Nickel has firmly established itself as a key player in the commodities sector, driven by its critical applications, especially within the rapidly growing electric vehicle (EV) industry. Investors and industry analysts are increasingly focused on whether nickel prices will sustain their upward momentum into 2024 and 2025.

This article explores the nuanced balance between short-term supply challenges and long-term demand, primarily influenced by the EV revolution. Although nickel is part of the green battery metals super cycle, it remains less prominent compared to lithium.

Nickel: Short-term surplus vs. long-term EV demand

Nickel’s price behavior is shaped by a complex interplay of short-term supply factors and long-term demand trends, particularly within the expanding EV sector. Recent analyses provide a snapshot of these dynamics.

Short-term challenges

As of mid-2024, recent reports indicate a continued short-term surplus in the global nickel market. According to ING Bank’s latest report, the market experienced a surplus due to an excess supply and a sluggish global economy impacting stainless steel demand. ING projects average nickel prices at approximately $21,000/t for the second quarter and $19,500/t for the third quarter of 2024. Despite these short-term pressures, nickel’s role as a critical component for the green transition, particularly in EV batteries, remains a significant factor.

Australian Resources & Investment also notes the challenges posed by increased Class 2 nickel production from Indonesia and China. Despite this, tight London Metal Exchange (LME) inventories highlight the ongoing importance of nickel in the energy transition. The demand for nickel, which enhances energy density and range in EVs, provides a positive outlook. Although short-term price forecasts have been adjusted downward, BMI’s long-term outlook anticipates nickel prices averaging around $27,000 per tonne by 2027.

Furthermore, Investing News highlights the ongoing impact of excess nickel supply and subdued demand, particularly from China. However, it anticipates a potential recovery in the latter half of the year, driven by economic incentives and growth in the battery segment. Long-term projections suggest that the battery sector will account for 41% of nickel demand by 2033.

Long-term resilience

Long-term demand for nickel remains robust, supported by the surging EV market.

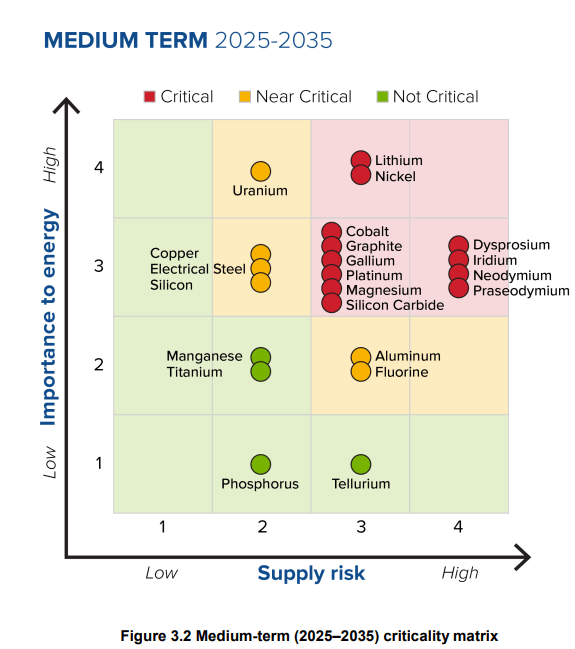

The U.S. Department of Energy’s Critical Materials Assessment, published in June 2024, categorizes nickel as a near-critical material. This classification emphasizes its growing importance in energy applications and supply risk. Nickel’s role in battery technology and energy storage continues to elevate its significance in the global market.

As per the research, on page 29, there are six critical materials in the short term, which include cobalt, dysprosium, gallium, natural graphite, iridium, and neodymium. The uses for these critical materials are spread across rare earth magnets, batteries, LEDs, and hydrogen electrolyzes. There are nine near-critical materials, which include electrical steel, fluorine, lithium, magnesium, nickel, platinum, praseodymium, silicon carbide, and uranium. Finally, there are seven noncritical materials including aluminum, copper, manganese, phosphorous, silicon, tellurium, and titanium.

Between the short term and medium term, the importance to energy and supply risk scores shifts for most materials. There are 12 critical, six near-critical, and four noncritical materials in the medium term. For example, the importance to energy scores for copper and silicon increase while their supply risks remain the same. In addition, supply risk scores for aluminum, iridium, manganese, neodymium, phosphorous, platinum, and SiC increase, while their importance to energy stays constant. Nickel increases in both importance to energy and supply risk. Dysprosium, on the other hand, falls in energy importance due to potential substitutions in the medium term but increases in supply risk, remaining a critical material. All other key materials remain in the same category from the short term to medium term.

We believe there is a solid case to be made that the short term supply surplus in the nickel market will be a short to medium term phenomenon. Long term, nickel will continue to be in high demand.

Nickel’s 25-year price trend

Examining nickel’s 25-year price trend reveals significant historical insights. The 2006 commodities boom saw nickel prices surge to $50,000/t, a level that mirrors the 2022 peak.

Nickel’s 10-year price trend

To project nickel’s price in 2024 and 2025, analyzing the past decade is crucial. The 10-year price chart reveals a prominent long-term trend channel, which has historically guided nickel’s price movements.

The potential of a W-reversal pattern, initiated by a price decline in early 2022, suggests a potential bullish outlook, further down the road, once nickel confirms a bottom at a much higher price than the 2020 lows.

This W-reversal pattern, characterized by a double bottom formation, indicates that if current support levels are maintained through 2024, nickel could experience significant price increases in the years ahead.

However, 2024 is not the year in which nickel will rise as the W-pattern is not ready to start its 4th leg.

Conclusion: Nickel’s future

Anticipating nickel’s price movements for 2024 and 2025 involves understanding its historical patterns, short-term supply issues, and long-term demand trends driven by the EV revolution.

While short-term projections may vary, nickel’s role as a key green metal ensures its resilience.

The shift from an established trend channel to a new W-reversal pattern provides valuable insights into potential future price movements. Investors should monitor these trends as the nickel market matures.