Crashing Chinese bond yields in recent weeks suggest that gold demand will remain elevated in China over the coming years, especially with gold the chart seeing a bullish structure.

Crashing Chinese bond yields are center stage in recent days and weeks – in the news:

- China’s bond market sees more economic pain ahead

- China’s cenbank warns mutual funds against feeding bond frenzy, sources say

- China’s short-term bond yields fall below 1% for first time since 2009

- China’s 10-year government bonds yield could drop below 1% in 2025: Aletheia Capital

The fall in bond yields which sees the 10-year and 30-year yields at record lows is due to surging demand for bonds which is a safe haven asset.

Crashing Chinese bond Yields

As more market participants buy bonds, the price of the bond is pushed higher which by default drops the yield.

RELATED – Must-see gold price chart on 50 years

Falling yields is due to higher demand for bonds and this typically happens when economic prospects are poor, hence the “slight to safety” trade.

Why would Chinese investors be rushing into a safe haven asset such as bonds and by extension, gold?

Between 2014-2024, China contributed 30.9% to global economic growth, outpacing India (16.1%) and the U.S. (9%). Recent economic challenges have significantly weakened this economic growth path. A part of China’s growth was the massive infrastructure projects which has showed to be an effective short-term economic driver but has become a longer-term drag on the economy because of the overcapacity from building too much too soon.

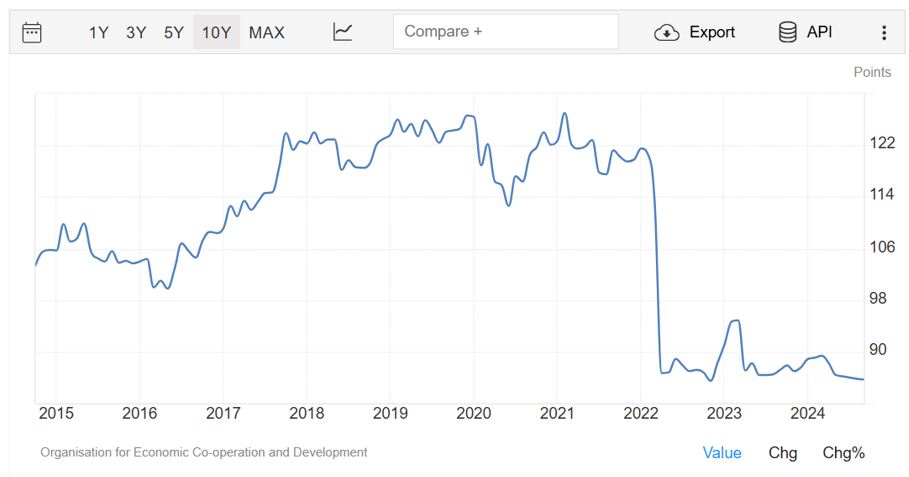

Crashing consumer confidence

Bucking the trend of the western economies, China has seen some months of deflation recently with an overall inflation rate of 0.2% in late 2024. While deflation is good for the consumer, it leads to lower revenues for businesses which then must commit more of their sales to paying off debt which will impact future investment and profitability for these firms. Lower asset prices such as real estate can impact economic sentiment as households see their wealth declining with a lower housing market.

Less property prices and land sales have exacerbated local government revenue challenges as they see reduced incomes that they rely on to repay debts. Consumer confidence in China has not managed to recover from the aggressive lockdowns causing confidence to remain very low since 2022 with no immediate sign of this recovering.

Importantly, when households are pessimistic about the future, they respond by saving more of their income rather than spending it. This has two obvious effects, firstly less spending leads to lower business sales which compounds the low-growth and low-confidence problem. Secondly, households are very likely to opt to store their savings into the salvation of physical gold which, in turn, will lead to higher gold demand in China.

Gold and the risk-off trade

This is the first tailwind for the gold market because as consumers are fearful of their economic futures, their savings ratio increases and much of that excessive saving will be channeled into physical gold purchases.

RELATED – Gold forecast 2025

Moreover, on a larger scale, there is clear evidence to suggest that the Chinese state is concerned about the public finances as UK export data shows the People’s Bank of China was secretly buying gold during the reported 6-month gold buying pause in late 2024. Perhaps the purchases were in secret as the government did not want to increase public anxiety during a time of low confidence and panic.

Whilst Chinese state gold buying is likely a de-dollarization strategy, this may also be a sign that the Chinese state is concerned about their economy and may want to stockpile gold in case they need to defend the value of the Yuan in the future.

Save haven assets are in demand in China

The second demand boost for the gold market comes from what falling bond yields signal. Investors flock to the safety of bond markets when the future economic prospects are deteriorating.

This is a clear sign that economic conditions are set to get worse in China and during these periods. Risk-on assets such as real estate and equities generally are out of favor; risk-off safe haven prospects such as bonds fare very well. If Chinese bond investors are correct about what they expect in the Chinese economy, this will only strengthen local gold demand.

Gold is considered by analysts as the ultimate safe haven asset and is positioned to see further capital flows from Chinese institutions and private investors looking for a recession-proof asset to store their wealth.

Gold trades close to ATH in all major currencies. However, Chinese consumers are unlikely to see a better asset to shield them from any negative impacts from the Chinese economy.

Lower Yields, lower opportunity costs

The third boost to the gold price is that lower interest rates reduce the risk-free return of saving accounts. Will less interest being paid for this type of investment; gold will be a beneficiary.

The largest risk to the gold price is positive real interest rates. This is less likely as the interest rate falls. By buying gold bullion, lower interest payments will ensure that the opportunity cost to holding bullion is low. This, in turn, favors buying gold.

Written by Levi Donohoe.