Gold hovers near $3,395, facing resistance at $3,425; a breakout or pullback hinges on geopolitical and macroeconomic shifts.

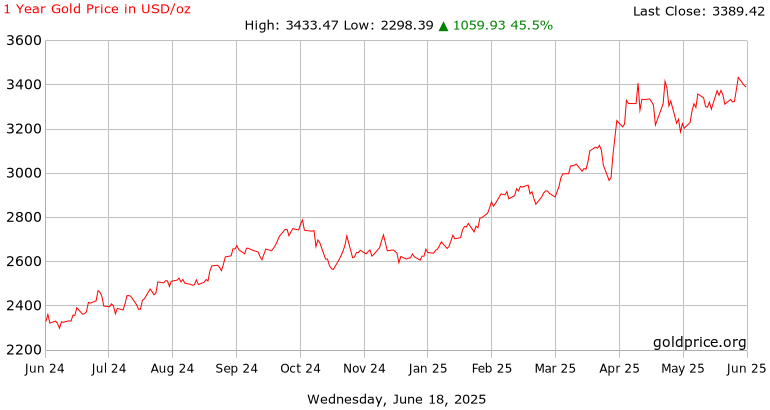

After cresting near $3,434/oz, gold briefly pulled back 0.5% to around $3,414 as traders locked in profits amid escalating Middle East tensions and is currently trading around $3,389.

With gold hovering at all‑time highs, the critical question now is whether this rally can endure—or if a correction is imminent.

Technical Snapshot: Struggling to Break Clear

Technically, gold is balancing precariously. The 50-day EMA (~$3,385) and 100-day EMA (~$3,368) offer immediate support, while resistance hovers at $3,415 and the prior April peak at $3,425.

On the daily chart, RSI is moderately bullish in the mid‑50s, yet MACD shows signs of tapering upward momentum.

A failure to surpass $3,415–$3,425 could trigger a retracement toward $3,350–$3,378, with Fibonacci retracement levels reinforcing that zone.

Fundamental Underpinnings: Macro and Geo‑Tensions

Geopolitical uncertainty—particularly in the Middle East—continues to drive safe-haven inflows, providing a consistent floor for gold. Concurrently, a weakening U.S. dollar, fueled by dovish expectations for Fed rate cuts, increases gold’s appeal.

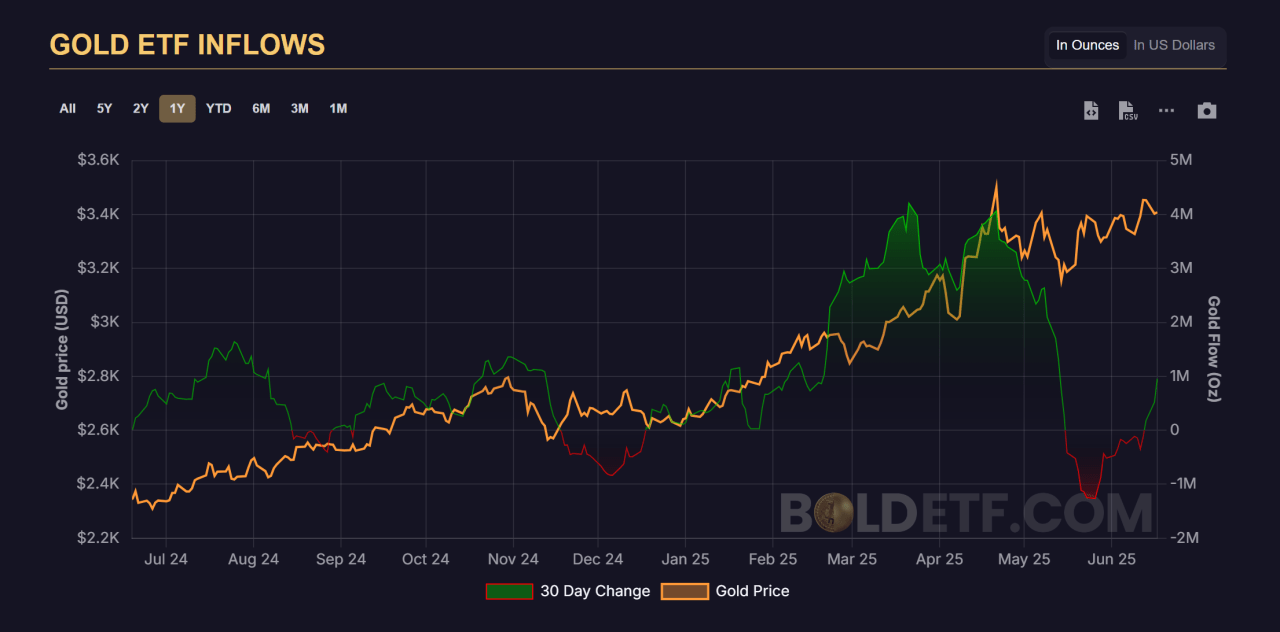

Central bank purchases and ETF inflows remain solid, but rising Treasury yields may cap upside if growth optimism takes hold.

Outlook: A Crossroads Between Pullback or Breakout

A consolidation back under $3,350—particularly below the 50‑day EMA—could open the door for a deeper pullback to $3,300–$3,320, or even $3,150, if U.S. economic data strengthens.

On the other hand, a decisive breakout above $3,425 would likely extend the rally, targeting $3,500 and beyond, as inflation-adjusted breakout dynamics remain bullish.

Conclusion

Gold’s near-term trajectory hinges on which side of the $3,350–$3,425 corridor wins out. A clean break below would favor a pullback, while a sustained move past $3,425 would signal fresh upside.

Given this tug-of-war, disciplined, defined-risk strategies—buying dips around support or fading failed breakouts—remain prudent. Watch the price action and stick tight to your risk parameters.

Our most recent alerts – instantly accessible

- Gold & Silver Shine but Not Simultaneously… The Market Loves To Confuse Investors (June 15)

- Silver On Its Way To 50 USD/oz (June 8)

- Precious Metals: The Long-Term Outlook Looks Profitable, Here Is Why (May 31)

- [Must-Read] Spot Silver – This Is What The Charts Suggest (May 24)

- Gold Close To Hitting Our First Downside Target. Silver Remains Undervalued. (May 18)

- A Divergence In The Precious Metals Universe (May 10)