In this post, you will learn how to invest in Gold. We will introduce you to the best ways to invest in gold and walk you through the step-by-step process of getting started. With gold stocks and gold ETFs.

We will also discuss gold’s past performance as well as its price forecast. We also explain what gold is and go over the different ways of investing in gold – from physical gold to gold futures.

Read on to learn everything you need know about buying gold for beginners.

How to Buy Gold – A 4-Step Guide

Here is a quick guide on how to buy Gold on eToro, an SEC-regulated and highly reputable multi-asset online brokerage. It has oversimplified the process of investing in gold, narrowing it down to just a few steps. Plus, you can start buying gold on eToro with only $10.

Step 1: Register a free gold trader account

Start by creating a free user account on eToro Simply hit the “Join Now” icon on either the eToro website or the eToro Mobile Trading app.

Step 2: Deposit funds

You need to make a deposit of at least $10 into eToro before you can start investing in Gold. The supported deposit methods include PayPal, credit cards, debit cards, bank transfers, ACH checks, and more.

Step 3: Find gold

From the list of financial instruments supported on eToro, find gold. Choose to invest in this precious metal by hitting the “BUY” option.

Step 4: Buy Gold

On the trading tab that pops up, customize this investment. Indicate how much you wish to spend buying gold and hit the “Open Trade” button.

Later on in this guide, we will walk you through the detailed step-by-step process of investing in gold and other precious metals supported on the platform. First, though we need to discuss where to buy gold, whether it is a good investment, and explore other ways of investing in Gold.

How to Buy Gold as a Beginner

Gold is one of the most popular and most traded precious metals. This explains why it currently is listed with virtually all commodity brokerages. And there are multiple ways of investing in gold.

These include trading contracts for difference, physical gold, futures and options, gold stocks, and gold ETFs. We start by understanding how to buy gold CFDs on the all-popular eToro brokerage.

eToro – Best Place to Buy Gold ETFs and Gold Stocks

eToro has put in place multiple measures that make it one of the best places to buy gold for beginners. These start with its beginner-friendliness as evidenced by the easily navigable user interfaces – mobile and web trader.

You will also like the quick and straightforward account opening process put in place by the online broker. Not forgetting that you only $10 to start investing in gold via eToro or that this deposit may be made using virtually all the popular payment processors in the country.

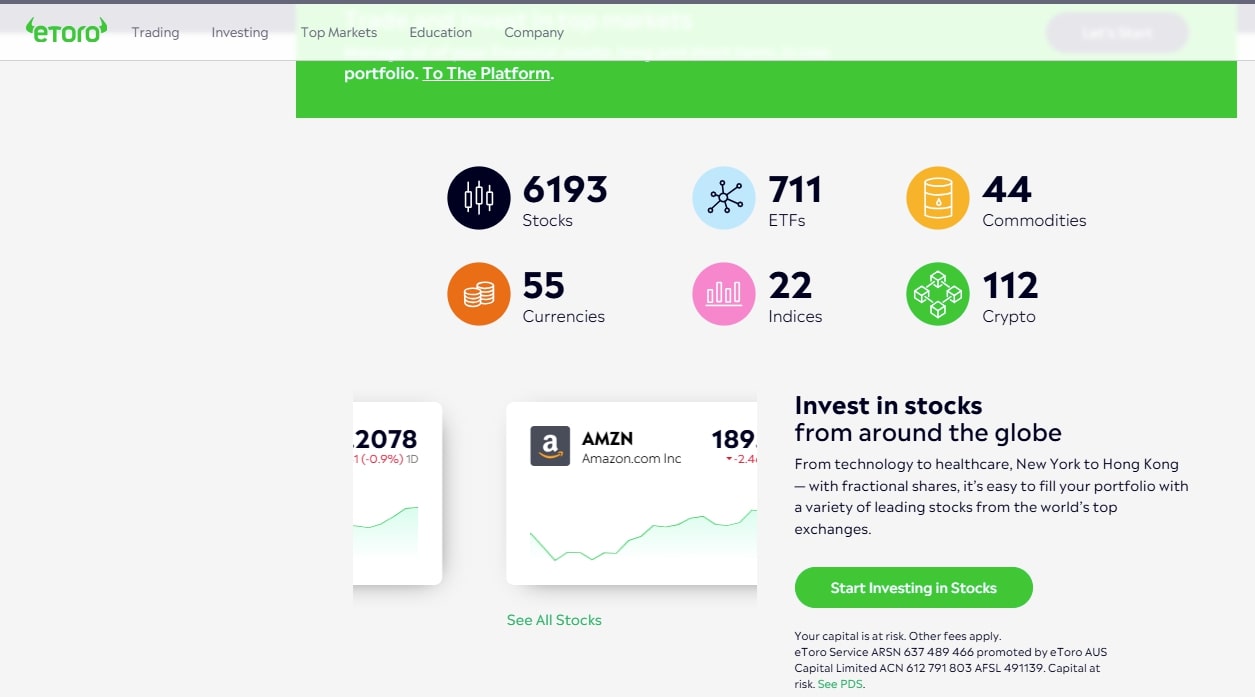

When buying gold via eToro. The online brokerage will give you access to two types of gold trade. These are gold exchange-traded funds (ETFs) and gold stocks. Some of the more popular gold ETFs to trade on eToro are the SPDR Gold Shares (GLD) and the iShares Gold Trust (IAU).

Some of the popular gold stocks to buy and sell here include Barrick Gold (GOLD), Newmont Corporation (NEM), Franco-Nevada (FNV), and Agnico Eagles Mines (AEM). All these give you an indirect exposure to gold and let you make money of the gold price action.

eToro is perhaps even more popular because of its passive investing tool – copy trader. This allows you to make money trading gold stocks and gold ETFs even if you aren’t familiar with commodities trading.

The automated tool allows you to copy the trade settings of the most successful trade gold investors. Note, however, that the minimum amount needed for copy traders is $200.

Pros

Allows fractional gold ETF ad stocks investing

Pay 0% when trading gold stocks

Social trading lets you interact with top gold traders

Access 75+ advanced trading and analytical tools

Cons

You cannot buy physical gold on eToro

No phone support, mostly ticket-based help

Robinhood – Buy Gold Stocks Commission-Free

Robinhood is a user friendly, highly regulated, and easy to use online brokerage. Here, you will have access to gold-related stocks, and gold ETFs like SPDR gold shares (GLD).

And unlike most traditional online brokerages, Robinhood doesn’t charge commissions on gold ETFs or stocks. The platform also gives you access to news and tools that help you track the price of gold and real-time market data.

Pros

- Allows for fractional share investing

- Processes transactions fast

- Access a high-yield cash account and debit card

Cons

- Slow customer response times

- No advanced trading tools

Webull – Best Place to Buy Gold Stocks for Pro Investors

Webull is yet another commission-free online brokerage giving you access to gold investments. Here, you get access to gold ETFs and stocks catering to beginners and experienced traders.

With its commission-free trading model and advanced charting tools, Webull stands out as a strong choice for investors looking to analyze gold price movements and make informed decisions.

Pros

- Webull gives you access to advanced trading and analytical tools

- Webull supports pre-market and after-hours trading

- Earn interest on uninvested cash

Cons

- No exposure to direct gold investment

- Platform’s advanced features may overwhelm new users

Other Ways of Buying Gold

When dealing with online brokerages like eToro, you can only buy and sell gold stocks and ETFs. Stocks, in this case, refer to investments in publicly traded companies that deal with gold at any stage of the supply chain, from mining to refining or even storage/custody services.

Outside of the online brokerages, there are two other ways of buying gold. The first involves buying actual gold – bullions or gold coins, and the second is investing in such gold derivatives as futures.

Invest in Physical Gold

Investing in physical gold involve purchasing and gaining possession of the precious metal. This may be in the form of gold bullions of gold jewelry.

In this case, gold bullions refer to investment-grade gold that is presented to investors and traders in the form of ingots, coins, or bars that are 99.5% pure gold. Note that these gold bars are available in different sizes and weights, varying from one troy ounce (31.1 grams) to one kilogram.

The bars will also have the manufacturer’s name and purity stamp on them. Some of the most reputable brands that sell quality gold bars include American Precious Metals Exchange (APMEX), JM Bullion, SD Bullion, and Provident Metals.

Gold Coins

Other than bars, you may also want to invest in gold coins. Some of these have monetary value but most are just speculative investing purposes and cannot be used as a cash alternative. Most of these are sourced from the US Mint or other countries.

Popular gold coins from the US mint include the 22-carat American Gold Eagle that comes in 1-ounce, 1/2 ounce, 1/4 ounce, and 1/10 ounce as well as the 24-carat American Gold Buffalo.

In addition to bullion bars and gold coins, you can also buy gold jewelry. Note that, unlike exposure to actual gold, jewelry gives you exposure to gold but they typically aren’t the same as gold investments.

Unlike bars whose costs are very close to the market price for gold, jewelry has other extrinsic costs related to such things as craftsmanship and branding.

Before investing in physical gold, however, understand that it carries extra costs and risks. You, for example, will need to cater for storage costs and even insurance fees. If you are storing the gold at home, you need to not only invest in a proper safe but also enhance home security.

Pros of Buying Physical Gold Compared to Stocks & ETFs

- Tangible Asset – Unlike stocks or digital assets, you physically own the gold, making it a reliable store of value.

- Hedge Against Inflation – Gold tends to retain or increase in value during periods of economic uncertainty and inflation.

- No Counterparty Risk – Unlike ETFs or gold-backed digital assets, physical gold is not dependent on any financial institution.

- Global Liquidity – Gold can be sold anywhere in the world and is widely recognized as a valuable asset.

Cons of Buying Physical Gold Compared to Stocks & ETFs

- Storage & Security Costs – Keeping gold safe requires secure storage, whether at home (with a safe) or in a bank vault.

- Lack of Passive Income – Unlike stocks or bonds, gold doesn’t generate dividends or interest.

- Liquidity Challenges – Selling physical gold may take time, and dealers may offer slightly below market prices.

- High Premiums & Fees – Purchasing gold often involves additional costs such as dealer premiums, insurance, and possible sales tax.

- Risk of Theft or Loss – Physical gold can be stolen or misplaced if not properly stored and secured.

Invest in Gold Futures

A gold futures contract is a legally binding agreement to purchase or sell a set amount of gold at a fixed price on a specified future date. Traded on exchanges, these contracts fluctuate in value based on market expectations of gold’s future price.

Today, In the U.S., gold futures can be bought on major exchanges like the Chicago Mercantile Exchange (CME Group), specifically on the COMEX division, where gold futures are actively traded. To access these contracts, investors need a brokerage account with a firm that offers futures trading.

Pros of Investing in Gold Futures Compared to Stocks & ETFs

- Leverage: Gold futures allow investors to control large amounts of gold with a relatively small margin, potentially amplifying gains.

- Liquidity: Gold futures trade on major exchanges with high volume, ensuring ease of entry and exit.

- No Management Fees: Unlike ETFs, futures contracts don’t have ongoing management fees.

- Direct Exposure to Gold Prices: Gold futures provide pure exposure to gold’s price movements, unlike gold stocks, which can be affected by company performance.

Cons of Investing in Gold Futures Compared to Stocks & ETFs

- High Risk & Volatility: Futures contracts can be highly volatile, and leverage increases the risk of large losses.

- Expiration & Rollover Costs: Unlike stocks or ETFs, futures contracts have expiration dates, requiring rollovers that may incur additional costs.

- Margin Requirements: Investors must maintain a margin balance, which can lead to margin calls if the market moves unfavorably.

- Complexity: Trading futures requires more expertise compared to simply buying stocks or ETFs.

- No Dividends or Interest: Unlike some gold mining stocks, futures do not provide dividends or yield.

What is Gold?

Gold is a rare and naturally occurring precious metal that is valued for its beauty, durability, and financial significance. For thousands of years, gold has had many uses, ranging from money, jewelry, and a store of wealth due to its unique properties.

These include its scarce supply, universal acceptance, high density, and malleability.

Today, gold is used primarily as an investment asset and a store of value. It is used a store of value primarily because it has intrinsic value which makes it a good hedge against inflation, economic instability, or currency fluctuations.

The investment appeal, on the other hand, is derived from the fact that it is hugely resilient and its price has maintained an overall uptrending direction.

Gold Price

Gold is currently at its peak and looking to extend what has become a multi-year bull run. At the time of writing, it is trading around the all-time high of $3,122, which has rallied by more than 18% in the first quarter of 2025.

This historic high marks Gold’s biggest quarterly gains in 38 years – since 1986.

Though a quick look at the charts may show that the current rally started in lthe ast half of 2024, zooming out shows that it has been going on for more than 5 years. That it only started gathering pace over the last nine months.

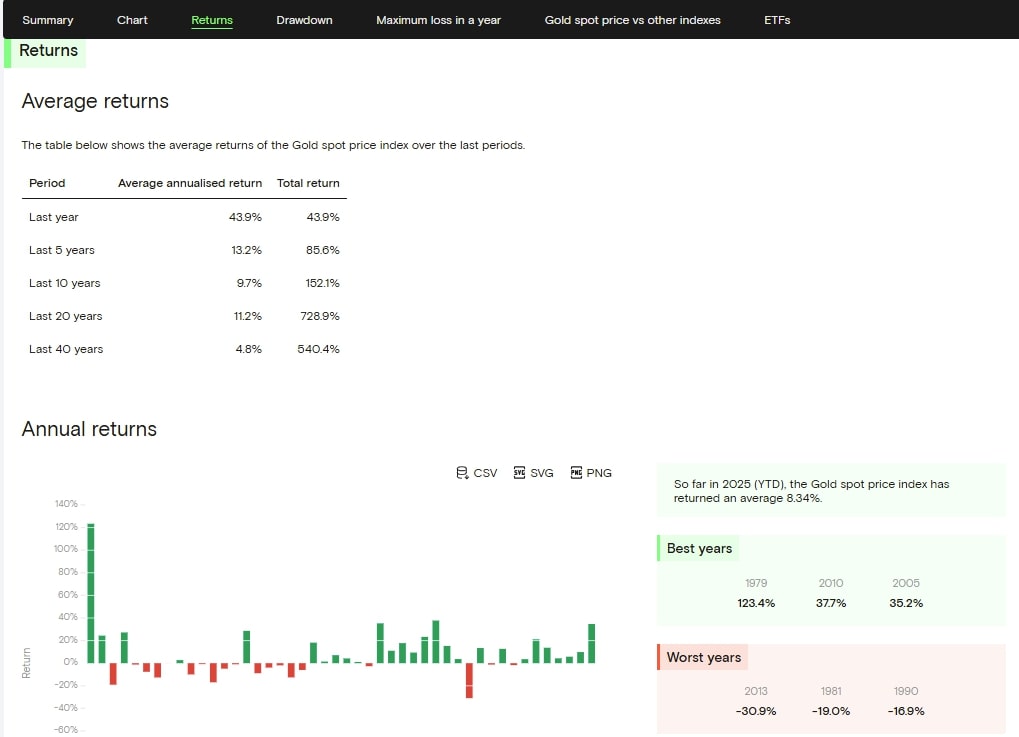

In the five years, gold prices have rallied by more than 85%. This implies that gold prices have appreciated by an average of 13.2% annually for five years, faster the 9.7% average of the past 10 years, the 11.2% of the last 20 years, and the more than double the 4.8% average of the last 40 years.

Among the top factors playing the biggest role in influencing Gold prices is rising economic uncertainty across the world, global political tensions, and a weakening US Dollar. President Trump’s election, has particularly had a significant impact on gold prices.

His imposition of reciprocal tariffs on all US trading partners has raised fears of rising inflation.

Elsewhere, central banks across the world have been swapping US Dollars for gold reserves.

China, for instance, held 2,285t of gold at the start of the year and has also relaxed its financial regulations, allowing insurance companies in the country to invest in gold. Other countries that have gone on a gold buying spree for the last three years include Russia and India.

Moving forward, there is general consensus among analysts and investors that gold prices will keep rallying.

Gold Price Prediction 2025, 2026, 2030

On its journey to $3,122, gold prices were influenced by such factors as heightened global tensions ignited by the enforcement of trump tariffs.

It was influenced by central bank demand with China, Russia, and Russia gobbling up more than 1000t of gold in the last three years. Inflation concerns, upcoming rate cuts for bench mark lending rates, and stock market volatility have also influenced gold’s price action.

Moving forward, these factors are expected to continue playing a critical role in shaping gold’s price action. By the end of 2025, for example, we are confident they have pushed the yellow precious metal to a peak of $3.275 before it further to $3,805 before the end of 2026.

And by the turn of the decade, gold will have grown its current price by 165% to reach $5,155.

How to Buy Gold on eToro – Step-by-Step Guide

In this section, we go over the process of buying gold ETFs or gold Stocks on eToro. Here, we provide you with a step-by-step guide to creating a user account and buying any of these gold products on the highly reputable multi-asset brokerage.

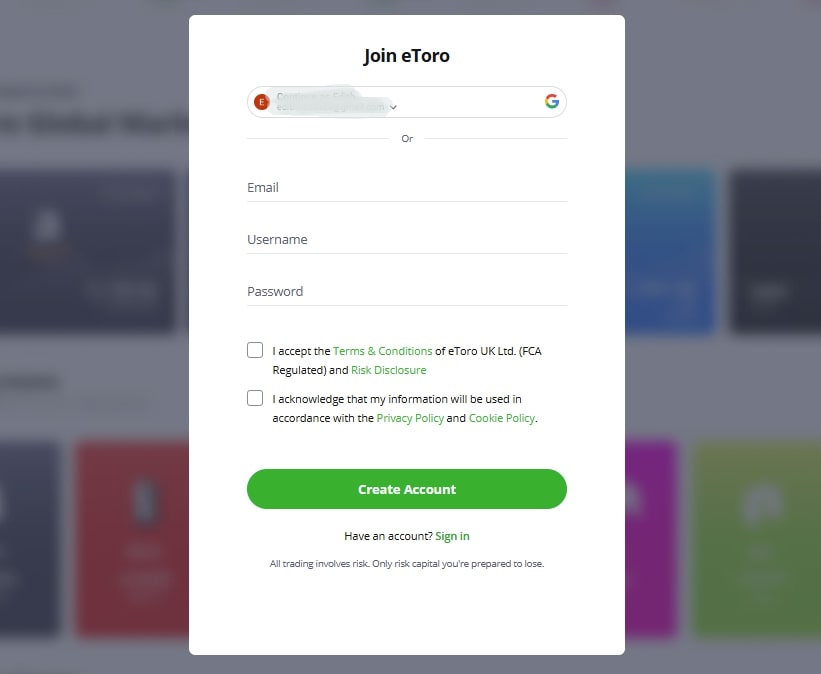

Step 1: Register a free Gold trader account

Start by opening the official eToro website or downloading the eToro mobile trading app. Click the “Join Now” icon on either platform to bring up the user registration form.

Complete this form that asks for basic personal details such as your name and email address, phone number and home address, trading experience, and income sources. The broker will also ask you to come up with a unique username and password for this account.

Step 2: Verify your identity

Before you can start buying and trading gold ETFs or gold stocks, you need to verify your identify. Simply send the brokerage a photo of your government-issued identification document, such as a driver’s license or passport.

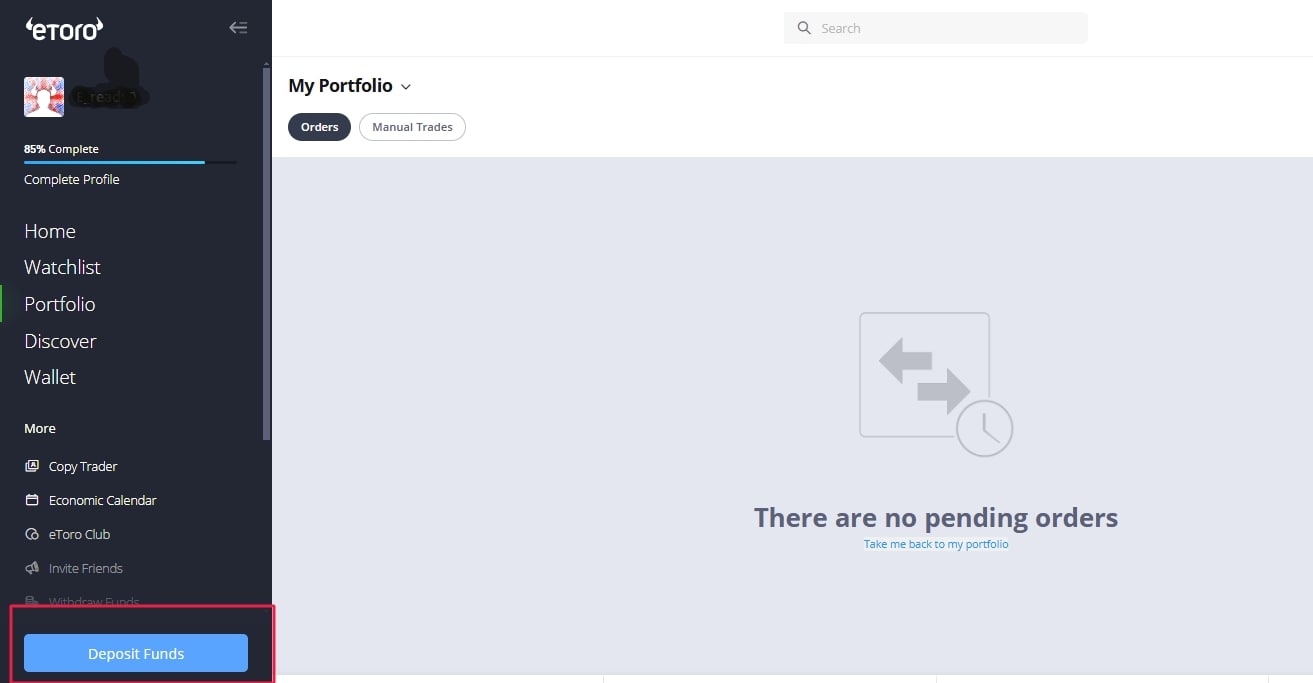

Step 3: Fund this account

Next, log into the approved eToro trading account and hit the “Deposit Funds” icon on your user dashboard. This brings up the funding tab, which lists all the payment processing methods available to you.

Choose the one you would want to use to deposit funds into eToro. Follow the prompts to deposit at least $10 into eToro.

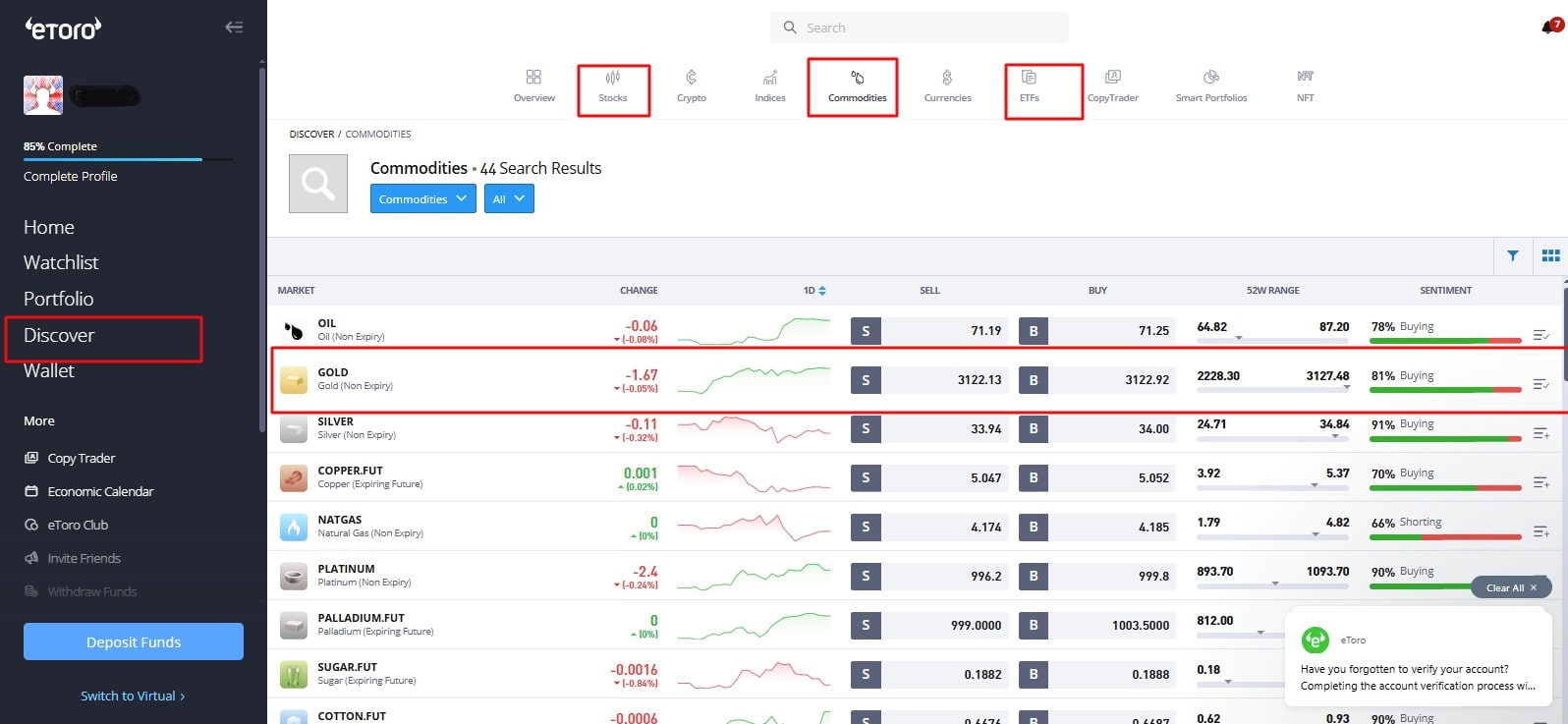

Step 4: Identify the gold stock or ETF to buy

Still, on your user dashboard, click on the “Discover” icon. This will bring up the financial instruments available for trading on eToro. If you are looking to buy Gold ETFs, choose “ETFS” and choose the Gold ETF you wish to invest in from the list that appears.

If you want to buy gold stocks, click on the “Stocks” option, and from the list that appears, identify the gold stocks you wish to invest in. Hit the “BUY” option against your preferred gold ETF or gold stock.

Step 5: Buy the gold stock or gold ETF

A trading tab will pop up. This allows you to customize your gold investment. You need to indicate how much you intend in gold ETFs or gold stocks. Then hit the “Open Trade” button to execute the purchase.

Note: eToro will immediately draw funds from your cash balance account and the stocks or ETFs will reflect in your portfolio section. Hold them here as you wait for their value to rise, after which you can flip them for a profit.

How to Sell Gold on eToro – Step by Step Guide

The process of selling gold stocks and gold ETFs on eToro is equally quick and straightforward. Let us go through it here today:

Step 1: Start by logging back into the eToro trading account.

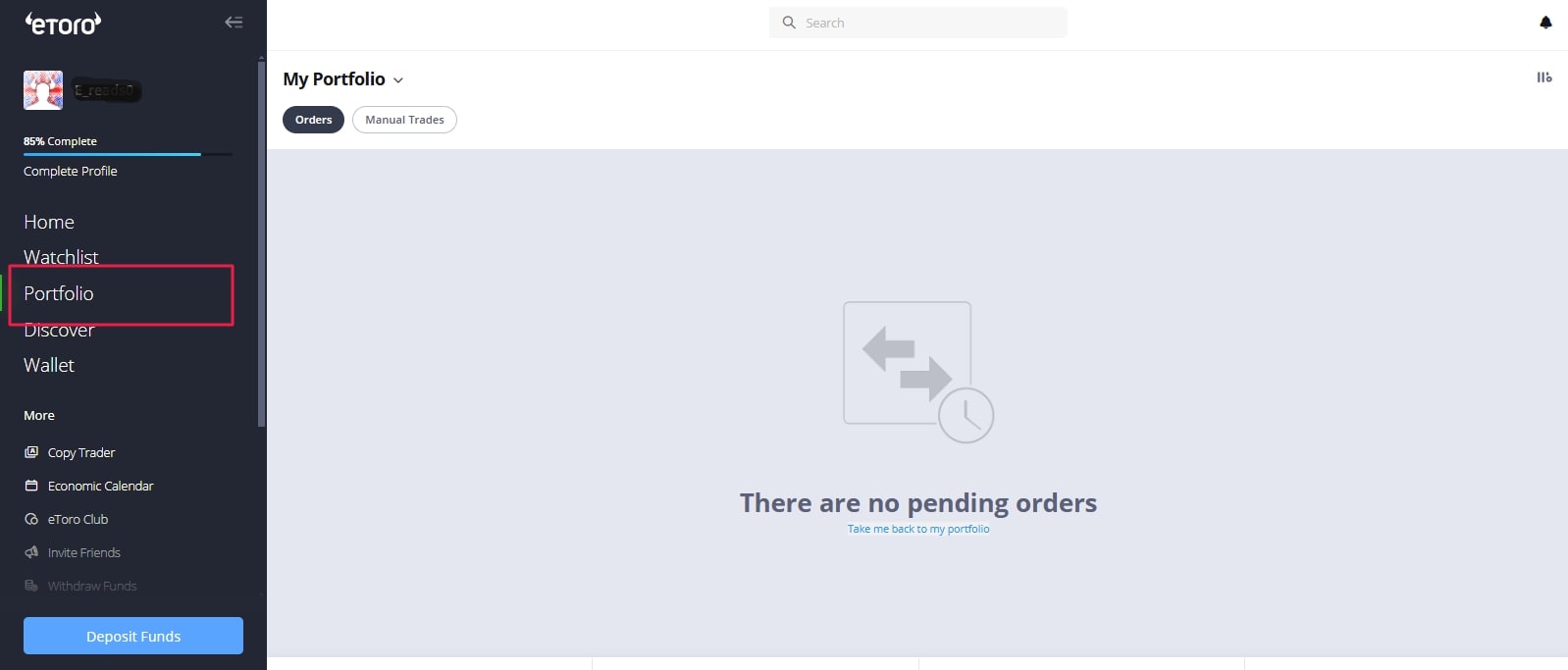

Step 2: On the user dashboard, hit the “Portfolio” icon on your user dashboard.

This will bring up a window that lists all the gold ETF and gold stock posiiyt9ns that you have open with the online brokerage.

Step 3: Identify the gold stock or gold ETF you wish to sell from this list and hit the “Close Trade” icon against this asset.

Step 4: A trading tab will pop and you will need it to customize this sale.

For starters, you have to decide if you want to sell a fraction of this investment or close the entire position. This involves indicating how many stocks or the percentage of the asset you intend to buy and hitting the “Close Trade” button to execute this trade.

Note: eToro will instantly deposit the cash equivalent of the gold stock or gold ETF you have sold into your cash balance account. You may use this funds to invest in a different gold stock or gold ETF. Alternatively, you can choose to withdraw the said funds.

Conclusion: How to Invest in Gold in 2025 for Beginners

There goes everything you need to know about investing in gold for beginners. We started by introducing you or the different places where you can buy gold stocks and gold ETFs.

Then discussed buying physical gold and trading gold futures, together with their pros and cons. We have also looked at gold’s recent price action and discussed its most likely price performance moving forward.

Want to jump straight to buying gold before its next leg up? Consider investing in gold ETFs and gold stocks and we have provided a detailed step-by-step guide to investing in gold via eToro hereinabove.

FAQs

How to invest in gold for beginners?

One of the most accessible for of investing in golf for beginner is buying gold ETFs and gold stocks on online brokerages like eToro where you only need $10 to start investing. Alternative investment methods include buying physical gold (bars, coins, and jewelry), or trading gold futures.

Which is the best way to invest in gold?

If you are looking for liquid gold investments with no storage or insurance costs or handling risks, consider buying gold ETFs and gold stocks. Only go for physical if you have access to secure storage services and insurance coverage.

Is it really worth it to invest in gold?

Yes, because gold has proved to be an effective hedge over inflation for more than a century. Its price has also maintained an overall uptrending price direction, making it a good store of value.

Can I invest 500 in gold?

Yes, you can invest $500 in gold through fractional ownership of gold stocks or gold ETFs. There also are small gold bars, coins and jewelry within this price range.

How much gold should a beginner buy?

Some reliable trading platforms like eToro let you buy gold with as little as $10. You however, need to decide the maximum amount based on such factors as your risk tolerance, trading experience, investment strategy, and investing goal.

Most finance coaches, however, advise that you convert at least 1%-10% of your portfolio to gold.

How can I profit from gold?

You profit from selling gold when you buy at a dip or at the base of a price rally and sell it when it eventually peaks. The same trading strategy applies to gold stocks and gold ETFs.

Join Our Premium Research on S&P 500, Gold & Silver — Trusted Insights Backed by 15 Years of Proven Market Forecasting

Unlock exclusive access to InvestingHaven’s leading market analysis, powered by our proprietary 15-indicator methodology. Whether it’s spotting trend reversals in the S&P 500 or forecasting gold and silver price breakouts, our premium service helps serious investors cut through the noise and stay ahead of major moves.

- Gold Retracing, Silver and Miners at a Critical Level (May 4th)

- The Precious Metals Charts That Bring Clarity Through Noise (April 27th)

- Highly Unusual Readings In Gold & Silver Markets (April 20th)

- Gold Miners Breaking Out, Here Are A Few Gold Stock Tips. What About Silver & Miners? (April 13)

- Gold, Silver, Miners – Bottoming or More Downside? (April 5th)

- Why Next Week Matters for Gold — But Less So for Silver (March 29th)

- Is the USD About to Bounce? What Are the Implications? (March 22nd)

Unlock Premium Market Insights

Securities trading offered by eToro USA Securities, Inc. (“the BD”), member of FINRA and SIPC. Cryptocurrency offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk.