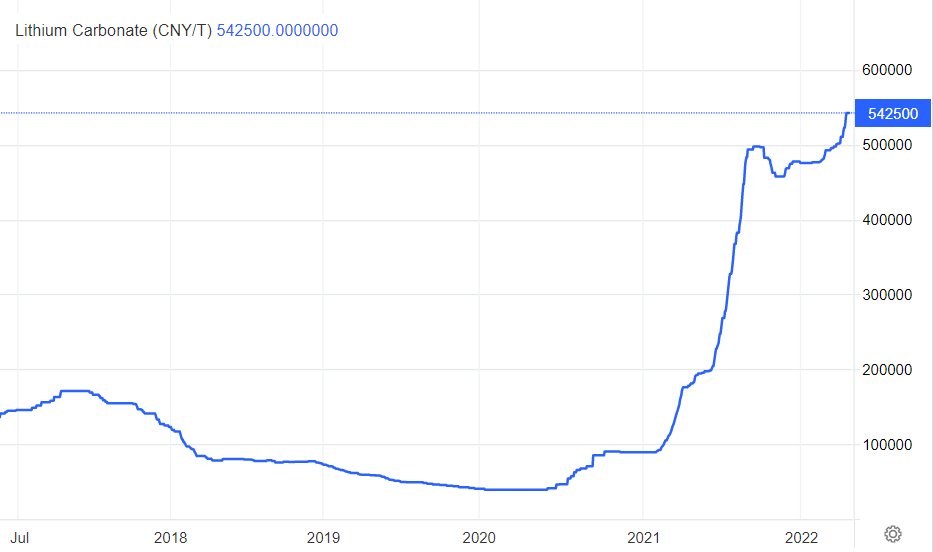

The 12 month price chart confirms that we have been predicting for a long time: the lithium price and lithium market will continue to remain hot. Note that lithium is The Hottest Commodity Of This Decade, The Only One At ATH.

The 5 year lithium price chart is insanely bullish. We don’t see how the lithium price will come down any time soon.

We expect the lithium price to be hot in 2023.

Lithium deficit prediction by 2025

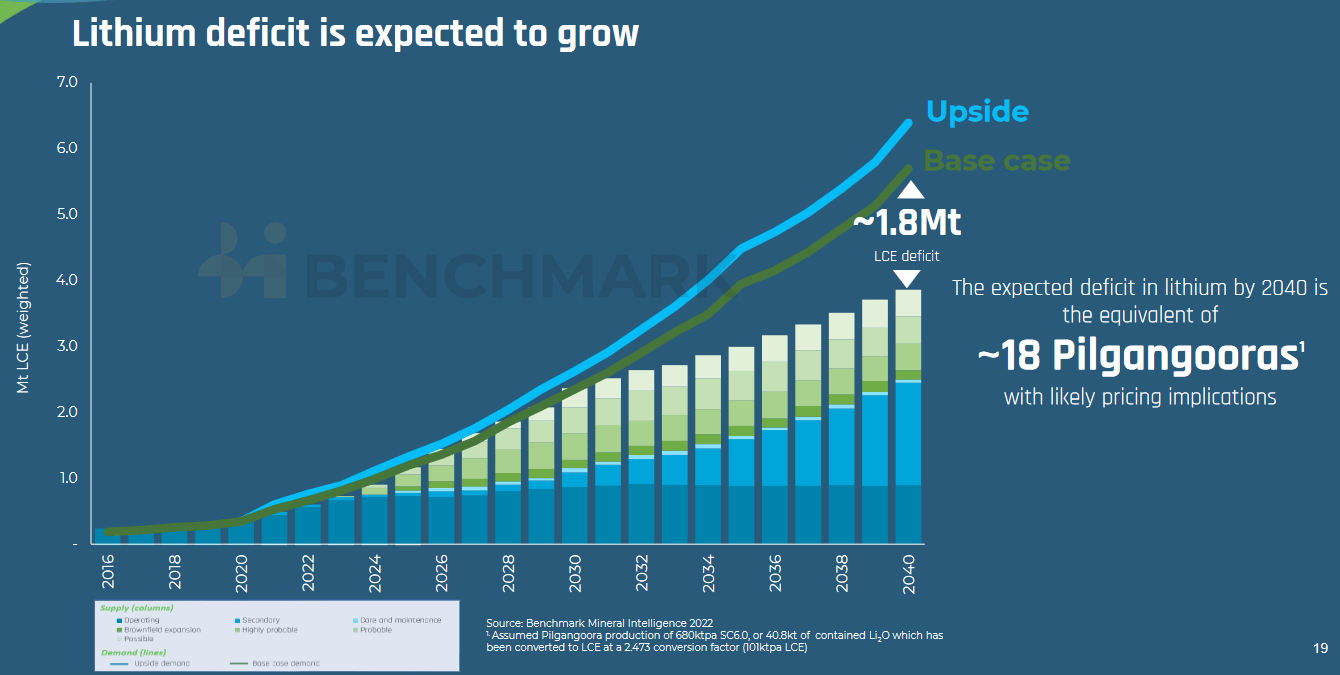

The lithium price is rising for a reason. The lithium market is going to enter a supply/demand deficit by 2025.

It seems that the exact timing and magnitude of the lithium deficit varies.

As pointed out by Bloomberg in How Much Lithium Will the World Need? It Depends Who You Ask:

In a survey of six leading lithium forecasters, estimates for how the market will look in 2025 range from a deficit equal to 13% of demand to a 17% surplus. Projections for the market’s size diverge sharply too, with demand forecasts ranging from as little as 502,000 tons to as much as 1.3 million tons.

They continue:

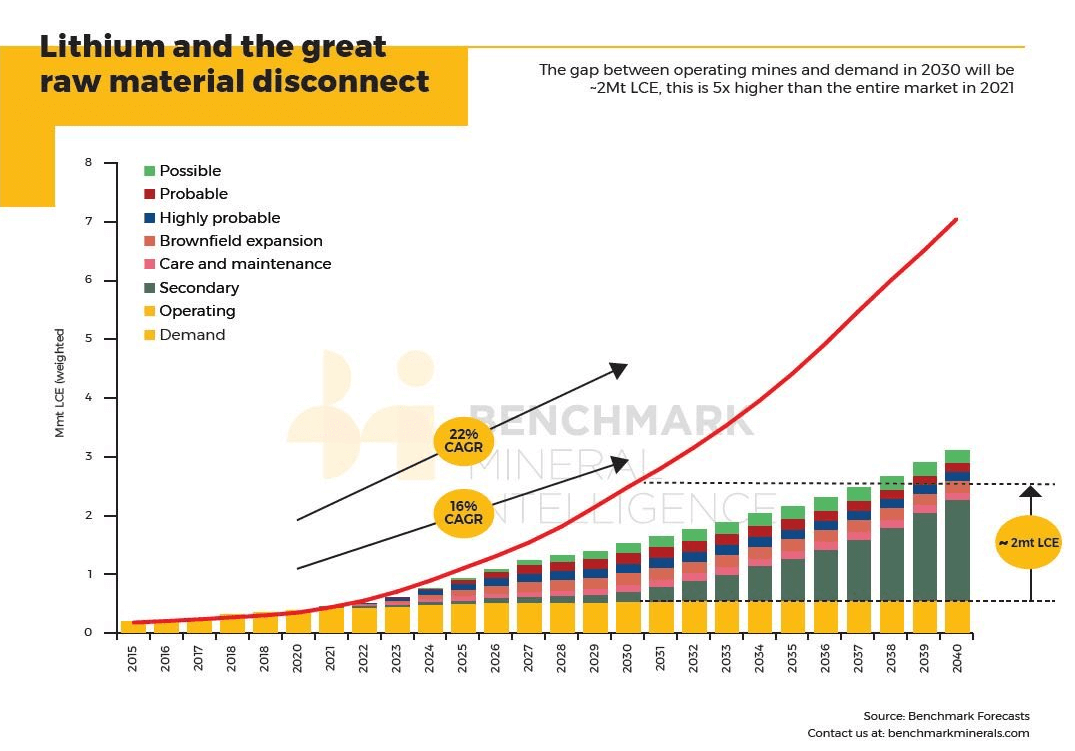

The gulf between forecasts reflects lithium’s status as a small market on the cusp of seismic expansion, with the average of the six estimates suggesting annual growth of more than 20% for both supply and demand between 2021 and 2025. That compares with typical growth rates of 2%-4% in larger and mature markets like copper, where surpluses and deficits usually equal a fraction of demand.

Irrespective of the exact details of the deficit we see a continued confirmation of the lithium market deficit in other research.

Interestingly, the following data point suggests that the “gap between operating mines and demand in 2030 will be approx. 2Mt which is 5x higher than the entire market in 2021.”

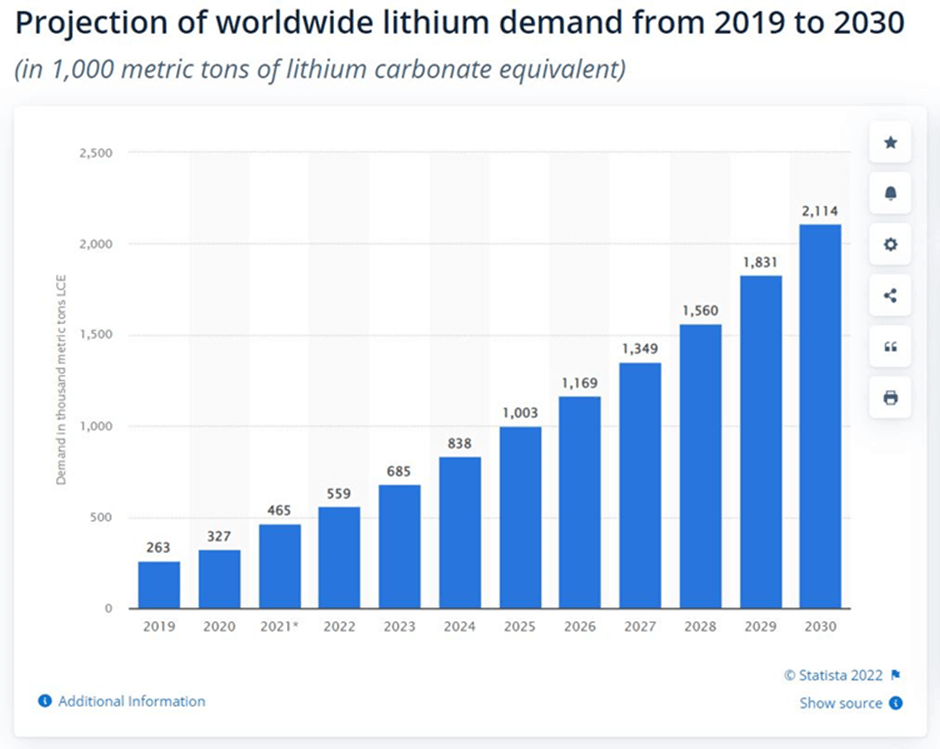

Here is one more data point from Statista: projection of worldwide lithium demand between 2019 and 2030:

The IEA has said that by 2025 the world could face a lithium shortage and demand for lithium could triple in the coming years, which means that the supply of lithium would be stretched.

This is the projected demand for lithium:

We conclude that a supply deficit is very likely to hit by 2025.

Lithium market forecast 2023

Because of all of the above we believe that lithium stocks are the place to be in 2023.

That’s also what LIT ETF shows: a wildly bullish W reversal in 2022 which will set the stage for a bullish wave in 2023.

What stands out on the LIT ETF price chart shown above is the higher low in September against June. This is a very bullish setup.

Moreover, let’s not forget that LIT ETF holdings are mixed. The ETF does not only contain pure play lithium stocks. That’s why a diligent lithium stock selection methodology is crucial for success!

How to profit from this bullish lithium prediction?

Because of the coming deficit in the lithium market, the booming lithium price and softening conditions in broad markets, we believe that lithium stocks are the place to be in 2023.

In our research note “Lithium & Graphite top stock selection” (available in the restricted area of our Momentum Investing service) we have outlined the structure that the market is following. There are multiple criteria that play a role when selecting a lithium stock:

- Size of the lithium deposit.

- Richness of the lithium deposit.

- Expected year of production.

- Production volume.

- Cost of production.

- Offtake agreements.

We have taken all those inputs into consideration and found a consistent pattern. Moreover, we mapped it against the stock charts of our lithium stock selection. There is a very clear pattern in our findings, there are very clear conclusions coming out our research.

We highly recommend investors with an interest to gain exposure to lithium stocks to read our lithium market research note. Essentially, we did the lithium stock selection for our members and leave the decisions up to members. Members can take their decision based on their risk appetite, time horizon and available capital, we provide the research material with the best lithium stock picks.