A combination of a sharp increase in gold price and a decline in industrial metal prices signals growing fears of a recession ahead.

The gap between gold and industrial metals has widened dramatically in 2025—gold has surged over 40% year-to-date, while metals like copper, aluminum, and zinc are down nearly 10%. This decoupling has caught the attention of investors and economists alike.

Is this simply a reaction to global uncertainty, or a broader macro signal that a recession is looming?

Technical Divergence Signals Stress

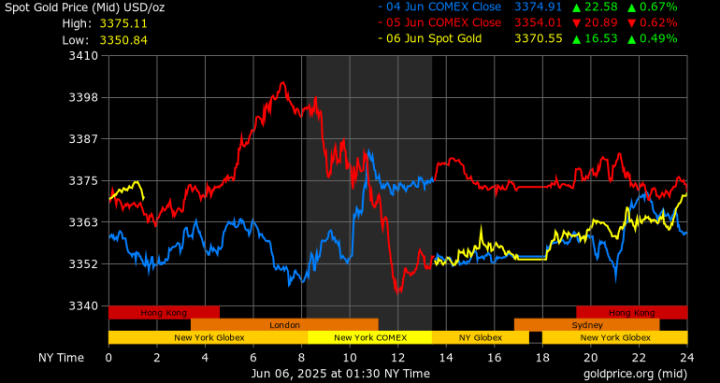

Gold’s sharp rise has broken key technical resistance levels, trading well above its 200-day moving average—historically a pattern seen ahead of economic downturns, such as in 2018 and early 2020.

In contrast, industrial metals, typically correlated with growth in construction and manufacturing, have lagged significantly. Copper prices, often a bellwether for global economic activity, have struggled amid weak demand from China and a slowdown in global infrastructure investment.

This classic divergence—safe-haven rally vs. cyclical slump—suggests growing market fears of a slowdown.

Macro Fundamentals Are Fueling Gold’s Rally

The fundamental case for gold remains strong. Central banks have collectively purchased over 1,000 tons in 2025 so far, driven by de-dollarization and geopolitical hedging.

Inflation remains sticky in both developed and emerging markets, with CPI and PCE readings above central bank targets, further supporting demand for hard assets like gold.

Meanwhile, the U.S. dollar has weakened—DXY fell below 99—adding tailwinds to commodity prices. On the flip side, industrial metals are weighed down by sluggish global growth forecasts and uncertainty around trade policy and energy costs.

Bubble or Bear Signal?

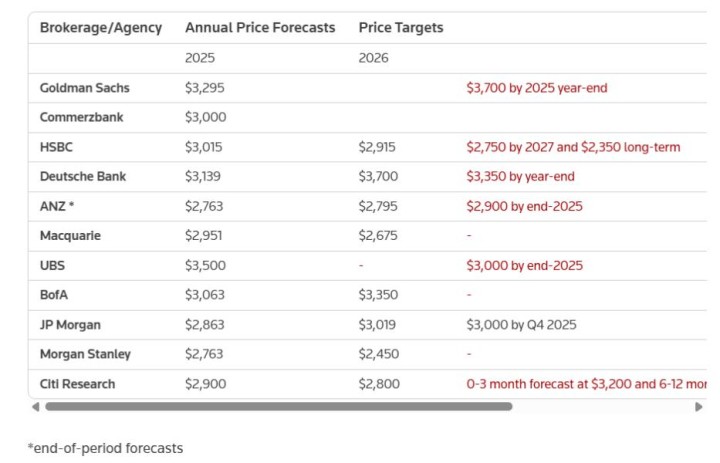

Forecasts for gold by Goldman Sachs stretch as high as $3,700 by year-end, with some analysts expecting a continued run into 2026.

Yet, caution is warranted— 49% of fund managers now view gold as the “most crowded trade,” according to a survey by Bank of America Securities. This suggests a potential correction if economic data surprises to the upside. If global activity rebounds, industrial metals may recover while gold loses steam.

Conclusion

While not a definitive recession call, the widening gap between gold and industrial metals is a clear macro signal worth watching.

Whether it’s fear-driven positioning or a true economic warning, upcoming economic data and policy signals will determine if gold’s rally is a hedge—or a red flag.

Our most recent alerts – instantly accessible

- Silver On Its Way To 50 USD/oz (June 8)

- Precious Metals: The Long-Term Outlook Looks Profitable, Here Is Why (May 31)

- [Must-Read] Spot Silver – This Is What The Charts Suggest (May 24)

- Gold Close To Hitting Our First Downside Target. Silver Remains Undervalued. (May 18)

- A Divergence In The Precious Metals Universe (May 10)

- Gold Retracing, Silver and Miners at a Critical Level (May 4)

Read more about our Gold and Silver market premium investing service here