The rising demand for AI products is matched by ongoing innovations in the AI sector.

This dual momentum is bolstering the resilience and appeal of AI stocks.

See related: Our top AI stocks for 2024

As companies embrace AI solutions, the market envisions sustained growth, fostering increased confidence and investment in this dynamic industry.

Last week, Micron Technology Inc. (MU) saw a 6.24% uptick following the release of the Q1 2024 financial results.

Today, Micron reported our FY24 Q1 financial results. Learn more: https://t.co/eFEx1d0TCd pic.twitter.com/cS2AQzXouI

— Micron Technology (@MicronTech) December 20, 2023

Surpassing the expected $4.4B Q1 revenue, Micron reported $4.73B, exceeding analysts’ predictions by 1.47%.

CEO Sanjay Mehrotra anticipates ongoing improvements in Micron’s business fundamentals throughout 2024, fueled by increased demand for memory content in AI-enabled devices.

Looking ahead to Q2 2024, the company aims for a revenue of around $5.3B.

Check out @MicronCEO’s CNBC interview where he talks about our better-than-expected Q1 FY24 results and how AI is boosting memory demand! https://t.co/VW6cfAHgQd pic.twitter.com/AZOoONGEhG

— Micron Technology (@MicronTech) December 21, 2023

The company’s future appears promising with a focus on new product launches using advanced technology.

The advanced DRAM and NAND technologies are expected to reduce costs.

Additionally, Micron plans to transition to D5 and initiate 1-gamma DRAM production in 2025.

These positive fundamentals support the following technical bullish MU price prediction for 2024.

MU Stock Forecast 2024 – Upward Trend Signals $110 and Beyond

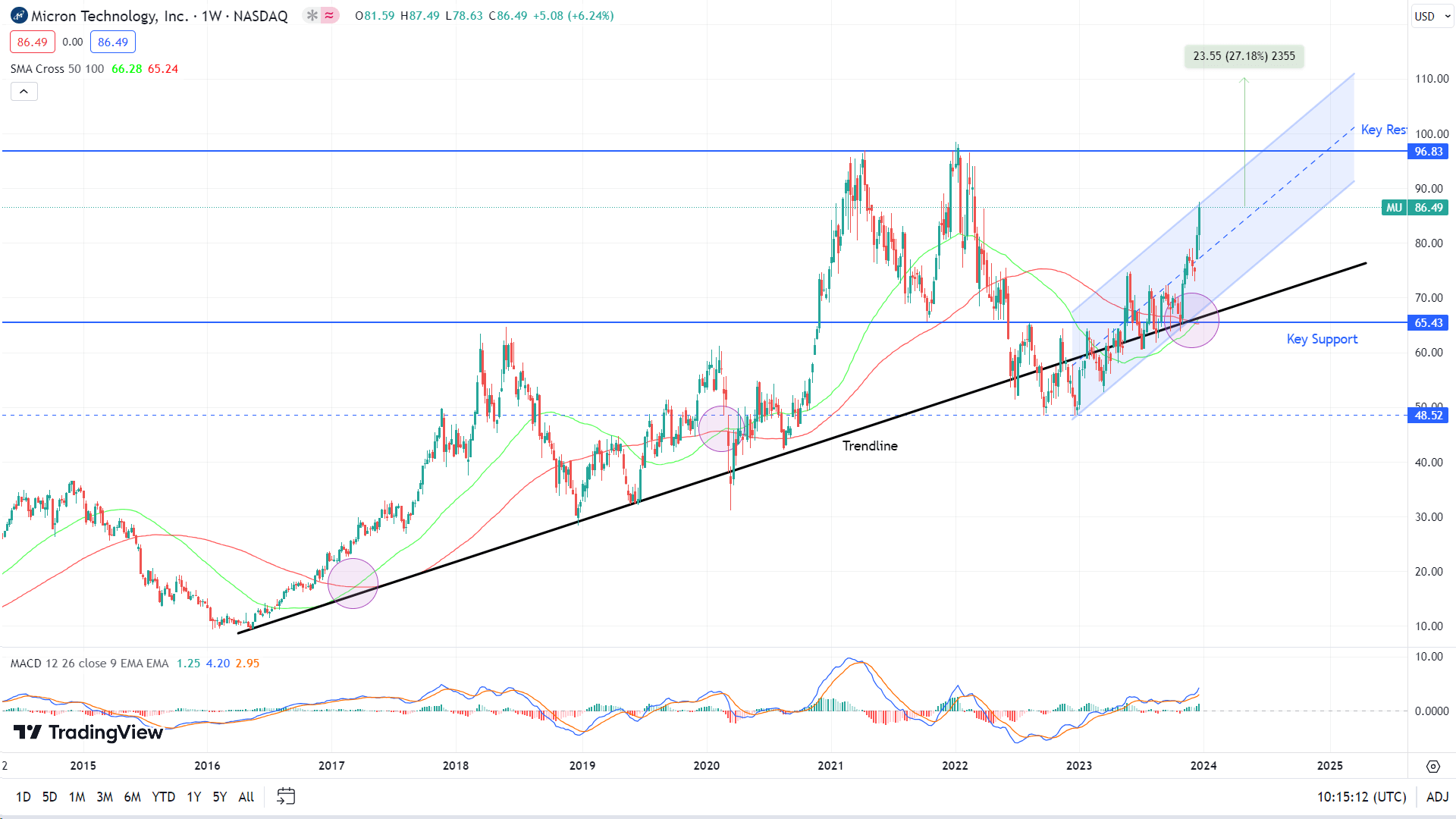

The weekly chart analysis of Micron Technology Inc. (MU) shows signs of upward trend continuation.

The prices have been moving in the ascending channel since the beginning of this year and have risen by about 82%.

The analysis indicates further upward movement, potentially reaching a new all-time high of $110. This projection represents a significant increase of about 23.5% from the current price level.

However, the $96 level could provide major resistance before reaching the targeted $110 level.

The prices have previously failed to move past this level, making $96 a key resistance level.

The recent SMA cross on the weekly chart reinforces the upward trend resulting from the collision of the 50SMA and 100SMA.

Based on previous SMA crosses (purple highlighted areas), the prices experienced huge price increments.

This raised optimism for reaching a target level of $110 and above.

Another technical indicator supporting this positive MU price prediction for 2024 is the MACD histograms.

They are already formed above the zero line and are picking volume, suggesting the strength of the upward trend.

See also: Stock forecasts for COIN | META

Summary

AI stocks are one of the hottest sectors in the market.

One could argue that they are even propping up overall market sentiment to keep the bull run alive.

Our MU stock forecast appears bullish for 2024, and is certainly one of the more intriguing AI stocks.

Disclaimer: this is not financial advice. Here at InvestingHaven we like to use technical and fundamental analysis to make educated predictions. Prior to investing, please DYOR (do your own research) and consult a licensed financial advisor.