Dalio urges investors to add gold and other non-fiat stores for protection. He suggests roughly 10–15% in gold as a starting point.

Ray Dalio warned at recent forums that rising U.S. debt threatens the dollar’s role. He said gold and other non-fiat stores will gain importance, and he urged investors to use gold as part of a diversified portfolio for protection.

RELATED: De-Dollarization Driving Gold Higher, Is The Next Rally Here?

Dalio’s Core Warning: Debt And Monetary Risk

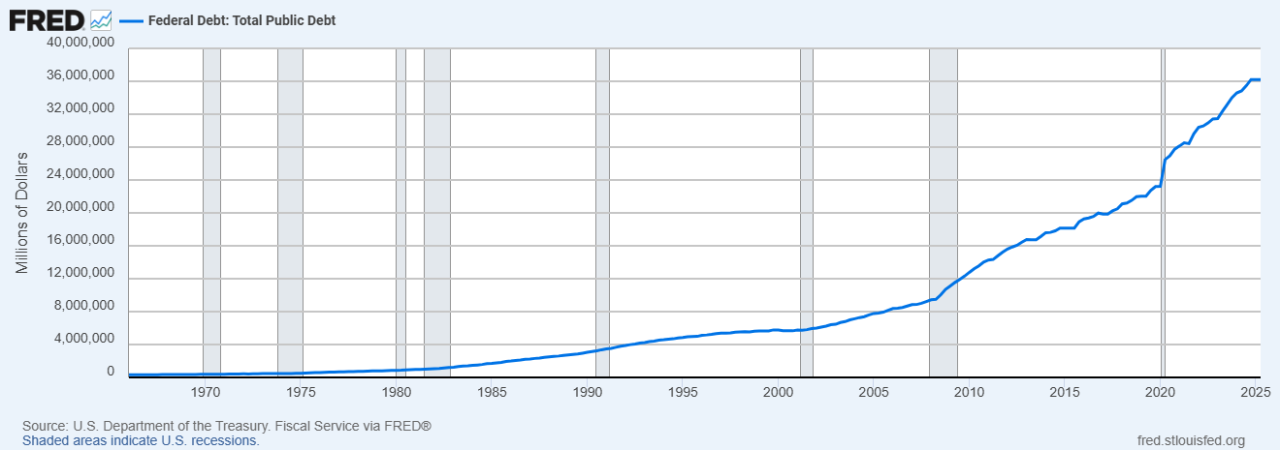

While speaking at the FutureChina Global Forum 2025, Dalio called U.S. fiscal paths unsustainable, saying excessive spending and rising debt put the monetary order at risk. He compared the buildup of debt to plaque in arteries and said, “A doctor would warn of a heart attack.”

Current federal debt stands at more than $36T.

The Bridgewater boss warned that mounting interest costs squeeze other spending and that this could weaken confidence in the dollar and Treasurys if authorities respond with more money creation.

He framed the comments as a warning to prepare.

RECOMMENDED: Gold Eyes $4,000–$5,000: Momentum Fueled by Fed Outlook

Dalio’s Recommendations: Gold And Portfolio Sizing

Dalio gave specific advice about allocations. He said a well-diversified portfolio should hold about 10–15% in gold. He recommended that investors treat gold as insurance against currency risk, especially if growing debt forces more monetary easing.

He suggested that when Treasurys lose their safe-haven status, investors should consider non-fiat stores of wealth, including physical bullion or liquid vehicles such as gold ETFs.

Dalio told investors to review their bond exposure, and he said gold can reduce vulnerability to dollar depreciation.

RECOMMENDED: Gold’s Record-Breaking Momentum: Can It Climb Further?

Conclusion

Ray Dalio leaves investors with a clear warning: U.S. debt has reached dangerous levels and may trigger a financial “heart attack” if ignored.

He insists on holding about 10-15% of a diversified portfolio in gold, which he says retains value when other assets fall. Dalio also urges people to reassess bond exposure, especially U.S. Treasurys, because growing debt and the risk of monetary easing threaten their reliability.

When is The Best Time To Buy Gold & Silver?

To receive key alerts and analysis on the best times to buy Gold and Silver, you should consider Joining the original market-timing research service — delivering premium insights since 2017.

InvestingHaven alerts are powered by a proprietary 15‑indicator system refined over 15+ years of hands-on market experience.

This is the same service that accurately guided investors through stock market corrections and precious metals rallies.

Act now and discover why thousands rely on us for timely, actionable signals — before the market makes its move.

Here’s how we’re guiding our premium members (log in required):

- Monster Basing Patterns in Precious Metals Resolving Higher (Sept 6th)

- Must-See Monthly Gold & Silver Charts (Aug 31)

- The 5 Most Important Silver Charts For H2/2025 (Hint: Very Bullish) (Aug 23)

- Silver – Speculators Keep Exiting The Long Side. What Does It Mean?(Aug 16)

- Must-See Secular Charts: Precious Metals Mining Breakout & More (Aug 9)