Analysts at UBS forecast that On Holding’s profits will increase significantly over the next five years.

It is expected that the organization’s emphasis is on innovation, athletes, and its direct-to-consumer division will lead to significant growth.

In addition, the company could generate an exceptional compound annual growth rate (CAGR) of 45% in earnings per share (EPS) throughout the following five years.

$ONON…. Someone is starting to buy this stock👍👍💯…. already … this morning… That did not take long📈… pic.twitter.com/shtSZfJ4jg

— Marty Chargin (@MartyChargin) December 22, 2023

This remarkable performance, according to analysts, will likely surprise the market and result in outperforming stocks.

See related: Stock forecasts for COIN | META

The latest quarterly revenue and earnings exceeded Wall Street’s projections, resulting in an upward adjustment of the revenue guidance for the entire year of 2023.

The revenue growth percentage that is reported underestimates the true performance of the company, as constant currency sales increased by approximately 58% annually.

Quarterly revenue and adjusted EPS for On Holding amounted to approximately $525 million and $0.22 US Dollars, respectively, exceeding the revenue forecast of $508 million and adjusted EPS of $0.17 put forth by Wall Street.

Strengthening to 59.9% from 57.1% in the corresponding period of the previous year, the gross margin demonstrated the company’s industry-leading performance.

Nike, a leader in its industry, disclosed a gross margin of 44.2% for the quarter that concluded on August 31st.

Should you invest in ONON?

Let’s first see the upcoming price direction of this stock from our ONON technical analysis.

On Holdings Stock (ONON) Could Rise After Another Liquidity Sweep

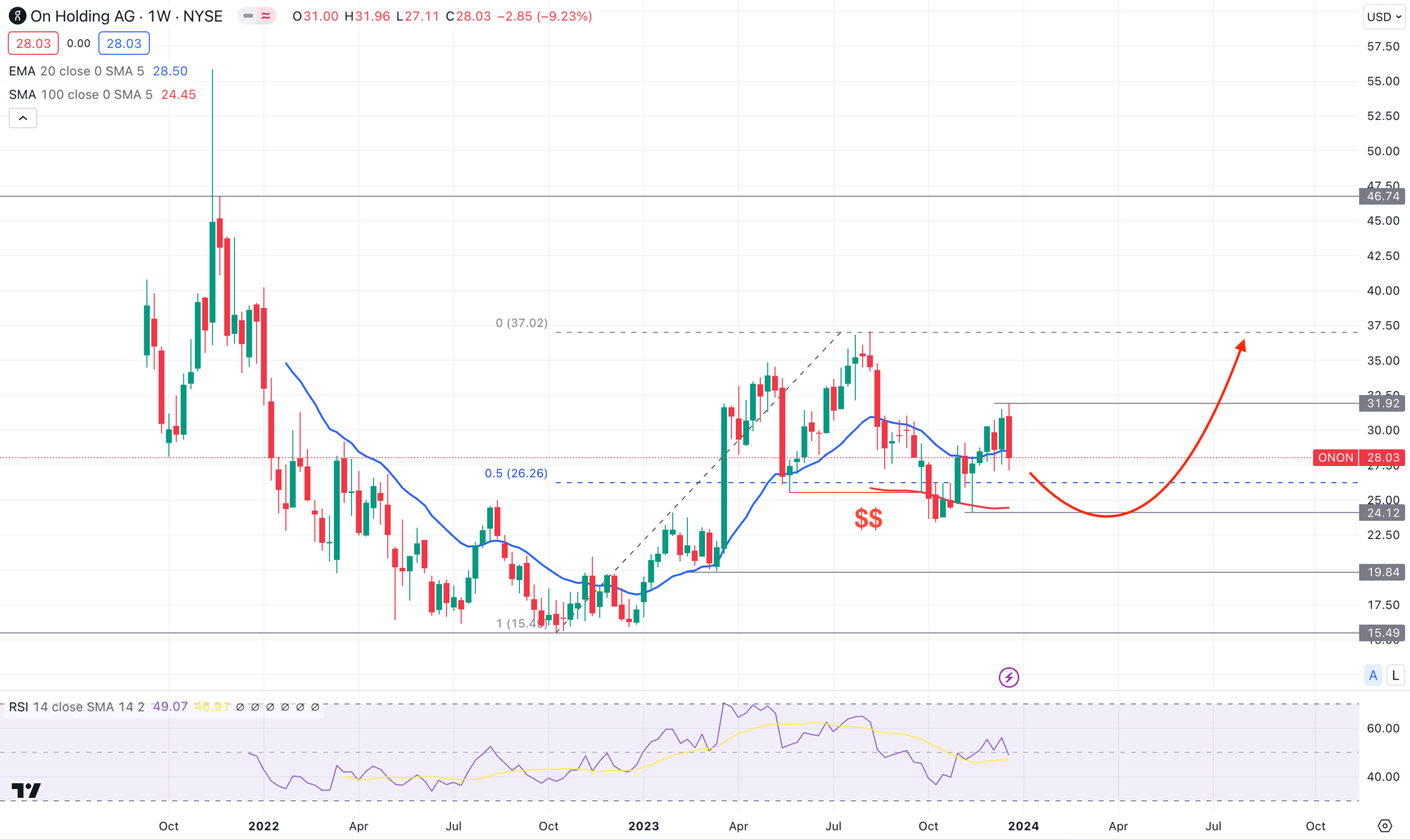

In the weekly ONON stock, the broader market represents a decently long opportunity as the most recent price has yet to reach the crucial discounted zone and form a sell-side liquidity sweep.

The 50% Fibonacci Retracement level from the 15.49 low to the 37.02 level is spotted at the 26.26 level, which is below the current price.

The ideal buying approach is to look for a long opportunity from the discounted zone, which could come after violating the 26.26 level.

The monthly candlestick suggests a strong bullish continuation opportunity, as the December 2023 candle came with a bullish inside bar.

Moreover, the November close came with a primary bullish indication as an engulfing pattern, which could attract bulls in the lower timeframe.

$NKE and $ONON basically trading with the same P/E multiple yet $ONON is growing 3x faster. $NKE needs to think about using their richly valued stock to do some acquisitions… $DECK or $ONON both make sense for different reasons. pic.twitter.com/5NXdV9fBQ6

— Jonah Lupton (@JonahLupton) December 21, 2023

Coming to the weekly chart, the 100-week SMA line works as a crucial support as it starts moving higher after the clear flat pattern.

Moreover, the dynamic 20-week EMA is closer to the current price. As the recent price hovers at the 20 EMA area, it might provide a long opportunity after grabbing sufficient liquidity.

In the secondary window, the 14-day Relative Strength Index (RSI) remains corrective at the 50.00 line, which indicates a corrective price action.

Based on the weekly price prediction op ONON, a bearish correction and a bullish reversal from the 24.12 level could be the primary long opportunity.

In that case, the conservative approach is to wait for a bullish weekly candlestick formation above the 20 EMA.

However, a deeper discount is possible below the 24.00 level, which might offer an additional long opportunity from the 22.00 to 18.00 zone.

On Holdings Stock (ONON): A Death Cross Continuation?

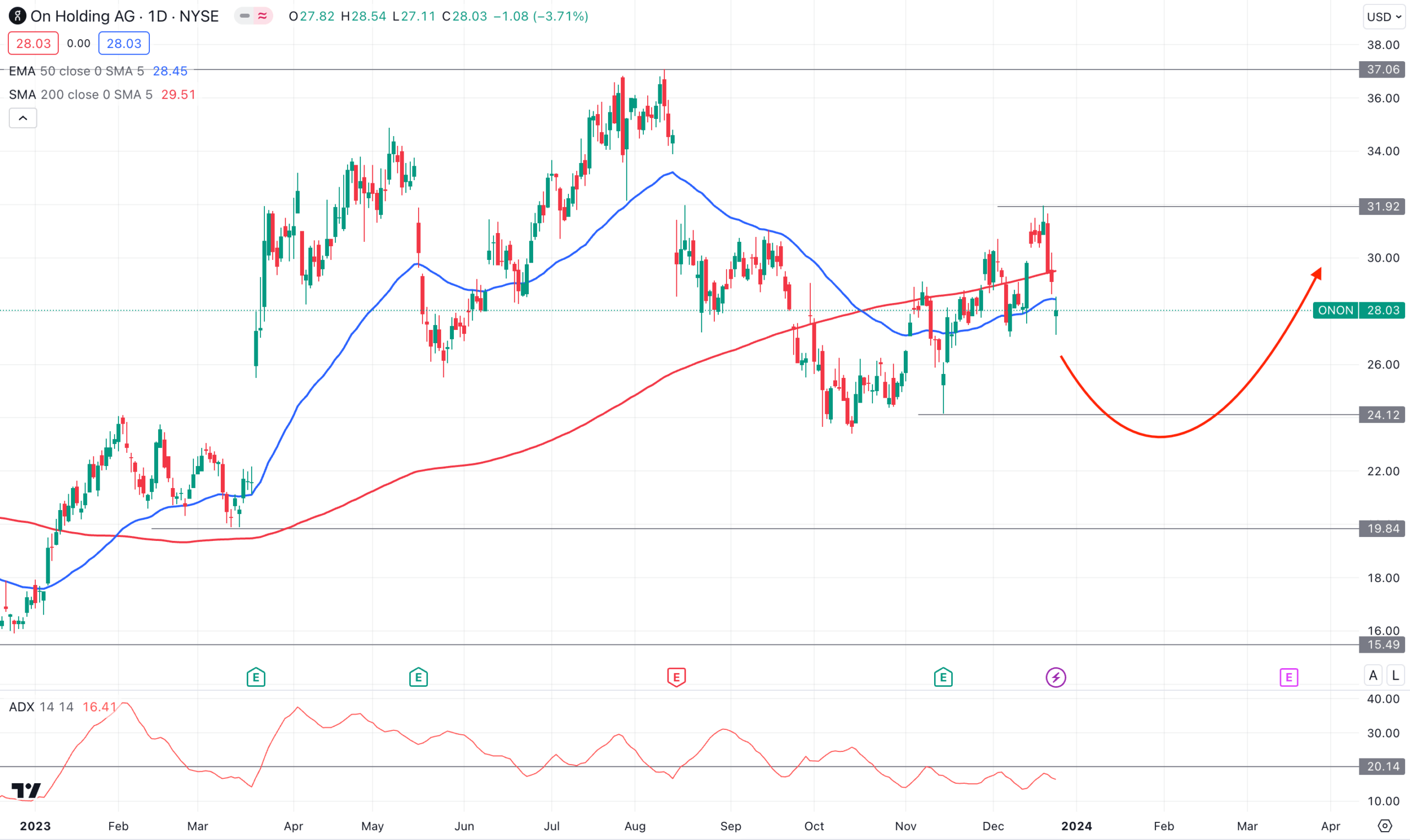

In the daily chart of ONON, the current price trades sideways below the 200-day Simple Moving Average, while the 50-day EMA is the immediate resistance.

It is a sign of a death cross formation, which could work as a bearish trend continuation opportunity.

In the secondary window, the current Average Directional Index (ADX) remains below the 20.00 line, which indicates a corrective market pressure.

Moreover, the lack of trading volume due to the holiday season could extend the consolidation in the coming days.

Based on the daily market outlook, the primary intention is to look for a continuation of the bearish trend.

A daily close below the 26.10 level could activate the downside possibility, which might lower the price towards the 19.84 support level.

The alternative trading approach is to wait for a bottom to form and have the 50 EMA above the 200 SMA.

In that case, the bullish Golden Cross could activate the long-term bullish activity, which could increase the price towards the 37.00 area.

Really like the way this is setting. Refusing to break this gap. In this mini channel right now. Looking for this spot to confirm tomorrow. If you check out the weekly it has this inverse head and shoulders look within the larger IPO pattern with weekly pivot above $31. $ONON pic.twitter.com/jqR47aJXaT

— jmoneystonks (@jmoneystonks) December 19, 2023

On Holdings Stock (ONON): Ichimoku Cloud Analysis

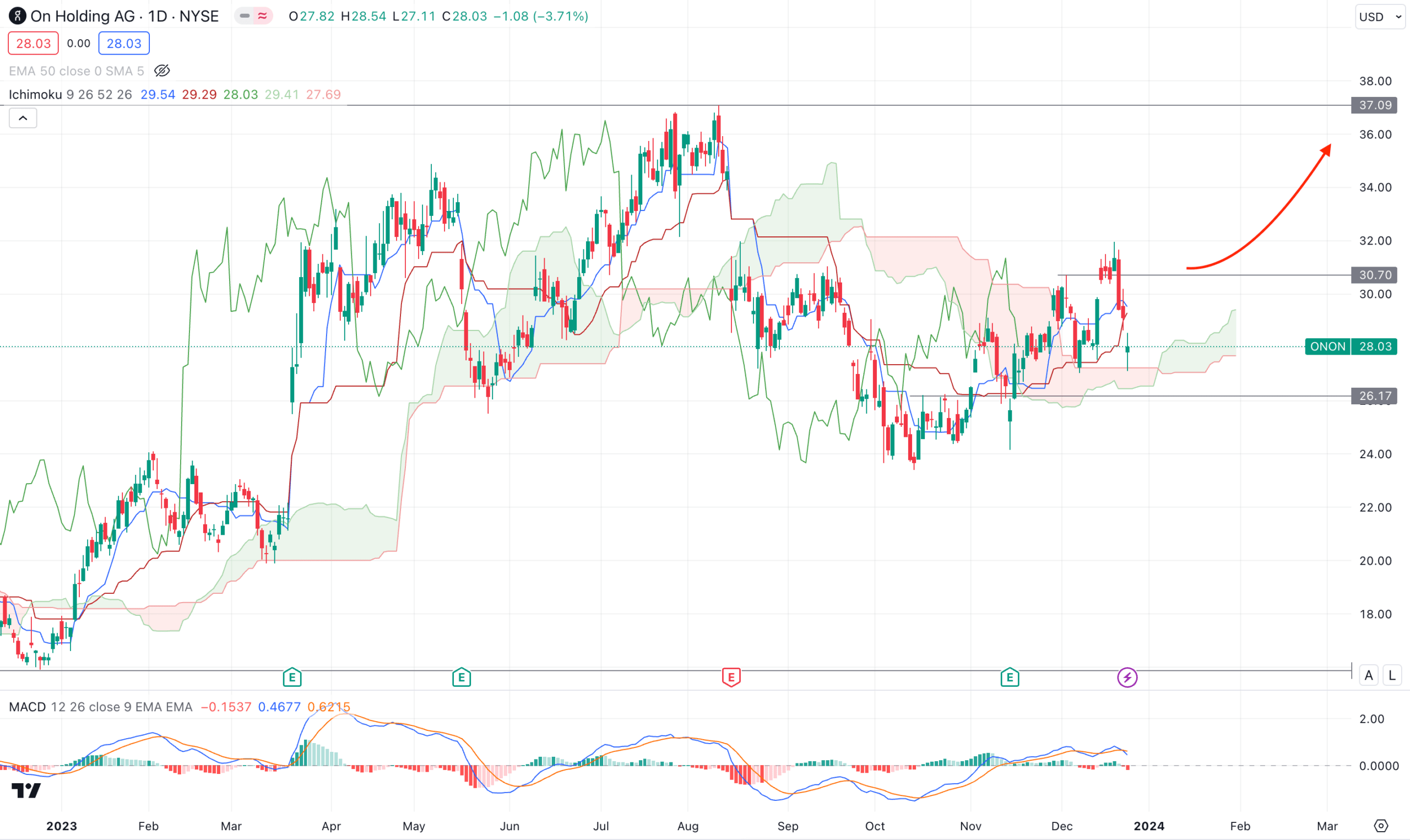

According to the ONON Ichimoku Cloud outlook, a stable market is seen above the Cloud zone, which is a strong bullish indication.

Moreover, the future cloud indicates a stable buying pressure as the Senkou Span A is above B.

A divergence is seen between the MACD Signal line and price, which signals a minor selling pressure in the market.

In addition, a bearish daily candle is below the dynamic Kijun Sen, while the MACD Histogram is corrective at the neutral zone.

Based on this structure, a bullish recovery with a daily candle above the 30.70 high could offer a decent long opportunity in this stock, targeting the 37.00 level.

On the other hand, a deeper bearish correction and a daily close below the 26.17 level might extend the downside possibility toward the 20.00 area.

Is On Holdings Stock (ONON) A Buy?

Based on the current multi-time frame analysis, ONON has a higher possibility of offering buying pressure once the sell-side liquidity sweep is over in the weekly chart.

However, investors might find an early buying opportunity after the valid recovery from the daily Kijun Sen support.

Still, we view ONON as a decent fitness stock to add to the long-term portfolio.

Mover over, Nike, there’s a new sheriff in town.