Whether you are looking for guaranteed long-term gains or simply want to preserve the value of your capital, there are endless reasons to buy gold. We explore three of these below.

In the last 12 months, Gold has moved from strength to strength, which was cultivated with a new price record for an ounce of gold, $3,505.

Moving forward, we are confident it will sustain this uptrend, possibly rallying to a new all-time high above $3,600. Such an impressive performance has sparked the debate on whether now is the best time to add the yellowstone to every portfolio.

Below, we look at three reasons why now may be the perfect time to buy and hold gold.

Gold Doesn’t Just Preserve the Value of Your Capital; It Helps It Grow

For more than a century, gold has been relied on as a store of value. In the recent past, however, gold has established that it can be used to grow capital.

It made this particularly clear when it rallied by more than 93% in the last 5 years, 43% in the last 12 months, and 29% in the year to date.

By 2030, our analysis indicates that gold prices will rally by more than 52% to reach $5,155, further confirming why it is worth adding to your long-term investment portfolio.

It is Less Susceptible to Volatility Compared to Other Assets

You will also want to buy and hold Gold today because it is less susceptible to market volatility. All it takes is one negative quarter performance for a stock to tank. Or a negative comment from a regulatory agency like the SEC for a crypto to crash.

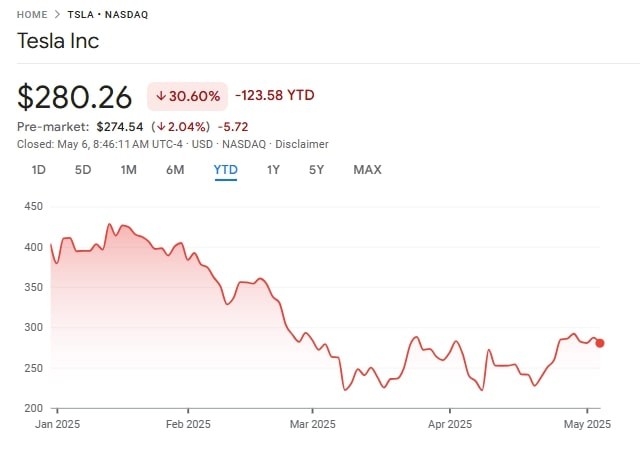

Take, for instance, Tesla stock, which is down by more than 30% in the year due to concerns over declining sales, increased competition, and CEO Elon Musk’s political engagements.

Bitcoin also crashed by more than 33% between late January and March, occasioned by aggressive trump tariff policies.

There is a Heightened Risk of Global Recession

Now is also the best time to buy gold because the global economy is headed for a recession. The IMF has already adjusted the economic outlook for the US downwards, from 2.7% to 1.8%.

Similarly, economic experts with global financial institutions, including JP Morgan and Goldman Sachs, opine that there is a 60% chance the world economy enters into recession in 2025. Prepare for this by investing in safe haven assets like gold.

Bottom Line

With its proven history of steady growth, resilience against market shocks, and strength in times of economic uncertainty, gold stands out as a smart hedge and growth asset.

Whether you’re hedging against volatility or preparing for a potential recession, buying and holding gold today could be one of the most strategic moves for long-term investors.

Join Our Premium Research on S&P 500, Gold & Silver — Trusted Insights Backed by 15 Years of Proven Market Forecasting

Unlock exclusive access to InvestingHaven’s leading market analysis, powered by our proprietary 15-indicator methodology. Whether it’s spotting trend reversals in the S&P 500 or forecasting gold and silver price breakouts, our premium service helps serious investors cut through the noise and stay ahead of major moves.

- Gold Retracing, Silver and Miners at a Critical Level (May 4th)

- The Precious Metals Charts That Bring Clarity Through Noise (April 27th)

- Highly Unusual Readings In Gold & Silver Markets (April 20th)

- Gold Miners Breaking Out, Here Are A Few Gold Stock Tips. What About Silver & Miners? (April 13)

- Gold, Silver, Miners – Bottoming or More Downside? (April 5th)

- Why Next Week Matters for Gold — But Less So for Silver (March 29th)