Our silver stocks outlook for 2023 and beyond is very bullish. We can’t make it any clearer than this. We assume that the base case in our silver forecast 2023 will materialize. However, if our silver forecast will entirely come true, we have to conclude that we are extremely bullish on silver stocks in 2023 and beyond. Only a doomsday scenario with an extreme and lasting stock market crash will invalidate our silver stocks outlook. As said, that’s not what we expect to happen.

[Editorial note: Most charts were updated on June 11th, 2023]

In this article we’ll conclude based on objective data points that silver stocks are looking really good as a long term investment. Our silver stock outlook for 2023 is very bullish.

We look at the silver stocks chart, also the junior silver stocks. We also look at two silver stocks ratio charts: we compare silver stocks with the price of silver and also with the S&P 500.

No matter how we look at this space, the bullish silver stocks outlook is confirmed.

Invalidation: a big market crash which seems unlikely. Yes, there will be periods with elevated volatility levels in 2023, but not a market crash as per our 2023 forecasts.

Silver market fundamentals

The fundamentals of the silver market are rock solid explained in Silver: A Divergence Of Epic And Historic Proportions. The physical market is flashing just one of the many bullish data points that we see in the silver market: Global Silver Demand Forecast to Reach a Record High in 2022 (source: The Silver Institute).

The global silver market is forecast to record a second consecutive deficit this year. At 194 Moz, this will be a multi-decade high and four times the level seen in 2021.

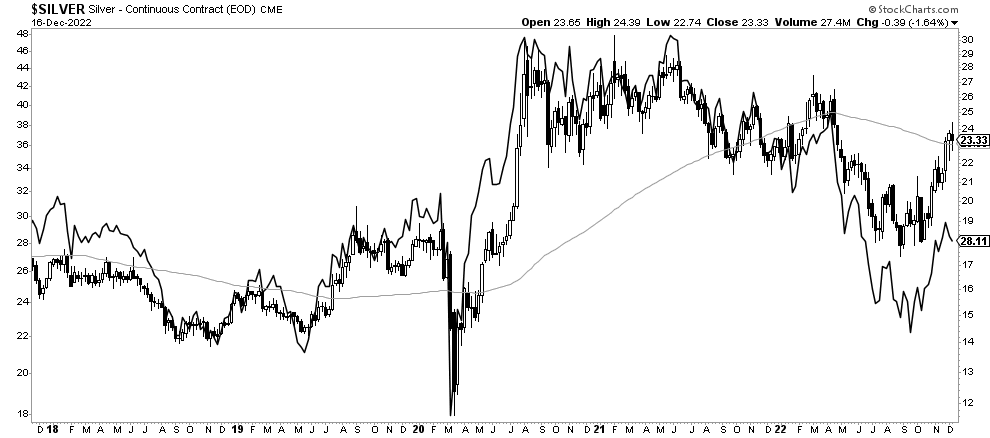

Silver miners lagging the price of silver

The price of silver went up significantly in October and November.

As seen on the first chart (on which the candlesticks feature the silver price) silver is now back at its long term moving average (the only one we are tracking). It should take a break here.

However, silver miners did not catch up to the same degree.

Yes, silver stocks went higher but are somehow lagging the price of silver as we head into 2023.

Chart update on June 10th, 2023: Silver miners are tracking spot silver. The upside in silver miners is huge, provided that spot silver is going to clear 28 USD/oz in 2023.

Stated differently, there is a window of opportunity in silver stocks, is what we conclude based on the first chart.

Silver stocks outlook and the silver stocks chart

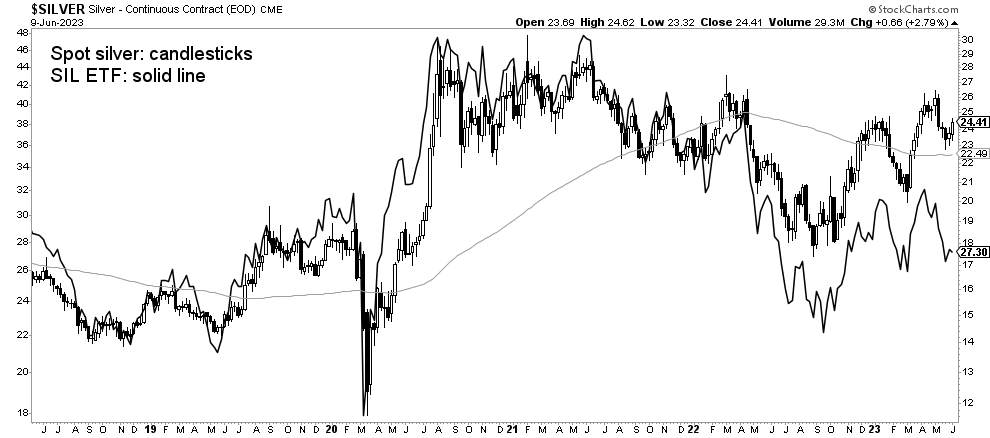

Based on strong silver market fundamentals we turn to the silver stocks chart.

We take the longest timeframe and use SIL ETF as our benchmark for silver stocks.

The chart is self explanatory if you consider our (few) annotations:

- A series of higher lows since 2016.

- Every dip came with a bull trap. Will this time be any different?

- Silver stocks tested the falling trendline that originated at the 2011 silver market top.

- 2022 might qualify as a bullish back test, is how we read this chart.

Provided 23 to 25 points in SIL ETF are respected in the first months of 2023, how can we not be super bullish on silver stocks? This one chart combined with the other charts in this post are a solid basis for a bullish silver stocks outlook in 2023 and beyond.

Chart update on June 10th, 2023: Silver miners are testing double support: the multi-year rising and falling trendlines.

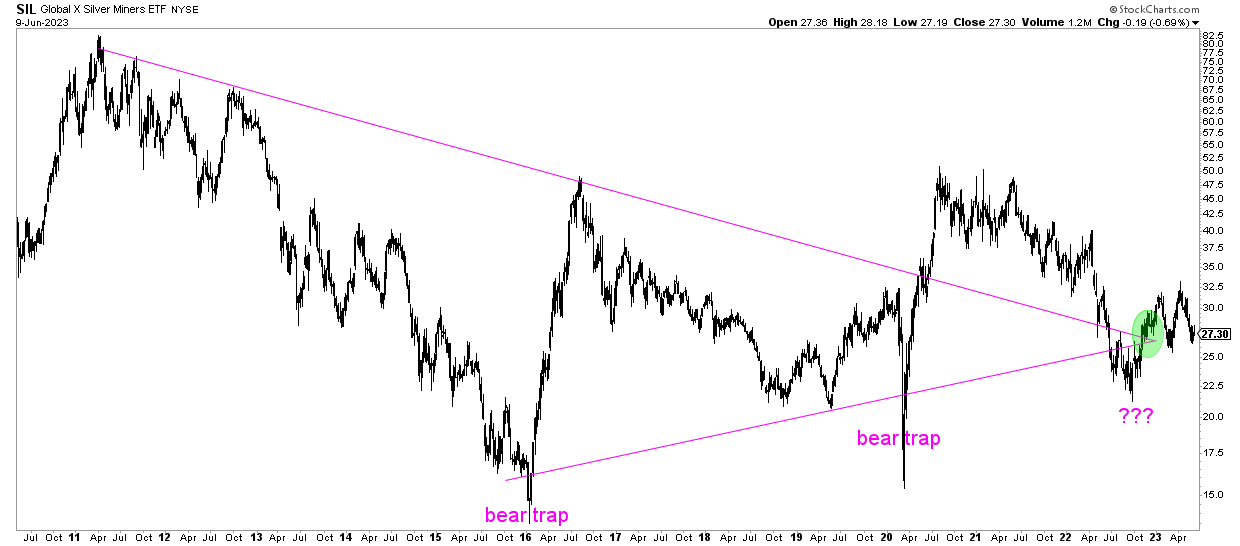

Silver miners relative to the silver price

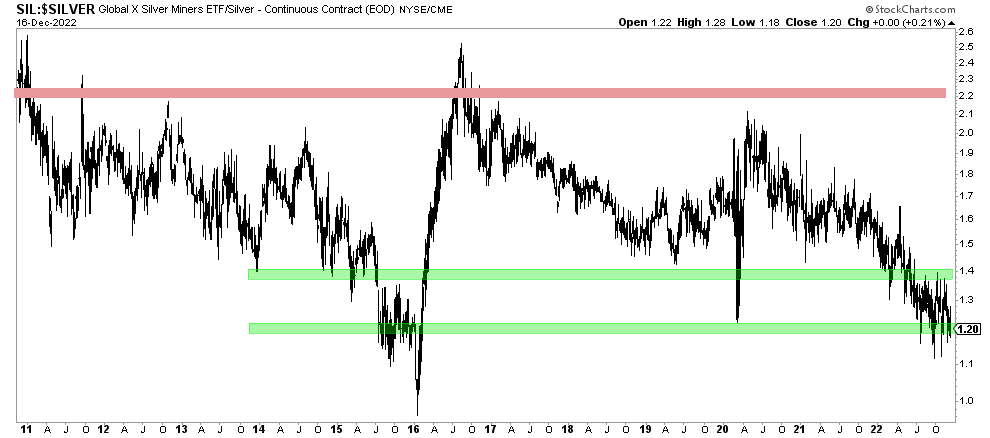

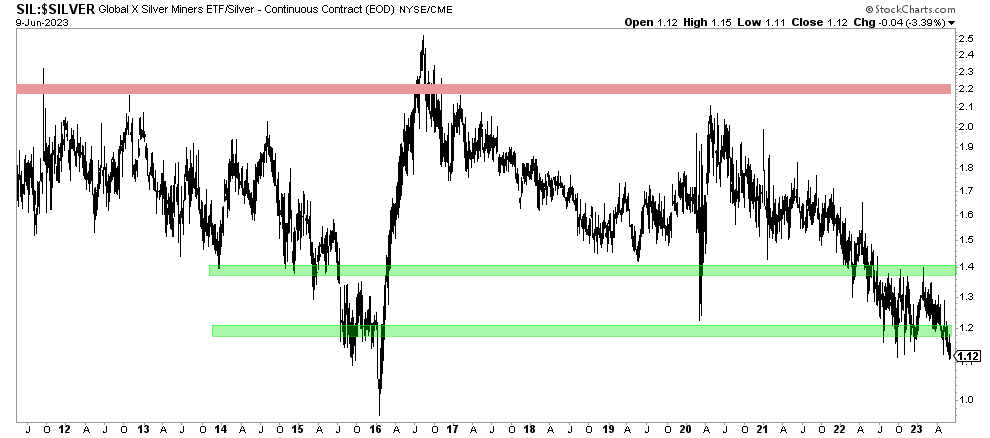

We’ll look at a relative strength chart: silver miners relative to the price of silver. The intention of this ratio chart is to understand relative strength of silver stocks vs. their leading indicator the price of silver. This gives a complementary view on the silver mining space. We use SIL ETF to represent silver miners.

From this article: Silver Miners To Silver Price Ratio Flashing Long Term Buy Signal

Every time this ratio dipped to the 1.20 area it marked the start of a big run in silver miners. In fact, there are 2 important levels to watch in the SIL to Silver price ratio chart: 1.4 and 1.2. Both are indicated in green. More specifically, once this ratio chart falls below 1.4 silver stocks start entering a very attractive area.

The chart says it all. This underpins our bullish silver stocks outlook for 2023 and beyond.

Chart update on June 10th, 2023: Silver miners in silver price terms are as cheap as back in the first months of 2016, before an epic really started. This low valuation, in relative terms, is taking a year to complete in the meantime. The upside is huge, provided that spot silver is going to clear 28 USD/oz in 2023.

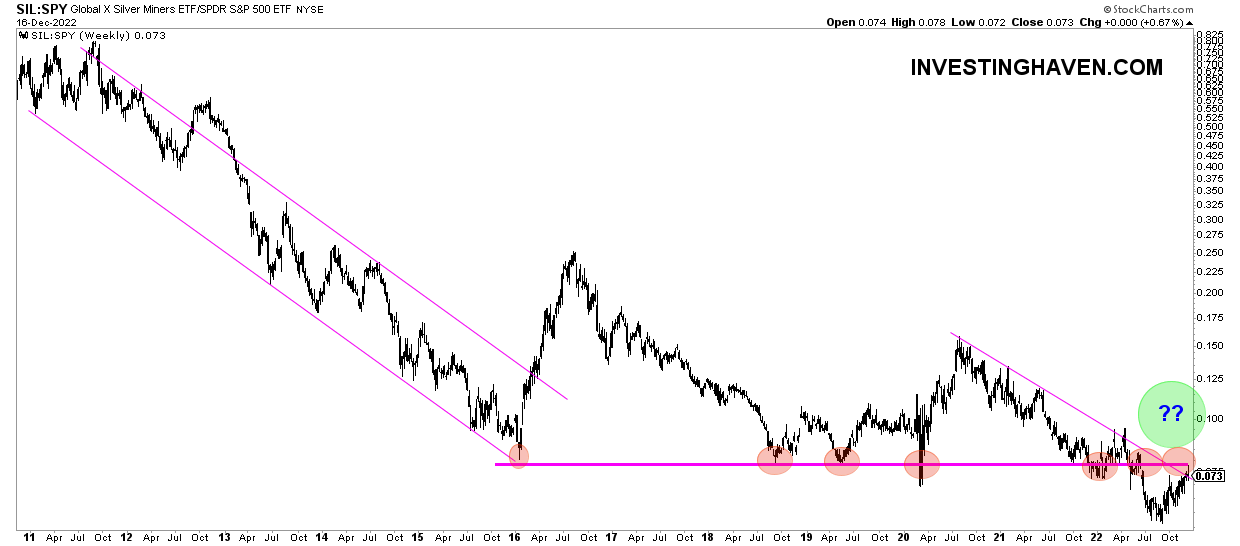

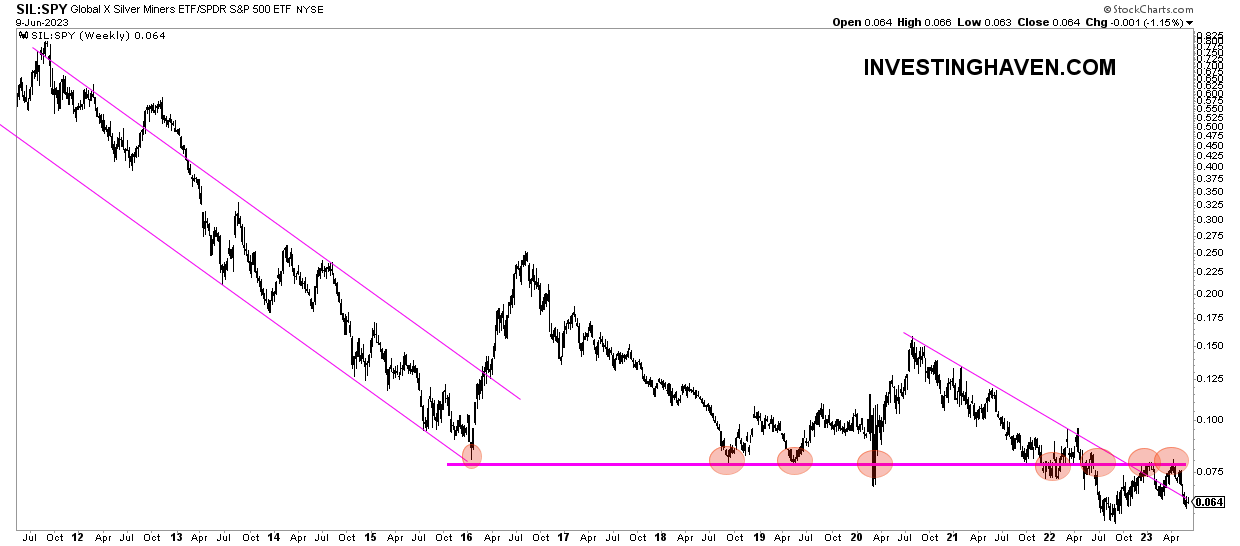

Silver stocks relative to broad markets

Another ratio chart we find value in is silver stocks relative to the S&P 500. This helps us understand how silver stocks, as a group, compare to the trend(s) in broad markets.

From this article Silver Miners To S&P 500 Ratio: An Epic Test Ongoing As 2023 Kicks Off:

The current reading of this ratio chart is hitting double resistance: the falling trendline and the 0.08 level. Resistance is and remains resistance until it’s cleared. On the flipside, imagine how much power will be unleashed once this double resistance is broken to the upside.

Stated differently: the first months of 2023 will be decision time for silver stocks!

Chart update on June 10th, 2023: Silver miners in SPX terms are as cheap as they have been in decades. The downtrend line is tested, the real breakout occurs once the thick horizontal trendline is cleared.

There is one potential scenario that we cannot exclude (we cannot bet on it neither): a W reversal that started mid-2016 which concluded the first part mid-2020. IF this pattern is in the making and IF current resistance is broken to the upside, we can reasonably expect a mind-boggling rally in silver miners going into mid-2024 approximately.

Silver stocks outlook: a select few junior silver miners will be explosive

So, no matter how we are looking at the silver mining space, we see (a) decision time is here (b) the start of a new uptrend is likely already in the making.

How to play silver stocks?

One thing we want to point out is the high risk associated with silver stocks investing. No matter how bullish our silver stocks outlook may be, the risk is there and elevated compared to other stock market segments. Stock picking is crucial for success, even then a promising silver stock may not deliver the desired results or may only deliver delayed results.

Please do not underestimate the risk.

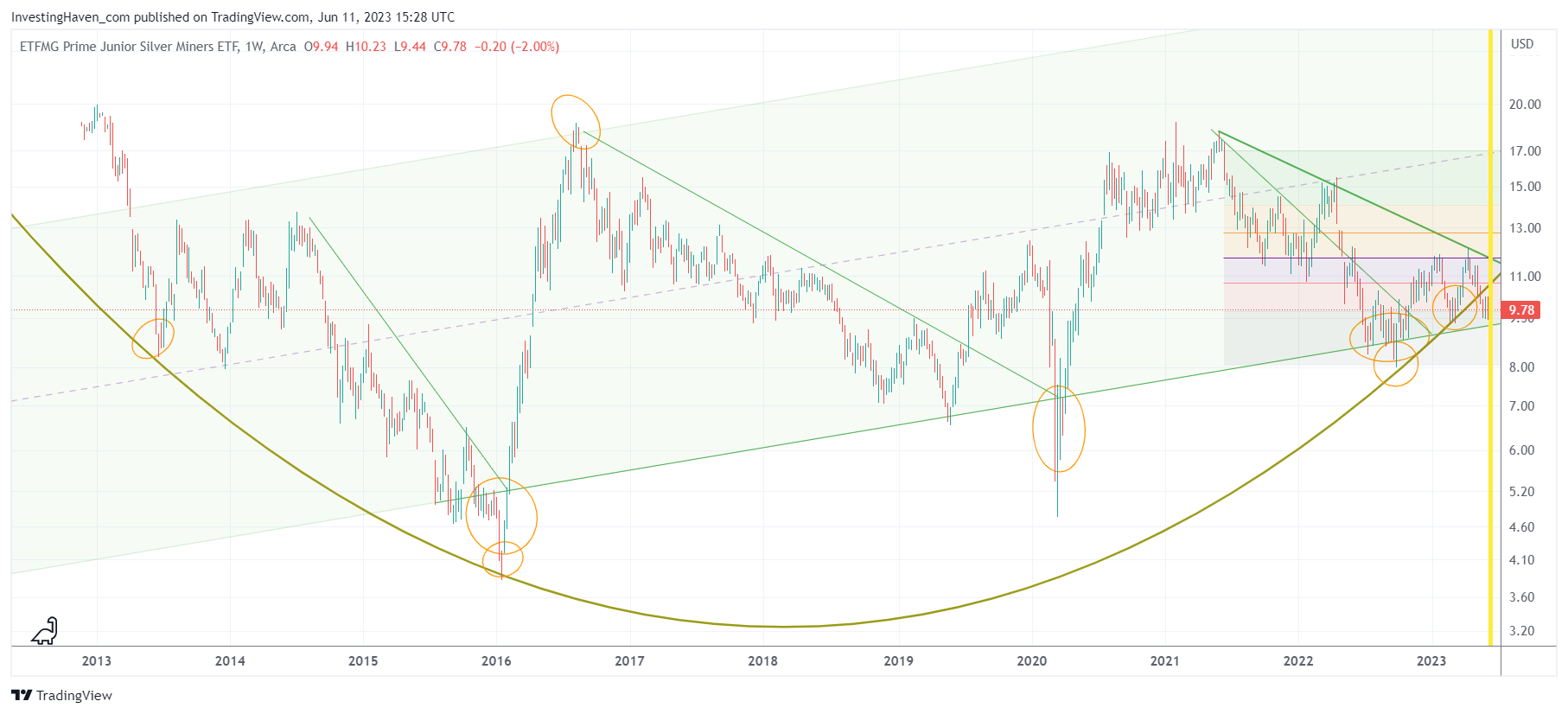

That said, there is one segment in silver stocks that looks explosive: junior silver miners.

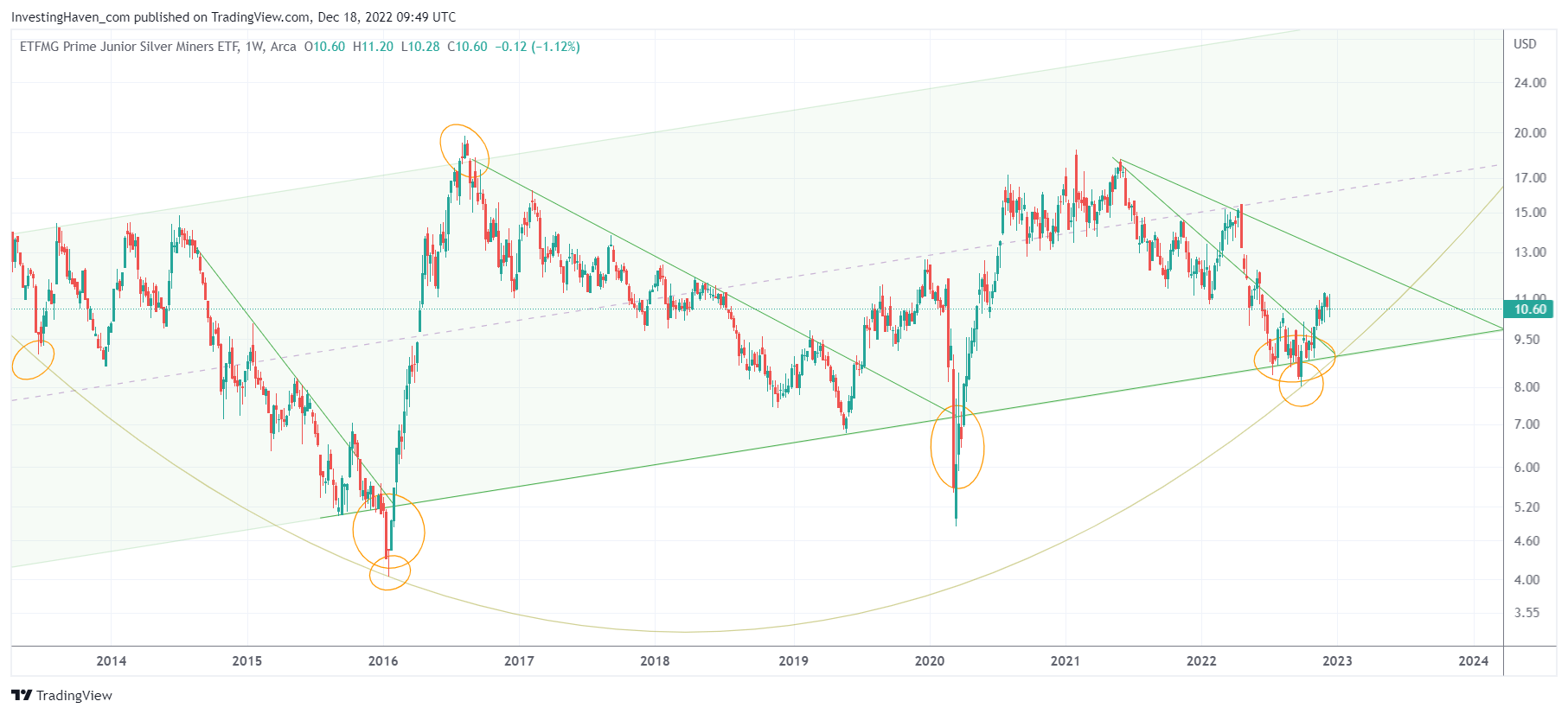

The chart below is the long term SILJ ETF chart, silver juniors, from this article: Why Junior Silver Miners Will Have An Amazing 2023.

The chart says it all: a major turning point occurred in 2022, this should underpin the thesis that a longer term new bull market in silver junior stocks started in October of 2022.

Chart update on June 10th, 2023: SILJ ETF, weekly timeframe, continues to test epic support. The longer support, the stronger. We cannot accept readings below 9 points in SIL ETF, certainly not on a 3-month closing basis. The upside is huge, provided that spot silver is going to clear 28 USD/oz in 2023.

Chart update on June 10th, 2023: SILJ ETF, weekly timeframe, continues to test epic support. The longer support, the stronger. We cannot accept readings below 9 points in SIL ETF, certainly not on a 3-month closing basis. The upside is huge, provided that spot silver is going to clear 28 USD/oz in 2023.